alisbalb/iStock via Getty Images

introduce

If people are looking for stock ideas, they are everywhere online. They promote their stock creative and newsletters commonly in advertising campaigns.At one time, they had their own my own radio program Special report on National Public Radio (NPR). For those of us who just started investing twenty-five years ago, we read their books for new stock pickers. They are a mixed bag of fools.

I am motivated by research a post Seen on Reddit, one user raised the following as a question:

Reddit post (Reddit)

Any investment firm claiming that it is a pump and dump scheme will be charged with a serious crime. I certainly would not accuse any organization of committing such a felony without any evidence.I never felt stupid The agenda being pushed is nothing more than an attempt to generate business. While it prides itself on being “silly,” I believe they are an organization that takes its fiduciary responsibilities seriously. It would be wiser to see if the Motley Fool has a careful and robust process. There is an index based on their process. Let’s study it.

Motley Fool 100 Index

My wanderings on the internet led me to discover The Motley Fool Index.It selects the 100 largest and most liquid companies and passes The following standards:

- Live in the United States

- The 150 highest-rated U.S. companies according to Fool IQ

- Daily trading volume reached US$1 million in the past three months

- Excludes ADRs, GDRs, EDRs, preferred stocks, closed-end funds, exchange-traded funds and derivatives.

- Apply 30% buffering to reduce universe turnover.

- The top 105 stocks are ranked based on Fool’s IQ beliefs.

- Previously qualifying stocks are included if their ranking is equal to or higher than 195.

- Final inclusion of the top 100 depends on market capitalization and index continuity.

- The top 70 stocks are automatically included.

- The remaining 30 stocks are based on belief scores.

- This is a market weighted index.

Despite the index’s strong performance, the average turnover rate for ETFs representing the index is only 5.8%.

Index performance

Before making any evaluation of an ETF, I always like to study its underlying index. The main purpose is because the history of the index is often older than one can analyze. I compared the Motley Fool 100 Index to the S&P 500 Index.

|

Fool 100 |

S&P 500 Index |

excessive |

||

|

Average* |

October 2017- March 2024 |

18.57%±21.51% |

13.64%±18.98% |

4.93% |

|

Rising year (rolling 12 months)** |

53 |

26.68% |

18.61% |

8.07% |

|

Year of decline (rolling 12 months)** |

14 |

-13.42% |

-8.67% |

-4.75% |

|

reward/risk ratio |

0.87 |

0.74 |

0.14 |

|

|

Beta |

1.07 |

1.00 |

0.07 |

|

|

*Annual returns are in geometric progression |

||||

|

**Rolling returns are arithmetic returns |

||||

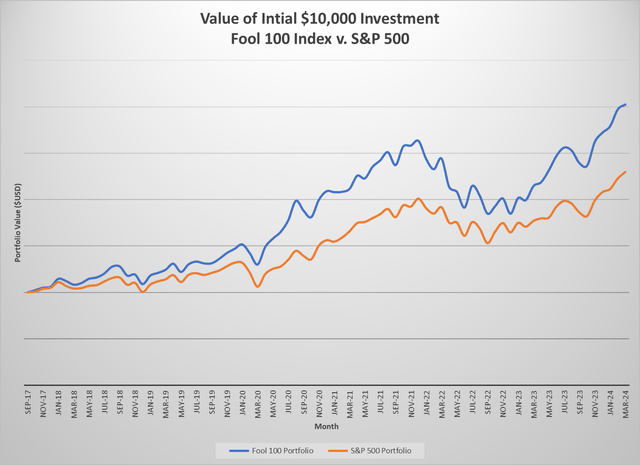

Here are the hypothetical returns on a $10,000 investment since the Fool 100 index was launched:

Hypothetical returns on Motley Fool 100 v. S&P 500 (Morningstar)

First, I like any focused index that outperforms the market. I also like that the fundamental risk indicators suggest that strategies with a higher beta (1.07) are worthy of additional returns. The caveat is that I don’t like the data for only seven years. I would feel more comfortable if I could analyze the entire 30-year cycle so that I could better understand how the lower end of the market is performing.

About ETFs

Motley Fool abandoned Launching mutual funds in 2021, focusing on ETFs. Motley Fool 100 Index ETF (Bat: TMFC) was launched in January 2018, with an average expense ratio of 0.50%. When comparing returns since 2019 to the corresponding index, its tracking error is -0.65%. The following is the website’s evaluation of TMFC investment:

- Morningstar – Strong Buy

- Lipper Leader – Strong Buy

- Zacks – Buy

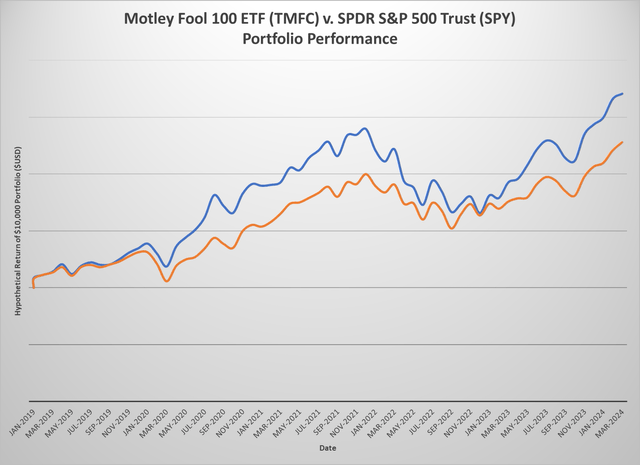

These are relative returns since 2019.

|

Motley Fool 100 ETF (TMFC) |

SPDR S&P 500 ETF Trust (SPY) |

excessive |

||

|

Average* |

January 2019-March 2024 |

20.89%±22.66% |

17.00%±19.72% |

3.89% |

|

Rising year (rolling 12 months)** |

40 |

30.53% |

21.64% |

8.90% |

|

Year of decline (rolling 12 months)** |

12 |

-16.89% |

-9.57% |

-7.32% |

|

reward/risk ratio |

0.93 |

0.87 |

0.06 |

|

|

Beta |

1.07 |

1.00 |

0.07 |

|

|

*Returns are in geometric progression |

||||

|

**The returned value is an arithmetic value |

||||

TMFC v. SPY (Portfolio Visualizer) Hypothetical Returns

As part of my analysis, I wanted to develop a method for evaluating ETFs. Here are the questions I want answered.

- Performance

- Does the underlying index or ETF perform better than the S&P 500 during market increases? Yes.

- Does the underlying index perform better than the S&P 500 during market declines? No.

- Does the underlying index or ETF have a better reward/risk ratio? Yes.

- history

- Does the underlying index or ETF have a long history through multiple cycles? No.

- cost

- Is the fee fair and reasonable for its overall performance?Yes

Based on these issues, I would rate TMFC a Buy at best. I’d like to see a longer history to determine how it reacts during market downturns. During these times, the protection of capital becomes critical, as does the overall market. As for the negative effects of market downturns, this becomes apparent if the risk/reward ratio is also not ideal.

If you just want to steal the Fool’s lesson, here are TMFC’s top ten holdings:

- Microsoft Corporation (MSFT)

- Apple Inc (AAPL)

- NVIDIA Corporation (NVDA)

- Alphabet Inc. (GOOG)

- Amazon.com (AMZN)

- Meta Platform Inc. (META)

- Berkshire Hathaway(BRK.B)

- Broadcom Corporation (AVGO)

- JPMorgan Chase & Co. (JPM)

- Visa Company (5)

Good luck and have fun.

Huge Games Selection

Huge Games Selection