Nelson Barnard

investment thesis

Although Disney’s (NYSE:DIS) Flagship streaming service Disney+ originally launched as a competitor to Netflix (NFLX) 2019, the platform’s growth has stabilized.While the platform has experienced strong growth in its early days, I predict their Stagnant user growth is a bigger problem than it seems, and it’s a symptom of the style of content Disney chooses to put on its platform.

their content library include Classic content and content that (for many Americans) have already been watched, rather than the more consistent new releases we see from streaming platforms like Netflix. While this content increases appeal to nostalgic audiences, the lack of new content may negatively impact their long-term appeal and competitiveness. Disney’s efforts to grow Hulu have also encountered problems.

While the Mouse House has seen a big Operating income has surged since 2022, and net profit Increase From $1.279 billion in the first quarter of fiscal 2023 to $1.911 billion in the first quarter of fiscal 2024, these impressive numbers are attributed to Disney’s reduced losses on streaming services, which is at the heart of my concern .

TV/digital assets are critical to Disney. With their TV properties accounting for a large portion of the company’s revenue and more than half of its operating income, older content affecting subscription rates is becoming a bigger issue. I believe the profitability of their streaming service will decrease because Disney will either have to pay for more content to keep its library fresh or face subscription churn issues. Regardless, this makes me own Disney stock.

