Mark Wilson

investment thesis

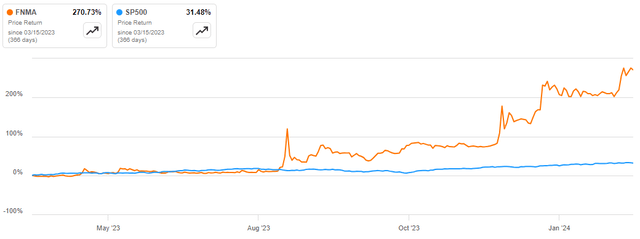

The Federal National Mortgage Association (OTCQB: FNMA) is a government-sponsored enterprise that finances mortgages in the United States. Its stock price rose approximately 271%, outperforming the S&P 500 Index by approximately 239%.

Seeking Alpha

From a technical perspective, I’m bullish on this stock as it just bounced off support and has a significant runway before hitting resistance. I believe its upside potential is supported by its unique business model, which I believe positions the company strategically for growth. Additionally, I view the company’s recent strategic moves, such as the appointment of new leadership and the sale of non-performing loans, as growth catalysts. For these reasons, I am optimistic about this stock, and therefore I recommend it to potential investors.

Technical Perspective: Analyzing Price Charts

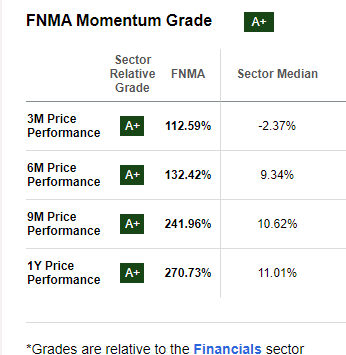

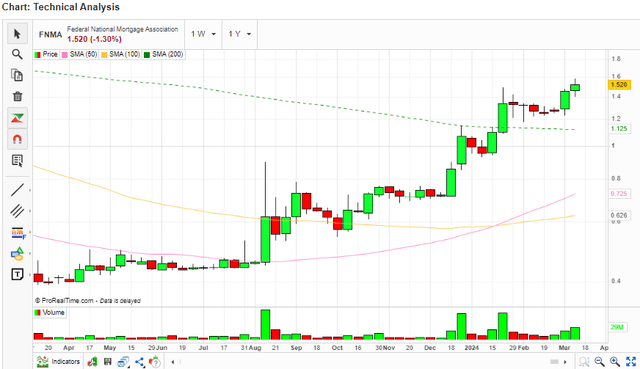

moving forward to Fundamentals, let’s study the price chart and see what’s in store for us investors. First, I will look at the support and resistance areas. According to the price chart, the stock bounced strongly off the main support around $0.4 after breaking the previous support at $1.49. At current prices, the stock appears to be on a strong upward trajectory, as shown by the momentum indicator in the chart below.

Seeking Alpha

Given this strong momentum, I don’t see a retest of support around $0.4. Therefore, I expect the stock to move strongly toward its resistance levels at $3.27 and $4.22, respectively, as shown below. These two support levels are my price targets for the stock.

trading ideas

To get clear direction, let’s delve deeper into other indicators. First, the stock is trading above the 50-day, 100-day, and 200-day moving averages, which indicates bullishness for the stock in the short, medium, and long term. To solidify the upward trajectory, there was a bullish crossover between the 50-day EMA and the 100-day EMA on January 2024, which means the uptrend is very strong.

market filter

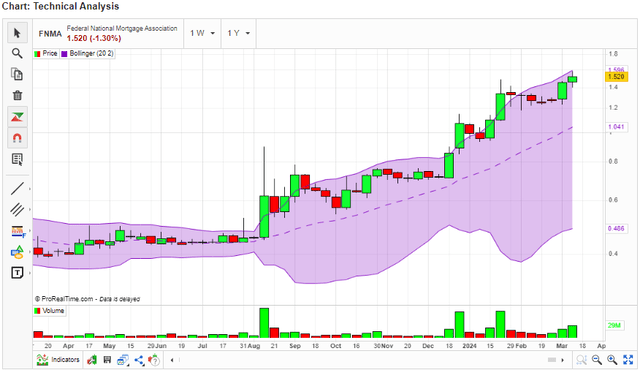

Additionally, looking at the Bollinger Bands, the price is above the midline and almost above the upper Bollinger Bands – indicating bullish momentum for the stock. It is worth noting that there is a significant divergence between the lower and upper Bollinger Bands, which shows how strong the bullish trend is.

market filter

In short, FNMA is currently in strong upward momentum with resistance zones at $3.27 and $4.22, which happen to be my price targets. Given this background, the purchase decision makes sense.

FNMA Business Model: A Unique Growth Catalyst

The company operates a unique business model as a U.S. Government Sponsored Enterprise (GSE). Its model involves expanding the secondary mortgage market by providing mortgage guarantees for mortgage-backed securities (MBS). This approach helps provide liquidity, stability and affordability to the U.S. housing and mortgage industry. I believe so because it buys mortgages from lenders, freeing up money for them to make more home loans. The system is designed to expand homeownership and make affordable housing more accessible.

