J Studios/DigitalVision via Getty Images

investment thesis

My previous bullish thesis on Enbridge (NYSE: ENB) As of November 28, 2023, age status is good.Shares lag the market, but my bet is on safe dividend growth, not outperformance In terms of growth, the market.Just days after my last paper was published, the company Increase The dividend will increase by approximately 3% in fiscal 2024. This is a bullish sign and confirms my optimism about the safety of the dividend. Moreover, the 3% growth rate is higher than the growth rate I included in my previous valuation analysis. The stock’s valuation remains very attractive, recent developments suggest the dividend remains safe, and the 7.4% forward yield seems a no-brainer for investors looking for safety and high yield. All in all, I reiterate my Strong Buy rating on Enbridge.

recent developments

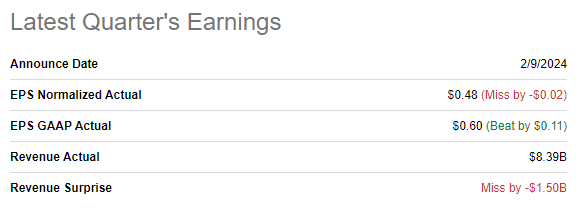

Enbridge released its latest quarterly earnings on February 9, when the company missed consensus estimates. Revenue fell about 15% year over year, but adjusted earnings per share grew 1 cent.

Seeking Alpha

The energy industry, even the midstream industry, is cyclical, and a company’s revenue depends largely on the cycle of the industry. But crucially important is the company’s flexibility to deal with revenue fluctuations. From this perspective, Enkyo looks very strong. Although revenue fell 15% in the fourth quarter, Enbridge’s gross profit margin increased by nearly 9 percentage points. This improvement also helped increase operating income by approximately 150 basis points. Improvements in operating leverage resulted in free cash flow growth of approximately $300 million annually. Free cash flow is a crucial metric given my bet on the safety of the company’s excellent dividend yield.

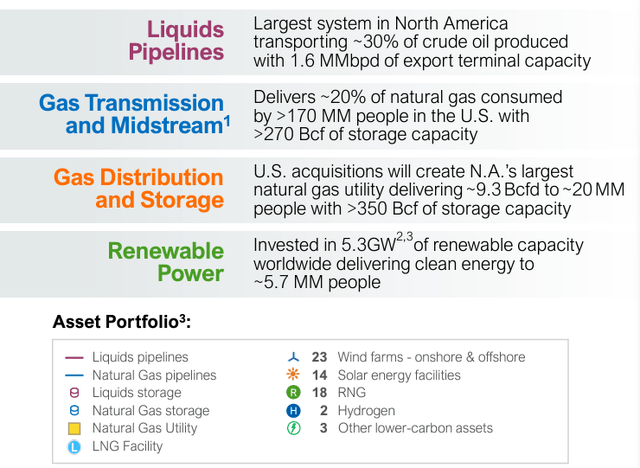

Enbridge is likely to maintain stable free cash flow over the long term because the company owns unparalleled assets, including liquids and natural gas pipelines and their storage, LNG facilities, and renewable energy assets. This diversified portfolio of assets positions Enbridge well-positioned to absorb growth in overall energy demand, thereby reducing the risk of long-term shifts in energy consumption patterns.

Latest ENB Investor Day

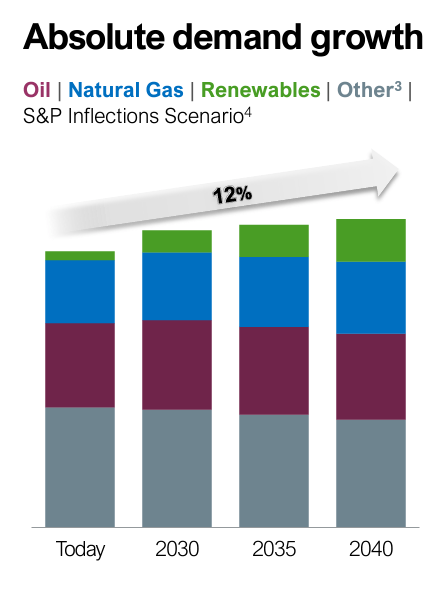

Absolute energy demand is expected to keep growing over the next few decades, according to the latest Investor Day report. It’s a favorable industry trend for Enbridge, one of the world’s largest energy midstream companies. The expected growth in absolute energy demand looks reasonable given the growth of the population and the trend towards more sophisticated digital solutions. need more energy.

Latest ENB Investor Day

Another positive development for Enbridge is that despite all the moves to accelerate the transition to clean energy, North America is still going all-in on conventional energy.Canada and the United States Record production volume By 2023, oil and gas production will increase. With Russian oil isolated after sanctions, North America now has greater potential to export energy commodities to Europe. As a result, Enbridge’s CEO predicts that Canadian pipelines will reach maximum utilization and run out of spare capacity within the next 3-4 years. This is a huge boost for Enbridge to improve its leadership position in the North American midstream business.

As a result, management expects significant capital expenditures in the coming years to expand infrastructure to meet the most likely demand growth. The recent joint venture with WhiteWater/I Squared Capital and MPLX (MPLX) is consistent with its strategy to expand its presence in the Permian Basin by adding pipeline and storage assets to meet growing LNG and U.S. Gulf Coast demand.

