Nico El Nino

The past few years have reshaped the exchange-traded fund (ETF) landscape.Just a few quarters ago, environmental, social and governance (ESG) ETFs were all the rage, attracting billions of dollars of global inflows into equity and fixed income markets funds.1

But a booming energy industry, driven by oil and gas exploration and production companies large and small, has attracted new money.

Then, two years ago, Russia invaded Ukraine, causing investors to rethink what “ESG” really meant—and since then, the once-popular theme has taken a backseat to “reshoring” and “friends.” Trends, despite the “S” and “G” factors remain top of mind for value-focused asset allocators.2

Investors seek safety in short-term bond ETFs

As all this happened, so did inflation.As of June 2022, the U.S. Consumer Price Index (CPI) has risen to more than 9%, the highest level in history Four decades.3

The Fed was soon forced to raise interest rates sharply – with short-term interest rates soaring, catching many bond investors off guard. Bond ETFs, especially duration bond ETFs, have been hit hard.

The traditional 60/40 stock/bond portfolio is in trouble in 2022 as both equity and fixed income prices fall – a very different market environment than most investors have seen today.4

This period revives memories of the 1970s, when bonds offered little diversification. However, there is also a beneficiary in the ETF space.

Short-term fixed-income funds—those that are relatively insensitive to rising interest rates—have attracted significant inflows.5

Today, they remain popular because the short-term yield is around 5%. Critics may argue that Treasury ETFs have had their day, but growth in covered calls and other income ETF strategies appears to be as strong as ever.6

Bitcoin’s new boom: ETFs take center stage

Of course, perhaps the most exciting ETF trend of 2024 so far is the approval and apparent popularity of spot Bitcoin funds.

Cryptocurrencies are back in the mainstream after two years of turmoil, with the SEC approving 11 such ETFs.7 Recall that spot Bitcoin rose to $69,000 at the end of 2021 before a deep bear market.

By November 2022, the largest cryptocurrency by market capitalization had plummeted. Holders of the spot Bitcoin ETF who bought in the first few weeks of the ETF’s existence have already been rewarded – as of the end of February, Bitcoin was trading for more than $60,000.8 Rumors are now swirling about the next wave of cryptocurrency funds, possibly related to spot Ethereum.9

ETFs: a measure of investor risk appetite

There are more stories to tell and more trends to sift through in the ETF space, but the bottom line is that investors should monitor what is happening and what is likely to happen to understand market conditions.

ETFs have proven themselves to be good barometers of risk sentiment and macro themes. A slew of AI-related ETFs have emerged, and actively managed funds have seen a resurgence.

ETF growth is solid, but not peaking yet

At Wall Street Horizon, in addition to corporate event reporting, we track U.S. ETF allocations, splits, and new ETFs.

