Ewan Akulic

introduce

I was looking at ICE Midland WTI futures the other day as part of my research on Intercontinental Exchange (ICE), the owner of these futures and one of my favorite financial dividend growth stocks – namely Not part of my portfolio yet.

So, I thought, why not start this article with a micro-lecture about this futures contract?

I believe most people will be familiar with NYMEX WTI futures, which are owned by the CME Group. It is the world’s largest oil futures after ICE Brent crude oil.

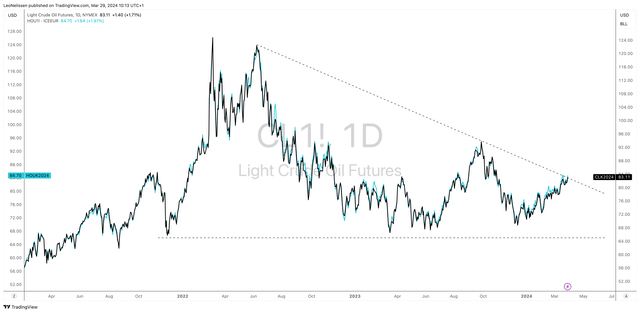

As shown in the chart below, ICE Midland WTI and NYMEX WTI have a perfect correlation. The correlation is so high that it’s hard to see the blue line behind the black line.

TradingView (NYMEX WTI, ICE Midland WTI)

However, a quick look at the x-axis Says there is one difference: pricing.

Typically, ICE Midland is about $1.50 more expensive per barrel than NYMEX WTI.

What makes ICE Midland so special is its focus on the highest quality U.S. oil from the Midland Basin, part of the powerful Permian Basin.oil is Deliverables Enter the Brent complex, which can be used by refineries in the United States, Europe and Asia.

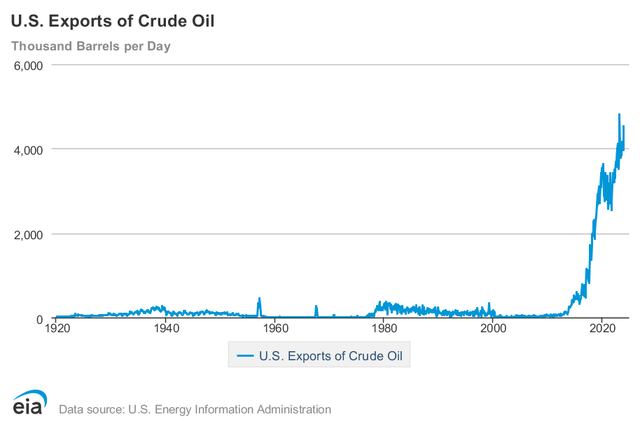

As the United States becomes an energy powerhouse, exporting more than 4.5 million barrels of oil per day, new ways of buying oil and hedging risks are needed.

Energy Information Administration

I bring this up because ICE Midland oil does not ship through Cushing, Oklahoma like NYMEX WTI does.

ICE Midland WTI is available for delivery to Enterprise Crude Houston and ONEOK Magellan East Houston (“MEH”) terminals.

S&P Global

this reminds me ONEOK Co., Ltd. (NYSE: OKE)The merger with Magellan owns the MEH terminal, making it a more important player in the U.S./global energy industry.

When it comes to long-term investing, I want to own the best companies, these companies are so important that without them we would be in trouble.

While efficient energy infrastructure may be something we take for granted in the West, recent developments show how critical energy infrastructure is to our daily lives.

This also explains why in war, energy infrastructure is a core target.

Google News

Having said that, my latest article on ONEOK was written on December 29th and was titled “5.4% Yield and the potential for annual returns of up to 10% – buy top income with ONEOK.”

Since then, OKE stock has returned 16%, which is about 6 points higher than the S&P 500!

In this article, I’ll take a fresh look at the stock, explain why it’s such a strong midstream player, and how I view the risk/reward after such an impressive rally.

By the way, OKE is a C Corporation. It is not taxed as a limited partnership like many of its midstream peers.

So, let’s get started!

