Reed Vancelick

investment thesis

Since post-COVID normalization, DocuSign (NASDAQ: DOCU) has always been a hot topic among investors. They often come under scrutiny for failed attempts to turn around the company’s performance, including replacing senior leadership, developing strategic go-to-market strategies, and failing to recover growth.

Investors, on the other hand, appreciate the company’s high operating margins and large free cash flow (higher than many software companies today) and see this as an opportunity to buy the stock at its current P/E ratio of 15.3x. This creates a serious dilemma for investors.

Additionally, the market has been flooded with news of DocuSign exploring potential acquisitions and recent news about the company’s new restructuring plans. Are these good news or bad news?

Given the current situation, is DocuSign a stock worth considering?At the moment, I don’t think so, and that’s what I’m about to experience article.

Unsurprisingly, failed to resume growth

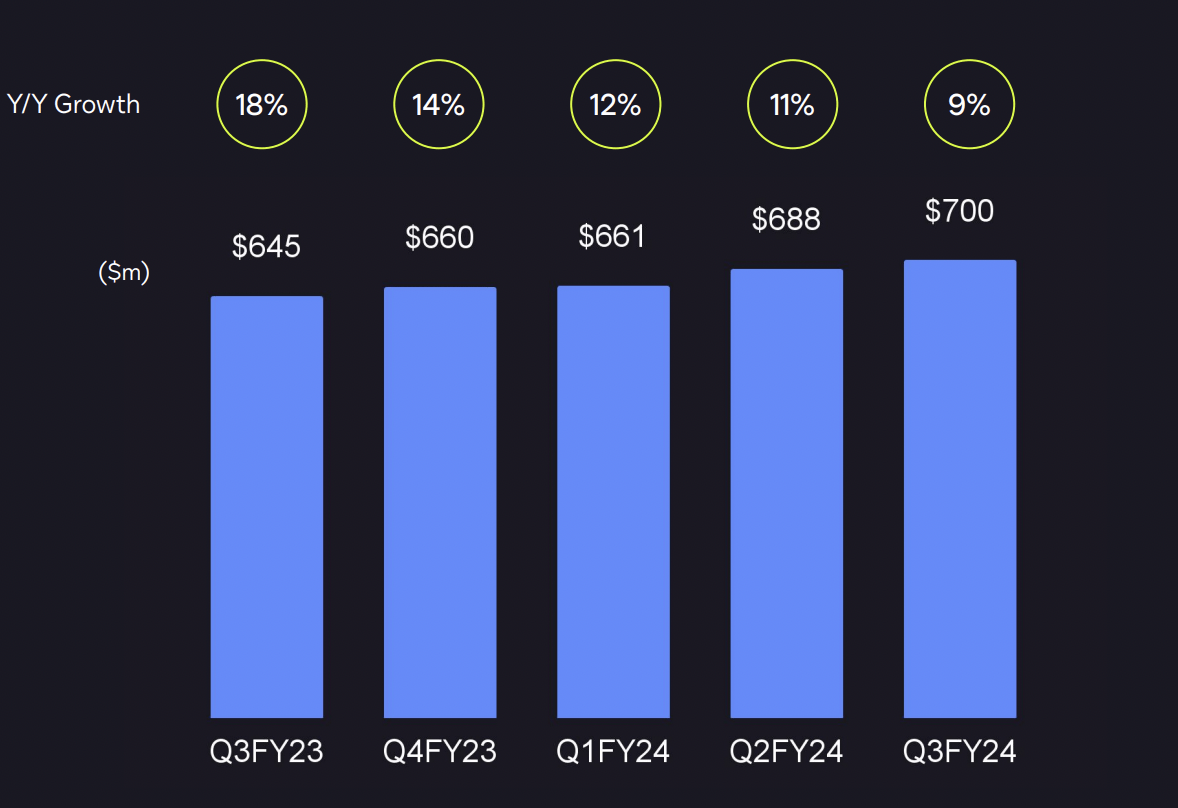

DocuSign 2024 Q3 Investor Presentation

already 2022former CEO Dan Springer resigned Current CEOAllan Thygesen, whose company lost 60% of its market value after the coronavirus outbreak. The company subsequently reported 22% year-over-year growth, down from peak growth of 50%. With many new changes in senior leadership to reinvigorate growth, growth continues to decline significantly by 7% as of Q3’24.

