Miscellaneous Photography

introduce

Enxiang Energy (Nasdaq: ENPH) stock’s performance over the past five years suggests it is a good choice to invest in during easy monetary conditions.However, monetary tightening has led to reduced demand for the company’s products, revealing two things Significant strategic weaknesses: Lack of vision and efficiency measures falling behind in a rapidly changing environment. I am pessimistic about the company’s performance in recent quarters as the environment remains uncertain and monetary policy is likely to continue to be tight in the coming quarters. Furthermore, the stock is about 9% overvalued, which seems like a premium that’s not worth it considering all the warning signs. All in all, ENPH looks like a “sell” to me.

Fundamental analysis

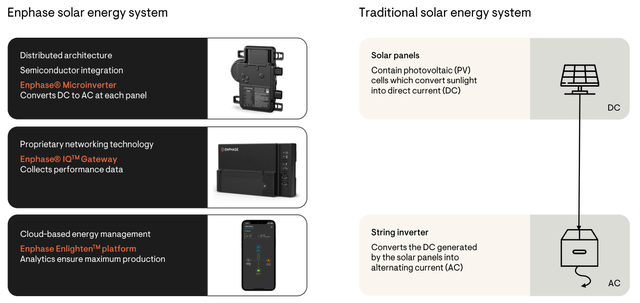

Enphase Energy provides smart, easy-to-use solutions that manage solar generation, storage and communications on a single platform, according to the 10-K.As of December 31, 2023, since its establishment, the company has shipped more than 73 million microinverters in more than 150 countries. The company positions itself as a cutting-edge smart energy system, including microinverters with semiconductor integration, proprietary network technology and cloud-based energy management solutions.

Investor introduction

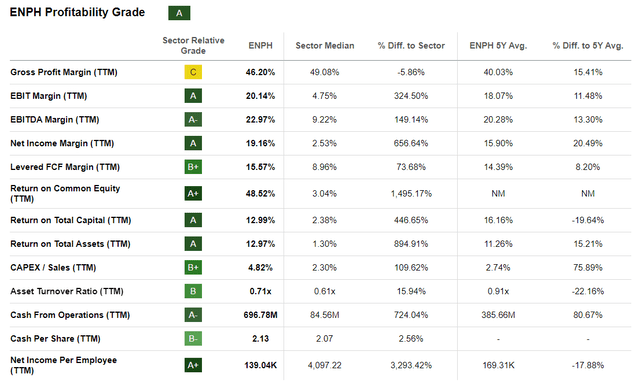

The company’s value proposition appears to be attractive to customers, as Enphase’s profitability is well above its peers and continues to improve as the latest TTM metric is significantly higher than the average over the past five years.

exist

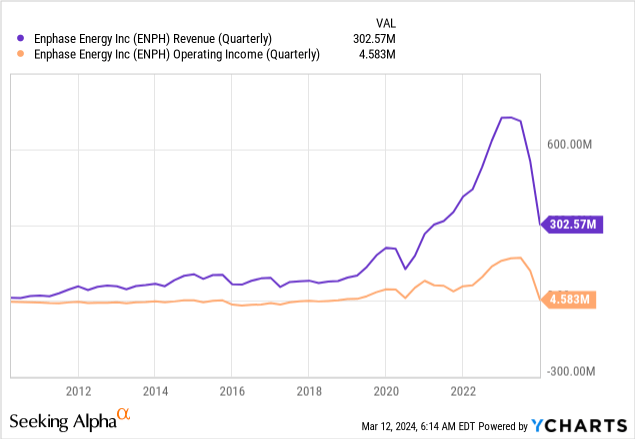

The company’s revenue fell sharply in the second half of 2023 due to weak demand due to macroeconomic uncertainty in the United States and Europe. Operating income showed a near-perfect correlation while also falling sharply. I believe the cyclicality in the broader environment is beyond management’s control, however, the decline in profitability suggests that the macroeconomic environment is starting to become more challenging since early 2022 when the Fed and ECB began to act quickly , management may be more proactive in managing costs. Monetary policy tightened.

I also believe that much of the revenue surge in 2022 will be driven by panic in energy commodity markets following Russia’s invasion of Ukraine. In March 2022, some people even said that oil prices Probably $300 The result of sanctions imposed by Western countries on Russian oil. Therefore, panic over a potential spike in natural gas prices has led to increased demand for alternative energy sources, which is a huge short-term driver for ENPH. But oil prices reached triple digits in a relatively short period of time and have fallen back to pre-war levels. As currency conditions in developed countries remain tight, I don’t expect any news of a spike in oil prices in the near future. Therefore, I expect this potential catalyst for microinverter demand growth to be unlikely to materialize.