Purchase diversified energy infrastructure

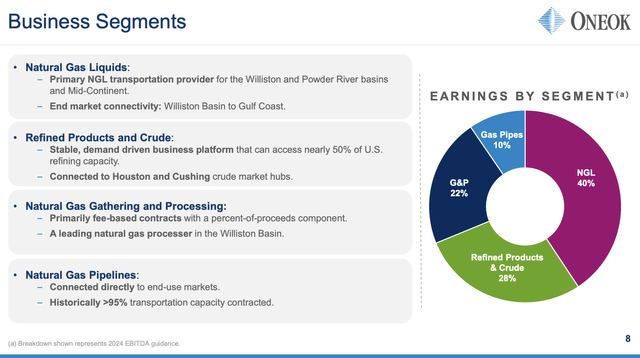

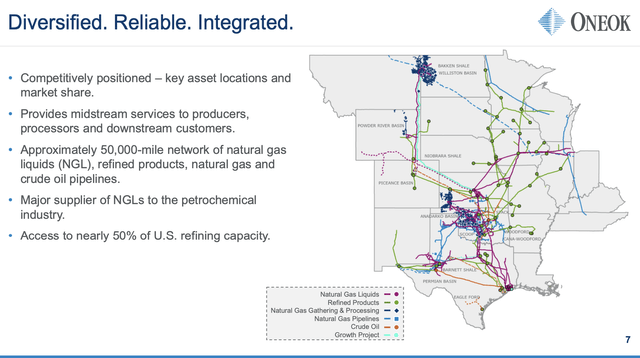

Initially, OKE was a natural gas and natural gas liquids (“NGL”) company. However, following a series of major transactions, including its merger with Magellan, it is now a highly diversified midstream company.

- As shown below, nearly 70% of its revenue comes from NGL and refining/crude oil operations.

- 22% of its revenue comes from collection and processing operations, which are mainly fee-based operations. In the Williston Basin, the company is a leading natural gas processor.

- 10% of its revenue comes from natural gas pipelines that directly connect supply and end-use markets.

Ook Corporation

The company has about 50,000 miles of pipeline and half of U.S. refining capacity

Ook Corporation

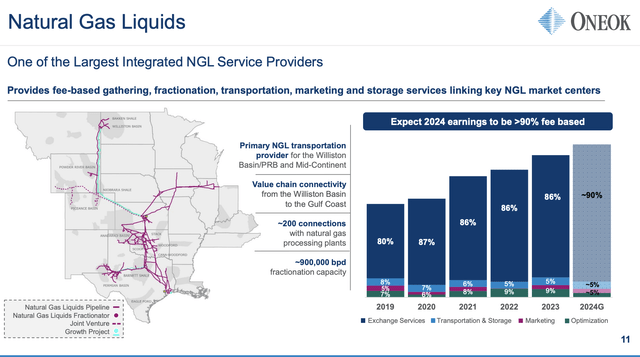

Even better, the company also benefits from increasingly favorable contracts. As shown below, more than 90% of its NGL revenue this year is expected to come from fees. This will be up from 80% in 2019.

Ook Corporation

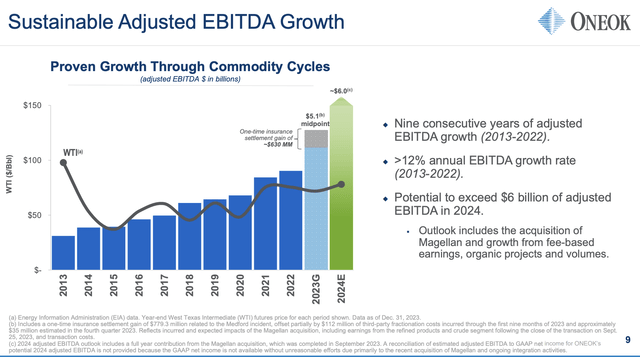

In fact, over the past decade, the company has transformed from a highly volatile midstream company into a reliable powerhouse with continued dividend increases, lower capital requirements and an increasingly healthy balance sheet.

The company has maintained impressive adjusted EBITDA growth over the past decade, demonstrating its resilience through many commodity cycles, including the 2014/2015 oil price collapse and the COVID-19 pandemic.

As you can see below, the company hasn’t seen a decline in Adjusted EBITDA since at least 2013, and its Adjusted EBITDA grew 12% annually between 2013 and 2022.

Ook Corporation

This is the power of midstream companies. They benefit from throughput. They are somewhat insulated from low commodity prices unless prices are so low that producers reduce output.

Note, however, that investors who want to bet on rising commodity prices would be better off buying oil and gas producers.

Personally, I do both. If oil continues to rise, I’ll buy upstream for the special dividend and potentially huge gains, and buy midstream for continued revenue growth and safety.

