Alexander Golubev/iStock via Getty Images

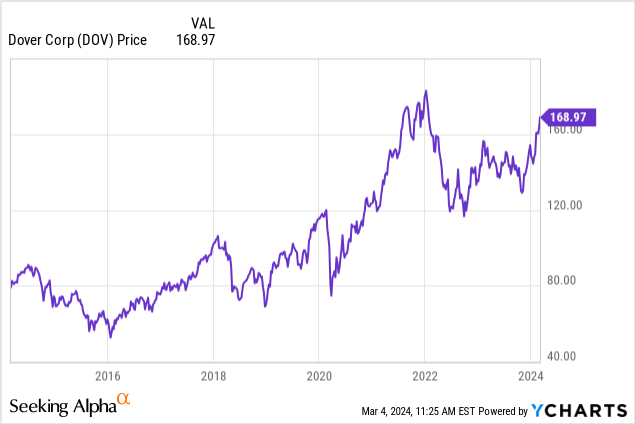

Dover Corporation (NYSE: DOV) hit a new yearly high on Monday. Investors are not only irrational in their evaluation of DOV, but also in their evaluation of most of the stock market.Most DOV indicators show inventory Not a buy at the latest price – the dividend yield is just 1.2%, the forward price-to-earnings ratio is 18.7x, and the tangible book value is negative. Additionally, the CFO continues to sell stock.

“Old School” Indicators

dividend

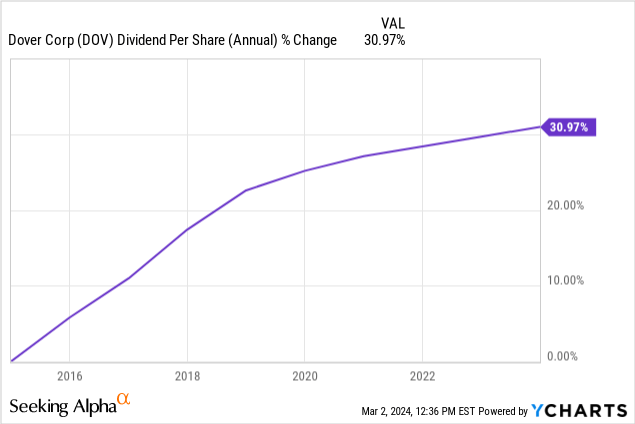

I want to start with Dover’s dividend. They have increased their dividends for 69 consecutive years. While this looks very impressive, in my opinion it is not a valid reason to buy/hold the stock if it is otherwise fully valued. The current quarterly dividend is $0.51, and the dividend yield is only 1.2% and is This rate is very low compared to the 4.53% on the 2-year Treasury note. The dividend growth rate over the past 10 years is about 31%, which means there has been no real growth because the CPI index has increased by more than 29% during the same period. I wasn’t impressed. Total dividends are up just 1% in 2023, from $2.01 in 2022 to $2.03, which is actually lower than the previous year when adjusted for inflation. The dividend is fairly safe, as it will account for just 24.9% of free cash flow in 2023, a big improvement from 49.2% in 2022.

