rarrarorro/iStock via Getty Images

introduce

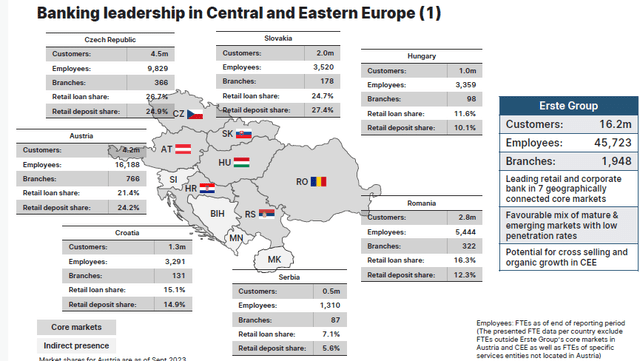

In my previous article on Erste Group ( OTCPK:EBKOF ), I argued that shareholders would be able to look forward to a dividend yield of 8% based on the Austrian bank’s dividend policy and expected earnings.Released by First Group Having announced its results not long ago, I was pleased to see that the bank will pay a dividend of €2.70 based on its 2023 results. I’ve been hesitant to take a long position in Erste Group because, on the one hand, I like its exposure to Eastern Europe. But on the other hand, this is a pretty unstable region politically and I already have some exposure through my indirect investment in KBC Group (OTCPK:KBCSF) (OTCPK:KBCSY)I Recently discussed in an article.

First Group Investor Relations

To be clear: Erste Group has no banking activities in: Ukraine or Russia.

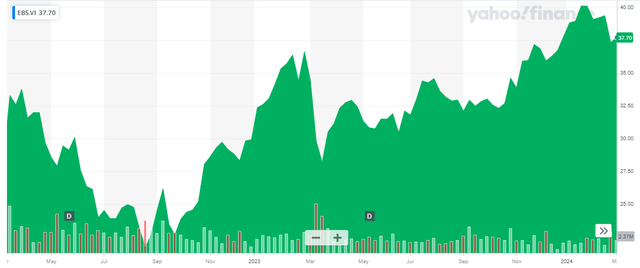

Yahoo Finance

Erste’s main listing place is the Vienna Stock Exchange Trades under EBS as its ticker symbol. Considering Austria’s average daily trading volume is approximately 475,000 shares, it should be the preferred trading venue for most shareholders as its daily trading volume is significantly better than any secondary listed company.All relevant documents and financial information to which I will refer can be found here.

2023 is a strong year for European banks

U.S. banks are facing choppy waters, while European banks appear to be able to weather the current turmoil without much effort. One of the main reasons, I believe, is that European banks prefer to maintain healthy cash balances rather than debt securities, so the amount of unrealized losses on debt securities is generally lower. For example, the Erste Group only has around €10.3B in debt securities, which is just over 3% of its total balance sheet. On the other hand, it has nearly €37B in cash on its balance sheet, which is about 11% of total assets. This obviously does not mean that there are no unrealized losses on the fair value of the loan book, but as these losses are not marked to market and valuations are only called into question when assets need to be liquidated, it is important to note that now due to the banks’ good liquidity sexual status and gained additional mobility.

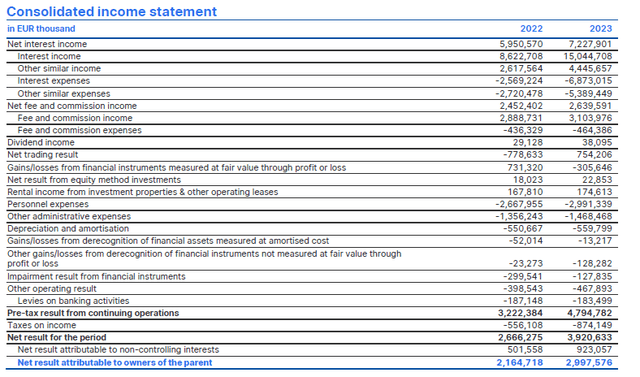

While U.S. banks struggled to cope with falling net interest income, European banks performed well, with Erste Group also increasing its net interest income by more than 20% to just over €7.2B. While interest expense increased 2.7x, interest income almost doubled, which in absolute terms resulted in a €1.3B increase in net interest income.

