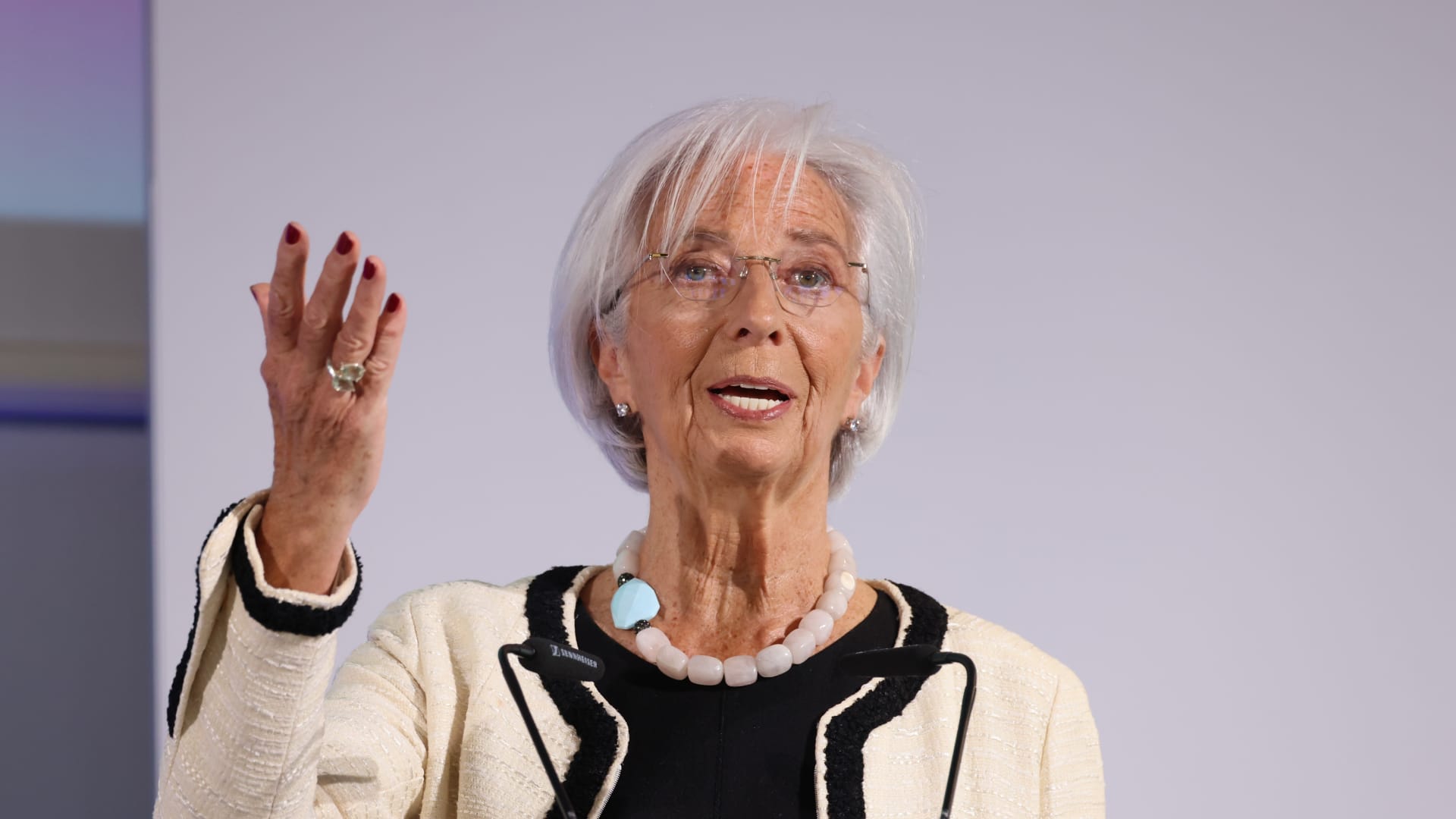

European Central Bank President Christine Lagarde at a meeting of the European Central Bank and its observers in Frankfurt, Germany, March 20, 2024.

Bloomberg | Bloomberg | Getty Images

European Central Bank President Christine Lagarde reiterated on Wednesday that June is the month when policymakers will consider lowering interest rates.

“By June we will have a new set of forecasts to confirm whether the inflation path we foreseen in our March forecast remains valid,” Lagarde said in a speech in Frankfurt.

Overall, her view on inflation is very positive, despite waning geopolitical uncertainty and continued domestic price pressures, particularly from the services sector.

“Unlike the earlier stages of our policy cycle, we have reason to believe that the expected deflationary path will persist,” Lagarde said. She stressed her confidence in the latest staff macroeconomic forecasts, which project inflation rates to be higher in 2024. The average is 2.3%, and 2% will grow by 1.9% in 2025 and 1.9% in 2026.

The Eurozone central bank has kept interest rates unchanged since raising them to a record high in September. Ahead of the March meeting, the bank’s message was that it was too early to discuss when to start lowering interest rates. The next meeting will be held in April and then in June.

Lagarde said on Wednesday that it would be judged on three criteria – the outlook for inflation, underlying inflation dynamics and the strength of monetary transmission – to gain “sufficient confidence to begin a phase of easing policy restrictions”.

June is marked as a key month by many members of the ECB’s Governing Council, which votes on the direction of interest rates. European Central Bank chief economist Philip Lane told CNBC last week that the central bank will “learn a lot by April and even more by June,” repeating a line from Christine Lagarde on Wednesday. Lots of stuff”.

This breaking news story is being updated.