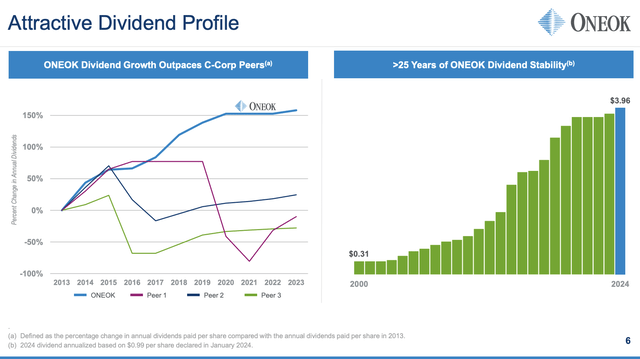

Going back to OKE’s track record, dividends paid to shareholders have also increased significantly. In 2000, the company paid $0.31 per share. After raising the dividend by 3.7% on January 17, the annualized dividend for 2024 will be $3.96. This represents a yield of 4.9%.

Ook Corporation

The best news for dividends is that OKE is getting flush with cash.

See, one of the biggest issues midstream companies have faced over the past decade (and before that) has been increased capital expenditures (“CapEx”). After all, building huge pipe networks is very expensive!

Now, as projects are completed and cash is brought in, the companies’ fees are falling.

For example, OKE’s capital expenditures in 2019 were $3.8 billion. This year, that number is expected to be $1.8 billion, and could fall to $1.5 billion by 2026.

Meanwhile, free cash flow is expected to increase from -$1.9 billion in 2019 to $2.9 billion in 2024 and $4.0 billion in 2026.

Since OKE has a market cap of $46.8 billion, this implies a 2024 free cash flow yield of 6.2%.

In other words, the company has enough free cash flow to pay the dividend 1.3x! By 2026, this number could rise to 8.5% (1.7x current dividend).

Even better, the company has an investment-grade credit rating of BBB and a long-term net leverage target of 3.5x EBITDA. Net leverage this year is expected to be 3.5 times.

Ook Corporation

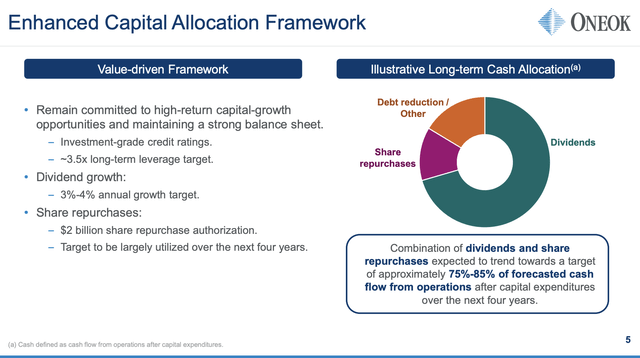

As such, the company remains committed to continued dividend growth and buybacks.

- It targets annual dividend growth of 3-4%.

- It announced a $2 billion buyback program.

- Over the next four years, the company aims to distribute up to 85% of operating cash flow after capital expenditures.

In January, we increased our quarterly dividend by 3.7% to $0.99 per share, or $3.96 per share on an annualized basis. Looking forward, ONEOK estimates that its annual dividend growth rate target is 3% to 4%.

We also announced $2 billion of stock repurchase authorization, which we aim to use primarily over the next four years. This plan is complementary to dividend growth rates when considering future shareholder returns.

Over the next four years, ONEOK’s dividend and stock repurchase portfolio is expected to reach a target of approximately 75% to 85% of expected operating cash flow after determining capital expenditures. – OKE 2023 Q4 Earnings Conference Call

I believe these numbers make OKE and many of its peers an excellent long-term investment, as we’re dealing with a company that can sustain profitable growth and reward shareholders in ways that were unimaginable just a few years ago.

Continued growth and good valuation

In addition to having an increasingly favorable free cash flow position, there’s plenty of room to grow.

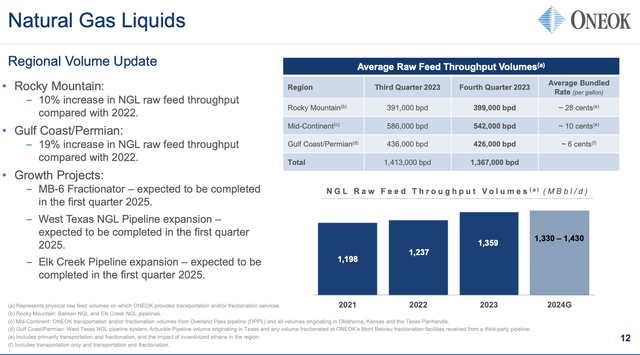

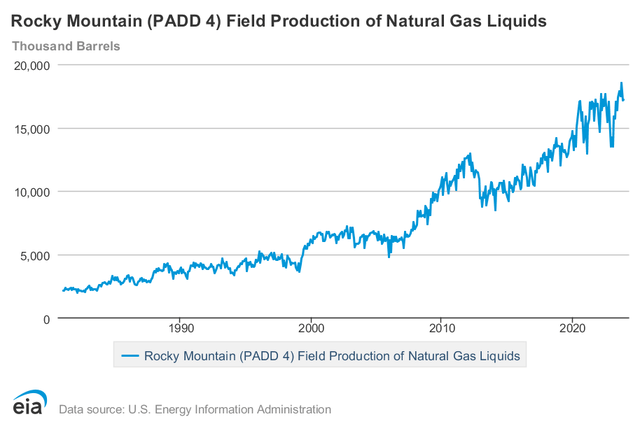

For example, the Rocky Mountain region has seen significant growth.

