Sorapop/iStock via Getty Images

We revisit the VanEck Video Gaming and Esports ETF (NASDAQ: ESPO) earlier than we expected. Blame it on a seemingly unstoppable pair of stocks that this ETF can own because enough of their business revolves around their target industries.When ETFs rise With a 12% gain since our hold on the rating, and about half the S&P 500’s appreciation, it’s not for the faint of heart. We’re seeing a snowball effect that may not continue into next year, but it’s prompting us to reassess and upgrade this niche ETF from Hold to Buy. The risks are high, but if the market continues to melt in this area, the potential rewards are too good to miss.

Ranking list

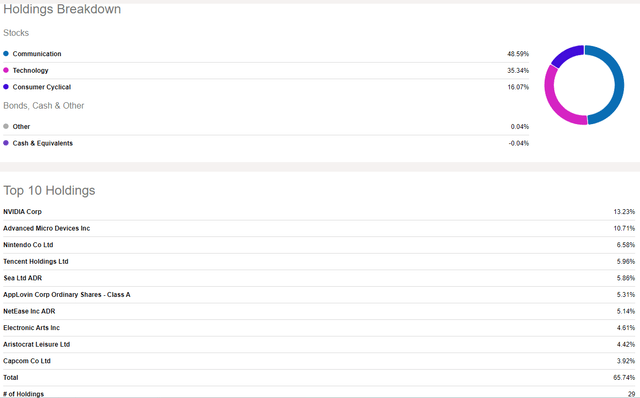

ESPO benefits from holdings in some superstar stocks, including Nvidia (NVDA), which are growing so fast. The stock now accounts for 13% of assets in recent months, while Advanced Micro Devices (AMD) accounted for another 11%. This occurs when a few stocks perform significantly better than the rest of the portfolio.

ESPO is riding a wave of momentum among the types of stocks it owns, although its video game business is only part of the reason for its stock price rise. The portfolio sells for about 28 times trailing earnings but has a 5-year expected earnings growth rate of 33%. We don’t see ratios like this very often. And, while we don’t know how long the market will favor these types of stocks, technology is the deciding factor for us. Let’s introduce it in detail below.

Review ESPO

The VanEck Video Gaming and Esports ETF is a focused portfolio of companies that derive at least half of their revenue from video games and esports. Related industries include game development, game-related software and streaming services, as well as casinos and online games. The resulting portfolio typically contains 25-30 stocks, with a maximum weight of 8% for any stock when rebalanced quarterly. ESPO goes beyond gaming-only ETFs, but like most of its peers, it has a global footprint, with holdings primarily in the U.S., Japan and China.

The ETF’s Core Positive Features

First, we like the uniqueness of the gaming/esports industry and think this is an area worth paying attention to. Growing up in the 90s, our parents would buy us Nintendo devices and video games to distract our kids. The average age of gamers is over thirty, which means that really wealthy adults are spending money in this space not only for their children, but for themselves as well. It’s no surprise, then, that gaming revenue is expected to grow from $227 billion in 2023 to $312 billion in 2027, at a CAGR of 7.9%.

In 2021, U.S. viewers alone watched 15 million years’ worth of content. Forecasts show that by 2024, 45% of the Western European population will be online streaming users. Not only that, streaming media revenue in the Asia-Pacific region is expected to grow to US$54 billion by 2026.

This is where eSports comes in. It is a form of competition using video games where the streaming platform is the conduit. So not only will streaming services benefit, but so will esports because streaming services are already so widely used. Not only that, there is a lot of room for growth. Internet streaming resources are entering emerging markets, especially rural areas in Indonesia, which means more areas for growth.

ESPO: Not a nerd

We like that this ETF isn’t a niche fund like the Roundhill Video Games ETF (NERD). NERD was created to track the performance of video game publishing and video game development companies.

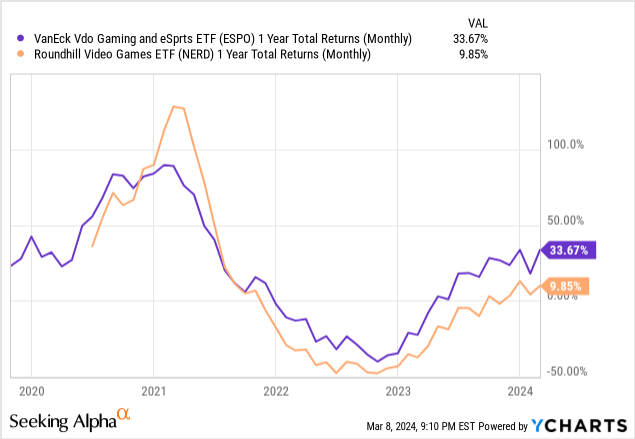

Comparing this peer ETF to ESPO, the components are not necessarily gaming companies, but are involved in related industries, including gaming-related software and streaming services. Because NERD was too specific about ETFs, they missed out on potential gains from streaming services and software technology companies such as NVDA. The numbers speak for themselves. ESPO has outperformed NERD in every rolling 1-year period since the end of 2021, as shown below.

