Kirill Gorlov

I don’t know about you, but when buying companies I tend to focus on businesses with relatively simple business models.I don’t follow high-tech growth companies; I prefer companies It’s easy to understand.An example can be viewed via Enpac Tool Group (NYSE:EPAC), an enterprise focused on providing industrial tools, services, technologies and solutions to customers in various industries. The company has been around for a long time since 1910. While it’s far from the oldest publicly traded company, it does have quite a history.

From an operational perspective, the business is indeed quite solid. Because of this, I have no doubt it will still be here many years from now.But that doesn’t necessarily mean it’s beneficial An attractive opportunity. Recent financial performance has been mixed, and management expects this trend to continue. Beyond that, the stock is very expensive both in absolute terms and relative to similar companies, and I believe there are better opportunities to explore right now. Of course, I may always be wrong.

In fact, management is scheduled to report financial results on March 21 before the market opens. These results should cover the company’s second quarter of fiscal 2024. If the data comes in stronger than expected and guidance for this year is revised higher, my stance on the matter may change. But for now, I think a “Hold” rating makes the most sense right now.

interesting company

As I have already mentioned, Enerpac Tool Group is an old company focus on Industrial tools, services, technologies and solutions. This is very vague. So, it’s best to take a closer look at what exactly it has to offer. According to management, the company’s main products sold are branded tools, cylinders, pumps, hydraulic torque wrenches and well-designed heavy lifting technology solutions. The company makes high-force hydraulic and mechanical tools that “allow users to apply controlled force and motion to increase productivity, reduce labor costs, and make jobs safer and easier to perform.” Some of them can withstand every square inch when used 12,000 pressure.

Outside the field of tools, Enerpac Tool Group also provides services to its customers. For example, it provides technicians for maintenance and manpower services. Specific needs addressed include, but are not limited to, assurance of bolting, machining, and joint integrity. Finally, the company has other divisions focused on the production of synthetic ropes and biomedical textiles. But these are only disclosed under the “Other” section.

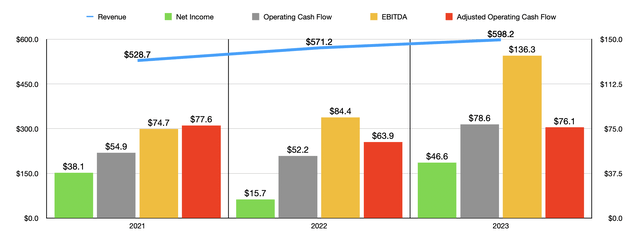

Author – SEC EDGAR Data

Management has done a good job growing revenue over the past few years. Sales increased from $528.7 million in 2021 to $598.2 million in 2023. Without foreign exchange fluctuations, sales growth would have been higher. For example, in 2023, foreign currencies had a negative impact on revenue of $11 million. The company also undertook an asset divestiture that reduced sales by $6 million.

Overall, though, the revenue growth is pleasing. Much of the growth in recent years has been driven by price increases on the product side, according to management. Unfortunately, there are some weaknesses when it comes to service. The company’s decision to cut certain programs by region is at least part of the reason why services revenue will fall 8% annually in 2023 compared with 2022.

As revenue increased, we saw margins improve. But the journey has been quite bumpy. Net profit increased from $38.1 million in 2021 to $15.7 million in 2022. But by 2023, that number suddenly increased to $46.6 million. Other profitability indicators have seen similar moves. The first chart in this article shows these. For example, even if we adjust for changes in working capital, adjusted operating cash flow in 2023 was $76.1 million, down from the $77.6 million reported two years ago. In fact, the only profitability metric that continues to improve is Adjusted EBITDA from continuing operations. It has grown from $74.7 million to $136.3 million.

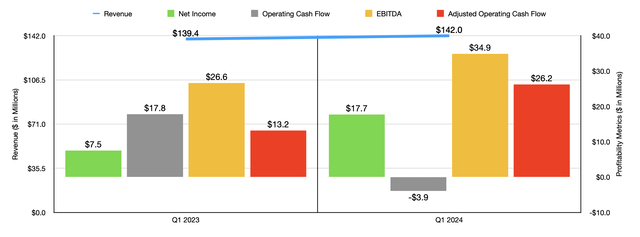

Author – SEC EDGAR Data

We do have some data to appreciate when talking about fiscal 2024. This data is, for the most part, quite favorable.The income is Season one A total of $142 million. That’s up slightly from the $139.4 million reported a year ago. However, much of this growth came from a $2 million gain related to foreign exchange fluctuations and a 13% increase in services sales driven by a 10% increase in organic demand.

Revenue growth led to improved profits. Net profit was $17.7 million, dwarfed by $7.5 million a year ago. This gain was driven in part by an increase in the company’s gross profit margin from 48.8% to 52.1%. Management said this was due to the company’s commitment to transforming itself, which resulted in improved operating conditions, as well as a favorable sales mix and higher pricing.