background

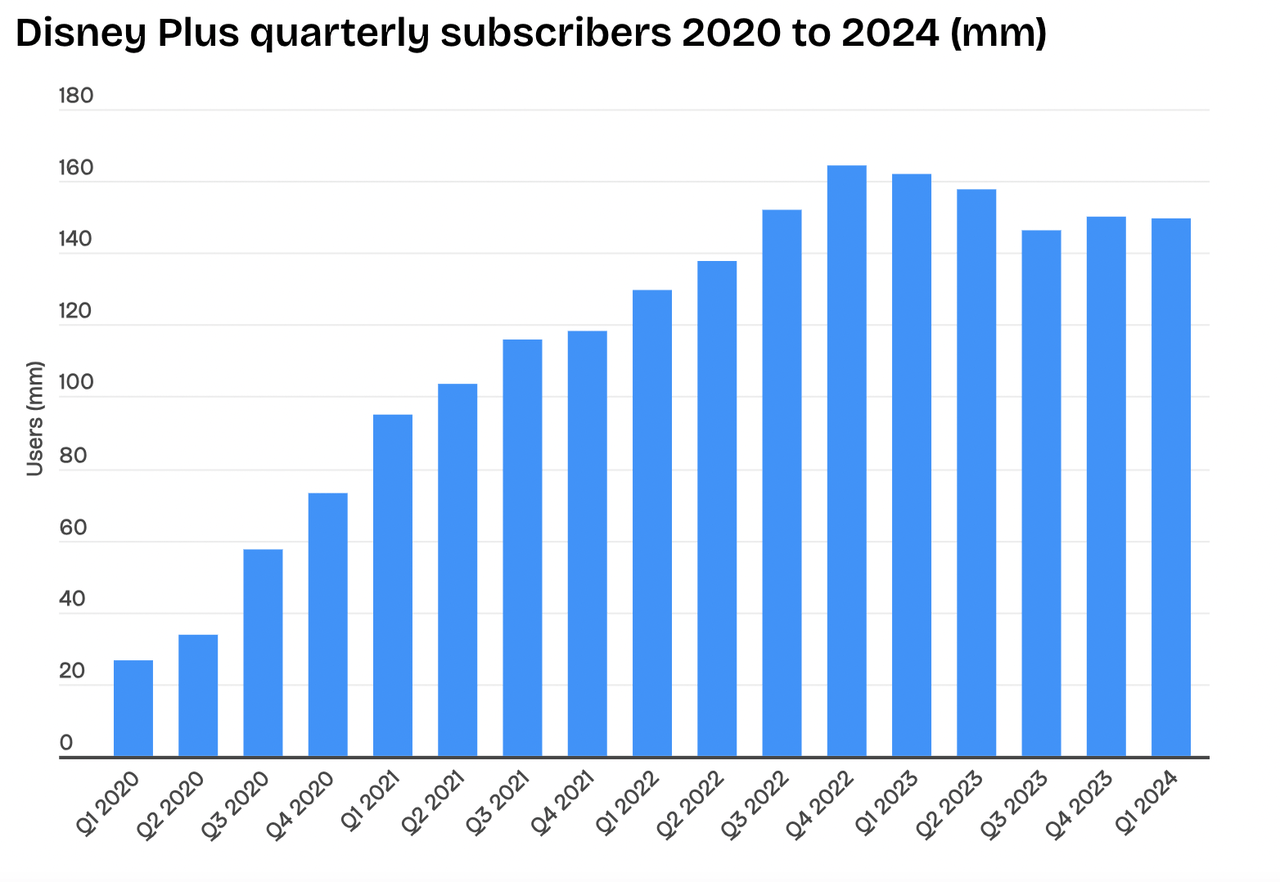

One of the key features that sets Disney+ apart from its competitors is its ability to cater to a specific audience looking for family-friendly and nostalgic content. Disney’s platform, which consists of old and new content from Disney franchises such as Marvel, Star Wars and Pixar, has earned the label “a kids’ paradise and a nostalgia home run.” aldult”. When Disney first launched it in November 2019, the initial launch was very successful.Within its first year, Disney+ reached 73.7 million subscribers (FYI, according to 10K data from Netflix (NFLX), which has been streaming for more than a decade, it had 204 million subscribers as of the end of 2020). As of early 2024, Disney+ had approximately 149.6 million subscribers in the last 10 quarters. As with other services, Disney created ad-supported tiers to further expand its consumer base.These program Allows users to watch the same content at a lower price, but with ads.

While they can appeal to those looking for a nostalgic, family-friendly option, a lack of variety and updated content makes them less competitive.To solve this problem, Disney+ implemented Integration Hulu content will launch in December 2023. The merger gives subscribers access to Hulu’s more adult programming, such as FX dramas Bears and the Kardashians. While this expands Disney’s content library, limitations remain due to licensing rights and the exclusion of certain Hulu titles and live TV channels from the Disney+ platform.

