Sunlight

The field of biotechnology has always been a hotbed of innovation and progress, with companies making groundbreaking advances in areas such as gene therapy, cancer treatment and regenerative medicine. This progress, coupled with impressive financial returns, makes the industry an attractive investment option.Unfortunately, the momentum is not there yet There. Most biotech stocks peaked in 2021 but are still well below those levels.

Is there potential catch-up trade compared to other products that are performing well? Maybe. If you also have this mentality, First Trust NYSE Arca Biotech Index Fund ETF (NYSE:FBT) is worth a look. FBT is an exchange-traded fund designed to replicate the price and yield performance of the NYSE® Arca® Biotechnology Index before fund fees and expenses. The index measures the performance of 30 leading biotech companies.

FBT operates on an equal dollar-weighted basis.This means it invests The amount of capital is equal for each company regardless of its size. The fund is restructured and rebalanced quarterly, allowing it to respond dynamically to changes in the industry.

Learn more about FBT’s holdings

Major holdings include

- Natra Corporation (Inland Revenue Department): A leading diagnostics company specializing in the development and commercialization of cell-free DNA (cfDNA) tests to provide advanced genetic screening and diagnostics in oncology, women’s health and organ health to facilitate early detection and informed treatment decisions.

- Bruker Corporation (BRKR): Global manufacturer and distributor of high-performance scientific instruments and analytical and diagnostic solutions designed to explore new developments in life science research, industrial applications and clinical diagnostics.

- Halozyme Therapeutics Ltd. (HALO): A biotechnology company focused on the development and commercialization of novel recombinant human enzymes to enhance the delivery and absorption of other drugs, committed to improving patient experience and outcomes through innovative and disruptive solutions.

- Mettler-Toledo International (MTD): A leading global provider of precision instruments and services specializing in laboratory equipment, industrial weighing solutions and process analytics designed to increase efficiency and productivity across industries.

- Waters Corporation (WAT): A global leader in developing innovative analytical science solutions, including liquid chromatography, mass spectrometry and thermal analysis, for life science research, environmental management, food safety and drug development.

Industry composition and weight

The fund’s investments are spread across multiple sub-sectors. The most important sub-sectors are Biotechnology Therapeutics (including companies engaged in research and development of therapeutics) and Biotechnology Tools and Diagnostics (including companies that produce and provide tools, systems or processes that support the practice of biotechnology).

Peer comparison

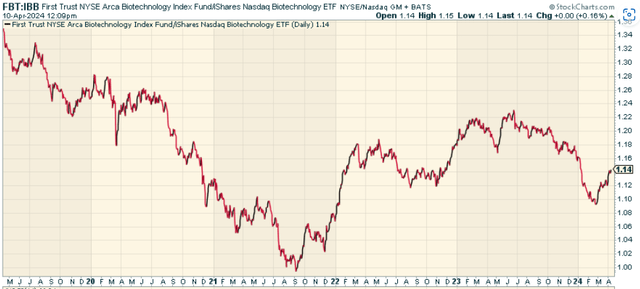

Compared to other similar ETFs such as the iShares Biotechnology ETF (IBB), FBT holds fewer companies but gives each company equal weighting. This strategy has the potential to provide greater exposure to smaller companies and reduce concentration risk. However, this also means that the fund’s performance is more dependent on the individual performance of each holding. When we look at the FBT to IBB price ratio, it appears that some relative strength has begun to emerge of late.

StockCharts.com

Pros and Cons of Investing in the Biotech Sector

Investing in the field of biotechnology, especially FBT, has both opportunities and risks.

On the positive side, the biotechnology industry is known for its high growth potential. Given the continued advancements in medical technology and the constant demand for new treatments and cures, the industry can provide investors with impressive returns.

In addition, by investing in FBT, investors can gain access to the growth potential of the biotech industry without picking individual stocks. The fund’s equal-weight strategy also provides a level of diversification that helps mitigate risk to individual companies.

However, the industry is also characterized by high volatility. Drug development is a risky and costly process, and many companies in the industry are losing money. Additionally, the industry is highly regulated, and companies often face significant obstacles in getting their products approved.

Investing in FBT also carries certain risks. As an index fund, FBT is exposed to the risks of its underlying index. If the companies in the index perform poorly, the fund will also perform poorly. Additionally, because the fund invests equally in all of its holdings, it may be more susceptible to underperformers than a fund that weights its holdings based on market capitalization or other factors.

Conclusion: Should you invest in FBT?

The decision to invest in the First Trust NYSE Arca Biotechnology Index Fund ETF depends on your risk tolerance, investment objectives, and confidence in the potential of the biotechnology industry. If you believe in the industry’s growth prospects and can tolerate the associated risks, FBT offers you the opportunity to invest in a diversified portfolio of biotech stocks. Please note that this is a volatile industry and should be scaled appropriately.