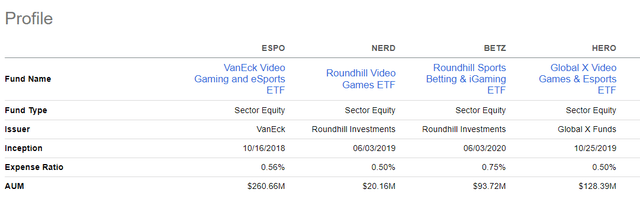

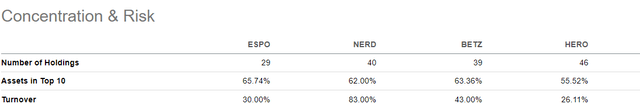

ESPO manages assets at a higher level than these peers.

Seeking Alpha

ESPO is the most talked about of the group, rising only slightly in terms of top 10 stock weighting, but is clearly on a mission to limit holdings to around 30 stocks.

Seeking Alpha

Technical photo: Qiang

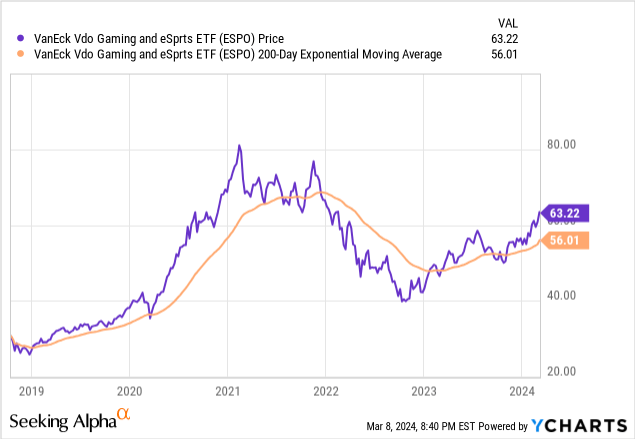

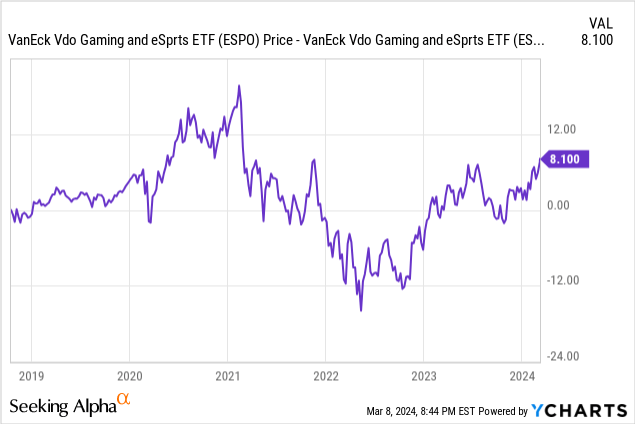

This chart shows that ESPO’s price is above its 200-day moving average. This is a positive sign, but we’re more interested in the chart below.

The second chart shows the spread between ESPO price and the 200-day moving average. Our quantitative eye notes that it is breaking out in a similar pattern to 2020, when the ETF gained ~50% in a relatively short period of time.

Of course, that’s because of the pandemic, and esports is replacing other activities. But the bottom line is, the momentum is there, and this is still a momentum market.

What’s missing from this story: Two huge gaming stocks

ESPO and its fellow ETFs exclude companies like Microsoft (MSFT) and Apple (AAPL), which have billions of dollars invested in gaming businesses. This will further accelerate results.

Seeking Alpha

But since gaming and esports do not account for 50% of its revenue, they are excluded. In particular, MSFT acquired Activation Blizzard in 2023 for $69 billion. That leaves Mr. Softie with ownership rights to the publisher of Call of Duty, World of Warcraft, and other lucrative franchises.

Conclusion: Winner

Given the risk characteristics, encouraging technicals, and expected industry performance going forward, we upgrade ESPO to Buy, hoping that market momentum continues to favor this market niche, and that the ETF’s quarterly rebalancing and 8% single-stock The cap will act as a boost. Strict portfolio management factors into this index fund.