HJBC/iStock Editorial via Getty Images

Here at the lab, we love utility companies, and our team recently upgraded Enel and E.ON. Today, we’re back with a review of Engie (OTCPK:ENGIY).As far as French players are concerned, we are in A Wait and see model, as reported in our last analysis, we expect a reassuring outlook and a simplified business model before changing our valuation. That said, before commenting on the company, we should take a step back and look at the industry.

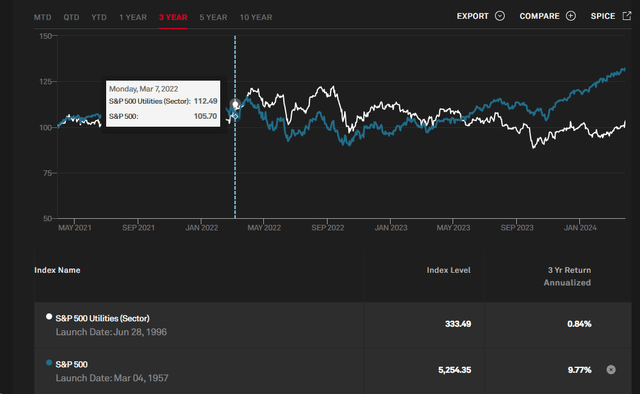

Looking at the utilities sector, it has significantly underperformed the market since 2022 (Figure 1). Given the ongoing Russia-Ukraine war and its impact on energy prices, we believe the industry could benefit from lower rates. Wall Street is awaiting communication from major central banks on the timing of the first rate cuts, which are expected to begin in June.Although June may I wish you all the best, nothing is set yet. The ECB and Federal Reserve believe their decisions will depend on economic and inflation data. Given the industry’s weak growth and historically high and stable dividends, we believe integrated utilities are likely to benefit from lower long-term interest rates, even though we don’t expect a rate cut in June. Furthermore, until recently, utilities were considered akin to high-quality bonds. However, as the grid scales to unprecedented levels, we are seeing lower-risk regulated assets growing better than before. This is already evident in Engie’s fiscal 2023 results.

S&P 500 Utilities Index Evolution

source: S&P 500 Utilities Index – picture. 1

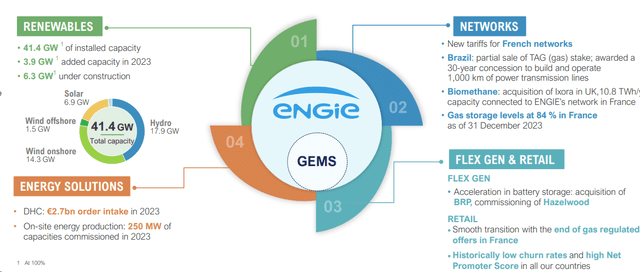

For our new readers, Engie SA is a global energy company headquartered in France operating through four segments: Renewables, Networks, Energy Solutions and Flexible Generation and Retail. In addition, Engie also operates nuclear energy business in Belgium. At the Laboratory, we had previously expected higher provisions for the extended life of nuclear assets and their waste liabilities.However, we believe the company may now significantly De-risk yourself.

Engie 4 core part

source: Engie 2023 financial year results presentation – figure 2

Why are we positive?

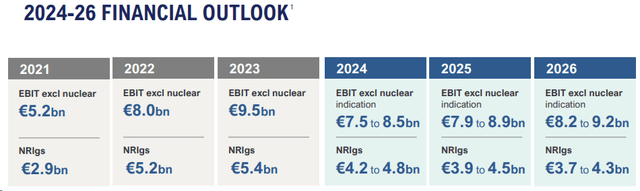

- With its fourth-quarter and fiscal 2023 results, the company reassured investors with positive mid-term guidance (Figure 3). After examining Engie’s financials and forecasting lower electricity prices, we report that the company’s low-end outlook remains above consensus. As such, this could have a positive impact on its share price evolution;

- Engie has an attractive capital compensation policy. Specifically, the company’s board of directors will propose a dividend of 1.43 euros per share. At current market prices, the dividend yield is 9.2%. Engie’s shareholder compensation is set at a dividend rate of 65/75% until 2026, with a minimum dividend floor of €0.65 (Figure 4). Therefore, there is downside protection in the event of an economic downturn. As a reminder, the company will go ex-dividend on May 2. In our forecast, we expect DPS to decrease in 2024-2025-2026, to €1.18, €1.16 and €1.17 respectively;

-

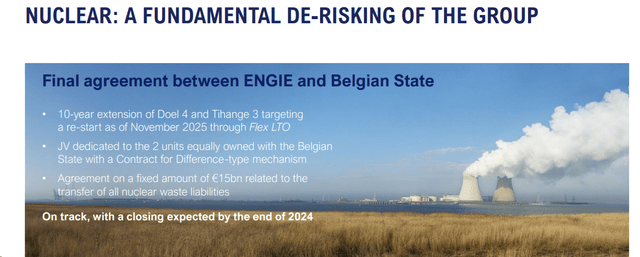

Engie signed the final agreement on Belgium’s nuclear programme, radically de-risking the group’s portfolio (Figure 5). The company currently expects nuclear energy to contribute €200-400 million to core operating profit after 2026. This removes Engie’s longstanding uncertainty over its nuclear waste liabilities. At the lab, we believe this also simplifies the team structure and eliminates another open question.

