matdesign24/iStock via Getty Images

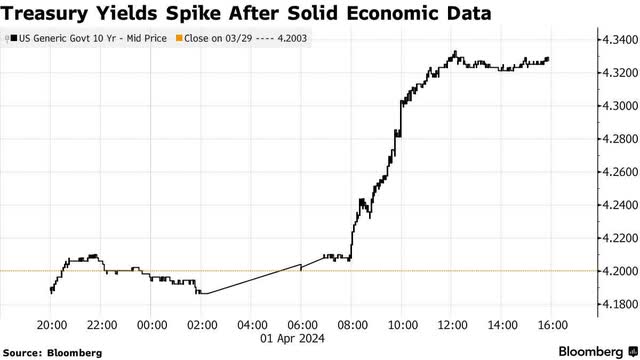

Stocks are taking a breather at the start of the second quarter, which isn’t surprising considering the strong first-quarter performance across major markets on average.Yesterday’s relatively mild decline blamed on sharp surge on long-term interest rates. The 10-year Treasury yield rose 14 basis points to 4.33%, its biggest one-day gain in two months, and when long-term interest rates rise, it puts pressure on the value of long-term assets such as common stocks. Investors appeared to react to Friday’s inflation report and stronger-than-expected manufacturing data.

Fenwitz

The core personal consumption expenditures price index, the Fed’s preferred measure of inflation, continued its gradual decline in February, falling to 2.8% from 2.9% in January.The 0.3% monthly gain increased The peak in January is unusual due to seasonal reasons. Still, investors are concerned that slow progress towards an eventual 100 basis point rate cut to the magic number of 2% will dash hopes that short-term rates will fall sooner or later. However, as long as the economy remains resilient, even delays will not matter.

Bloomberg

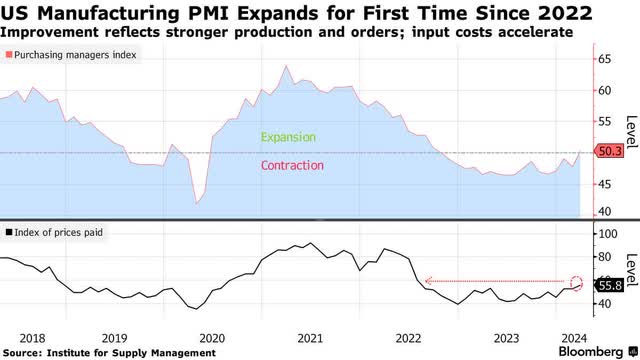

The Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers’ Index showed greater resilience. The U.S. manufacturing PMI rose above 50, marking the first expansion in 17 months. That’s not surprising considering a similar survey of the industry by S&P Global, which tends to lead the ISM, has been in expansion territory for the past three months.

Bloomberg

Last year, I said we would see a much-needed recovery in manufacturing to help offset slower growth in the much larger services sector. Thankfully, that seems to be happening, but I’d hardly call it a description of power. Pessimists have sounded the alarm about rising prices paid by manufacturers, another canary in the inflationary coal mine, but prices at 55.8 were broadly in line with pre-pandemic levels. There is no reason to sound the alarm. A soft landing is a balancing act between strength and weakness, and that’s what we’re seeing today.

I think investors should avoid overcomplicating things when evaluating high-frequency economic data. Most experts continue to dig into every detail of every report, seemingly trying to find some cause for concern. There are constant warnings about rising inflation, a weakening labor market and the timing of rate cuts, but the underlying trends and rates of change in the data still favor a risk-on approach, which is why major market averages remain in an upward trend. As investors, the only reason we analyze data is to identify underlying trends in the market and stay in the right direction with our money.

Keeping it simple has been the best strategy since the October 2022 bear market lows, but fear sell-offs and warnings have been more popular than a steady stream of good news. I intend to continue to pay attention to the basic trends of the market and pay close attention to the rate of change of economic data to capture the upside of this bull market as much as possible. There will come a time when it makes sense to become more defensive, if not bearish, but that time is not today. Still, I appreciate a lot of the pessimistic commentary because it’s the glue that keeps the uptrend intact.