Christmas treasure

introduce

Ferguson Corporation (NYSE: FERG) is a value-added reseller covering HVAC, plumbing and appliances, helping customers replace and maintain equipment.In this article, I will discuss the company’s Q2 2024 results, my outlook for the company, and analyze the current valuation and risk, to see if the current share price provides investors with an attractive entry point.

Company Profile

Ferguson is a dealer HVAC and plumbing products in the United States and Canada.just below $30 billion Today, the company’s annual revenue has grown to 35,000 employees. About half of its business is residential and the other half is non-residential (commercial and industrial). The customer base of over 1 million customers is very diverse, with no single customer accounting for more than 1% of the company’s sales.

background

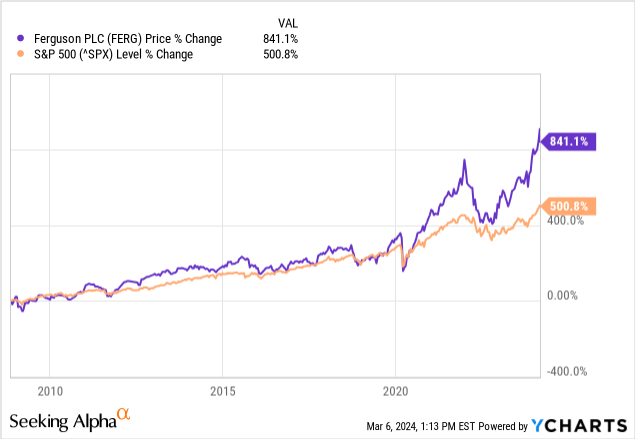

Compare Ferguson’s value for money with In other markets, the company has significantly outperformed the broader market. Since the 2009 financial crisis, Ferguson’s stock price has returned 841%, compared with the S&P 500’s return of just 501%. With an average annualized return of 17.4% per year, investors who have held the stock for a long time have done quite well.

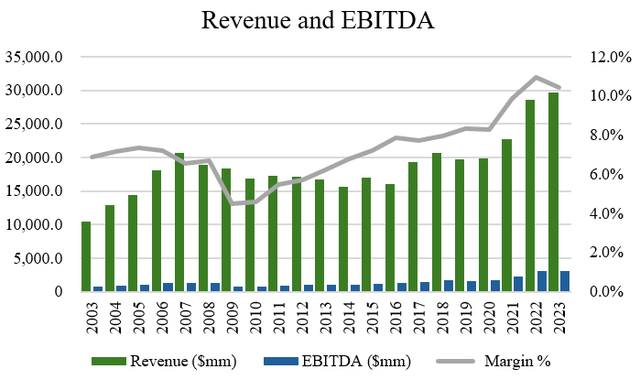

This outstanding performance can also be reflected through the company’s financial data. Over the past 20 years, Ferguson has achieved impressive compound annual growth rates in both sales and profitability, with revenue CAGR of 5.4% and earnings before interest, taxes, depreciation, and amortization (EBITDA) CAGR of 5.4%. The rate is 7.6%. Over the past decade, revenue and EBITDA have grown at a CAGR of 5.9% and 11.5%, respectively, indicating that the company’s returns are still growing at an above-average rate (Source: S&P Capital IQ).

Author, based on data from S&P Capital IQ

recent results

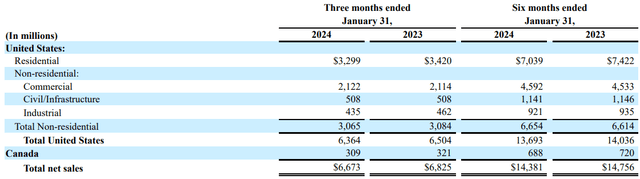

In its most recent results for the second quarter of 2024, Ferguson reported both revenue and earnings per share below expectations. Revenue for the quarter was $6.67 billion, down 2.2% year-on-year, $90 million lower than market expectations, and earnings per share were $1.74, compared with market expectations of $1.84.

