Christmas treasure

Investment Summary

My recommendation for Ferguson (NYSE: FERG) is a Buy rating because I am optimistic about both near-term and long-term growth prospects.In the short term, there are some leading indicators pointing to a recovery in growth, and in terms of longer-term drivers, large economies Projects, the backlog remains healthy. Notably, FERG’s ongoing investments should also support margin expansion and growth.

Business overview

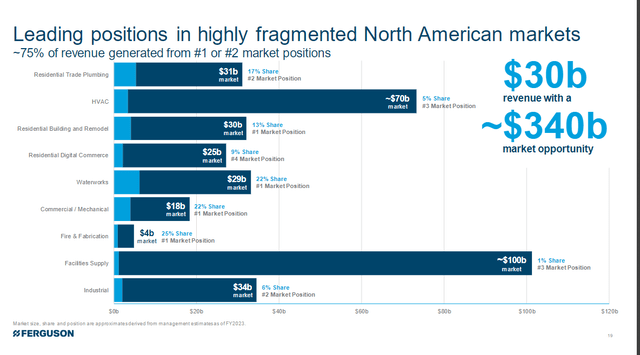

FERG is a leading specialty distributor of HVAC and industrial supplies, serving the North American market (100% of revenue) with a broad range of products in heating and ventilation, residential construction and more. The business is working capital intensive because FERG must have many loose parts in inventory to meet demand. On average, FERG turns over inventory in approximately 70 days. A key part of FERG’s growth strategy is M&A, and it has executed 24 acquisitions since 2015, averaging about three acquisitions per year. FERG reports second quarter 2024 financials As of March 5, 2024, the business had revenue of $6.673 billion and adjusted EBIT of $520 million (margin 7.8%). From a growth perspective, organic growth fell by 3.7% in the second quarter of 2024, with declines of 3.7% and 3.3% in the United States and Canada respectively. Overall U.S. growth was 2.2%, with nonresidential down 1%, which was a 300 basis point decline compared with the 2% growth rate in the first quarter of 2024, but compared with U.S. residential, which was down 400 basis points, it was a steeper decline. good performance.

Feig

Organic growth should start to look better

Organic growth will be slow in the first half of 2024, but I think FERG will start to see growth in the coming months due to strong bidding activity and the recovery of water plants. While RMI currently expects to remain weak through the third quarter of 2024, management noted encouraging signs for new homes, with builders taking a more aggressive approach when bidding for subdivisions. These are leading indicators of a return to demand, and the catalyst for a stronger recovery would be for the Federal Reserve to actually cut interest rates, thereby eliminating market doubts that the Fed might not cut interest rates at all (given the strength of the U.S. economy). As interest rates come down in real terms, market participants, including builders and others, will become more confident in taking on more projects as they expect lower capital costs in the future. Additionally, pricing trends favor FERG. While they expect 2H24 finished goods pricing to be in the low single digits, I think there is upside potential as FERG sees good pricing for HVAC and water heaters, and resin prices have moved higher.

Tender activity is active across our broad and diverse business portfolio, including residential, commercial, public works, municipal, instrumentation and metering technology, wastewater treatment plants, soil stabilization and urban green infrastructure.

We’re seeing resin prices increase within the market, and then from a steel pipe perspective, we’re seeing some stability. So we are more confident about it.CEO Kevin Murphy’s second quarter 2024 earnings report

Tailwinds support long-term growth

I think the more important aspect for the FERG business and stock is that the underlying long-term outlook remains very attractive without any major changes. Management noted strong bidding activity for large and large capital projects, particularly in data centers, onshore, electric vehicles (EV), wafer/battery plants and mining, which is good for FERG’s growth in the long term Omen. I believe that FERG is best positioned to capture these growth opportunities because of its size. My point is that project owners would rather work with a single vendor than with multiple vendors offering individual solutions, especially given the complexity of these projects. In this case, FERG fits the bill because it offers a fully bundled solution that no one else can. The best part is that FERG continues to grow in size due to more deals, which increases bids for future projects – this is known as the flywheel effect.