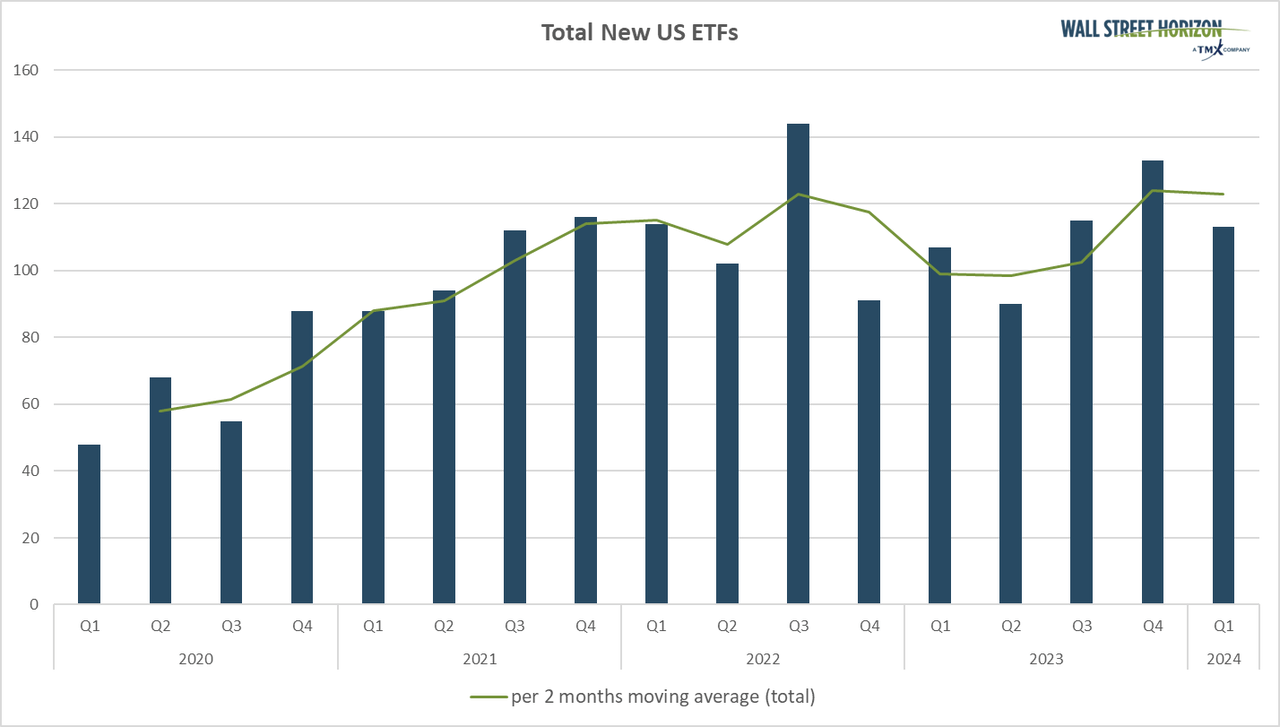

One of the most telling trends we found is that while new ETF themes have emerged in recent quarters, overall growth in the domestic ETF market has been essentially flat since the end of 2021. what is the reason? It’s hard to pinpoint for sure, but we can try.

It’s reasonable to assume that today’s rise in interest rates has broadly dampened financing activity.

Note in the chart below that ETF growth surged from early 2020 to late 2021, a period of intense market speculation, including the IPO and SPAC craze and a rapid rise in cryptocurrency interest.

Although many new ETFs are launched every quarter, the overall growth rate currently remains stable.

Total U.S. ETF new additions by quarter

Source: Wall Street Horizon, based on 230+ ETF providers

Analyzing ETF split trends

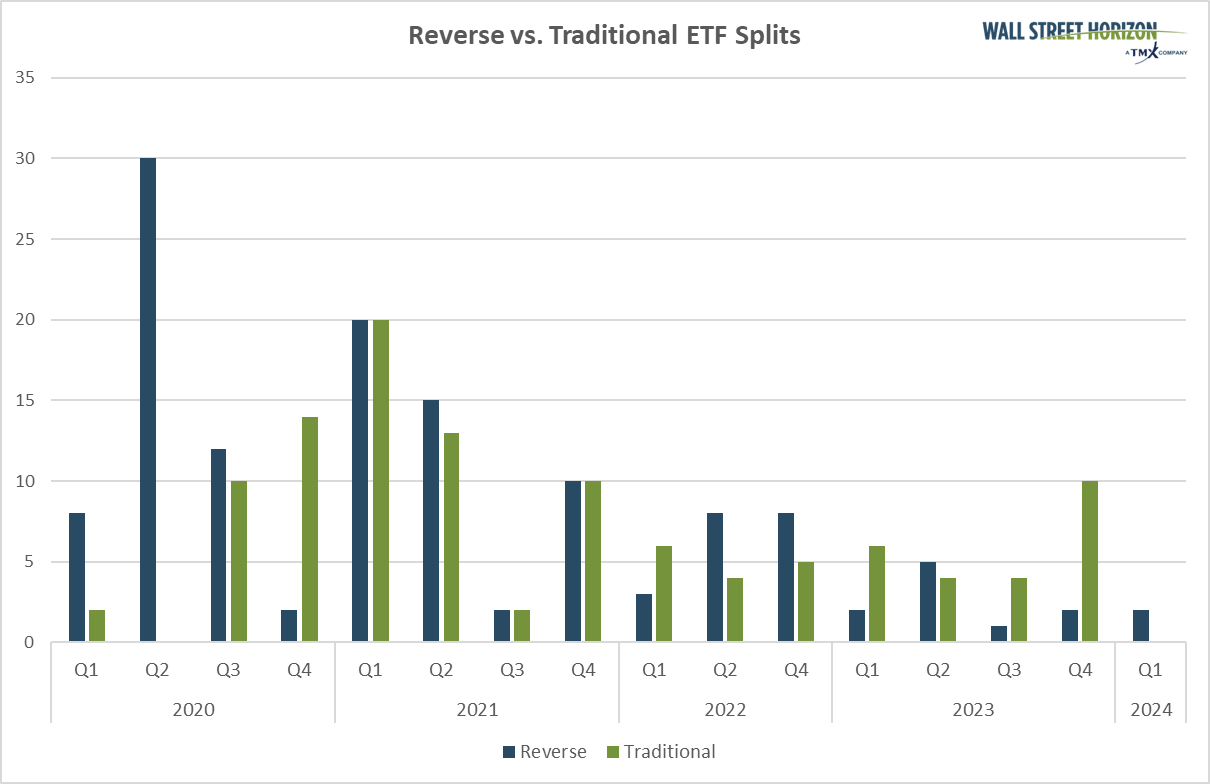

Another measure of market excitement is the ratio of traditional ETFs to inverse ETF splits. It’s been pretty quiet on this front.

An ETF may undergo a traditional split to lower the share price to attract more investors or to keep the price within a desired dollar range.