Why retention and subscriber growth are weaker than Netflix

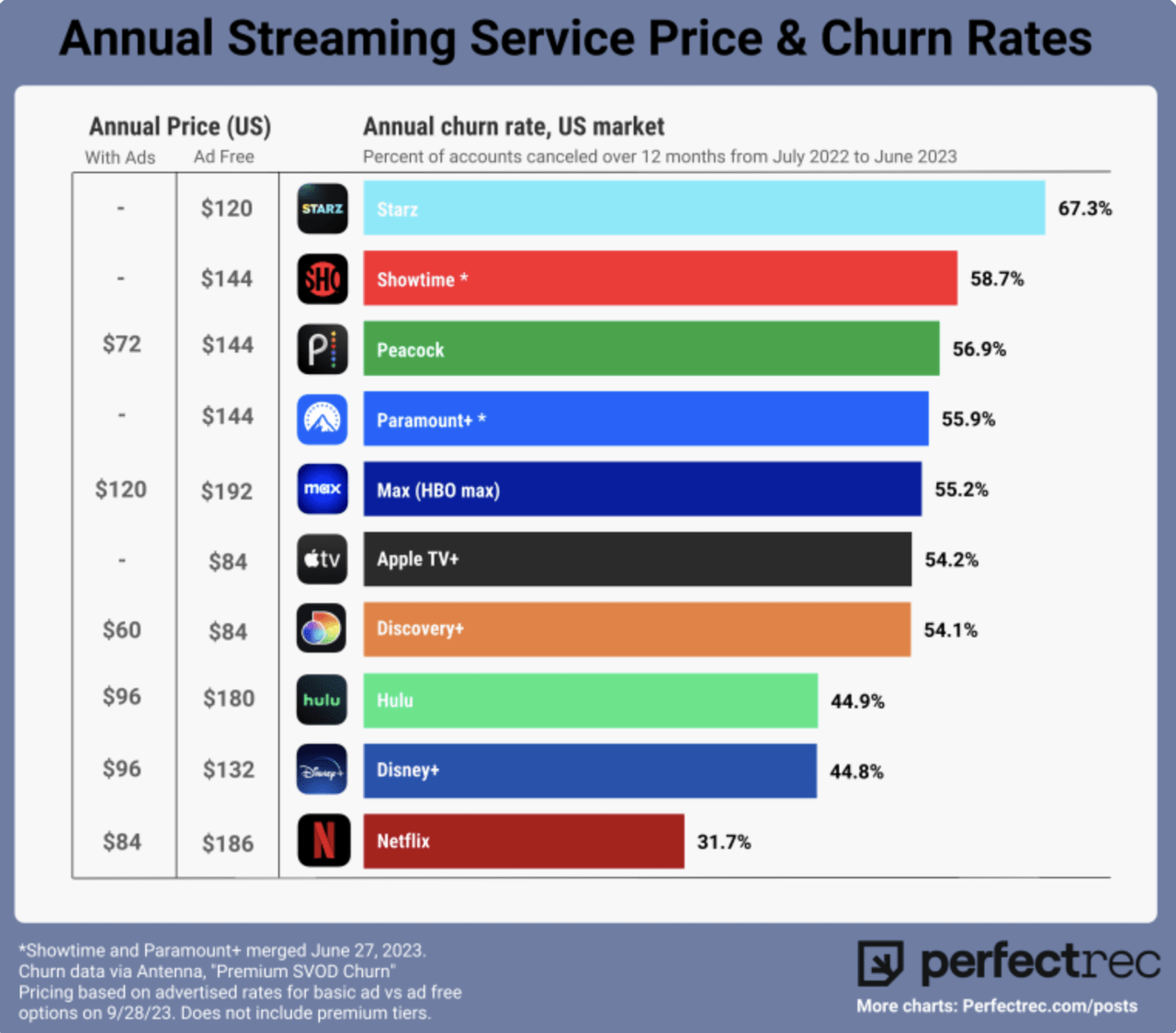

Annual churn rate of streaming services (Perfect record)

Disney+ faces challenges in sustaining subscriber growth compared to Netflix and other rivals, likely due to a lack of new content.As of Q1 2024, Disney+’s monthly churn rate is 4.8% That compares to Netflix’s 2%. This higher churn rate suggests that a larger percentage of Disney+’s subscriber base is canceling service each month compared to Netflix.To put things into perspective, in the chart above, from July 2022 to June 2023, Disney+’s annual churn rate is close to 45%. The chart also shows that Hulu, owned by Disney, has a churn rate of nearly 45%. This is much higher than Netflix’s 31.7% churn rate during the same period.

