Designer 491

Federal Real Estate Investment Trust (NYSE: FRT) It is the first choice for passive income investors who value FFO visibility and dividend growth, as well as the potential for long-term appreciation.

Federal Real Estate Investments is one of the oldest real estate investment companies in the United States U.S. investment trusts have delivered continued strong performance to shareholders in terms of FFO growth, regardless of underlying economic conditions.

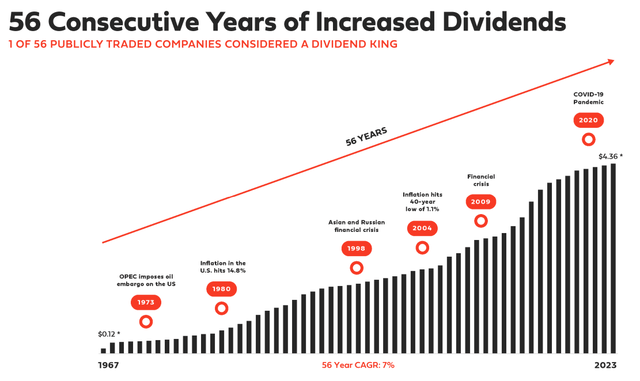

Federal Realty Investments has a proven track record of more than half a century, and the trust has been able to grow its dividend even during recessions. Federal Realty Investment’s stock currently yields 4.3%, and the stock trades at a reasonable FFO multiple.

My rating history

Federal real estate investing has been a core investment in my passive income portfolio for quite some time.The main purpose of holding federal real estate investments in my portfolio Security of trust dividends. Federal Real Estate Investments (FFO) has huge growth potential in the coming years, and its dividend should continue to rise.

Diversified mixed real estate portfolio across the United States

Federal Real Estate Investments is a well-managed REIT looking back on decades of portfolio and FFO growth.The trust was officially launched in 1962, seven years before Dividend Champions Real Estate Income Corporation (O) was founded in.

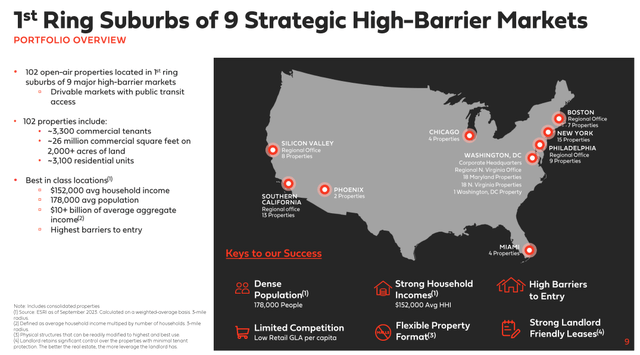

Federal Real Estate Investments focuses on a mixed real estate portfolio that includes commercial and residential units. The core of Federal Realty Trust’s real estate portfolio includes 102 shopping centers leased to more than 3,000 commercial tenants and approximately 3,100 residential units.

The Trust’s primary operational focus is on major metropolitan areas such as New York, Philadelphia, Miami and other urban centers that are subject to active immigration flows and higher household incomes. Strong income indicators associated with major metropolitan areas indicate above-average rental growth potential.

Portfolio Overview (Federal Real Estate Investments)

Federal Real Estate Investments stands out primarily because of its ability to grow FFO at a faster than average rate among its competitors, primarily due to its focus on fast-growing cities with above-average household incomes.

Cities such as Boston, Miami or New York offer only limited space for new commercial and residential development, which in turn benefits owners of commercial and residential businesses such as Federal Real Estate Investment Corporation.

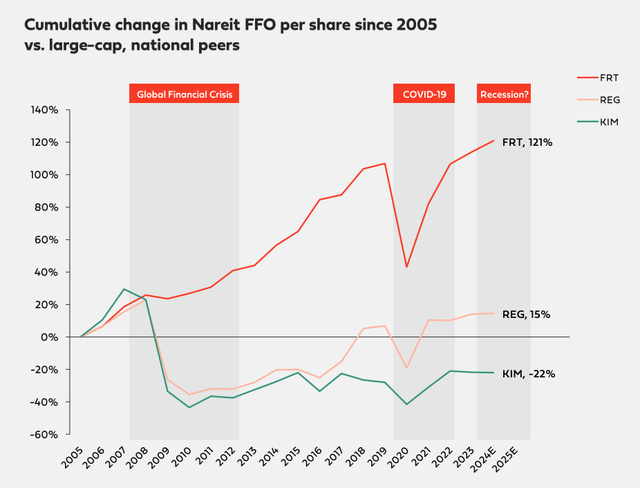

Federal Realty Investment has successfully grown FFO during major economic crises, such as the Great Recession in 2008 and the Covid-19 pandemic in 2020.

In terms of FFO growth, Federal Realty Investments has outperformed other mall-focused REITs such as Kimco Real Estate Inc. (KIM) I feel good about that too.

Working Capital (Federal Real Estate Investment)

FFO growth and good dividend payments

Commercial REITs are showing healthy underlying FFO growth in 2023 as the real estate market remains resilient and rental income continues to rise.

