Philomia Indawangpan

Share expense management platform expense company (NASDAQ: EXFY) The company’s performance has rebounded since it reported better-than-expected fourth-quarter 2023 net income on February 22, 2024.Cost-cutting measures accounted for growth, but revenue Growth still faces challenges, and existing customer seats decreased by 42,000 in fiscal 2023 after expanding by 85,000 in fiscal 2022. With its new platform set to roll out on a rolling basis in 2024 and its marketing methods questionable, the beneficial owners who bought into this failed IPO deserve a deeper look. Analysis below.

Seeking Alpha

Company Profile:

Expensify, Inc. is a Portland, Oregon-based cloud-based expense management software platform targeting small and medium-sized businesses (SMBs). As of the last quarter of 2023, the company had approximately 719,000 paid members across an average of 47,000 businesses in more than 200 countries and territories. Founded in 2008, Expensify went public in 2021, raising net proceeds At $27 per share, earnings per share were $57.5 million. The stock trades at about $1.70 per share, equivalent to a market capitalization of about $145 million.

The company consists of three classes of shares. The 70.6 million publicly traded Class A shares confer financial benefits and one vote per share. The 7.3 million privately held LT10 shares provide financial benefits and 10 votes per share, while the 7.3 million privately held LT50 shares provide financial benefits and 50 votes per share. As a result of this arrangement, owners of LT10 and LT50 shares represent 17% of the financial interest and 86% of the voting power in Expensify.

Technology and business model

The backbone of its raison d’être is SmartScan, which allows users (individuals or employees) to take a photo of virtually any receipt of any quality, then Expensify’s technology transcribes and categorizes the information, sends it for approval, and provides next-day reimbursement. These services have since expanded to business credit card management, invoice generation, bill payments, collections and travel bookings, all available through its mobile app or website.

Individuals can sign up for a free subscription, which includes Track, which allows use of the SmartScan receipt scanning feature up to 25 times per month; and Submit, which allows expense reports to be submitted for reimbursement. When the threshold of 25 scans per month is exceeded, these free plans become paid customers. Expensify believes that individuals using its software and/or apps are its best marketing tools because they will tell managers to subscribe to its services company-wide.

These commercial services include collection and control plans, where customers pay a fixed monthly fee for each active membership, or annual plans where they commit to a minimum number of seats per month in exchange for a discount. If your business uses Expensify (Visa(5)) card, allowing them to reimburse employees for cash expenses, send invoices to customers, and set up bill payments. The paid collection and control plan allows customers to integrate with small business accounting, travel and human resources systems, configure expense report approval workflows, and pay employees and contractors internationally through ACH or through global reimbursement. Additionally, Expensify receives a percentage of redemptions on all spend on its cards.

share price performance

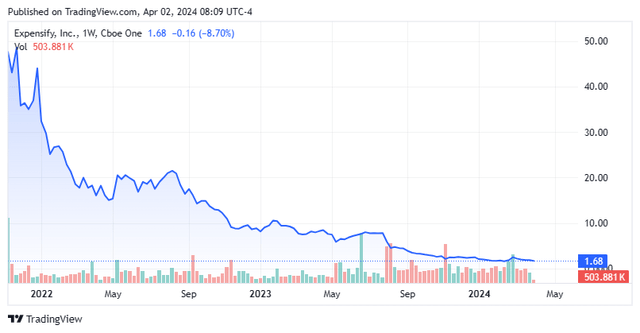

So, with an expense management, invoicing and bill payment platform complemented by its own credit card, the company seeks to expand its customer base by adding new platform features and word-of-mouth recommendations.The playing field includes more than a dozen private competitors – one of which is named epencia – Fighting for a share of a strong domestic small business market of 33.2 million people, Expensify has nothing special except that it’s publicly traded. As a result, its revenue struggled, falling 11% to $150.7 million in FY23. This contrasts with the long-term growth target of 25% to 35% that management set after the release of its fourth-quarter 2021 financial report in March 2022. Therefore, the once very popular IPO – priced at US$27, first traded at US$39.75, peaked at only 11 trading days after listing, and the stock price has fallen to US$51.06, a 94% drop from the IPO pricing, and a decline from February 2024 It fell 97% from its peak on the 22nd when it hit an all-time intraday low of $1.52 per share.

To revive growth, management is launching version 2.0 of the platform, which is described as PayPal (PYPL) Wen Mo, Meta Platform (META) WhatsApp and Dropbox (DBX). It will have the recently added free (for now) chat feature. It will remain active through 2024.