First Group Investor Relations

The income statement above also shows that the bank earned 8% in net fee and commission income amid favorable trading results, partially offset by unrealized losses on debt securities. At the same time, the net impairment result on financial instruments (compared to the US “loan loss provision”) fell from 300 million euros in 2022 to 128 million euros in 2023. The total amount of new loan loss provisions was 264 million euros (a decrease of 264 million euros compared with 2022). €336 million in 2022), but the bank was also able to recover some provisions previously recorded, which explains the relatively low loan loss provisions.

The bottom line shows net profit of just under €3B, which means earnings per share of €7.12 based on the current share count of 421 million (the average weighted share count is higher in 2023 as the bank completes its buyback program). The bank will pay a dividend of 2.70 euros per share, which is the lower end of its 40%-50% dividend payout ratio.this Dividend withholding tax rate Individual shareholders are 27.5%.

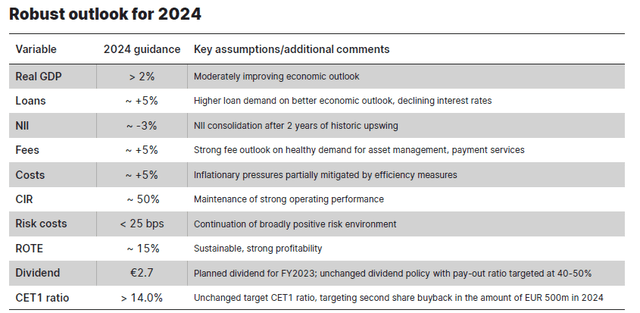

The outlook for 2024 is a bit mixed. The bank expects loan size to continue growing but net interest income to fall 3%. According to the accompanying statement, the lower NII will not have a noticeable impact on net profit, as Erste mentioned that minority interests in the savings bank unit will absorb the majority of the NII decline.In addition, the first Call it the “consolidation” of net interest income After two years of strong growth.

First Group Investor Relations

An important part of the 2024 guidance is cost of risk guidance. Erste expects to keep its loan loss provisions below 25 basis points, which is still a significant increase from the net loan loss provision of 6 basis points in 2023, but remains very manageable. For example, a total risk cost of 0.20% would have a negative impact on pre-tax income of approximately €300 million, which would represent only 6% of pre-tax income in 2023.

The bank also guided for a return on tangible equity of over 15%, and taking into account the total equity on the balance sheet while adjusting for intangibles and non-controlling interests (assuming a pro-rata split of intangibles), that would mean net attributable income of about $2.7 B Euro. Assuming the bank completes its new 500 million euro share buyback program, the share count could be reduced to 410 million shares (or even lower) by the end of the year, with earnings per share subsequently reaching 6.5-6.6 euros. To be clear: This includes an expected increase in loan loss provisions.

investment thesis

The bank looks cheap based on a price-to-book multiple (about 0.8 times tangible book value) and a price-to-earnings ratio (about 6 times earnings), while capital ratios remain relatively high. The regulatory minimum CET1 ratio will increase to 11.35% by the end of this year as regulators require higher countercyclical buffers, as well as higher buffers for systemically important banks, but the end-of-year CET1 ratio will be around 15.6% By 2023, banks will There will be no problem meeting the increased CET1 ratio requirements. Based on a 40% dividend payout ratio and an expected spend of €500 million on a share buyback program, the bank will retain around €110 million in earnings this year, which would, in any case, improve the CET1 ratio by 70-80 basis points. Therefore, I believe that, barring unforeseen circumstances, First Group’s CET1 ratio at the end of this year may be close to or even exceed 16%.

I don’t currently have a position at Erste Group, but the bank has proven in 2023 that it can take advantage of rising interest rates in financial markets. While net profits may be slightly lower in 2024 due to the extremely low cost of risk recorded in 2023, the bank is still priced attractively and I may consider opening a long position, but this will not happen in the next 72 hours .

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.