Overall, it was a pretty weak quarter for Ferguson, with shares falling more than $10 on the news. When analyzing the reasons for the drop in sales, customer demand dropped significantly, and prices dropped by about 2%. Excluding additional revenue from acquisitions, which accounted for 1.5%, organic revenue fell 3.7%, with residential sales weaker than non-residential sales. Residential sales fell 3.5%, non-residential sales fell 0.6%

Company filing

Ferguson has traditionally been an acquisitive company, making small acquisitions to add value by expanding margins or entering new geographies. The company has completed more than 50 acquisitions in the past five years.

Completed three new acquisitions this quarter declare This will increase the company’s annual revenue by approximately $220 million. While the purchase price for each acquisition is unclear, Ferguson has more than $500 million in acquisitions deployed for 2024, and management expects acquisition-related revenue contributions to be approximately $600 million for the full year.

In terms of profit margins, Ferguson is still able to maintain good profit margins. Gross profit margin this quarter was 30.4%, compared with 30.2% in the same period last year, but the company’s operating profit margin dropped from 8.0% in the same period last year to 7.1% in this quarter. The reason for the increase in gross profit margin is the company’s pricing strategy, but higher SG&A costs have lowered the company’s operating profit. This also means that earnings per share also fell 9.7% from the same period last year to $4.40.

Although earnings per share fell, that didn’t stop Ferguson from distributing excess cash to shareholders. Historically, Ferguson has returned cash through a combination of dividends and stock buybacks. So far in FY24, the company has conducted $250 million in stock repurchases and paid another $0.79 in quarterly dividends (a 5% increase from last year). Overall, the return of remaining cash through stock buybacks and dividends underscores the stability of Ferguson’s business and management’s confidence in the company’s long-term future.

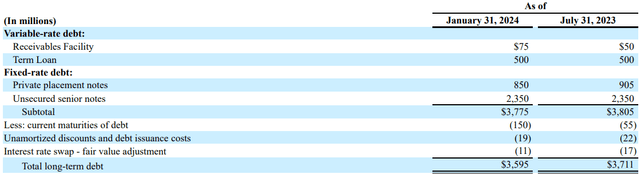

Finally, in terms of the balance sheet, Ferguson had $704 million in cash and $3.6 billion in long-term debt on its balance sheet at quarter end. Net debt is $2.9 billion, which gives the company a net debt-to-EBITDA ratio of 1.1x, indicating it has ample cash flow to pay down debt. The majority of its debt (85%) is fixed-rate debt, with longer maturities and lower interest rates, so the company’s refinancing risk is relatively low. Historically, Ferguson has been fairly low-leveraged and has done a good job of maintaining a healthy balance sheet.

Company filing

Appearance

As for my outlook for Ferguson, I don’t expect significant growth for the remainder of the year, with results missing and below expectations, and management is not lowering guidance, and it’s unclear if this is because they expect a meaningful pickup in results. . Second half or if they are too conservative.

What we’ve seen so far is weak demand for Ferguson products across the board.Looking at the end markets it serves and industry drivers, we can see single-family homes start It’s likely to be about a 5% annual decrease, which would be a net negative for Ferguson. Additionally, the market for repair and renovation activities, including demand for things like HVAC, has been under pressure.

The Leading Indicator of Renovation Activity is an indicator published by the Joint Center for Housing Studies at Harvard University. predict The downturn the U.S. economy experienced in early 2024 should bottom out later this year. That doesn’t make me too excited about the rest of 2024 for the company.

That said, the company has a good balance sheet, and if valuations are attractive and Ferguson can find the right targets, there may be some opportunity to be more aggressive on the M&A front. Longer term, when the market returns to a more normalized cycle, revenue should rebound closer to the 5-7% range, funded partly by organic growth and partly by acquisitions, in line with the company’s long-term revenue CAGR .By 2028, the U.S. market size will be expected With a compound annual growth rate of 6.3% to $280.1 billion, industry tailwinds are certainly in Ferguson’s favor.