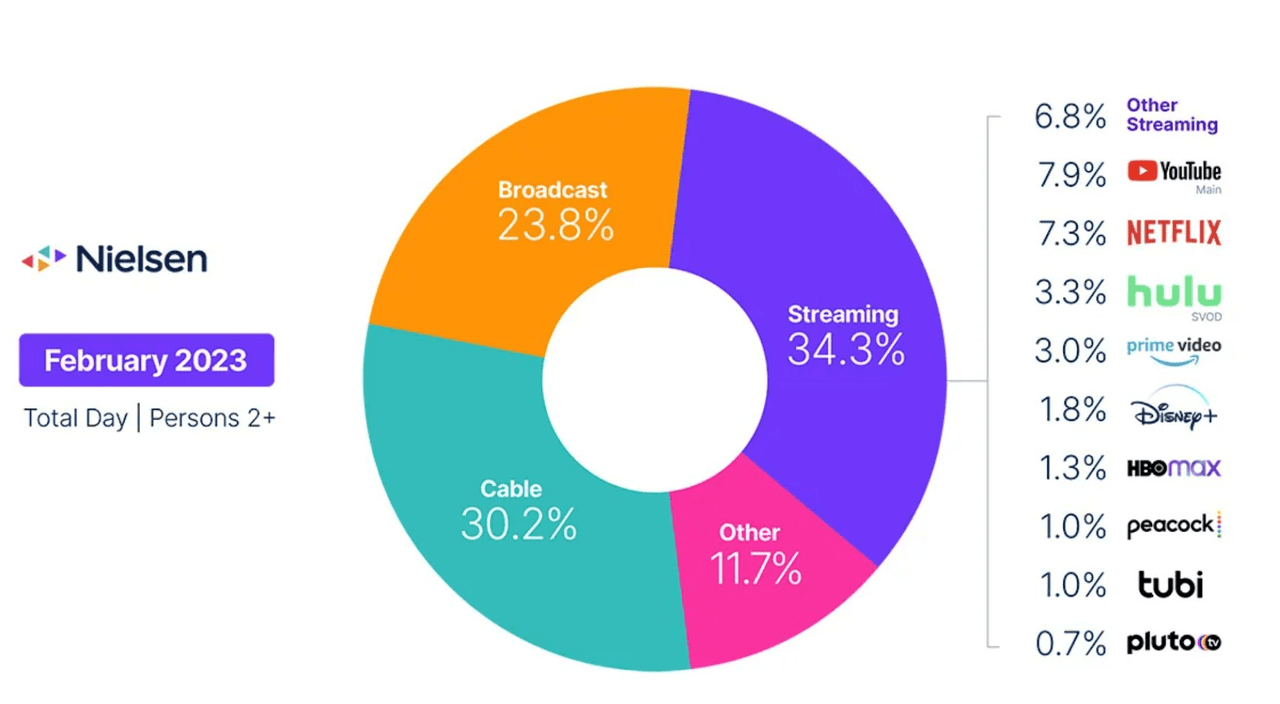

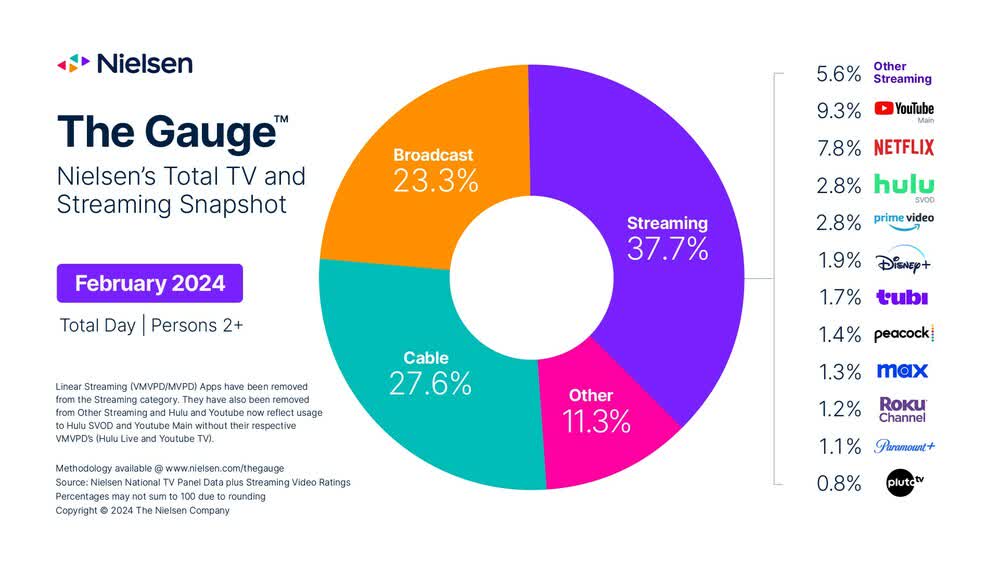

Their lack of new content contributes to their churn rate, but the amount of original programming may also play a role. Disney+ only has approx. 80 original programming (called Disney+ Originals), which is much smaller than Netflix’s global content library of more than 30 titles 3,500 people Original titles, over 6,600 in the US (original means content that is original to the platform and has never been seen before). This difference in original content offerings directly impacts subscriber engagement and retention, playing an important role in reducing churn. As I mentioned before, in order to increase its content library, Disney is merging the majority of its content library with Hulu.Nonetheless, according to the chart 2023 and 2024 Below, Hulu appears to be losing market share, while Disney+ doesn’t really seem to be gaining market share.

In February 2023, Hulu had a 3.3% market share, which dropped to 2.8% in February 2024.

Nielsen February 2023 Snapshot (Nielsen)

Nielsen February 2024 Snapshot (Nielsen)

Even if Disney releases newer content, these theatrical versions won’t implemented As expected, this may indirectly impact the appeal of its streaming service. In 2023, 7 of the 8 major theatrical releases (movies) performed significantly poorly both in the U.S. and overseas. As a result, Disney+ lost 1.3 million subscribers after price increases in the fiscal first quarter of 2024. $10.99 By the end of 2023, the price will drop to $13.99. This means their subscriber base is down 12 million from this time last year. The $12 million decrease was partly caused by price increases. But that raises a new problem: Disney+ is losing money and may have to raise subscription prices to grow revenue and become profitable. But this causes subscribers to cancel, creating a vicious cycle.

