Rob Daly/OJO Photo via Getty Images

Overview

My recommendation for DocuSign (NASDAQ: DOCU) is a Neutral rating because despite positive overall revenue and billing growth, I still don’t have any confidence that growth can accelerate in FY25.My assessment shows Revenue growth is still poor compared to history, and year-over-year bill growth is still weak, with single-digit percentage growth. While there are signs of stabilization, the fact is that DOCU is expected to grow by mid-single digits, well below the growth rates of its peers.please note that i Previous rating Give DOCU a Hold rating due to weak operating metrics, and I’m concerned that short-term performance will remain weak given the poor macro environment.

Recent results and updates

While I’m encouraged by the more positive tone on execution and customer usage trends, coupled with macro comments suggesting stability The environment is slightly better Q4 2024, I’m still not entirely convinced that the DOCU business will see positive changes in fiscal 2025. I think the popular near-term bull thesis stems from two key metrics in the recent Q4 2024 results: revenue and billings growth, where DOCU reported total revenue of $712 million, up 8% and beating consensus growth estimates by 200 basis points, And it expects revenue to be US$833 million, an increase of 13% compared with the third quarter of 2024, and an annual growth acceleration of 800 basis points.

Just taking it at face value seems to indicate that there has been a strong positive change in DOCU’s growth. However, my assessment is different. On the revenue side, while it beat expectations, I noticed that the 8% year-over-year growth slowed down compared to the past few quarters. To better assess the “inflection point,” I looked at DOCU’s sequential revenue growth rate, which was only 1.7% in Q4’24, still well below the normalized 10% sequential growth rate that DOCU typically sees in Q4 ( To make matters worse, the sequential growth rate in 4Q24 was actually lower than the 2.2% sequential growth in 4Q23). As for billing growth, I believe the 800 basis points year-over-year growth acceleration should not be extrapolated to fiscal 2025 because the 400 basis points is due to: (1) large customer renewals; (2) billing starting in Q3 2024 Deferred billing; (3) boosting demand starting in fiscal 2025. If I simply assume that they each contribute equally to the 800 bps improvement, then the actual improvement would be around 260 bps, given (2) and (3) which are unlikely to happen again. Year-over-year billing growth is only about 800 bps (single-digit growth).

Therefore, my FY25 growth turning point assumptions remain conservative. However, I think DOCU’s medium-term growth is warranted as some key indicators show signs of further stabilization. Management reported that overall macro sentiment improved slightly in 4Q24, despite acknowledging that software optimization and macro-related customer purchasing caution continued to impact overall net new expansion. Other signs of stabilizing demand can be seen in DOCU adding signs and renewing multi-year, multi-million dollar contracts, with traction seemingly extending into at least the first quarter of 2025 (since they guided on this in early March), Because management expects net retention to be flat or slightly lower in the first quarter of 2025 (down 200 basis points sequentially from the fourth quarter of 2024). Likewise, consistent with the previous quarter, total customers increased 11% to 1.51 million, with sequential net customer additions returning to the recent average of 40,000. After two contractions in Q1 and Q2, customers with annual contract value (ACV) >$300,000 increased by 9 QoQ to 1,060 net additions in Q2, indicating recovering demand conditions .

Valuation and risk

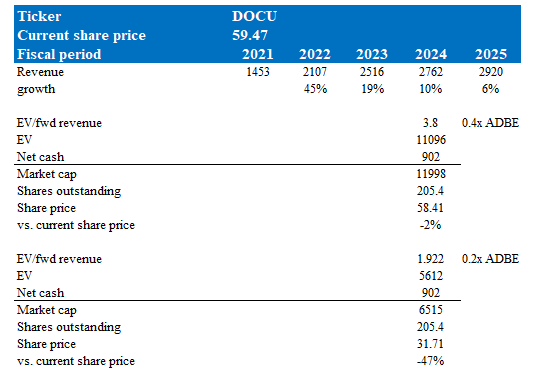

Author’s valuation model

According to my model, DOCU is valued at $58.41 based on the current outlook. This price target is based on my 6% growth forecast for fiscal 2025 (the midpoint of guidance). As I noted above, I don’t believe DOCU will see strong growth acceleration in fiscal 2025 (reflecting 13% billable growth) due to delayed and early billing confirmations. I mean, management is actually guiding for 6% growth, which speaks to growth momentum so far in the first quarter of 2025. This growth estimate does look poor compared to Adobe (ADBE), which guided for around 11% growth at the midpoint. Prior to COVID-19, DOCU typically traded at around 0.8x to 1x ADBE forward revenue multiple, but today it has dropped to 0.4x, which I believe reflects a significant slowdown in growth. In my base case, given the slowdown in growth, I assume DOCU will continue to trade at a relative multiple of 3.8x forward revenue (0.4x ADBE multiple). In the pessimistic scenario, if DOCU’s growth continues to slow (which may be due to continued weakness in the macro environment), and ADBE’s growth continues to accelerate (consensus expects growth to accelerate from 10.6% in FY24 to 11.5% in FY25), Then the relative multiple may fall back to a historical low of 0.2x. In a bear market scenario, DOCU might be worth only $31. Therefore, I don’t think the current share price is attractive.

generalize

To conclude this article, I maintain a Neutral rating on DOCU. Despite signs of stabilization, FY25 growth is still expected to be in the mid-single digits, lagging behind ADBE. The recent growth acceleration appears overstated due to one-time factors and pull demand. While the stock trades at a discount to Adobe, this reflects DOCU’s slower growth trajectory. That said, if growth accelerates again, DOCU could be a good fit for investors looking for a turnaround, but for now, the Neutral rating reflects the lack of a clear turning point.