MotionIsland/iStock via Getty Images

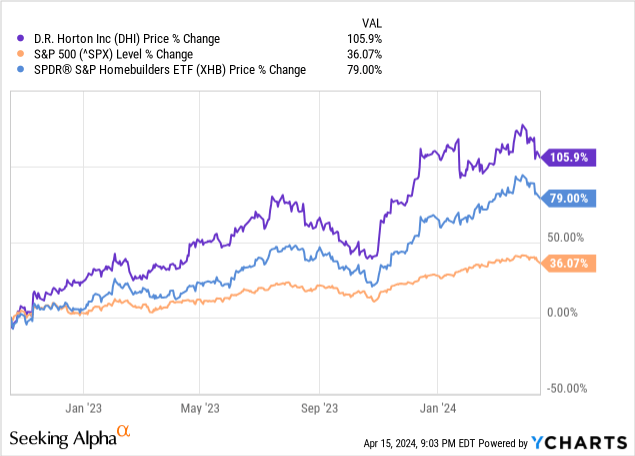

Dr. Horton (NYSE: DHIDHI has experienced a stunning run since we initiated our bullish view in October 2022 with a Strong Buy rating. The S&P 500 rose 36.1% (SP500) and a return of 79.0% SPDR S&P Homebuilders ETF (XHB) over the same period.

Our recommendation that homebuilders outperform the market amid a sharp hike in interest rates by the Federal Reserve was extremely unpopular and dismissed by many readers. It’s understandable why our idea seemed too risky to some investors at the time. Nonetheless, we firmly believe that the severe housing shortage will support residential property prices and provide meaningful upside potential for DHI’s earnings over the next few years. DHI’s homebuilding business is also fundamentally The company’s shares are solid and deeply undervalued, as overwhelming fear continues even after the market bottoms in October 2022.

what did we do wrong

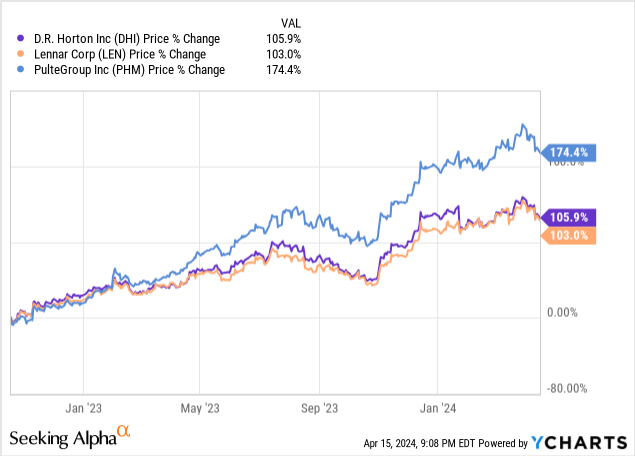

We chose DHI after comparing it to other large homebuilders like Lennar Corp. (LEN) and PulteGroup Inc. (PHM). Admittedly, this is where we missed out. PulteGroup emerged as the best performer in the group, posting a stunning gain of 174.4% during the period. Meanwhile, Lennar Corp’s results were just slightly behind DHI’s.

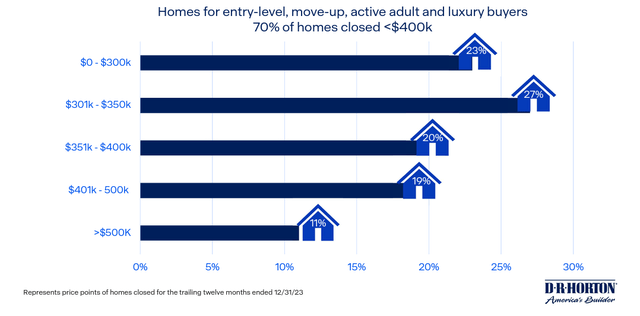

Looking ahead, we remain optimistic about DHI’s target market, which is more inclined to attract entry-level homebuyers. According to data released in a slideshow from DHI’s first quarter fiscal 2024 investor presentation, 70% of the homes the company closed were priced under $400,000.

Dr. Horton’s First Quarter Fiscal Year 2024 Investor Presentation

We continue to believe that the influx of skilled workers and the formation of new households among Millennials (aged 25-35) will drive demand for new housing. Therefore, we expect multifamily and lower- to mid-range single-family properties to continue to enjoy strong demand given the low- to moderate-income status of these demographic groups.

Bullish outlook unchanged

Today, the underlying factors leading to the severe housing shortage remain largely unchanged, and we see little evidence that authorities are making any progress in solving the problem.

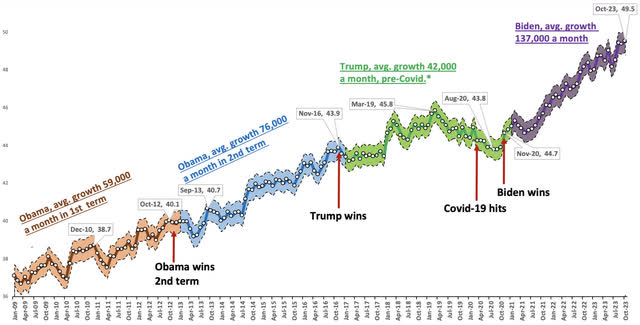

Not only introversion Increased immigration Increased significantly during the Biden administration, adding to both immediate and projected demand for housing in the coming years. But pent-up housing demand among conventional household formations continues to be strong.Different kinds rumor Surveys by industry observers suggest buyers are holding off on purchases simply in anticipation that mortgage rates will eventually slow as the Federal Reserve cuts rates.

Center for Immigration Studies

These factors driving our bullish view on homebuilders remain in place, while the industry continues to underbuild due to rising labor and material costs.

High borrowing costs also benefit large homebuilders like DHI, which have economies of scale and financial strength, allowing the company to gain market share from smaller builders.

Valuation remains attractive relative to the broader S&P 500

While DHI’s gains since we proposed our bullish view have been impressive, the stock trades at an attractive TTM P/E of just 10.9x as of this writing.By comparison, the S&P 500 trades at about 27.5 timesnot only provides investors with an opportunity to reduce risk by rotating out of technology stocks into value stocks, but we also believe that DHI offers more upside potential.

Therefore, we reiterate our “Strong Buy” rating on DHI. We believe the recent decline in price action represents an attractive accumulation opportunity for investors.