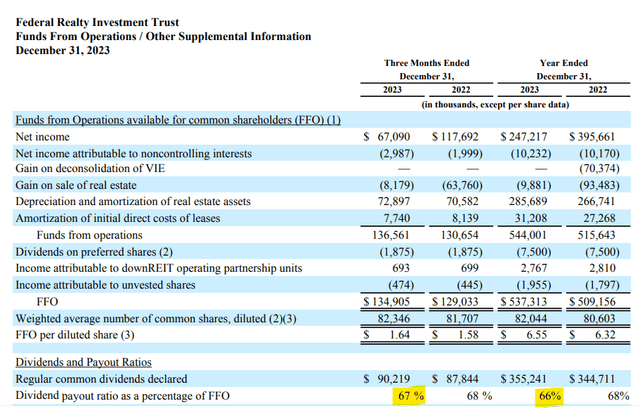

Federal Realty Investment generated $134.9 million in FFO from its real estate assets in Q4 2023, up 5% year over year. On a per-share basis, this represents an equally impressive 4% annual growth rate.

I think FRT is a particularly good investment for passive income investors, in addition to its FFO growth, because of its modest payout ratio, ensuring that the trust can continue to grow its dividend in 2024.

The FFO-based payout ratio was 67% in 4Q23 and 66% in 2023. Many income investors may use Real Estate Income as a reference point given its long history of dividend growth, with its payout ratio of 76%, so from that perspective I would actually say FRT is a good choice for passive income investors Provides a higher margin of safety for dividends than real estate income.

Payout Rate (Federal Real Estate Investment)

The true value of investing in federal real estate is the implicit potential for lasting dividend growth. The trust has been raising its dividend for more than half a century, and the low FFO-based dividend yield gives Federal Realty Investments considerable room to provide passive income investors with substantial dividend increases in the future. Clearly, these dividend increases are more valuable in an inflationary environment.

According to the latest inflation data, consumer prices Up 3.2% in February. In my opinion, dividend-paying stocks like FRT become more valuable in this environment, and the same should be true for investors holding some kind of fixed income.

Increase Dividends (Federal Real Estate Investments)

What are the potential issues with federal real estate investments?

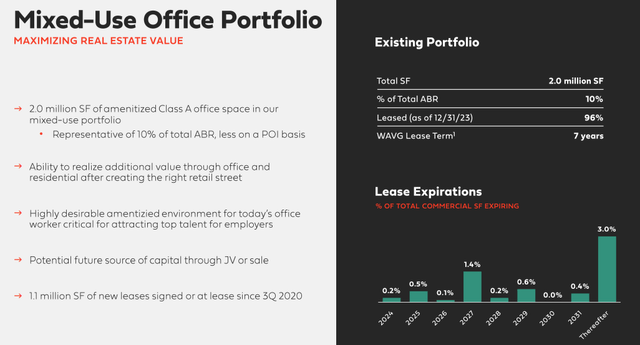

The commercial REIT has exposure to the U.S. office market, which is notoriously struggling due to a variety of factors including rent and vacancy pressure.

Approximately 10% of the trust’s annualized base rents are derived from Federal Realty Investments’ portfolio of mixed-use office buildings.The office market faces serious headwinds, leading to WP Carey Corporation (WPC)For example, there is a rush to divest its office properties in order to get them off its balance sheet. Therefore, a deterioration in occupancy rates (96% as at 30 September 2023) must be expected, which may impact the Trust’s overall real estate performance.

Mixed Use Office Portfolio (Federal Real Estate Investment)

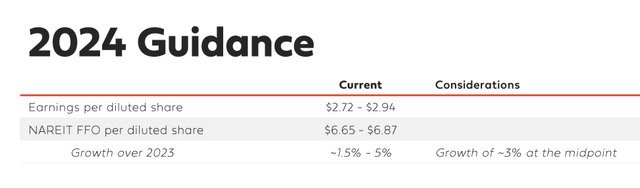

Guidance and FFO multiples

Federal Realty Investments’ guidance for 2024 implies lower year-over-year FFO growth: the trust expects 2024 FFO of $6.65-$6.87 per share, reflecting an FFO multiple of 15.0x based on a stock price of $101.

Realty Income has a similarly impressive, durable record of dividend growth and a retail-focused real estate portfolio currently selling for 12.6x FFO.

Kimco Realty is another mall REIT that sells for 12.5x FFO, but its dividend track record isn’t as clear and long-term as Federal Realty Trust. Kimco Realty’s LTM FFO payout ratio is 59%. Although federal real estate investments are more expensive, I think FRT is a solid long-term buy.

2024 Guide (Federal Real Estate Investment)

Office Exposures, Risks and Other Considerations

Federal real estate investing has proven to be a reliable passive income investment over the long term, but it does come with risks. A key area of risk is the office portfolio, which is relatively small compared to the Trust’s other commercial and residential real estate assets but still represents a risk as the office market weakens.

Therefore, weak office leasing activity and rising vacancy rates in 2024 could adversely affect the trust’s FFO and margin of safety.

my conclusion

Federal Realty Investment is a well-managed, mall-focused REIT that has delivered strong FFO growth over an extended period of time, including the fourth quarter of 2023.

As one of the oldest real estate investment trusts in the country, the trust has proven itself in many different economic environments, and Federal Real Estate Investments has been able to increase its dividend during this time.

In my opinion, Federal Real Estate Investments offers a strong dividend for passive income investors, with a current yield of 4.3%.

Although Federal Realty Investment’s FFO multiple is not cheap and is more expensive than Realty Income and Kimco Realty, I think FRT has a solid place in passive income investors’ portfolios.