While a change in senior leadership won’t necessarily bring immediate results, we can all agree that the implementation has so far not been effective, and growth has been disappointing to say the least. Additionally, management has been touting its international growth opportunities and expansion into CLM, but the growth has not reflected this.

Isn’t DocuSign’s CLM service necessary?

Personally, I am a DocuSign user and a satisfied customer. I appreciate the seamless file signing process it provides and recognize its importance. However, I question whether it is necessary for my company to adopt complementary services beyond the DocuSign electronic signature product. These additional services are, at best, not as important as other important services.

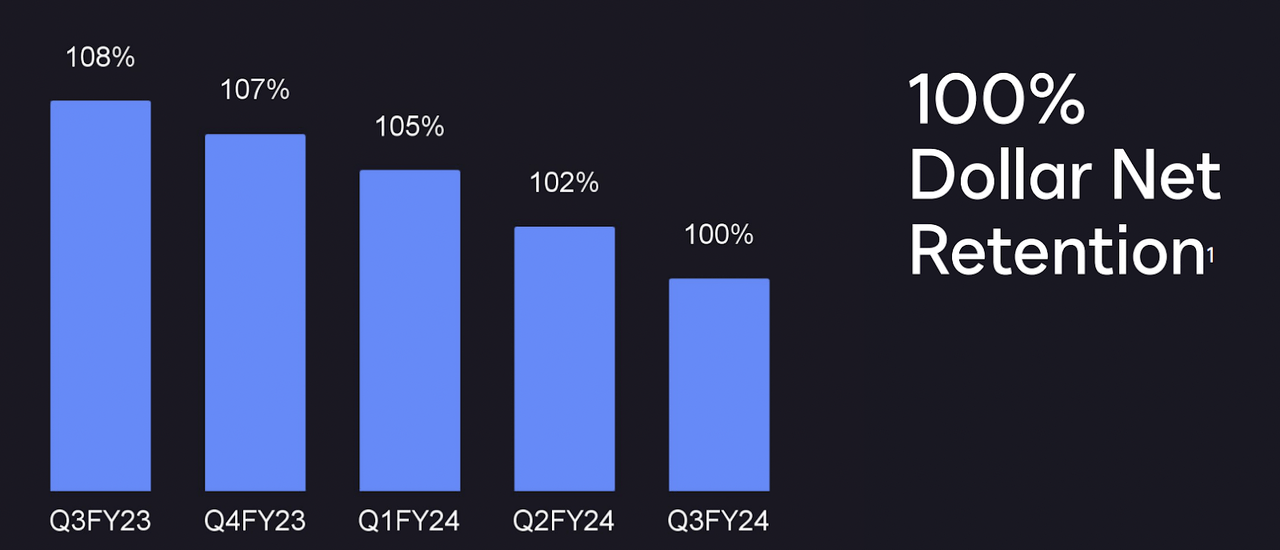

DocuSign 2024 Q3 Investor Presentation

Maybe the problem isn’t the reorganization but that customers don’t see the need to adopt it, making cross-selling extremely difficult. This is clearly reflected in the decline in dollar net retention rates.

Strong free cash flow, operating margin and balance sheet – good or bad?