Ten-year dividend per share percentage change

book value

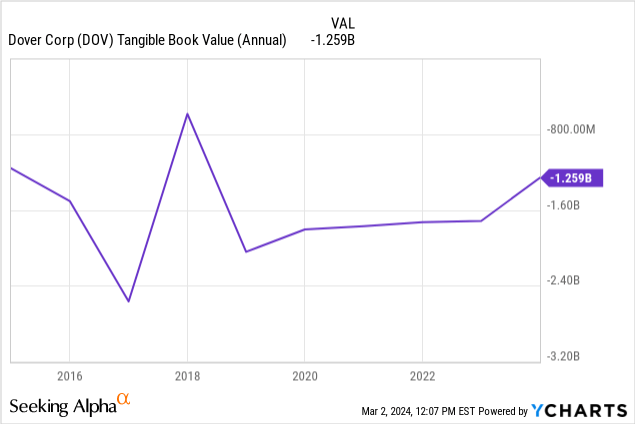

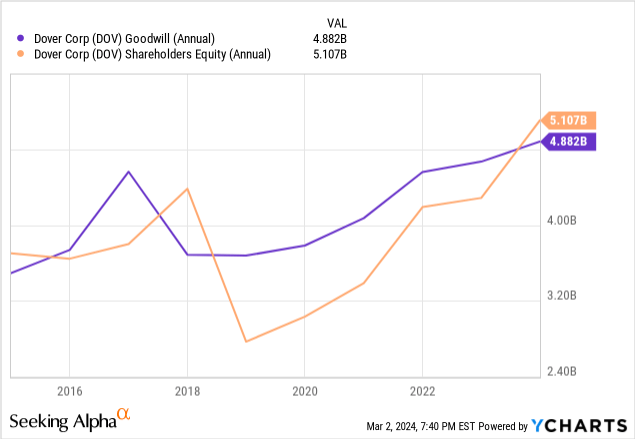

Another “old-school” metric that some investors often look at is book value. Dover’s tangible book value is negative $1.259 billion. There are two main reasons for this huge negative value. First, they have $4.882 billion in goodwill on their balance sheet from acquiring companies whose book value exceeds that company’s book value. Second, they repurchased $6.798 billion of stock, which reduced shareholder equity.

tangible book value

Total shareholders’ equity and goodwill

P/E ratio

Another popular metric is Price/Earnings. On a conference call on February 1, management gave 2024 earnings per share guidance of $8.95 to $9.15. Using a midpoint of $9.05 per share and the latest DOV price of $169.23, the forward P/E ratio is 18.7x. Given the lackluster growth over the past few years, 18.7x may be a bit high given the current high interest rate levels used to estimate the present value of future earnings. It’s worth noting that their guidance “is primarily driven by specific products and end market exposures rather than AG, the Fed will lower interest rates and GDP will expand.”

insider trading

While this isn’t actually an indicator, it is one that many investors pay attention to – recent insider buying/selling. Treasurer Brad Cerepak submitted a Form 4 disclosed on February 27 that he sold 18,410 shares of DOV stock on February 23 at an average price of $163.014 per share. He still owns 23,909 shares and holds another 2,959 shares in his 401k plan. He also owns 181,754 vested shares with stock-settled appreciation rights.I think that’s a major negative, especially after he Sell 14,000 shares were issued on December 5 last year at a price of $142.

Business Model – Buying and Selling a Company

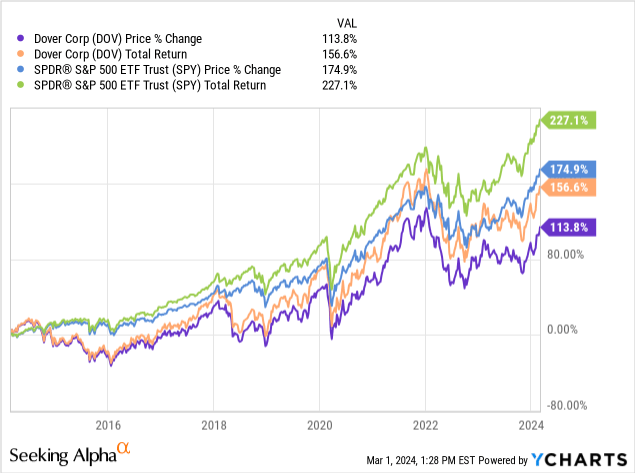

Dover Corporation manufactures a variety of industrial products in the middle of the supply chain. Few of their products are sold directly to individual consumers. However, Dover’s actual business model is to buy and eventually sell/spin off businesses. I’ve followed this stock since the early 1980s, and this has been their business model for decades, but their long-term record has been disappointing relative to the rest of the market.

Dover Total Return vs. S&P 500

From 2013 to 2023, Dover acquired 54 companies for $5.86 billion (an average of $108.5 million).Recently they purchase Forward FW Murphy is worth $530 million. During the same period, they sold or spun off many companies. In 2014, Knowles Corp (KN) was spun off (0.5 shares of KN for one share of DOV), and in 2018 Apergy (formerly APY) was spun off (0.5 shares of APY for one share of DOV). They just completed the sale of De-Sta-Co for $680 million.

Investors can’t actually evaluate specific acquisitions because the company does report detailed financial performance. Newly acquired companies are often lumped in with other companies in the field. So, for example, you can’t see whether synergies are actually being realized.

