Artur

generalize

Readers can find my previous reports through this link. My previous rating was Buy because I believed in Duolingo’s (NASDAQ: DUOL) Growth momentum will continue for the foreseeable future, with positive progress in GAAP EBIT FY24. I reiterate my Buy rating as DUOL continues to grow at over 40%, as it has for the past 10 quarters, which is a strong sign that demand remains strong. As DUOL rolls out more GenAI features, I expect growth to continue at this strong pace. In particular, if DUOL can roll out GenAI capabilities to lower pricing tiers, it could speed up the free-to-paid conversion rate.

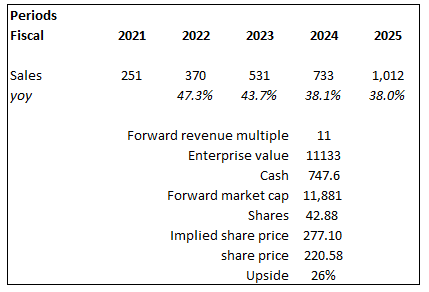

Finance and Valuation

DUOL reported strong performance in the fourth quarter of 2023, with total revenue growing 45.4%, mainly driven by 50% subscription growth (a 300 basis point sequential acceleration from 47% in the third quarter of 2023).Subscription strength Revenue was driven by subscriber growth, with paid subscribers increasing 57% year over year. However, gross margin compressed 20 basis points due to lower advertising gross margin (lower advertising revenue per DAU) during the period. This compression was largely offset by higher subscription gross margin contributions from a higher subscription revenue mix. Looking at the income statement, adjusted EBITDA became more positive at $35.2, primarily due to revenue growth. As of Q4’23, DUOL reported cash of $747.6 million and no debt.

Based on the author’s own mathematical calculations

Looking at UDMY’s growth momentum, I still think the business can grow at a very high rate in the short term. For FY24, management guided for $723.5 million at the midpoint, which implies growth of 36%. However, looking at DUOL’s performance so far, I think it may surpass this guide. Historically, DUOL has outperformed its guidance by an average of 1.3%, which I use to arrive at my fiscal 2024 estimate ($723.5 million * 101.35) of $733 million, representing ~38% year-over-year growth. While this is 200 basis points lower than my previous estimate, I remain confident in DUOL’s growth trajectory (a large pipeline of free subscribers that can be converted to paid and new GenAI features should also drive increased conversion rates); therefore , I now expect similar growth in FY25 to FY24. With growth continuing at such high levels, I believe DUOL should continue to trade at a premium to its peers (Coursera and Udemy) at 11x, 1.9x, and 1.6x respectively. Comparing the growth rates of the three companies, DUOL is the only company that has maintained a growth rate of 40% to 50% in the past 10 quarters, while Udemy’s growth rate has shrunk from 90% to 100% in mid-2022 to 20% in the fourth quarter of 2023. %, while Coursera’s growth rate continued to decline from 40% to 50% in mid-2011 to 20% in the fourth quarter of 2023.

Comment

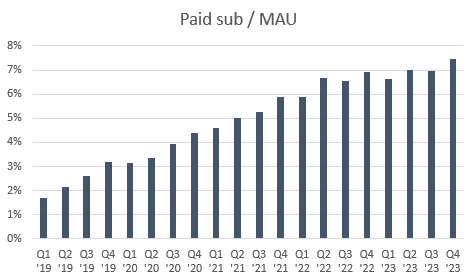

The growth momentum shows no sign of weakening, with total bookings becoming stronger, growth accelerating to 51.1%, and total bookings at the end of the year reaching US$191 million. I expect DUOL’s bookings to continue growing as its home planning strategy is progressing well and has been a core driver of 51.5% growth. In 2023, family plan bookings will increase by more than 100% year-on-year. With family plan subscribers accounting for only 18% of total paying subscribers, there’s plenty of room for DUOL to continue driving adoption.Beyond that, DUOL’s freemium strategy continues to work as it sees free-to-paid conversions continue to be strong per queue. If we assume the same intensity of free-to-paid conversions going forward, monthly active users (a good metric for the number of free users) will grow significantly over the past few quarters (from 49 million in Q1 2022 to 2023 88 million in the fourth quarter), there are a large number of free users who are likely to convert to paid users. One analysis I did to support this was dividing the number of paid subscribers by the number of monthly active users, and the results clearly show that more and more monthly active users are converting to paying users.

Based on the author’s own mathematical calculations

Yes. So the way we think about paid subconversions internally is based on queues. Throughout 2023, essentially every new user segment will have higher free-to-paid conversion rates.Source: 4Q23 Earnings

I actually believe that as DUOL continues to implement GenAI capabilities into its products, the free-to-paid conversion rate will accelerate in the next few years, which will lead to better unit economics. The features will be implemented for select learners in its premium version, Duolingo Max, in March 2023, and the feedback has so far been positive. With all the updates coming to the DUOL implementation, I continue to see huge room for growth in the future, especially since considering the release is so recent, it’s likely still only a small percentage of the user base.

But the bigger overall price change this year will be our experiment with three tiers. So we’re seeing a lot of demand for our top products at higher prices. This year we will experiment and see what happens.Source: 4Q23 Earnings

I didn’t specifically mention the cost of implementing these GenAI features in my previous update.I was surprised to find out that the cost can actually be Go down As DUOL gains access to large language models like OpenAI, and they have already See costs come down. This is huge as the economics of the unit are better than I expected; of course I would assume that maintaining the entire AI feature would be very expensive (which is why I think DUOL will only be rolled out to the premium tier as only that pricing tier can justify Reasonable cost). However, if the cost can come down, then DUOL can market it to lower-priced users, which would significantly improve the product’s value proposition to learners.

But we’ve also said that we believe the cost of using this functionality, of putting these features on our applications, will actually go down because access to large language models like OpenAI – the price will come down, and we’ve seen that . I mean prices are actually going down. So what you’re going to see us do over the next few months is, I think it’s important to start talking separately about the fact that we have three tiers of subscription and artificial intelligence capabilities.Source: 4Q23 Earnings

risk

As GenAI gains more and more attention, GenAI like ChatGPT is likely to replace DUOL from an adoption and development perspective. The concern here is that ChatGPT may not even need to reach sufficient capacity to completely surpass DUOL.if it shows enough early evidence Can Instead of DUOL, I think the stock price will face strong headwinds.

in conclusion

I recommend giving DUOL a Buy rating as the business continues to show impressive execution, growth, and prospects. The free-to-paid conversion rate continues to show a good upward trend, which indicates that the number of potential paying users is huge considering the growth rate of monthly active users. Additionally, as DUOL implements GenAI capabilities, I see the potential for accelerated conversion from free to paid, and it’s worth noting that the unit economics may be better than expected given the declining costs.