Klaus Weidelfeldt

Duckhorn Portfolio was founded in 1976 (NYSE: NAPA) operates a portfolio of wine brands throughout North America.company’s brand Includes names like Duckhorn Vineyards, Paradux, Decoy, Goldeneye and Migration.Yajiao makes most of its revenue from wholesale, but also sells Serving wine directly to customers.

Following its initial public offering in early 2021, Duckhorn’s stock price has almost steadily halved, despite a pretty good profit trajectory based on IPO data.

IPO stock chart (Seeking Alpha)

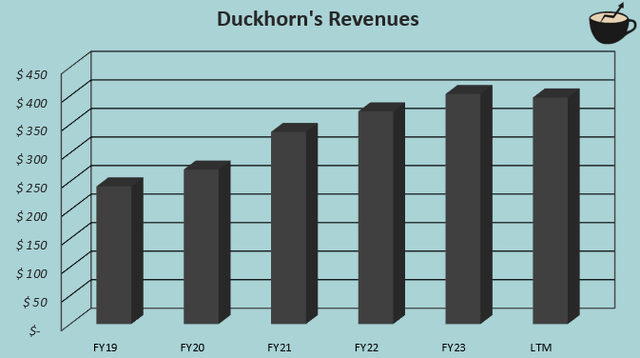

Record of profitable growth

From fiscal 2019 to current trailing revenue ending in the second quarter of fiscal 2024, Duckhorn’s revenue has grown at a compound annual growth rate of 11.7%. The company has been able to steadily increase sales with its luxury wine portfolio.Along with its steady growth, Duckhorn has also been able to maintain high profit margins; the company’s current trailing operating margin of 26.1% is within the company’s upper range The historical annual range for tracking margins from fiscal 2019 to now is 23.0% to 27.0%.

Calculations performed by the author using Seeking Alpha Data

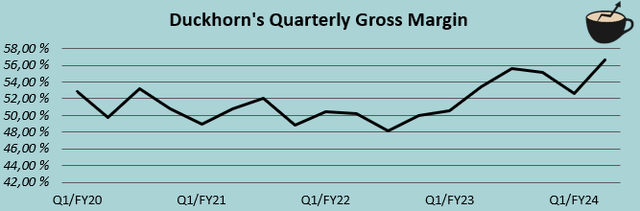

Duckhorn’s profit margins grow significantly Q2 Investor Presentation, Duckhorn communicates good grape sourcing as a driver of higher profits. In the second quarter of fiscal 2024, the company’s gross profit margin expanded to 56.6% from 53.3% in the second quarter of fiscal 2023, and its operating profit margin increased by 3.4 percentage points annually. The company’s gross margin has begun to expand significantly on a quarterly basis.

Author’s calculations using TIKR data

While margin expansion is substantial, I don’t think it’s reasonable to extrapolate margin expansion for now; even with higher gross margin levels, Duckhorn’s operating margins are within the company’s historical range.

Growth requires capital

That growth requires capital — and Duckhorn has plenty of investment. In the fourth quarter of fiscal 2023, the company acquired a wine production facility in California, which increased capital expenditures by approximately $55 million during the quarter. Continued growth requires such investments in capacity expansion. Another important capital requirement is continued working capital growth; Duckhorn must expand its inventory to support growth, with inventory currently increasing by $62.7 million over the past 12 months and total working capital increasing by $78.4 million. The company’s working capital continues to increase to support growth.

Taking into account capital expenditures and working capital changes, Duckhorn’s cash flow is currently quite constrained. The company currently has a trailing ROE of 7.01%, according to earnings data from Seeking Alpha, and while the ROE excluding goodwill is higher at around 11.96%, this growth certainly isn’t free. The return on capital achieved is pretty good, but doesn’t make growth incredibly valuable.

current weakness

As can be seen from the revenue in recent quarters, Duckhorn’s revenue in the first half of fiscal year 2024 has not yet grown. First-half revenue fell -2.9% year-on-year, mainly due to a weak first quarter. Duckhorn tied the weakness to weak industry performance during the company’s first-quarter earnings call, as consumer sentiment has been weak.

Duckhorn has narrowed the fiscal 2024 revenue outlook range to the lower end in the Q1 report, and further reduced the revenue outlook in the Q2 financial report; the current revenue guidance of US$395 million to US$411 million may still face some downward pressure. The midpoint of current guidance still expects some revenue growth in the second half. Duckhorn said on its second-quarter earnings call that the company expects the market to remain challenging in the coming quarters but still expects to grow faster than the overall luxury wine market. In a second-quarter investor presentation, Duckhorn showed the company had grown 3.0% for the twelve weeks ending January 28, 2024, compared with Luxury Wines’ performance of 1.1%; current growth stagnation appears likely Eventually fading, this does not represent poor company performance specifically, but rather a sign of market weakness.