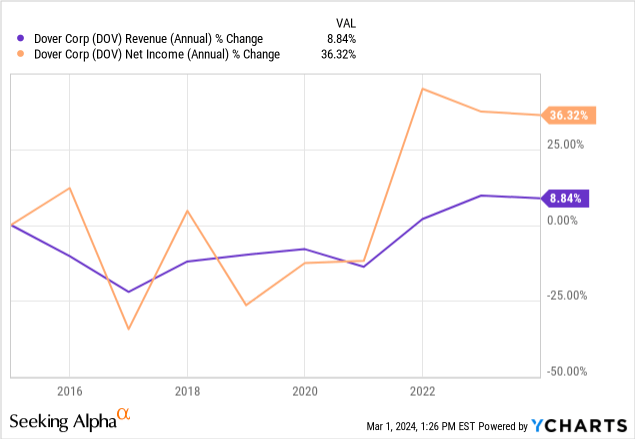

It’s unclear what Dover will bring. In business school, we are taught that, in theory, one of the main reasons for acquisitions is that the buyer has more and/or cheaper capital than the acquired company. Since Dover’s debt rating is S&P BBB+ and its net debt to net capital ratio is quite high at 37.3%, Dover’s capital is likely cheaper than many acquired companies. Another reason for acquisition is that the buyer has better management/better expertise. Based on Dover’s operating performance, I don’t think that will be the case for them. Revenues and profits have been weak, especially after accounting for inflation. This is probably the main reason why their long-term results are not impressive – buy-side management adds little or no value.

10-Year Revenue and Net Income Percent Change

Diversification

Dover currently has five sections. There are many independent companies in these market segments. The problem for investors is that the composition of these industries often changes due to the ongoing buying and selling of individual companies.

Quarterly and Annual Revenue and Earnings by Segment

government security agency

I did a search for specific companies and most of them have sales brochures with long lists of products. Dover sells literally thousands of different products. For example, the newly acquired FW Murphy has a large portfolio of products, including pneumatically controlled discharge valves, as shown below. (So if the reader needs a pneumatically controlled bleed valve, it can be purchased from FW Murphy for $400-$600.)

FW Murphy Drain Valve

www.fwmurphy.com

However, individual consumers are exposed to other Dover products every day, such as refrigerated display cases manufactured by Hillphoenix.

Hillphoenix Refrigerated Display Cabinet

www.hillphoenix.com

Having so many products also means having so many different ingredients and suppliers. This means there could be serious supply chain issues in the future, such as what happened in 2021 and 2022. With a relatively financially strong parent company, individual companies are able to hold on to inventory without being squeezed by suppliers, especially when there are weaknesses in that particular industry. If a company is facing serious financial problems, suppliers will often impose strict terms, including cash on delivery, but a Dover-owned company will most likely not face such problems. This is a major competitive advantage.

Dover holds an important position in the energy industry, particularly natural gas. The domestic natural gas industry has performed well over the past few years, in part due to the export of LNG. This is a part of the industry that many countries around the world want to “end” in the long term. They also have access to clean energy and can benefit from the Inflation Reduction Act and the Bipartisan Infrastructure Act.If Trump is elected, some of them will Tax incentives Will “clean” hydrogen projects be scaled back or even cancelled?

Year-end bookings weak

Year-end bookings mean revenue in 2024 will likely be lower than in 2023, as year-end bookings historically account for 95% to 105% of next-year revenue. In my opinion, management’s EPS guidance of $8.95-$9.05, compared with $7.52 in 2023, could be a challenge. To hit their guidance, margins would have to increase significantly from 21% in 2023.

Bookings for the end of 2023 and changes from the previous year

Engineering products $2.097 billion +4.6%

Clean energy and fuels $1.746 billion (4.1)%

Imaging and Recognition US$1.121 billion (2.9)%

Pump and process solutions $1.677 billion (1.9)%

Climate and sustainable development technologies US$1.349 billion (19.2)%

Fourth Quarter and Annual Income Statement for 2023 and 2022

government security agency

in conclusion

I sold all of my DOV stock last Friday and this morning (Monday) as well as a few others because I thought the overall market was overpriced. I just bought DOV as a trading stock a few months ago. Dover companies have been difficult to analyze over the decades because their holdings, as well as their industry exposure, have constantly changed. The reality is that many investors buy/hold DOV stock not because of specific circumstances related to its operations, but based on management’s ability to buy and sell the company at a profit.

I think DOV stock is long term neutral/maintain Because there are some potential positive developments, such as clean energy, but there are also long-term negative impacts, such as the fossil fuel industry that much of the world is trying to “terminate.” Additionally, its price-to-earnings ratio of 18.7x isn’t cheap. However, I wouldn’t hold DOV based solely on its 1.2% dividend yield, as there are other better dividend investments out there.