Even more impressive was the drop in selling, general and administrative costs from 38% of revenue to 29.6%. This result was primarily due to an $8 million reduction in transformation program costs, as well as reductions in personnel costs and other items.

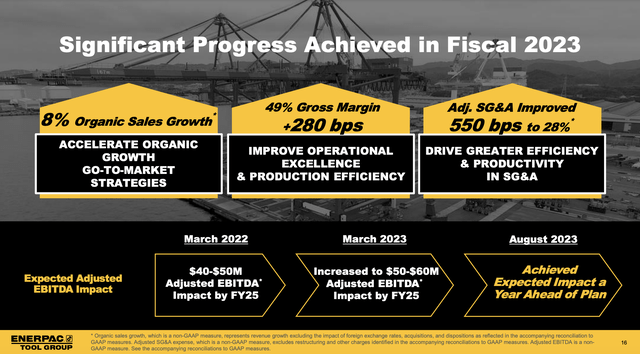

Enpac Tool Group

I’ve mentioned the company’s transformation plan several times.The name given to it by management is Climb high, launching in March 2022. It actually revolves around three main themes. The first is to accelerate organic growth by optimizing sales channels, engaging in strategic pricing and selective innovation.

The second is to improve operational performance to increase efficiency, including productivity. Management has been working to simplify the company’s organizational structure and physical footprint. They are also working on sourcing and reducing indirect spending while rationalizing certain assets, goods and services they offer.

Finally, the company is working to improve efficiency and productivity in sales, general and administrative costs. A lot of this involves integration.

Enpac Tool Group

The progress achieved through this measure has proven to be effective. The original plan was to increase EBITDA by $40 million to $50 million by fiscal 2025. That figure was later revised upward in March 2023 to a range of $50 million to $60 million. But then in August of that year, management said they were achieving expected results about a year ahead of schedule. Obviously, other profitability indicators also benefited. While operating cash flow did fall from $17.8 million to negative $3.9 million, the adjusted number nearly doubled, from $13.2 million to $26.2 million. Finally, the company’s EBITDA grew from $26.6 million to $34.9 million.

Enpac Tool Group

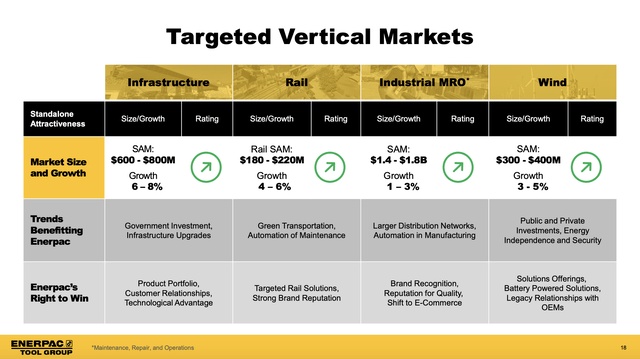

Management has some pretty ambitious goals for the long term. They hope to achieve annual organic revenue growth of 6% to 7% by 2026. This will involve a variety of efforts, including expansion in certain vertical markets, investments to make the company more digital, innovation based on customer needs, and a concerted effort to expand into the Asia-Pacific region.

Because of how the company breaks down its revenue data by geography, we don’t know exactly how much sales the company brings in from that region. But we do know it accounted for at least 7.1% of total revenue.

When it comes to the vertical markets the company hopes to enter, management is focusing on infrastructure with a serviceable addressable market worth between $600 million and $800 million. The rail market is estimated to be worth between $180 million and $220 million. The industrial MRO market is much larger, ranging from $1.4 billion to $1.8 billion. The wind power market they are looking at is worth between $300 million and $400 million.

Enpac Tool Group

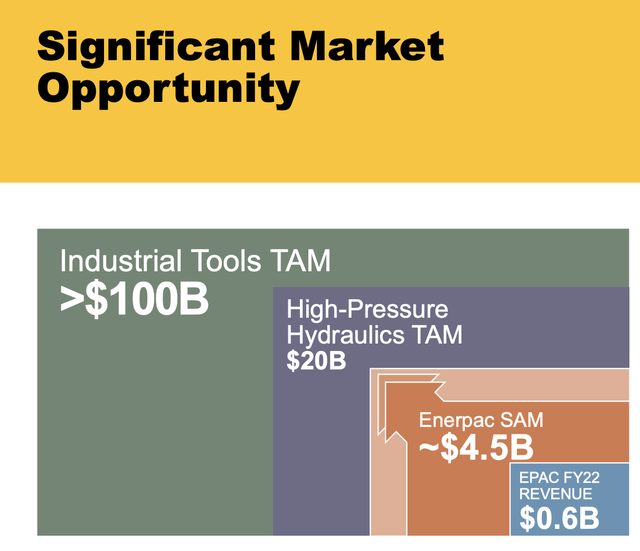

Currently, the total market in which Enerpac Tool Group operates is estimated to have a serviceable addressable market value of approximately US$4.5 billion. This does appear to offer shareholders significant upside potential over the long term. Even if a company reaches saturation in this area, there are still other huge opportunities to consider. Entering the high-pressure hydraulics market will bring a total addressable market (TAM) of approximately $20 billion. The industrial tools market is even larger, exceeding $100 billion.