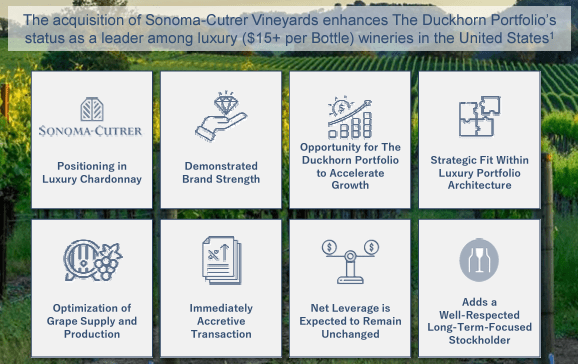

Acquisition of Sonoma-Cutler Vineyards

duck horn declare The November 2023 acquisition of Sonoma-Cutrer Vineyards, acquired from Brown-Forman, a company I have previously reported on. Total consideration for the acquisition is approximately $400 million, which includes 31.5 million shares of Duckhorn stock, valued at $350 million at the time of the transaction, and cash consideration of approximately $50 million, subject to certain unspecified adjustments. The acquisition will be completed in spring 2024.

The acquired company’s sales for the fiscal year ended on the 31st were approximately US$84 million.Yingshi July 2023. At the current stock valuation, the price tag is a whopping $333.5 million, with an EV/S ratio of 3.97, while Duckhorn’s current trailing EV/S ratio is 3.35; the acquisition price is unattractive compared to Duckhorn’s own valuation force. Sonoma-Cutler Vineyards’ adjusted EBITDA margins are said to be similar to Duckhorn’s. However, in my opinion, the estimated $5 million in annual run rate synergies makes the acquisition reasonably valued. Duckhorn further rationalized the acquisition by improving the positioning of luxury Chardonnay.

Duckhorn Second Quarter Investor Presentation

Falling stock prices now provide an attractive entry point

Although Duckhorn initially had a higher P/E following its IPO, good earnings growth and a lower stock price have resulted in a more attractive forward P/E of 14.1x now.

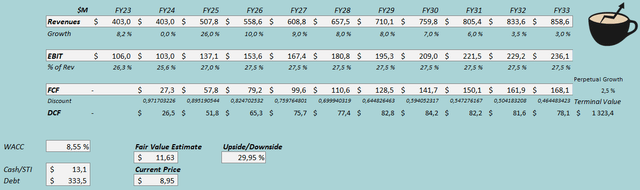

To further demonstrate valuation, I constructed a discounted cash flow model. In the DCF model, I consider the acquisition of Sonoma-Cutrer Vineyards, which increases the stake count by 31.5 million shares and increases debt by $50 million. To put it more clearly, I estimate that this acquisition will be accretive to earnings starting in fiscal 2025, with 26% growth in that year after revenue stabilizes in fiscal 2024. After that, I estimate growth to be roughly in line with Duckhorn’s historical track record, with growth expected to be 10% in fiscal 2026, before gradually slowing to a permanent growth rate of 2.5%, with total revenue CAGR from fiscal 2025 to fiscal 2033 is 6.8% with organic performance.

As the acquisition has similar adjusted EBITDA margin but is expected to generate $5 million in synergies and exhibit gross margin leverage, I estimate Duckhorn’s EBIT margin to rise to 27.5% from an estimated 25.6% in fiscal 2024 %, with a certain degree of leverage. The company’s growth requires a lot of capital, and I estimate that cash flow conversion will be poor initially but improve as growth slows.

Based on the above estimates and a cost of capital of 8.55%, the DCF model estimates Duckhorn’s fair value at $11.63, which is approximately 30% higher than the share price at the time of writing. Following the stock’s decline, the current price now appears to be a fairly attractive entry point.

discounted cash flow model (Author’s calculations)

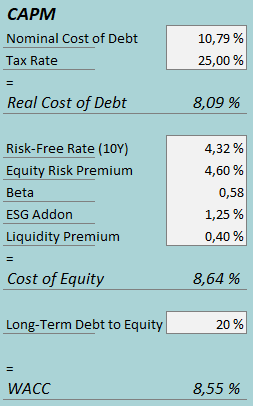

The weighted average cost of capital used is from the capital asset pricing model:

capital asset pricing model (Author’s calculations)

Add in Duckhorn’s current interest-bearing debt and second-quarter interest expense, and the company’s interest rate reaches a rather high figure of 10.79%. The company’s debt leverage is quite high, and I estimate the long-term debt-to-equity ratio is 20%, which is slightly lower than it currently is. For the risk-free rate in terms of cost of equity, I use the U.S. 10-year Treasury bond yield of 4.32%. The equity risk premium calculated by Professor Aswath Damodaran is 4.60% latest estimate United States, updated on the 5thth January.Yahoo Finance estimates Duckhorn’s beta at The number 0.25.I think this estimate is very low and instead use the average of the other three alcohol producers in addition to Duckhorn’s beta – and Brown-Forman’s beta Beta value is 0.79Constellation Brand’ Beta value is 0.96and Diageo’s Beta value is 0.33, establishing a beta value of 0.58. Finally, I add a small liquidity premium of 0.4%, resulting in a cost of equity of 8.64% and a WACC of 8.55%.

take away

Duckhorn’s profits have grown steadily over the past few years. Additionally, the company reported continued high margins and improved gross margins, suggesting there is still potential for modest margin expansion amid challenging market conditions that have generally had a negative impact on growth in recent quarters. While growth doesn’t come for free with investments in new facilities, increased inventory requirements, and acquisitive growth, I believe the stock price reflects a fairly attractive entry point after the stock’s steady decline. My DCF model estimates considerable upside potential for the stock; currently, I think that constitutes a Buy rating.