Mulunni

iShares MSCI Australia ETF (NYSE:EVE) experienced positive performance in 2023, returning +13.98% in 2023.While this may be considered underwhelming compared to the US and other developed markets, it has some real highlights; an attractive dividend profile, some diversification features, and Offering niche investment opportunities in the region. Although I currently have a Hold rating on EWA based on current valuations and some macro headwinds, the current picture is positive.

Anomalies in the Asia-Pacific region

Australia caught my attention for several reasons. It is a stable, prosperous, industrialized country relatively close to Asia. We are in an era of changing geopolitical alliances, and with US-China relations deteriorating recently, I find myself looking at countries in the region that may be of strategic importance, and Australia is one of them.us Cooperation and investment between Australia and other global powers are increasing in response to China’s saber-rattling.only last week Britain and Australia sign a mutual defense agreement to strengthen maritime security.

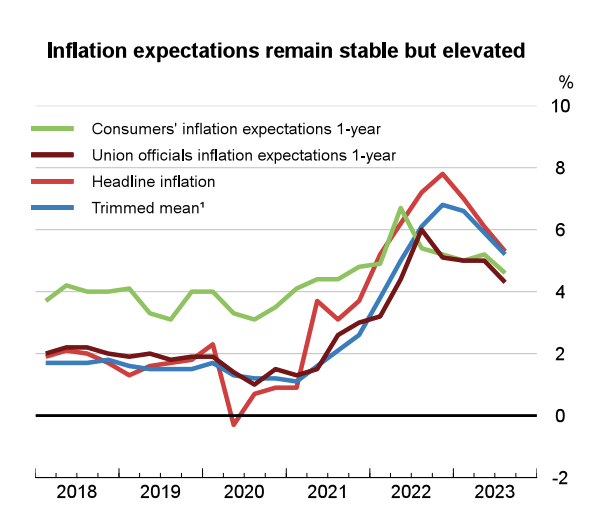

The country’s macroeconomic environment is tepid, but still improving.according to OECDGDP is expected to slow to 1.4% in 2024, compared with 1.9% in 2023, before picking up again in 2025, growing to 2.1% in 2025. From the perspective of monetary environment, inflation is on a downward trend.Reserve Bank of Australia Keep interest rates stable At last week’s meeting, the rate was 4.35%. Contrary to messages from many central banks, it remains ambiguous about the direction of interest rates. The Australian dollar fell on the outcome of the meeting, showing investors were betting on a rate cut soon. This could be a boon for the Australian mining industry (and the fund, which has significant allocations for basic materials), as a weaker currency typically helps exports. However, one area of concern is how a falling interest rate environment might impact EWA Financials’ net interest margin.

OECD

Yihua Holdings

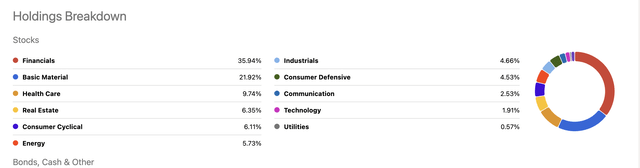

EWA is a $1.9B ETF holding 73 stocks as of this writing. The fund has a track record of more than 25 years, starting with iShares’ first single-country ETFs in 1996. This fund is a financial ETF and contributes approximately 36% to the industry. The next largest allocation is to basic materials ~22%, followed by hygiene ~10%.

Seeking Alpha

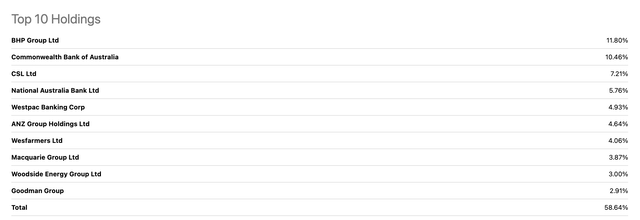

The fund’s top ten holdings account for about 60% of total assets, with the largest allocation (about 12%) to multinational mining company BHP Group (BHP).It’s no surprise that Australia is one of the main location for global mining. The second largest allocation is to financial giant Commonwealth Bank of Australia (OTCPK:CBAUF) at around 10%.