Fourth Quarter 2023 Financial Conditions and Fiscal Year 2024 Outlook

Additional details on the rolling release are provided in Expensify’s fourth quarter 2023 financial report, which is available after the close on February 22, 2024. EBITDA was $5.9 million, revenue was $35.2 million, EPS was $0.09 (non-GAAP), and adjusted EPS was $0.09. In the fourth quarter of 2022, EBITDA was US$11.2 million and revenue was US$43.5 million, a decrease of 58%, 48% and 19% respectively. Despite the lackluster year-over-year results, net income beat consensus forecasts by $0.09, while revenue was essentially flat. This is the first time in four quarters that Expensify has missed net profit line expectations. Cost-cutting measures helped improve expectations.

Company introduction meeting in February 2024

This resulted in fiscal 2023 losses of $0.01 per share (non-GAAP) and adjusted losses of $0.01 per share. EBITDA was $13.2 million on revenue of $150.7 million, while earnings per share (non-GAAP) were $0.31, and adjusted earnings per share were $0.31. EBITDA in fiscal 2022 was US$42.5 million and revenue was US$169.5 million, a decrease of 102%, 69% and 11% respectively. The biggest factor in these declines is not the addition of new customers, which are essentially the same (43,000 seats in fiscal 2023 vs. 42,000 seats in fiscal 2022), nor the loss of customers due to leaving the platform or going out of business (-62,000 seats vs. – 62,000 seats), but instead existing customer expansion decreased from an increase of 85,000 seats in FY22 to a decrease of 42,000 seats in FY23. Expensify blames this dynamic on the poor macroeconomic backdrop.

After free cash flow fell from $26.3 million in fiscal 2022 to $0.6 million in fiscal 2023, management said it expected to generate $11 million in revenue in fiscal 2024 based on the midpoint of the range.

Company introduction meeting in February 2024

Since the release of this relatively lackluster report, EXFY shares first jumped nearly 50% from the closing price of $1.59 on February 22, 2024. The stock has given back most of its gains over the past few weeks.

Balance Sheet and Analyst Comments:

On an encouraging note, the company repaid $44.3 million of debt in fiscal 2023, leaving its balance sheet strong, reflecting $47.5 million in cash and equivalents and $22.7 million in debt. Expensify can use a portion of its projected fiscal 2024 free cash flow toward its $50 million stock repurchase program, under which it repurchased 504,493 shares in fiscal 2023 with $41 million remaining authorized. Still, despite the lower stock price, management has said that heading into 2024, the company will focus more on paying down debt than stock buybacks.

With the company’s stock price down 97% from peak to trough, most Wall Street has given up on its optimism about the company. Analysts who were unanimously optimistic in October 2022 are now decidedly negative, with 2 rating Buy, 4 holding, 1 underperform and 1 selling over the past 5 months Among analysts commenting, the median price target is $2.On average, they expected Expensify earned $0.16 per share (non-GAAP) on fiscal 2024 revenue of $143.3 million, followed by $0.19 per share (non-GAAP) on fiscal 2025 revenue of $152.4 million.

Beneficial owner Steven McLaughlin is apparently more optimistic than Wall Street’s forecasters, as he recently purchased 182,941 shares at $1.59 ahead of the earnings report on February 22, 2024. The deal boosts his ownership interest to 12%. Notably, several company insiders, including the CEO, sold a total of just over $1.4 million worth of stock in March.

judgment:

Despite Mr. McLaughlin’s cost levelling, Expensify still offers a commoditized product, even though management believes otherwise. The company should use the IPO proceeds to invest more in brand recognition rather than relying on bottom-up viral lead generation and word-of-mouth approaches. That said, it does plan to spend more on SEO in fiscal 2024, but that still doesn’t seem to be the best use of its marketing dollars. In short, management doesn’t have any real plans for growth.

That said, if valuations are convincing, a boring, somewhat rudderless story may suffice. However, Expensify stock trades at double sales and a price-to-earnings ratio of just over 10, based on Street forecasts for fiscal 2024. These valuations seem fair, but not particularly compelling, given the company’s history of destroying shareholder value. Product differentiation is minimal. EXFY stock should rise if the small business economy surges, but I don’t think that economic scenario will materialize.

Now, if the company is to meet or exceed its free cash flow target in 2024, and it looks like it may continue to do so this time around, Expensify, Inc. stock might be worth watching again, as that would boost the free cash flow yield in a high position. Trading levels are currently in the single digits.