Josh Adelson/AFP via Getty Images

EssilorLuxottica Société anonyme ( OTCPK:ESLOF , OTCPK:ESLOY ) has delivered a total return of >35% since we began coverage, outperforming the S&P 500’s results.Looking back at our publications, we are pleased with the company’s performance both financially and operationally terms. last week, Essilor Luxottica Report Its key growth highlights for the fourth quarter and fiscal 2024 are as follows:

- Innovation is a key value driver and is supported by Stellest, Ray-Ban Meta and Varilux XR

- Nuance Audio successfully debuted at CES in Las Vegas

Regarding the theory of value, we report the following:

- The company’s sales growth during the year was >7%. In constant currency terms, this was the third consecutive fiscal year of growth of more than 7%.This is supported by a new partnership with EssilorLuxottica

- Free cash flow of 2.4 billion euros, dividend per share recommendation of 3.95 euros, up 22% reduction compared to 2022 payments

In addition to EssilorLuxottica’s intrinsic value, our buy thesis is supported by 1) a good mix of technology, pharma, and fashion and 2) an economic moat due to the company’s size.

past analysis

Fourth quarter and full year results

EssilorLuxottica’s revenue exceeds 25 billion euros and net profit is close to 3 billion euros. Without a doubt, we can say that the company has once again exceeded its mid-term sales targets. During the Q&A, the CEO said that 2024 is already off to a good start.

watching quarterly resultsRevenue surged in the fourth quarter, driven by operations in North America and Latin America, while core operating margins were below Wall Street consensus expectations. Performance improved in all four geographic regions, with sales accelerating. The Europe, Middle East and Africa region confirmed sales trends over the past three months. Gross profit reached 16 billion euros, an increase of 6.7%. Looking at the income statement, adjusted EBIT in the second half was 5% lower than market expectations, with a profit margin of 14.6%.

The company’s 2026 target is set at revenue between 2.7 and 28 billion euros, with an EBIT margin in the 19/20% range. In our previous estimates, we exceeded the company’s targets, with sales of €26.7 billion and €28.08 billion in 2024 and 2025, respectively, and EBIT of €4.82 billion and €5.32 billion.

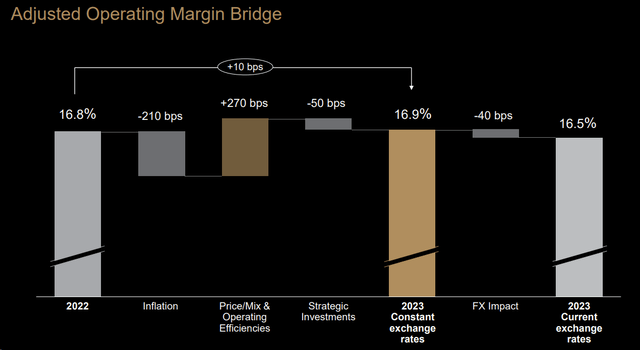

In the financial report, we were surprised by the change in EBIT margin, which declined compared to our estimates. Our target is core operating profit of around 16%. Another soft-margin print will prevent Wall Street analysts from becoming more constructive on the name. The CEO said the company’s declining profitability was just “Temporarily facing greater pressure in 2023“, core operating profit growth will accelerate in 2024. EssilorLuxottica’s EBIT margin is also under pressure from unfavorable currency evolution. Looking at the numbers, this has a 40 basis point impact on 2023.

Essilor Luxottica EBIT profit margin evolution

Key takeaways and estimate changes for the fourth quarter

Following the release of Q4 results, it will be critical to report on the following key points:

- The CEO confirmed that the company is off to a good start in 2024 due to positive expectations in North America and Europe, the Middle East and Africa.These areas remain an important part of EssilorLuxottica’s growth story

- The company’s price/mix will remain stable in 2024 due to higher pricing activity (Smart Glass introductory prices are $299, €329 and £299, while Wayfarer Glass has European pricing of 155 euros to €175).As reported in our previous analysis, product launches come with at least a 100% markup

- In 2023, the -200 basis points EBIT impact is primarily due to labor costs, while cost inflation is expected to “fade out” By 2024. Additionally, the company’s strategic investment margins fell 50 basis points. This is not expected to happen in 2024. Therefore, we expect margins to be higher in 2024 than in 2023.This is supported by price mix and driven by GrandVision synergies and higher operating efficiencies

- CEO reiterates commitment and confidence in CMD goals

New brands such as Moncler and Jimmy Choo further strengthened EssilorLuxottica’s eyewear product portfolio, with double-digit growth in the number of licenses. “All of these will contribute to the development of our group and the transformation of the industry in the next decade,” management said. The company has also achieved important results in its “Care for the Planet” sustainable development plan.

These positive results strengthened EssilorLuxottica and increased dividend payments by 22% to €3.95 per share. Even though there are rumors about the sale of Marcolin to EssilorLuxottica, we believe that this transaction is impossible due to the size of EssilorLuxottica. Marcolin’s brand portfolio includes Adidas, Guess, Harley-Davidson, Tod’s, Max Mara and Zegna. The most valuable asset, however, is the license to the Tom Ford brand. In 2022, Marcolin purchased the perpetual license for $250 million. At Labs, we believe Kering and Safilo are two candidates to acquire the asset. Therefore, our estimates suggest that there are no potential M&A transactions.

Following the announcement of 2023 results, we have lowered our forecast for EBIT levels. Based on the company’s goals, we expect mid-single-digit growth in 2024. Sales grew 6%, supported by new collaborations, and we estimate sales have reached $26.7 billion; however, our core operating margin increased to 16.9%. Our EBIT fell in absolute terms from €4.82 billion to €4.5 billion. The company has enough free cash flow to reduce its debt financial position. On average, we expect to reduce debt by nearly $1.5 billion per year.

Valuation

Our earnings per share for 2024 are set at €7.42. Based on the lower forecast, we arrive at earnings per share of €7. Valuing EssilorLuxottica at an unchanged P/E target of 28.1x, our valuation returns to €196 per share. We still believe there is room for upside in the share price; the company trades at €189 per share. The CEO confirmed the 2026 targets and reverse-engineered the earnings per share forecast; if these results are achieved, EssilorLuxottica should earn about €9 per share.

risk

In terms of downside risks, the company’s sales are primarily generated in mature markets. Therefore, rising unemployment and weak macro consumption may lead to lower sales. Any changes to private health insurance subsidies may also affect turnover. Currency fluctuations may affect sales and core operating profit, with particular attention being paid to the evolution of USD:EUR (North American operations account for approximately 60% of group sales). In addition, changes in distribution channels and customer tastes may result in profitability risks. The company’s eyewear licensing makes its earnings results more susceptible to fashion demand.

in conclusion

New cooperation yields positive results. There is room for price increases due to developments in pharmaceuticals and technology. EssilorLuxottica has a deleveraging story while increasing shareholder returns through higher dividends per share (and continued buybacks). In terms of execution risk, we currently see attractive risk/reward and maintain an Overweight rating target.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.