-

The key to the report is Engie’s structural growth expectations for the next few years. We believe the market has overlooked the company’s EBIT growth. In our espoused forward view, Engie’s growth engines will be battery and renewable energy development, strongly supported by the company’s resilient earnings source, namely its networks division. Looking back, we should report that the company delivered core operating profit CAGR of 13% between 2021 and 2023. Engie’s new network core operating profit guidance supports our financial forecasts even as we forecast a gradual deterioration in the group’s merchandise-driven earnings;

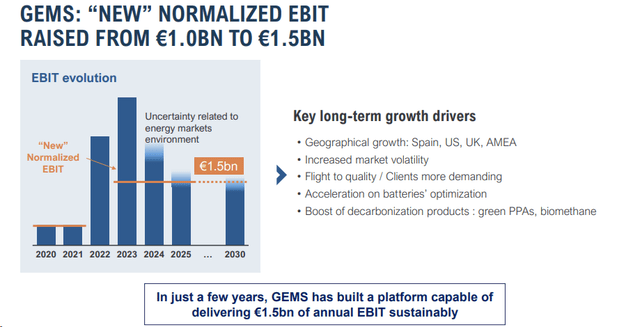

- Looking at the GEMS and retail segments (Figure 6), we believe the company’s guidance will remain cautious. Our different views are supported by three key takeaways: 1) greater energy price volatility post-COVID/Ukraine war; 2) our view of higher margins for battery storage assets; 3) increased demand for renewable power Increased (from B2B customers), higher profits in the retail sector;

- As commodity-driven profits normalize and Engie’s core EBITDA generation declines, we expect Engie’s hard work to bear fruit. At Labs, we expect EBITDA to decline over the three-year visibility period. Looking at the numbers, our EBITDA for 2024-2025-2026 is €14.54, €14.46 and €14.14 billion respectively. Based on the aggressive capital expenditure plan, our EBIT is expected to be 9.07 euros, 8.89 euros and 8.96 billion euros, and earnings per share are 1.81 euros, 1.66 euros and 1.67 euros;

- Furthermore, even if we do not speculate on portfolio rotation, we know that disposals may play a crucial role in housekeeping. This also provides flexibility in the net debt position. Over our three-year visibility period, we expect financial leverage to be below 4x.

Enji Outlook 2024-2026

image 3

Enji DPS flooring

Figure 4

Engi Nuclear Energy Update

Figure 5

Engie GEMS new estimates

Figure 6

Valuation

We recently valued Enel, so we are leveraging that previous publication. In fact, looking at the industry, the P/E and EV/EBITDA of EU integration companies are 14.86x and >7x respectively. In our 2024 data, Engie’s P/E ratio is 8.56x and EV/EBITDA is about 5.5x. At this stage, we believe the market places limited value on Engie’s growth prospects. Additionally, network/GEMS upgrades may make it easier for French businesses to cope with lower energy prices. French gas storage levels are quite high and the winter of 2024/2025 should be quite secure from a supply perspective. More importantly, the overhang of the nuclear debt has been eliminated.

We see no reason for Engie to trade at a discount. That said, using a 10x P/E ratio because EPS is expected to decline by 2026, we value Engie at €18.1 per share ($19.5 in ADR terms). This means the expected total return on the Buy-rated valuation is approximately 26% on a one-year forward estimate.

risk

Engie Key risks to our price target include a protracted depressed energy price environment, capex delays and no growth in net solar and wind capacity additions, reduced credit for battery and renewables growth after 2024, GEMS EBIT returning to energy crisis current levels, and regulations in the retail sector. Higher interest rates will also have a negative impact on Engie.

in conclusion

We believe Engie will outperform the market in 2024. Our analysis is supported by: 1) attractive valuations, 2) earnings defensiveness driven by the online segment, 3) lower nuclear power risks, and 4) simplified structure. Even if we don’t speculate on rate cuts, the industry is sensitive to interest rate movements and we believe we are in the rate selection phase. As a result, Engie is now the first choice for Mare Evidence Lab.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.