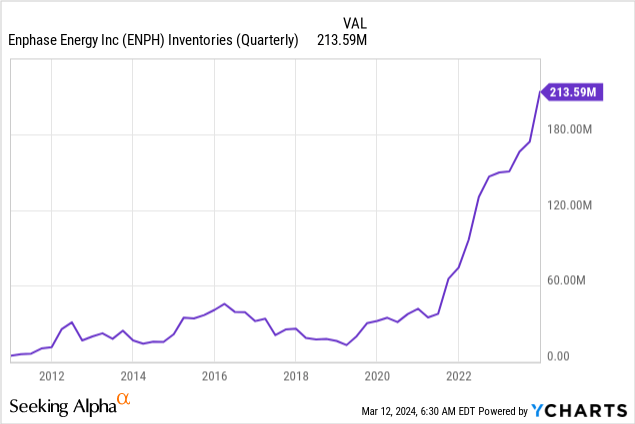

Outstanding profitability and huge revenue growth in recent years show that the company’s smart energy system is indeed a superstar, but it’s a discretionary item for households.Since there are currently Little certainty Regarding the Fed’s future actions, I’m also very unsure about when ENPH might rebound and resume its stellar revenue growth trajectory. Revenue fell by more than 50% annually last quarter, resulting in extremely high inventory levels relative to historical performance. This shows a lack of planning and foresight in working capital, production and procurement management, a clear strategic weakness.

The high concentration of revenue from microinverters also creates significant risks for investors. The company’s products enable it to generate unparalleled profitability and demonstrate exponential revenue growth, but are less adaptable to tight monetary conditions. Therefore, investors are at risk of a long-term drawdown under adverse macro conditions. For example, despite the broader market’s sharp gains in 2023, Enphase is currently trading at more than twice its December 2022 levels. With the macro environment still uncertain and the Fed in no rush to start cutting interest rates, I am bearish on ENPH.

Valuation analysis

Despite a 40% decline over the past 12 months, momentum on shorter time frames looks strong. The share price has rebounded significantly by 26% in the past three months, indicating that sentiment on the stock is improving significantly.

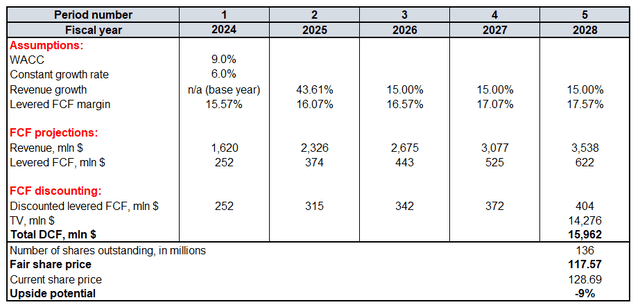

In order to assess how far the rally might go, I have to estimate my price target. Therefore, I am modeling a discounted cash flow (“DCF”) analysis.Future cash flows will be discounted using the following formula 9% Weighted average cost of capital. Taking into account all the long-term industry tailwinds and the company’s strength, I use a very aggressive 6% constant growth rate in my terminal value (“TV”) calculations.From a short-term revenue perspective, I expect fiscal 2025 revenue to roughly rebound to 2022 levels and end at Compound annual growth rate of 15% 2026-2028. Using a TTM leveraged FCF margin of 15.57%, I expect revenue growth to be accompanied by 50 basis points of expansion. According to Seeking Alpha, ENPH has approximately 136 million shares outstanding.

Calculated by the author

The DCF model suggests a fair share price of around $118. This is 9% lower than the market share price, indicating an overvaluation. The premium seems too generous, especially considering I’ve adopted a very aggressive 6% constant growth rate. Therefore, I believe the stock is significantly overvalued at its current share price.

Mitigating factors

As I mentioned in my valuation analysis, the momentum ENPH has shown over the past three months has been impressive, and there’s a lot of uncertainty about how long the rebound will last. Therefore, the rally could continue for weeks, depending on the overall sentiment in the stock market.

Despite all the strategic weaknesses I highlighted in my fundamental analysis, the company’s technological differentiation and high profitability are important catalysts supporting extremely positive sentiment for the stock over the long term. With a cumulative return of 1,355% over the past five years, ENPH looks to be one of growth investors’ favorite stocks. Shorting an investor favorite is inherently risky, but my pessimism is tied to the company’s near-term prospects, with financial results expected to rebound once the macro environment becomes more conducive to discretionary spending.

exist

The solar industry is supported by the U.S. federal government through tax credit incentives, making all players in the industry heavily dependent on these measures. With the transition to clean energy looking irreversible, federal support for the solar industry is likely to remain strong. The spike in ENPH prices may have been caused by rumors of a sudden expansion of incentive programs in the industry. However, I think this is extremely unlikely to happen in a presidential election year.

in conclusion

I think a 9% premium to fair value could be a good deal in an extremely favorable environment, but that’s not the current reality. The company’s lack of resilience during uncertain times puts it at “Sell” status in the current environment. I will likely become more optimistic when the federal funds rate approaches zero, but we will likely be far away from that reality.