Valuation

According to the 14 sell-side analysts covering Ferguson stock, 10 have a “buy” rating, 3 have a “hold” rating, and 1 has a “sell” rating. The average price target is $233.76, with the highest forecast being $261.89 and the lowest expected. Expected to be $261.89. $183.07 (Source: TD Securities). From current prices to the average price target one year from now, this implies a potential upside of 16.3%, excluding the 1.6% dividend yield. With total return potential of 17.9% next year, analysts seem quite bullish on the company’s near-term prospects.

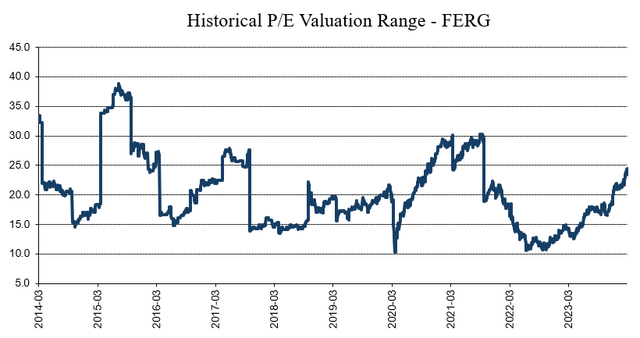

Analyzing the historical valuation range, Ferguson appears to be at the upper end of its historical P/E range. At 23.4 times P/E, the company’s P/E ratio is higher than the ten-year average of 20.4 times, indicating that it may be overvalued.

Author, based on data from S&P Capital IQ

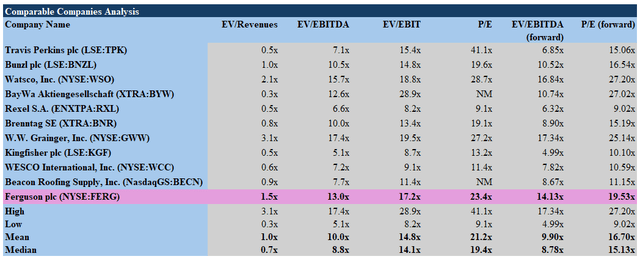

When looking at comparable companies with similar growth profiles, leverage, and operating in similar or adjacent industries, Ferguson trades at 14.1x forward EBITDA and 19.5x forward earnings, which is slightly higher than its peers. While one might argue that Ferguson is a higher-quality business model, has a higher return on equity (over 30% over the past decade) and has a track record of consistent returns, the company’s stock is not a good deal for investors. Cheap. HVAC dealers are likely to grow by mid-single digits.

Author, based on data from S&P Capital IQ

Therefore, I would say that the stock is quite expensive today and does not represent a good value. At near the midpoint of its historical valuation range of 20.4x P/E or the category median P/E of 19.4x, Ferguson’s stock likely represents a better value. This would imply a share price between $165 and $175, which in my opinion is a more attractive entry point and provides a better margin of safety.

As for the risks to my investment thesis, the main risk is weak market demand that continues into 2025. Looking at consensus estimates, the company’s sales and EBITDA are forecast to rebound modestly (up 5% and 8% respectively), so longer-than-expected market weakness will weigh on the company’s stock price. Second is the company’s acquisition strategy. While Ferguson has proven itself to be a disciplined allocator of capital, maintaining a conservative balance sheet, there is a risk that as the company grows in size, smaller acquisitions will no longer be effective in growing the business. There is another risk to consider. If valuations rise again, Ferguson may not be able to find a way to allocate capital with a high rate of return, resulting in multiple compressions of the company’s stock price.

in conclusion

Ferguson has a long history of excellence and is of the highest quality in HVAC. There are clear advantages to being a trusted brand, having economies of scale, and allocating capital efficiently through accretive acquisitions. However, judging from its recent quarterly results, the company is facing challenges such as weak demand and declining operating margins. While I expect a recovery in 2025 and the current weakness may be temporary, the company’s valuation appears elevated compared to historical averages, raising concerns about potential overvaluation. While analyst sentiment is bullish, I don’t think the stock offers an attractive entry point at current price levels given the large gap between its forward P/E and its peers’ forward P/E. difference. Therefore, with a price target of $165 to $175 per share, I will wait for a pullback before initiating a position in the company today. For these reasons, I rate the stock a Hold.