Given that many major market indexes have jumped to all-time highs, one would conclude that a more traditional split will be on the agenda, but we are not seeing that yet.

There has also been a pause in reverse segmentation activity. Typically, inverse splits or leveraged ETFs experience inverse splits because they are susceptible to negative compound returns during periods of volatility.

In addition, the share price of an inverse fund (i.e., a fund that moves inversely to a market index) may decline, causing the issuer to engineer a reverse split in order to bring the share price back up to a more respectable level.

U.S. ETF splits decrease since 2022

Source: Wall Street Horizon, based on 2,900 U.S. ETFs

Your ETF Distribution Center

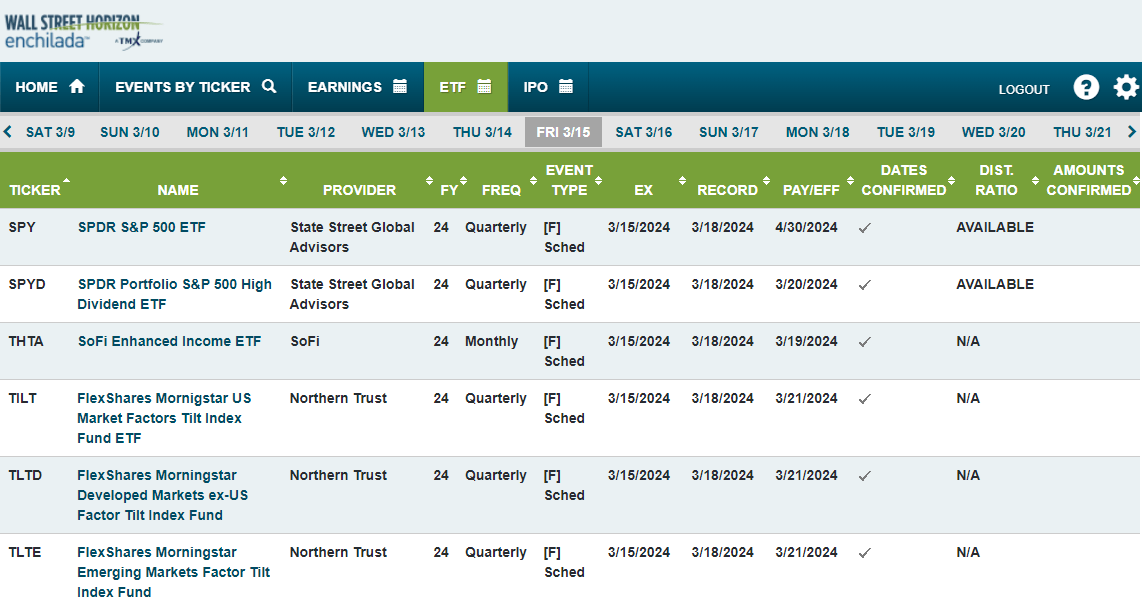

Finally, this time of year, many stock ETFs pay quarterly dividends. March, June, September and December are when distributions typically occur.10

Our team tracks important ETF dividend announcement dates, ex-dividend dates, and payable dates so investors can stay ahead of distributions.

For example, SPDRⓇ S&P 500 IndexⓇ The ETF (SPY) traded ex-dividend on Friday, March 15, 2024, but the amount has not yet been confirmed.

The shares will be payable to shareholders of record on March 18, with a dividend payment date of Tuesday, April 30, 2024.

Upcoming SPY Dividend Ex Dates

Source: Wall Street Horizon

bottom line

ETFs continue to be a popular way to invest. However, topics change, and today’s popularity may quickly give way to tomorrow’s next hot topic.

Nonetheless, market insights can still be gleaned by analyzing trends in the ETF market. In addition, investors should stay informed about new funds as they become available as well as important distribution dates and dividend amounts to manage their portfolios more efficiently.

1 Money invested in ESG funds more than doubled in a year, CNBCGreg Yacusi, February 11, 2024

2 The exodus of U.S. investors has caused a historic blow to the global ESG fund market BloombergFrancis Schwarzkopf, January 25, 2024

3 US inflation rate, trade economicsFebruary 28, 2024

4 Trustworthy 60-40 Investing Strategies Just had the worst year in generations, wall street journalEric Wallerstein, October 19, 2023

5 short-term government bond ETFs experienced large inflows of funds. VitafiJames Countois, September 11, 2023

6 VettaFi Speaks: The biggest stories of 2023, VitafiHeather Bell, December 15, 2023

7 Statement Regarding Approval of Spot Bitcoin Exchange-Traded Products, U.S. Securities and Exchange CommissionGary Gensler, January 10, 2024

8 Bitcoin to USD, stock chartFebruary 28, 2024

9 After the spot Bitcoin ETF was approved, the focus turned to the Ethereum Fund decision-making. Bullock EngineeringBen Strecker, January 17, 2024

10 Do ETFs Pay Dividends? VitafiJared Kamans, June 24, 2015