Afternoon pictures

introduce

While researching its more well-known counterpart Leggett & Platt (LEG), I came across Ethan Allen Interiors (NYSE:ETD).I’m always on the lookout for good dividend stocks to add to my portfolio, especially ones that Trade at a good price. As a buy and hold investor, I typically look for investors that not only have a solid business model, but also the fundamentals.

What’s the point of buying a company that I expect I’ll earn the dividend from if I hold it for only a few months? I look for companies that are likely to not only continue paying dividends but also grow over time. With the occasional special offer, this might actually be worth considering. In this article, I’ll discuss why dividend investors should consider Ethan Allen as a holder of their income-focused portfolio.

brief overview

some of you You may be familiar with the company. I had never heard of them before doing my research.But they are a leader in interior design and a manufacturer and retailer of high-quality homewares.

Headquartered in Danbury, Connecticut, ETD first went public in 1993. They have design centers in the United States and abroad. They were founded in 1932 and incorporated in the late 1980s. Also offering some of the most beautiful luxury classic furniture, which is probably why I’ve never heard of them. Because to me, a couch is a couch; it’s just for sitting on, nothing more. I’ve also never owned a home, but that may change if I decide to buy one.

latest quarter

Ethan Allen reported their fiscal second quarter earnings in February. The company missed both revenue and profit targets, with earnings per share of $0.67, $0.09 lower than expected, and revenue of $167.28 million, $11.92 million lower than expected. With a challenging economic backdrop causing consumer finances to become more strained due to interest rates, you can understand why the company’s financials are subdued.

Both of the company’s first-quarter metrics missed expectations, but both metrics in the second quarter achieved quarter-over-quarter growth. Despite missing the mark in both quarters, the company still showed strong operating margins, with a gross margin of 6.1% and an operating margin of 12.1% in the first quarter. However, delivery sales experienced a double-digit decline of 23.6%. This was driven by a weakening economy and major flooding of manufacturing operations in Vermont.

Consolidated net sales of $163.9 million were also affected by lower sales due to weaker demand. However, net sales grew about 2% sequentially to $167.3 million. Gross profit margin also improved to 60.2%, exceeding 58% for 11 consecutive quarters, while adjusted operating profit margin increased to 12.8% from the previous quarter.

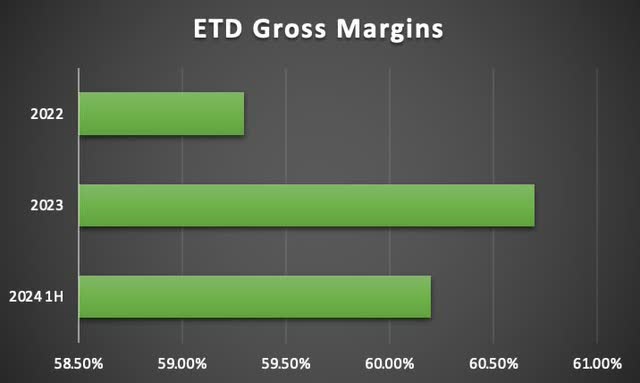

Gross profit margin also improved to 60.2% from 56.5% in 2021 and 59.3% in 2022. The gross profit margin for the whole year of 2023 was 60.7% and 16.3% respectively. So, despite the challenges the company faces, they still show strong profit margins, which have improved over the past two years.

Author’s creation

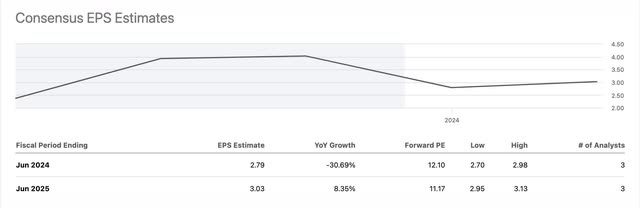

Analysts expect full-year earnings of $2.79, down sharply from $4.03 at the end of 2023. But they do expect the company to return to its growth path in 2025, with earnings per share expected to rise nearly 9% year over year. Year.

Seeking Alpha

If interest rates do fall as expected, Ethan Allen’s top and bottom line could improve. Of course, there are rumors of a recession in the foreseeable future, but that remains to be seen. The Fed expects to avoid a recession, but no one knows what will happen in the future.

Shareholder friendly

Despite these challenges, which I expect the company to overcome in the near future as margins and financials are likely to improve, the company is very shareholder-friendly and occasionally rewards shareholders with special dividends.