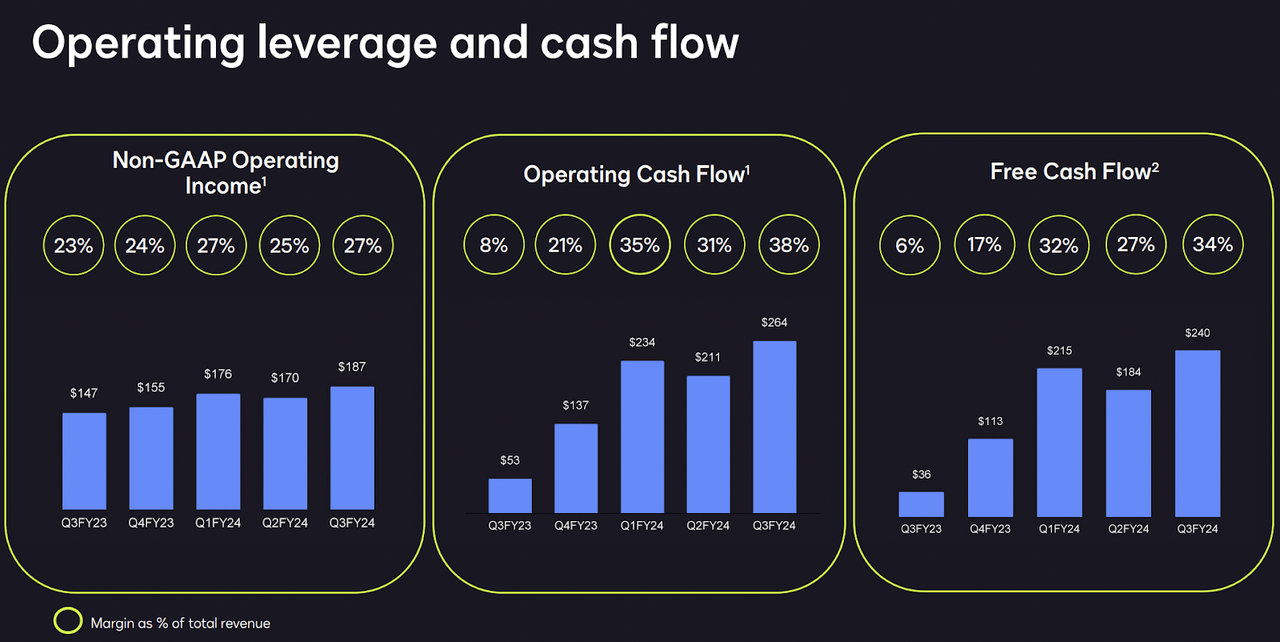

DocuSign 2024 Q3 Investor Presentation

Despite lackluster growth, its operating margins and free cash flow are impressive compared to many software companies. As of the third quarter of 2024, it had $1.2 billion in cash on its balance sheet, accounting for 11% of its current market capitalization of $10.55 billion.

While these numbers are certainly impressive, there is an opportunity cost when cash is underutilized. Typically, companies will enhance shareholder returns through buybacks, dividends, or strategic investments (which we prefer). Failure to deploy cash efficiently to generate returns above the cost of capital is likely to be considered inefficient and detrimental to shareholders.

The next question comes – what will they do with the cash?

The latest news on acquisitions and restructuring plans – good or bad?

In December 2023, news that DocuSign was exploring an acquisition spread like wildfire, sparking an uproar among investors and sending the stock price to as high as $60, but then fell back as acquisition talks progressed. stagnation After price disagreement.

I’m pondering the question, if the growth opportunities are equally exciting and lucrative, why are these companies exploring acquisitions?

After all, with DocuSign facing significant pressure from shareholders due to poor performance, exploring an acquisition to take it private is likely a more suitable strategy, as management will not have to deal with the pressures of being a public company and can focus entirely on running the company. If shareholders can receive a premium well above the current market capitalization, this is another way to maximize shareholder value.

In addition, the recently announced restructuring plan It doesn’t help that DocuSign is trying to reduce its workforce, primarily in sales and marketing positions.

While it makes sense from a cost reduction perspective to streamline operations and allocate resources to other high-priority areas, there are concerns about the company’s ability to drive growth and cast doubt on DocuSign’s ability to effectively execute its restructuring plan. This affects investor confidence.

Valuation

From a valuation perspective, 15.3x P/E doesn’t seem expensive for a software company with strong free cash flow, high operating margins, and a strong balance sheet. But if we take into account other factors, such as multiple failed attempts to revive growth, the valuation may not be as attractive as it seems.

in conclusion

Ultimately, as an investor, I want to see management invest cash in high-return projects to deliver value to shareholders.

I think there’s a lot of uncertainty about the company’s ability to successfully drive growth, and recent news of acquisitions and restructurings further reinforces that management has issues with its turnaround, making it a less-than-ideal investment right now.

What do you think? Let me know in the comments section below!