But if I look behind the scenes at what’s being built in the industrial environment, I see a significant backlog, especially in the area of major capital projects. We have discussed the trend of large projects.CEO Kevin Murphy

If you think about artificial intelligence and what the impact of data centers is, these are very good projects for us across multiple customer segments, and the way we’re seeing it evolve is the same as the way we’re seeing it evolve with larger projects very similar. This is a collaboration across client segments with owners, general contractors to ensure Ferguson is a valuable partner to contractors and owners alike. So we’re optimistic about what’s going to happen in the second half and that comes into play starting today.CEO Kevin Murphy, second quarter 2024 financial results

Investments are improving FERG’s competitive advantage

Finally, I’d like to mention that management is hitting the investment accelerator, which leads me to believe they can achieve their goal of outperforming the market by 300-400 basis points. Investment in Market Distribution Centers (MDCs) is a typical example, as warehouse labor productivity increases and transportation costs are reduced due to the automation of MDCs. Faster growth (i.e. more products to meet a wider range of needs) and better profits (i.e. better inventory management) are the financial implications for FERG. Compared with FERG’s smaller competitors, these competitors lack the resources to make similar investments that should increase market share and strengthen FERG’s moat.

FERG has also been expanding its HVAC capabilities to cover a wider region. This measure should yield positive results, especially as the HVAC industry is experiencing rapid expansion due to structural drivers such as new energy sources. heat pump regulations. Specifically, these investments should strengthen FERG’s competitive profile, allowing it to better bid for contracts in areas where it previously lacked presence, thereby solidifying its market position as the third-largest player in the industry. Size matters because like I mentioned before, I think larger contractors like to work with larger dealers because it’s easier for them to do business and they can take advantage of rebate programs.

Valuation

Red Fox Capital Concept

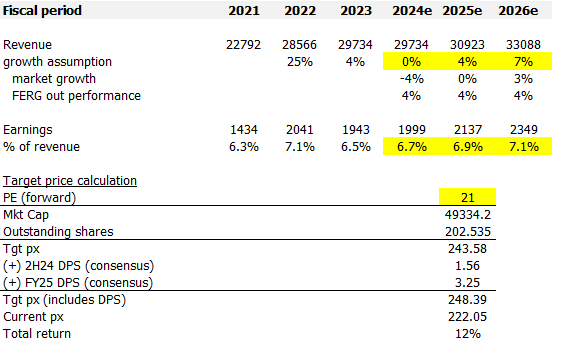

I model FERG using a forward PE approach and based on my assumptions, I believe FERG is worth $254.90. For revenue, my growth assumptions are based on my belief that FERG can grow 400 basis points above the market (as management guided during the call) and my belief that market growth will return to 400 basis points above the market in fiscal 2026 GDP level expectations. Using this growth bridge, I expect FERG growth to be flat in FY24 (management guided for flat growth in FY24, which implies market growth of about -4%), 4% in FY25, and 7% in FY26 %. FERG should expand its net income as its higher revenue base more than covers fixed costs, coupled with its continued investments (such as MDC) to drive margin expansion. I think these drivers will push FERG’s net margin to at least 7.1% in fiscal 2022. Investing today also means investors are entitled to 2H24 and FY25 DPS, totaling approximately $4.81 (approximately 2% yield). I also assume that FERG will continue to trade at a forward P/E of 21 times as I expect growth to accelerate going forward. Assuming no share buybacks, I see overall upside potential of 12%. However, I must point out that FERG has been buying back shares at a rate of 3% per year since FY20. If we include 3% buybacks, there is still 15% upside potential.

We expect to outperform these markets by approximately 300 basis points to 400 basis points. We have a tailwind from completed acquisitions that we expect will generate just over $600 million in revenue, with the benefit of an additional sales day in the third quarter.CEO Kevin Murphy, second quarter 2024 financial results

risk

FERG’s growth may fluctuate due to the timing of booking projects and converting those bookings into revenue, particularly large projects. This could cause overall volatility to be higher than expected and unnerve investors. This could lead to several consecutive quarters of weak growth for FERG, leading investors to believe that FERG faces growth headwinds. Additionally, FERG’s growth is tied in part to the health of the U.S. real estate economy. If overall housing (new and existing) demand falls sharply due to a severe recession, FERG will see growth slow further, impacting growth.

in conclusion

My opinion on FERG is a Buy rating. While organic growth is slow, positive signs are emerging and I believe FERG is well-positioned to capitalize on strong tendering activity and a healthy backlog of large projects. Continued reinvestment in operations such as MDC should improve efficiencies and profits, further strengthening FERG’s competitive advantage. In terms of upside, I think the potential upside is 12-15%.