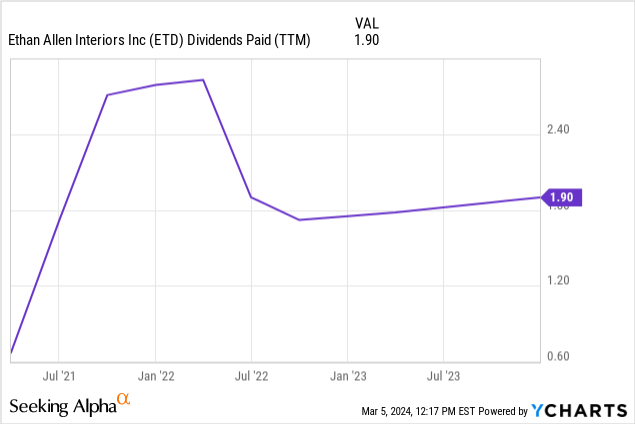

Since they were forced to cut their dividend during the financial crisis, they have paid multiple special dividends, including a $1.00 special dividend in 2019 and a $0.75 special dividend in 2021. Additionally, they have issued a special dividend of $0.50 each of the past two years.

Since the company suspended its dividend, they have also continued to increase their regular dividends, with a growth rate of 71.4%. During the first half of the fiscal year, the company has paid $31.1 million in dividends and generated $32.3 million in cash from operations. Their current yield of over 4% is also attractive.

Although the full-year FCF payout ratio is currently tight, with operating cash down nearly 26% from $40.9 million to $30.3 million, the company is well positioned to continue making regular payments due to its strong balance sheet. Dividends and occasional special dividends.have No debt!

The luxury furniture maker had $0 in debt and $55 million in cash at the end of its latest quarter. So impressive! During the quarter, they generated $13.6 million in cash from operations and paid $9.2 million in dividends, giving them a safe payout ratio of about 68%.

Although the company faces weak consumer demand due to tough economic conditions, I expect they will temporarily stop paying special dividends for the foreseeable future. But I suspect this will continue once management learns more about the economy and understands interest rates.

Valuation

At the current price of approximately $33 per share, ETD’s forward P/E ratio is approximately 11.7x, below the industry median of nearly 16x and its 5-year average of 12.78x. If the company can return to growing like it has in the past, I think the company will provide promising upside for shareholders. Their P/E ratio is also lower than that of larger and well-known peer LEG at 15 times, and slightly lower than La-Z-Boy (LZB)’s 12.4 times.

While the recent pandemic has caused consumers to shift their attention to items like travel, management sees positive trends as consumers’ attention shifts back to their homes, which could have a positive impact on the company.

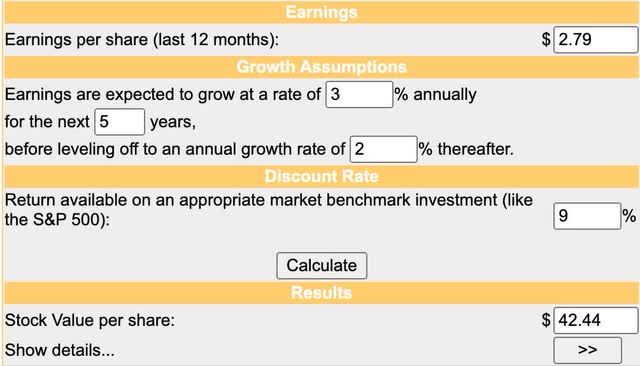

What’s more, management saw growth in December, and the company expects to reap some of that growth. If so, they could see some nice upside once interest rates start to fall and tightening eases. Using a discounted cash flow model along with a 3% growth rate and 9% ROR (in line with the S&P’s historical 7% – 10%), this puts them at a fair value of approximately $42. This is approximately a 24% increase from current prices.

money chimpanzee

risk

Considering that the company has been greatly affected by changes in consumer spending habits brought about by the epidemic, an unexpected economic downturn such as a recession may indeed harm the company’s financial situation in the future. As financial conditions become tighter for luxury furniture manufacturers, consumers may spend their money on cheaper items.

Also affected has been an increase in credit card debt, which has been rising steadily over the past few quarters. As interest rates have risen over the past two years, consumers have had to rely heavily on credit cards, resulting in balances reaching $1.079 trillion at the end of the fourth quarter. That’s an increase of $273 billion from two years ago. If interest rates remain high for an extended period of time, this number will likely continue to grow, leaving consumers with less money to spend on luxury goods from companies like Ethan Allen.

loan tree

bottom line

Ethan Allen is a lesser-known company with a history of over 20 years. Despite being forced to cut its dividend during the global financial crisis, the luxury furniture maker has significantly increased its dividend while occasionally issuing special dividends to reward shareholders.

The company has faced headwinds from changes in consumer spending habits since the recent pandemic, but nonetheless has shown strong financial strength and has seen improved gross margins over the past few years. Additionally, the company has a very solid balance sheet, with zero debt. This gives them the financial flexibility to continue paying regular dividends. With a 4% yield, shareholder-friendly management, and a Fortress balance sheet with double-digit upside potential, I rate Ethan Allen a Buy.