The region’s LNG production has surged by more than 20% per year over the past five years, while natural gas processing has grown steadily at 10% per year during the same period.

In the fourth quarter of 2023, the company’s natural gas processing volume increased by 14%. NGL sales increased by 10%.

Additionally, OKE officially pushed to expand the Elk Creek Pipeline’s capacity to 435,000 barrels per day, increasing total NGL capacity in the Rocky Mountain region to 575,000 barrels per day.

Ook Corporation

Even better, expectations for production growth in the Rockies and Midcontinent remain strong, with higher-than-expected well connections in 2023 and producer activity levels expected to remain stable in 2024.

Energy Information Administration

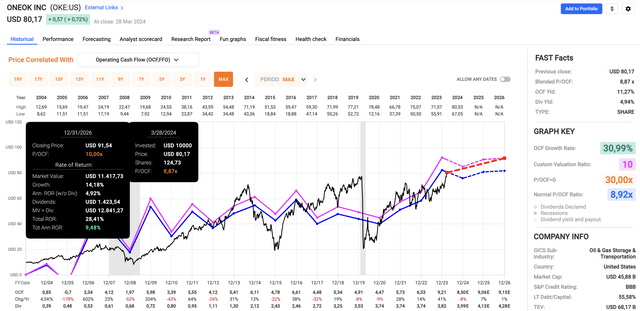

Turning to its valuation, despite a 16% return since December 29, the stock still offers potential for new investors and those looking to add to their positions.

Currently, OKE’s blended P/OCF (operating cash flow) ratio is 8.9x.

Historically, the company has traded at a P/E ratio of 8.9x. However, as the company has become more mature, I would expect 10x to be a very good fit. If the market shifts from growth stocks to value stocks, I wouldn’t even rule out the possibility of a P/E ratio of 11x in the next few years.

quick chart

Additionally, the company’s OCF is expected to grow 7% in 2025 after declining 8% in 2024. Growth is expected to be 1% in 2026.

My personal view is that all of these growth rates could end up being higher than expected because I’m very bullish on LNG production and I see higher associated gas production — especially if crude oil production in key basins continues to increase.

Combining a 10x OCF multiple with expected EPS growth and its yield of 4.9%, we get a potential annual return of 9.5-10.0%.

I believe the company could exceed this number in the long term.

Therefore, I remain bullish and believe that OKE remains an excellent investment for everyone looking for high-quality income – especially in an environment where we could see a rotation from growth to value, as I discussed in this article (and others as discussed in many articles).

take away

Investing in an energy infrastructure giant like ONEOK not only provides continued revenue growth but also the potential for strong long-term returns.

With its diversified business, resilient earnings and commitment to rewarding shareholders through dividends and buybacks, ONEOK stands out as a promising player in the industry.

Its increasingly favorable free cash flow profile, coupled with expansion projects and strong sales growth expectations, make it an attractive stock for income-focused investors and those looking for capital appreciation.

Advantages Disadvantages

advantage:

- Revenue continues to grow: OKE has a diversified portfolio and a track record of steadily increasing dividends, making it a reliable source of income.

- Flexible profit: OKE has shown resilience despite market volatility, with its Adjusted EBITDA continuing to grow over the past decade.

- Favorable free cash flow position: The company’s improving free cash flow position, coupled with reduced capital expenditures, points to continued dividend growth.

- Growth opportunities: The Rockies and other regions offer continued growth opportunities.

- reasonable valuation: Despite recent gains, OKE remains fairly valued.

shortcoming:

- demand dependency: Although OKE’s dependence on commodity prices is limited, commodity demand risks may rise during an economic downturn.

- Potential regulatory risks: Changes in regulations or environmental policies may affect the company’s operations and profitability.

- competitive landscape: OKE operates in a highly competitive industry and faces competition from other midstream companies. In general, however, major midstream companies tend to have wide moats.

- market fluctuations: Like any stock, OKE is subject to market fluctuations, which can cause short-term fluctuations in its share price.