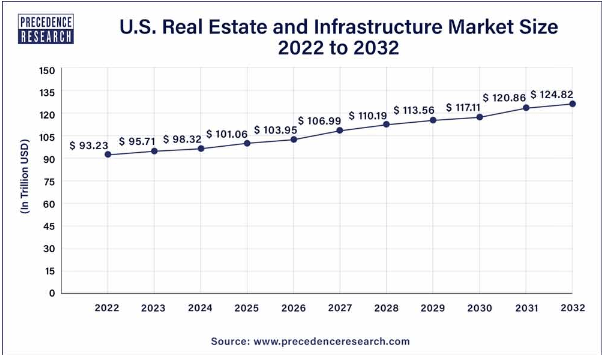

Given this pattern, I find this company to be well-positioned for future growth for several reasons. First, its role in the mortgage financing system allows it to benefit from the overall growth of the housing market.according to Prioritize researchThe U.S. real estate and infrastructure market is expected to grow at a CAGR of 3% between 2023 and 2032, which I believe will boost the company’s growth.

Prioritize research

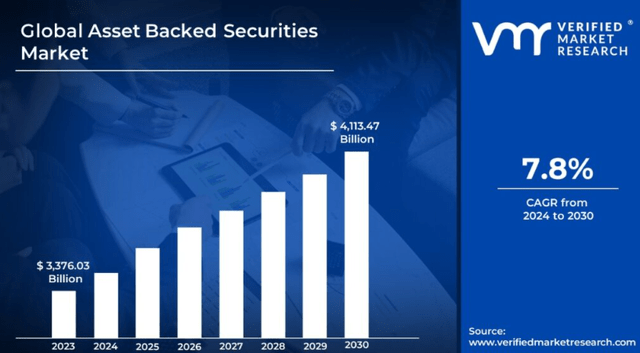

Given that global asset-backed securities are expected to grow at a CAGR of 7.8% between 2024 and 2030, I expect the company to capitalize on growth in the overall real estate market.

Proven market growth

Additionally, its model allows for innovation, which I believe will also be a catalyst for growth.For example, on March 1, 2023, the company introduced an updated Quality inspection requirements. The update calls for enhanced prefinancing and post-closing policies aimed at improving the integrity of the mortgage process and the stability of the housing market.

For example, the time frame of the post-delivery quality control cycle was shortened from 120 days to 90 days. Additionally, the company has tightened reporting requirements, stating that lenders must complete a minimum number of pre-financing reviews each month and that the total number of loans pending review should be 10% of the total number of closings last month, or 750 loans. With these innovations in place, it means any issues can be identified and resolved more quickly as quality control times are reduced – which will help maintain the overall health of the housing finance system. In addition, enhanced reporting requirements will ensure that a consistent and sufficient number of loans are reviewed, which will provide a more comprehensive overview of a lender’s portfolio, helping to promote high standards of loan quality.

Another aspect of its business model that I believe will translate into solid growth is its ability to manage economic cycles. The company’s business model is designed to ensure the smooth flow of credit regardless of economic conditions, and its mortgage purchases ensure stable growth in the real estate market.

Given this background, I believe the only way to support this business model is to reflect on its financial performance. With this in mind, FNMA’s trailing revenue was $31.9 billion, with an annual growth rate of 30.19%; net profit was $17.4 billion, with an annual growth rate of 34.71%. Given this solid financial performance, the company has attractive factor ratings for both growth and profitability – which I believe is a testament to the company’s business model.

Seeking Alpha

Most interestingly, its business model is protected by unique legislation such as the Federal National Mortgage Charter Act, which makes the company a key player in the secondary mortgage market. The bill ensures a certain degree of financial autonomy for the FNMA.

strategic initiatives

In addition to its unique business model, FNMA has also taken strategic steps that I think are very promising. The first move was to sell bad loans. March 12, 2024 The company announced Results of the 23rd NPL sale transaction. The sales announced on February 8, 2024 included the sale of 1,581 severely delinquent UPB loans totaling $235.8 million. The winning bidder was VWH Capital Management, LP.

This strategic move is a good decision because it has several benefits, including reducing portfolio risk. With the sale, the company reduced the size of its retained mortgage portfolio, thereby reducing the risk of loans with irregular payments. Another benefit is compliance with regulatory targets. This goal requires reducing the number of seriously delinquent loans and meeting the portfolio reduction targets set forth in the Federal Housing Finance Agency’s goals.

Another strategic move is to appoint Peter Akwaboa As Chief Operating Officer. I firmly believe that this is an excellent move given Peter’s experience and expertise. With nearly three decades of experience in the financial services industry, Peter brings a wealth of experience and expertise. To underscore his background, he has been focused on technology and operations, serving as chief operating officer of technology and head of innovation at Morgan Stanley. Additionally, his involvement in the Ghanaian government’s $3 billion bond sale during his tenure at Morgan Stanley proved his ability to capitalize on opportunities is undisputed. Most interestingly, his diverse background, which includes roles at Deutsche Bank, KPMG and IBM, as well as his philanthropic work, shows that he is a well-rounded leader who can bring a well-rounded perspective to the company leadership.

Overall, Peter’s experience coupled with his strategic and innovative thinking make him a promising leader capable of driving the company to greater heights.

risk

While I’m bullish on this stock, investors should be aware of its inherent risks. First, its unique model as a government-backed enterprise is subject to future government housing finance reforms, which will create a degree of uncertainty. In addition, due to the cyclical nature of the real estate market, FNMA is also subject to market shocks, which could impact its financial performance during a recession.

in conclusion

In conclusion, FNMA is currently on a solid upward trajectory and is supported by solid fundamentals. I am optimistic that the uptrend will continue until the stock hits resistance. For these reasons, I recommend this stock to potential investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.