MCCAIG

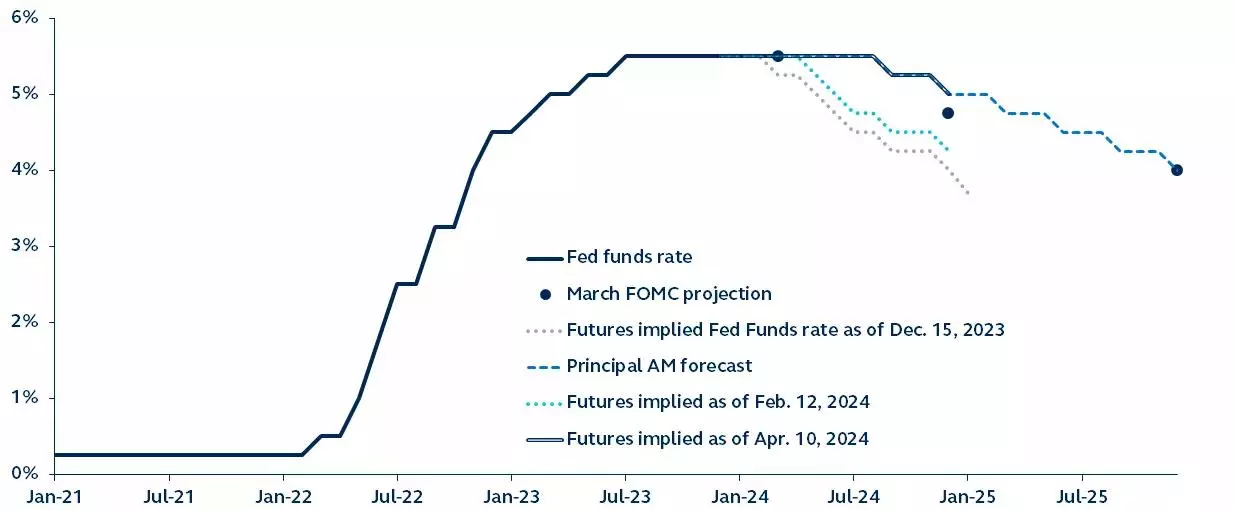

The strong economic data has led to a major shift in market expectations about when and how quickly the Federal Reserve will begin cutting interest rates.

Our own forecast is for a first rate cut September, but the complexities of initiating an easing cycle ahead of the U.S. presidential election do create significant uncertainty.

Fed policy rate path

Federal funds rate and forecasts, 2021 to date

source: Federal Reserve, Bloomberg, Principal Asset Management. Data as of April 10, 2024.

The past few months have been a particularly volatile period for the Fed’s policy rate forecasts. March’s CPI report was the latest in a series of upward inflation surprises, meaning the stagnant deflation narrative can no longer be viewed as a blip.

Financial market expectations have now shifted from six rate cuts to just There have been two interest rate cuts this year – smaller than the Fed’s own forecasts.

Chairman Powell has made it very clear that he wants to cut interest rates this year. Not only did he downplay the importance of recent inflation data, but the upward revisions to the Fed’s growth and inflation forecasts did not prompt any changes in its near-term policy path forecasts. The Federal Reserve continues to forecast a rate cut of 75 basis points this year.

The continued strength of the U.S. economy suggests that only one rate cut may be necessary, but the Fed’s clear desire to do so should not be ignored.

Therefore, assuming deflationary trends resume in 2023, we revise our 2024 forecast from three rate cuts to two, with the first cut in September.

There are significant risks to this forecast (November’s US presidential election) and starting a rate cutting cycle immediately before the November election may be a bridge too far for the Fed.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.