bjdlz

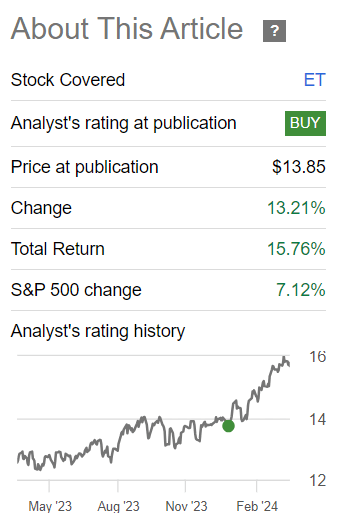

At the beginning of this year I wrote an article energy transfer(NYSE: ET) Provides several arguments as to why, in my view, the dividend yield of 9.1% at the time was well supported by strong fundamentals, and overall why a similar situation is likely An event like ET’s dividend cut in 2020 is highly unlikely. So the combination of a very attractive dividend and improving cash generation makes it a buy for me.

The stock has delivered strong returns for investors since the article was published, and the dividend yield has plummeted to about 8% thanks to some multiple expansion.

Seeking Alpha

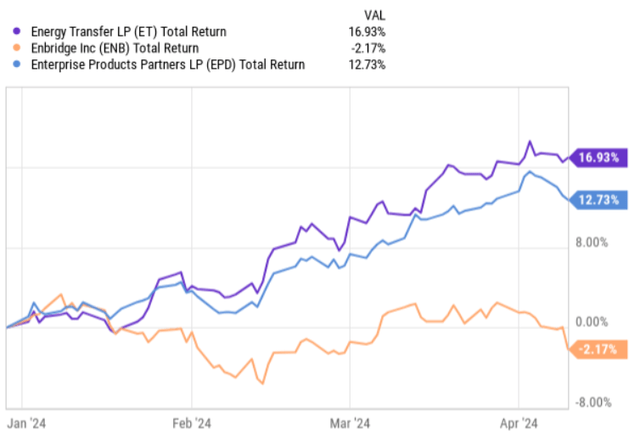

We can see that ET has managed to achieve significant alpha (on a year-to-date and total return basis) compared to other popular peers.

Y chart

In theory, one might question whether now is the time to cut ET’s position is to allocate some of those profits into other interesting value plays that haven’t experienced significant multiple expansion as recently as ET.

For example, as some of my readers may have noticed, I’ve been very bullish on Enbridge Inc. (NYSE: ENB ) recently due to significant progress on the balance sheet side and expanding EBITDA generation. Looking at the chart above, one might consider de-emphasizing the traditional energy infrastructure risks of stocks that have surged recently (like ET) and allocating those gains to ENB to guarantee seemingly better upside (in this particular areas do not overly tilt the portfolio).

However, in my opinion, ET has actually become a more attractive investment and embodies the necessary aspects for investors to truly consider adding incremental capital to the position.

That’s why.

Paper update

The latest earnings report revealed some interesting developments that clearly support a bull case going forward.

All in all, the results were very strong and operationally, ET managed to deliver record sales across its four main business segments. For example, crude oil transportation volume increased by 39% compared with the fourth quarter of 2022, significantly breaking the previous record. Likewise, LNG fractionation and transportation volumes increased by 16% and 13% respectively compared to the fourth quarter of 2022, also setting records.

These solid operating performances clearly reflect well on the quarterly earnings numbers. EBITDA grew nearly 6%, which also led to an expansion of the DCF base, which grew approximately 5% in the fourth quarter of 2023 compared to the same quarter in 2022.

In addition to industry-level drivers related to strong commodity markets across the board, there are also some ET-specific drivers that have helped the company achieve such strong results. While the impact of embedded revenue escalators and organic capital expenditures also play a role, the most important ET-specific aspect is noteworthy M&A transactions. The acquisitions of Lotus Midstream and the Crestwood equity model, which are completed in 2023, are immediately accretive to underlying DCF/unit and significantly enhance overall financial and operating results due to integration effects.

Additionally, it’s definitely worth highlighting the latest developments on the balance sheet side. Last year, Standard & Poor’s upgraded ET’s senior unsecured credit rating to BBB with a stable outlook, and in the fourth quarter of 2023, Fitch finally upgraded ET’s rating to BBB. As a result, ET’s current rating is Double BBB with a stable outlook, which creates more favorable conditions for the company to take advantage of cheaper and more flexible debt financing alternatives.