Enpac Tool Group

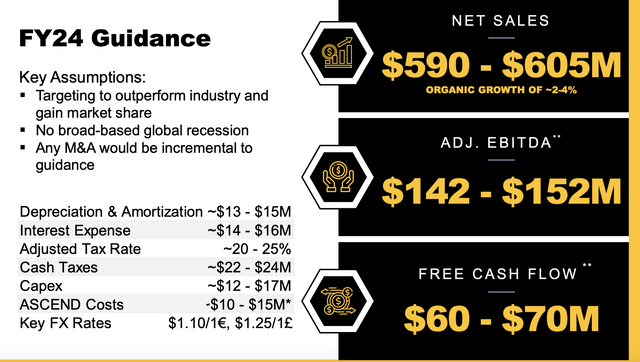

Of course, this all takes time. For example, management expects full-year 2024 revenue to be between $590 million and $605 million. This is based on organic revenue growth of 2% to 4%. Meanwhile, EBITDA is expected to be between $142 million and $152 million. No guidance was given on adjusted operating cash flow. But according to my estimation, its revenue should be around $82.1 million. Using these results, it is easy to value the company.

Author – SEC EDGAR Data

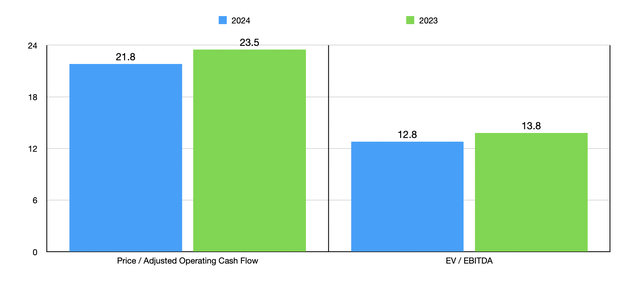

As the chart above shows, the stock does look quite expensive relative to cash flow. However, they are priced more reasonably when using the EV to EBITDA method. However, they are quite expensive relative to other players in the field. In the table below, I compare Enerpac Tool Group to five similar companies. On a price-to-operating cash flow basis, I find that Enerpac Tool Group ends up being the most expensive of the group. However, this ranking does drop to only three companies being cheaper when using the EV to EBITDA method.

| company | Price/Operating Cash Flow | Enterprise value/interest, tax, depreciation and advance profit |

| Enpac Tool Group | 23.5 | 13.8 |

| Barnes Group(B) | 17.1 | 14.9 |

| Hillman Solutions (HLMN) | 8.1 | 14.3 |

| Kennametal (KMT) | 6.8 | 8.2 |

| Standis International (SXI) | 19.9 | 10.5 |

| Tennant Company (TNC) | 11.1 | 11.4 |

It is also important to understand that conditions may change, especially during times of economic uncertainty. That’s why investors should pay close attention to when management reports second-quarter fiscal 2024 results. This is expected to happen before the market opens on the morning of March 21.

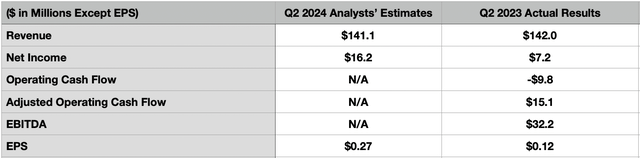

Currently, analysts are actually forecasting slightly weaker revenue of around $141.1 million. This would be a slight decrease from $142 million in the same period in fiscal 2023. All in all, things are expected to be different. Earnings per share are expected to be $0.27. That’s more than double the $0.12 per share in the second quarter of 2023.

If the plan comes to fruition, net profit this year will increase to US$16.2 million from US$7.2 million last year. No estimates were provided for other profitability metrics. But in the table below, you can see what the second quarter of 2023 looks like.

Author – SEC EDGAR Data

take away

All things considered, Enerpac Tool Group is an interesting company and one that’s going through some meaningful changes. I’m definitely happy to see this. Over the long term, I suspect the company will continue to expand and create value for shareholders.

On the other hand, analysts are somewhat uncertain about near-term revenue, and even if we assume management’s forecasts are accurate, Enerpac Tool Group Corp.’s stock price doesn’t look attractive. Given these factors, I think a “Hold” rating makes the most sense until we see otherwise develop.