Latest ENB Investor Day

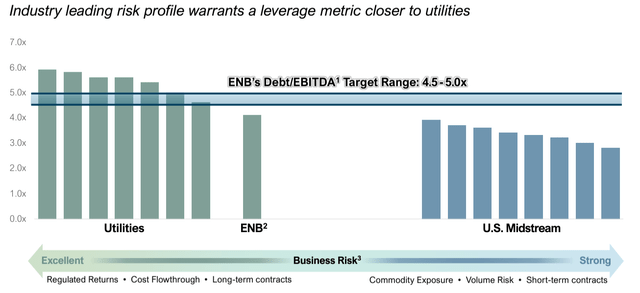

Despite the risks associated with investing in a major expansion project, I’m confident that Enbridge has a good chance of turning this large capital expenditure into long-term success. First, Enbridge has a healthy balance sheet and moderate leverage, which gives the company significant financial flexibility and funds its large capital expenditures. Second, in my opinion, the company’s capital allocation and investment framework are flawless, as ENB has been striking a successful balance between expanding capacity, growing revenue, and increasing dividends for decades.

Valuation update

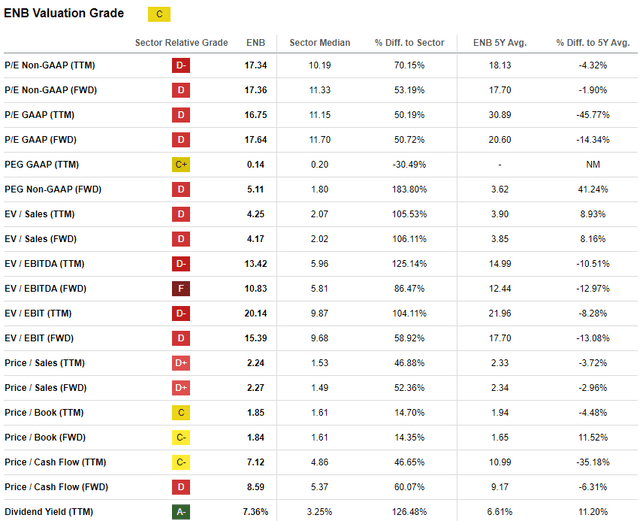

Shares are down about 3% in the past 12 months and 1% year to date. ENB is currently trading at the midpoint of its share price range over the past 52 weeks. When I compare the current P/E ratio and price/cash flow ratio to ENB’s historical averages, the stock looks very cheap. Since ENB is a dividend superstar to me, I believe these two ratios are by far the most important when we talk about the valuation of this stock.

Seeking Alpha

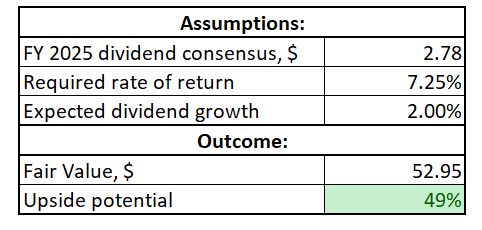

I’m modeling a dividend discount model (DDM) to gain more confidence that ENB is undervalued. Despite the recent 3% dividend increase, I reiterate my long-term CAGR of 2% just to be on the safe side.I cut the previous WACC by 75 basis points, which is in line with expected triple rates 2024 cuts. I also updated the current dividend payment, with consensus forecast of $2.78 for fiscal 2025. I’m using fiscal 2025 estimates because I’m calculating a price target for the next 12 months.

Author’s calculations

According to my DDM simulations, Enbridge’s fair share price is closer to $53. This suggests an upside potential of 49%, which means the current share price is attractive. Don’t forget about the high forward dividend yield of 7.4%, too.

Risk update

The energy midstream industry is not a big trend like artificial intelligence or cloud. This means the industry is unlikely to achieve significant CAGR again. The industry has matured, and my optimistic thesis is based on Enbridge’s strong strategic positioning within the industry and its unparalleled midstream infrastructure. However, the industry itself is not expected to grow quickly. Therefore, investors looking for stock index returns will likely be disappointed to find that Enbridge is growing steadily.

The business is highly capital-intensive, meaning it relies heavily on debt financing to expand production capacity. Monetary policies in the United States and Canada are currently tight, and there is little uncertainty about how quickly interest rates will return to near zero. Tighter monetary policy limits Enbridge’s financial flexibility, which could be a headwind if interest rates remain elevated for an extended period.

Despite its expanded presence in renewable energy, Enbridge is likely to be viewed as a traditional energy midstream company. That means the company’s performance could be disrupted by initiatives from eco-activists, whose influence is growing as North American political leaders tend to support an accelerated transition to clean energy. For example, just a few weeks ago, There was a discussion About the Enbridge Pipeline’s Possible Adverse Ecological Impacts on the Great Lakes. If eco-activists succeed in their goal of shutting down any of the company’s pipelines through a government decision, it could have a significant impact on Enbridge’s financial performance.

bottom line

All in all, Enbridge remains a “Strong Buy” stock. The stock is about 50% undervalued, with a forward dividend yield of 7.4%. Given the company’s strong fundamentals, I think the dividend is safe and is expected to grow at least in line with the Fed’s long-term inflation goals.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.