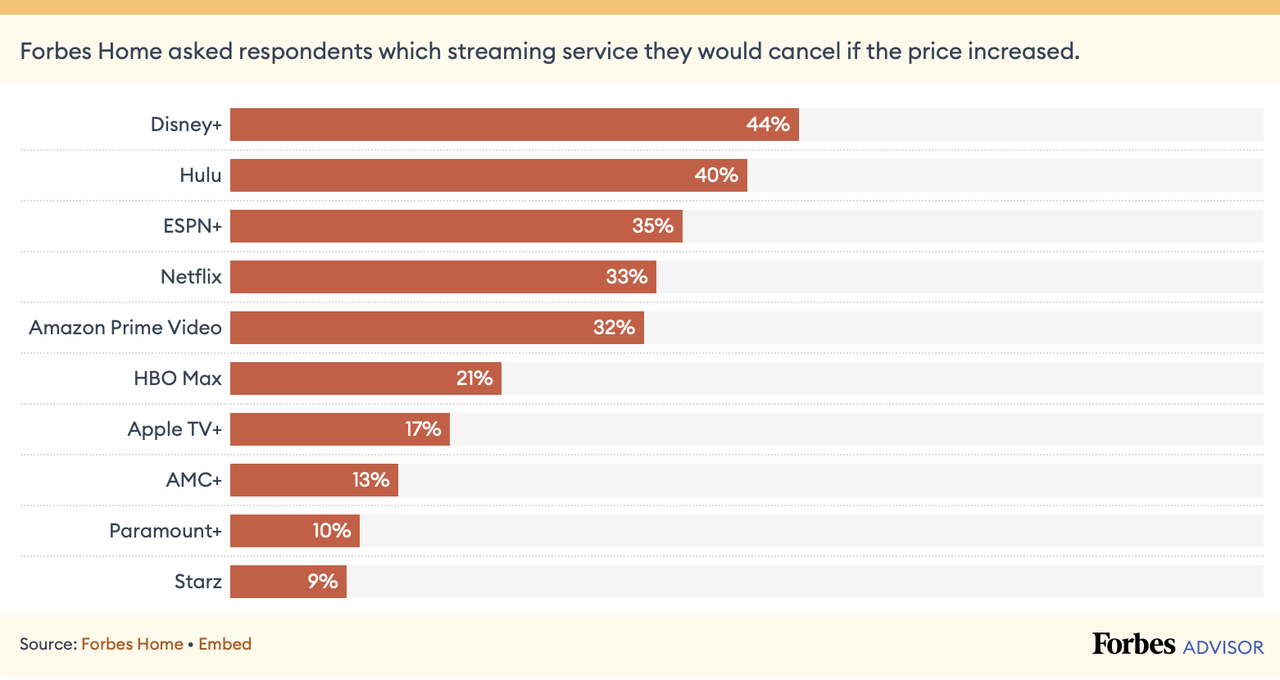

Forbes recently conducted a survey to test this hypothesis. Their findings determined that if subscription prices for major streaming services increased, 44% of streaming users said the first service they would cancel their subscription to was Disney+. The second and third? Disney’s other streaming services (Hulu and ESPN+).

Survey on which streaming services consumers will cut back on (Forbes)

Valuation

As I said before, Disney lost 1.3 million subscribers in the first quarter of 2024 after the price increase.The graph below gives a good idea of how the number of subscribers has changed: becoming steady (after decline) since the third quarter of fiscal 2023.

Disney+ subscriber numbers by quarter (App Business)

Currently, Disney’s forward price-to-earnings ratio is 25.04 times, giving it a “D” rating among the technology industry’s median forward price-to-earnings ratios. I think the tech industry is a good comparison because Disney is trying to grow themselves with their streaming service.

While the company has a “B” rating for forward revenue growth as it expects future revenue to grow 5.34% year-over-year (compared to the industry’s forecast of 2.90% year-over-year growth), I think this growth rate is likely overestimated. As we’ve seen, the company’s Disney+ subscriber numbers continue to stagnate, and any price increases aimed at driving growth could lead to more cancellations.

Given this, I think the stock’s current valuation looks rich. I’m not saying this is a sell because I don’t know how much of a pullback we could see from here. But given that Disney+’s fundamentals show some weakness (and because streaming is supposed to be the company’s future), I’m cautious.

bull paper

While I believe Disney’s streaming services may lose their competitive advantage in the near future, there are some noteworthy aspects of Disney’s strategy that may still keep them viable in the TV streaming market.disney Model, which includes streaming movies simultaneously in theaters and on Disney+, could lead to subscriber growth and offset traditional box office revenue streams. We saw this strategy in action a few years ago with the Black Widow release strategy. It is reported that the film’s domestic box office revenue during its opening weekend could reach US$97 million to US$130 million. The actual figure is $80 million. Although these numbers result in Disney making less money from the box office, buying a Disney+ subscription brings in more money than buying a single ticket.

To grow its catalog of content, Disney has begun combine Their content is the same as Hulu’s. A beta version of their combined streaming service “Hulu on Disney+” is now available, available to individual subscribers of the streaming service or Disney bundle subscribers. This new launch not only aims to increase the amount of content library, but also combines Disney’s nostalgic content with adult-oriented TV shows/movies.

Disney’s financial performance suggests that, as of now, Disney is keeping up (my concern is what the long-term trend is). Disney+’s revenue in 2023 will be US$8.4 billion, an increase of 13% from the previous year. However, much of this growth appears to be coming from price increases rather than subscription growth (as evidenced by the subscriber decline in Q4). Disney can only raise prices so high (as I mentioned before). At some point, customers will reduce their subscriptions.

Finally, although the company face An activist investor (Nelson Peltz) with a history of turning around companies, but his recent track record isn’t that great encourage. Active investors are not always an indicator of a buying opportunity.

bottom line

Given that a large part of Disney’s future financial success lies in the hands of its streaming platform Disney+, I think investors should remain cautious and wait until we see more information. To me, their heavy reliance on nostalgic content, combined with less fresh and original content (compared to Netflix’s content plans), makes it hard to imagine they can sustain long-term subscriber growth and engagement with their current strategy. That way, investors may find better opportunities on more dynamic, content-rich platforms like Netflix (which I wrote about last week ). Given that Disney stock is up 28.56% year to date (as of this writing), I think investors should hold off on investing for at least the short term.