Seeking Alpha

Outflows dominate year to date

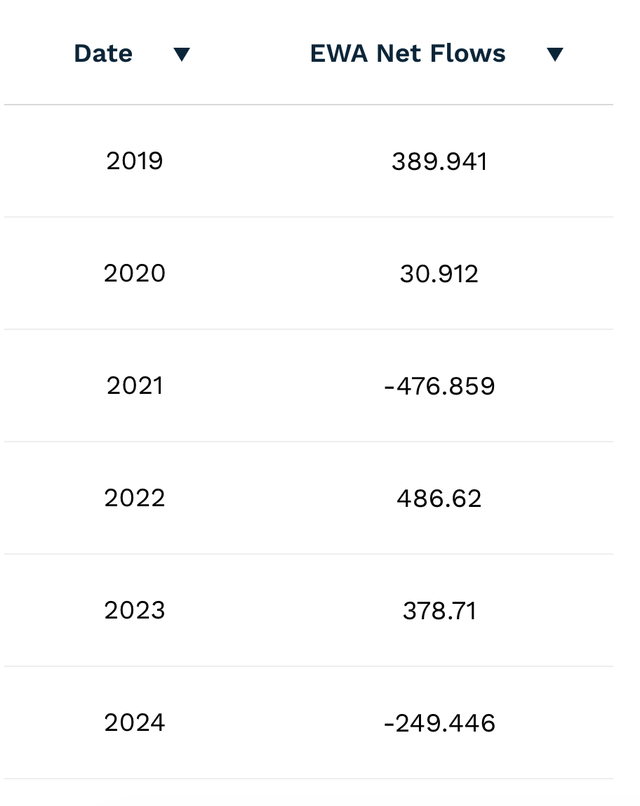

EWA has experienced massive outflows in recent times. In 2021, there were net outflows of $476 million, and year to date, the fund has also seen significant outflows of approximately $250 million. Since January, there haven’t been any major market moves that would prompt a sudden flight from EWA. However, major institutional investors may have rebalanced away from funds causing outflows of the magnitude.

ETF.COM

Some benefits of diversification

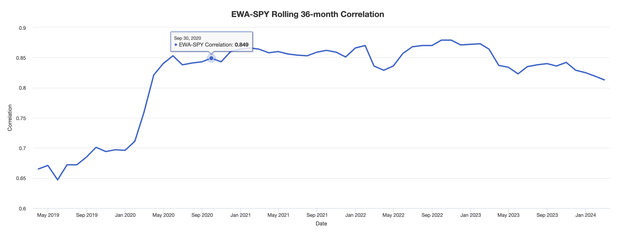

When looking at rolling 36-month correlations over the past 5 years, we find that EWA, which uses the SPDR S&P 500 ETF (SPY) as a proxy for the U.S. market, has had lower correlations with U.S. equities during certain periods. Despite its recent rise in relevance, EWA is able to provide diversification. It is a developed industrialized country located in the Asia-Pacific region. This makes it quite a niche market.

Portfolio Visualization Tools

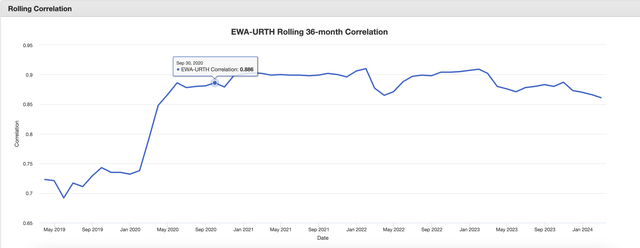

We see here that, using iShares MSCI World (URTH) as a proxy, EWA generally has a higher correlation with global equities, although it also has periods of declining correlation.

Portfolio Visualization Tools

Provides benefits, but not high value

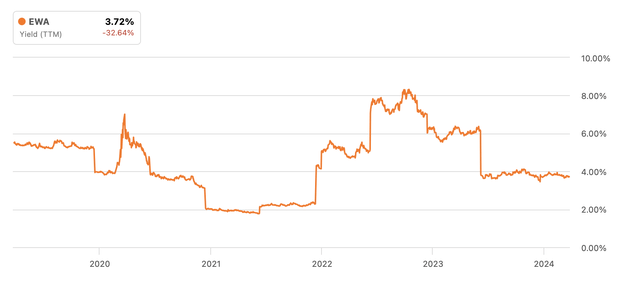

EWA’s current 12-month trailing yield is 3.78%, which is more attractive from an income perspective. Its yield has been above average in the past, although we haven’t always seen consistent and continuous dividend growth. With a price-to-earnings ratio of 17.99 times and a price-to-book ratio of 2.37 times, the valuation multiple is less attractive, which is the key reason why I am currently hesitant about EWA.

Seeking Alpha

Conclusion

EWA has some solid components and is well-established in the Australian economy. The country faces challenges almost everywhere. Its yield profile is attractive, and while it doesn’t always provide consistent dividend growth, the yield is still above average. The fund has proven in the past that it can provide some diversification benefits to developed markets. However, I believe the market has priced in most of what it has to offer by now. I’ll keep an eye on how the story unfolds, but I’m taking EWA as a hold off for now.