Interestingly, while ET issued incremental $3 billion of senior notes and $800 million of junior subordinated notes to redeem all outstanding Series C and Series D preferred shares with the goal of exiting the Series E units, But Fitch has made this decision for the 2024 period as well. This clearly illustrates ET’s inherent financial resilience and suggests a considerable margin of safety in maintaining a stable credit rating. However, in order to complete the preferred unit repurchase aspect, investors must now consider that the quarterly distribution of approximately $150 million to preferred shareholders will now be significantly scaled back, leaving more capital for shareholder distributions (due to the attracted debt proceeds Reflecting lower financing costs than other shareholders).

That said, the fundamental case for ET’s conservative approach to managing its balance sheet remains intact. Co-CEO and Director Tom Long clearly confirmed this during a recent earnings call:

As a result of our continued emphasis on strengthening our balance sheet, we are in the strongest financial position in Energy Transfer’s history, which will give us the flexibility to pursue new growth opportunities with further reductions in leverage, maintain our targeted distribution growth rates and increase our unit Equity compensation to holders.

In addition to growing EBITDA and DCF generation levels, what really helps management keep the business on a “deleveraging path” is the reduction in organic growth capital. 2024 guidance indicates organic growth capex will be in the range of $2.4 billion to $2.6 billion (primarily related to NGL and refined products and midstream segments). This is fully consistent with ET’s long-term strategy of maintaining an annual growth capital run rate of between $2 billion and $3 billion, providing a sound basis for gradually reducing debt or increasing shareholder distributions against the backdrop of historical levels (e.g., 2018 and Previous organic capital expenditures were approximately $5 billion per year).

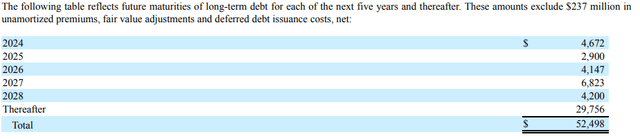

Now, as many of my followers may have noticed, I look very carefully at the risk of upcoming refinancings, which could trigger interest costs if the debt wall is evident and financing costs are much lower relative to the market The component expands the level of interest rates at which the company can attract new borrowings. Against the backdrop of secular strength, this becomes even more critical.

However, in ET’s case, I don’t think there is a significant risk here because if we take debt maturities of 2024 and 2025, we would come up with about 14% of the total outstanding borrowings that the company has to roll over.

Energy Transmission LP Form 10-K filed February 16, 2024

Given management’s commitment to continue reducing balance sheet risk, Successful refinancing As well as savings on senior units to date (such as the refinancing of $225 million of outstanding principal with a 10-year term at 4.05% in the second quarter of 2023), ET is in a position to keep its interest cost composition stable Good location.

Finally, ET also issued strong guidance for 2024, setting an adjusted EBITDA generation target of between $14.5 billion and $14.8 billion, which would allow for EBITDA growth of over 7%, even if record results in 2023 lead to a fairly tough 2023 composite data.

This will be driven in part by synergies from recently integrated acquisitions, organic capex assets coming online and attractive embedded sales growth. However, there is also a strong industry-level component that provides the necessary impetus to the growing demand for ET infrastructure, as crude oil prices rise mainly due to global tensions and strong demand in Europe.

bottom line

In my humble opinion, Energy Transfer is still a stock worth buying, even taking into account the recent run-up in the share price. From a valuation perspective, a P/E ratio of 10x is still cheap, and a dividend of 8% is still very attractive.

If we take into account recent financial developments, improvements (e.g., BBB’s dual rating, DCF growth, and the gradual reduction of debt and senior units) and assumed momentum will significantly enhance ET’s attractiveness, outweighing the potential for higher stock prices. Negative impact. Furthermore, the risks that might arise from a higher long-term strengthening scenario are irrelevant to ET’s case, as short-term maturities are relatively inconsequential and recent refinancings indicate that the company does have access to very cheap sources of debt capital. Better terms now that it has dual ratings and continues to work on shrinking the debt portion of its balance sheet).

For all of the above reasons, ET remains an attractive buy.