big country

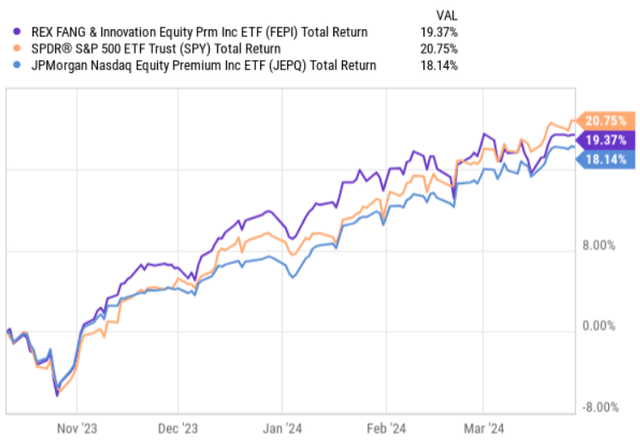

REX FANG vs. Innovation Equity Premium Income ETF (NASDAQ:NASDAQ: FEPI) is a relatively new covered call ETF, established in November 2023.

Since its inception, it has successfully kept pace with the well-performing S&P 500 Index, providing attractive Distribution income from written options.

Y chart

During this period, FEPI has even slightly outperformed the more popular JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ: JEPQ ), which shares some of the features associated with FEPI.

Although we can’t assess much from FEPI’s historical data given its recent inception date, we can still understand the underlying mechanics of FEPI and understand how ETFs fit into investor portfolios.

structure

At its core, FEPI is a traditional covered call ETF that tracks a selected range of stocks while selling Money demands income.

The expense ratio is 0.65%, which is more or less in line with what we find across the entire covered call ETF space. It’s neither cheap nor expensive.

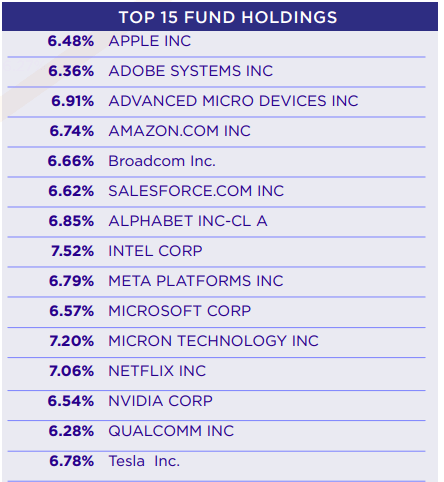

FEPI is more specific to the sample of stocks it tracks or holds as the underlying investment for put calls. Exposure here is heavily focused on leading technology companies, which make up a sizable share of the S&P 500 and Nasdaq 100 indexes.

FEPI fact sheet

As we can see in the chart above, the top 15 (consisting of large technology companies) explains FEPI’s entire holding base.

Furthermore, it is worth highlighting the distribution among these 15 names. Unlike most other covered call ETFs, such as JEPQ, or popular indexes such as the S&P 500 and Nasdaq 100, FEPI’s portfolio uses an equal-weighted underlying structure, thereby avoiding over-concentration in a few companies with strong market cap performance.

In the case of a covered call plan, it is no different than the traditional approach found in other similar ETF vehicles:

- The written call period is usually 30 days.

- FEPI is not sold on an in-the-money or at-the-money basis.

- Call strike prices are typically far removed from the underlying stock price (although management can maneuver by making tactical bets based on market conditions and overall opportunity).

paper

Now, once we establish the basics (i.e., how FEPI is structured and what the risk and return drivers are), I’ll detail two of FEPI’s unique advantages that can incentivize investors to go long in ETFs.

this First This is the enhanced yield potential, which comes from the relative concentration of positions in only 15 companies.

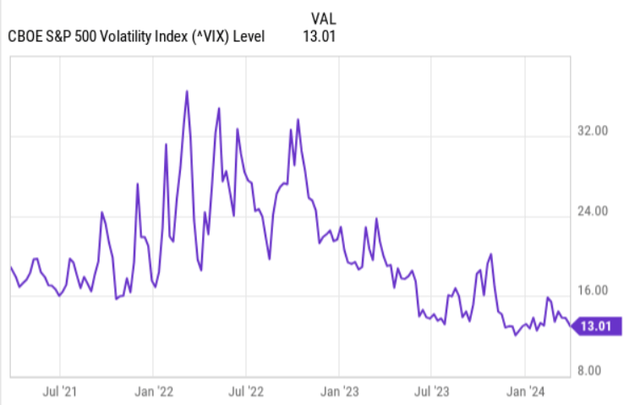

Covered call ETFs can distribute attractive income through option sales without stripping the underlying net asset value. The higher the option price, the higher the income paid to unitholders. One of the fundamental drivers of option prices is the level of implied volatility. That is, the more volatile the stock on which the call is sold is, the higher the premium the ETF can earn.

Currently, overall volatility levels are low, making covered call strategies less attractive overall.

Y chart

However, if we look at FEPI’s distribution yield, it’s still in double-digit territory at around 10.6%.

Therefore, in the case of FEPI, there are two specific drivers that provide direct support for yield generation:

- FEPI does not sell calls on broad indexes, which by definition are less volatile than individual stocks or indexes consisting of a small sample of stocks. As a result, implied volatility levels are typically higher than usual/covered call ETFs because there are fewer positions to sell calls on.

- The stocks tracked by FEPI are themselves quite volatile, and given that tech stocks also have strong correlations, this again supports capturing higher volatility.

For example, if we compare JEPQ to FEPI, we note that the latter is able to provide a positive yield spread of approximately 170 basis points.

Having said that, there are some additional risks associated with holding more concentrated exposure. While yields may be higher, the sensitivity of FEPI holdings (or even single companies) to significant price adjustments may result in a corresponding reduction in the ETF.

this the second related to deflection Gorgeous 7 Those are the companies that really drive the stock market over a significant period of time.As we all know, if Gorgeous 7the entire stock market will be in a completely different zone (i.e., nowhere near its all-time highs).

What it comes down to here is investors’ subjective view of whether these individual stocks can sustain the assumed momentum that drives the stock market to incremental highs. If this is the case, and more importantly, if the benefits occur in a sustained, incremental manner, FEPI will be the clear beneficiary.

Conversely, if small-cap factors suddenly come back into play while large-cap stocks stall or decline due to multiple stretching, FEPI will be affected accordingly. Granted, there is some built-in protection in the form of a redemption premium, but in the case of really large withdrawals, this won’t make any difference.

bottom line

In my opinion, FEPI presents an interesting opportunity for investors to isolate themselves from booming technology investments while capturing a large portion of the proceeds in the form of attractive current income. At the same time, by going long FEPI, investors can obtain a certain degree of downside protection due to the inherent covered call option plan, in which the premium in income can partially compensate for losses caused by depreciation in the price of the underlying portfolio.

That being said, there are some obvious risks. Most notable, in my opinion, is the opportunity cost of not fully participating in the ongoing earnings of the Magnificent 7 name. Although there is a certain distance between the underlying price and the option execution price, it is of little significance because FEPI must focus on yield generation.

A booming FEPI scenario must be associated with a gradual rise in large-cap and tech-related companies because in this scenario, no significant opportunity cost is incurred and investors can safely earn above-average gains due to higher volatility rate of return.

For me, FEPI is a holdover.