CuorerouC/iStock Editorial via Getty Images

Since early March 2022, our team has been working closely with Ferrari (NYSE:NYSE: RACE).There is a book called Ferrari competes again, we recorded triple-digit share price appreciation (Figure 1). In 2024, we Still looking forward to one Outstanding, but we believe the company’s valuation is unattractive. While we like Ferrari’s quality and long-term growth prospects, we downgrade our recommendation to Neutral from Buy. However, we raised our target price to €380 from €350 to reflect improved long-term profit expectations and lower expenses. We see the stock market focusing on quality companies; however, the stock is up 30% since our last update (early January 2024) and the stock is currently trading at nearly 12 times its 2024 guidance, The P/E ratio exceeds 50 times.

Mare rating evolution

picture. 1

Ferrari numbers in perspective

here at Lab, we love car companies and have luxury cars in our coverage.We pay close attention Porsche AG, Aston Martinand Lamborghini, Volkswagen control. Therefore, before providing our updates and helping our readers, it is important to report our following key points:

To repay Ferrari’s current market value of 73 billion euros, Ferrari should sell more than 800,000 vehicles based on a record average selling price of 397,000 euros per car and a net profit margin of 21%.At current production rates, it would take more than 60 years to complete.

Another consideration that helps investors put a company’s scarcity into perspective is:

Dr. Inge. hc F. Porsche AG (or P911) (OTCPK:DRPRF) (OTCPK:DRPRY) has accomplished in one year what Ferrari has accomplished in its entire history. This Italian company was founded in 1939;

Ferrari delivered approximately 13,663 units, equivalent to 10 Toyota production hours.

Our negative view

Our previous analysis projected sales and EBITDA margins of 6.55 billion euros and 29.0% respectively in 2024. This was supported by higher pricing (2%) and better product mix evolution (+6.5%). On the positive side, we take into account the higher personalization of the car, but we also take into account the lower average selling price of the upcoming Roma Spider (the starting price of the new car is 249,650 euros, while the recorded average selling price per car Approximately €397,000) Q4 2023).

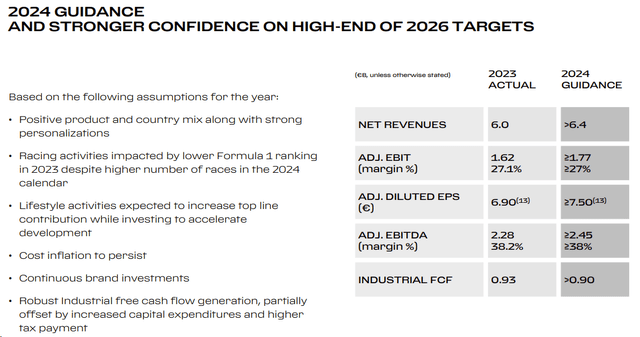

In the laboratory, we expect the usual Paida raise dynamics For Ferrari, as a result, we are above the company’s 2024 EPS estimates. Therefore, we stick to our previous figures and confirm our 2024 EPS forecast of €8.4. We should also report that Ferrari’s initial 2024 guidance pointed to revenue and EPS growth of between 8% and 10% (Figure 3). In fact, Ferrari plans to grow; however, this is slower than the historical average. Looking back on the past year, revenue and earnings per share grew by 17% and 36% respectively. As a result, sell-side analysts may decide to lower their price targets for the company.

There are four more negative news worth digesting:

- ferrari will face Class action lawsuits in the United States. The company has been accused of failing to fix brake defects on some models, including the Ferrari 458 Italia. Class action lawsuit uncovers brake fluid leak, company may face new complaints despite recalling cars;

- We believe Ferrari will slow down the pace of buybacks. With a P/E ratio well over 50x, we’re convinced Ferrari has better ways to deploy its capital. This could put pressure on the company’s share price;

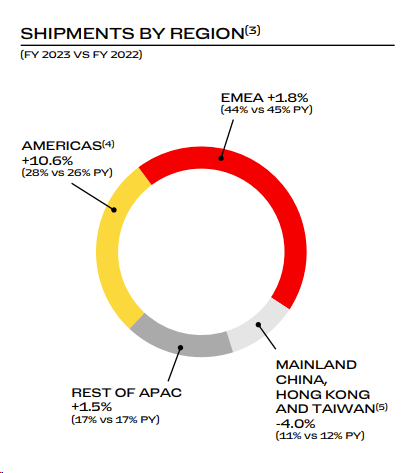

- The company has not been immune to declining sales in China. Specifically, sales in China declined in the fourth quarter of 2023 (Figure 2);

- From a business perspective, pure electric technology requires more certainty. In the long term, at the lab, our team sees Ferrari as one of the few remaining automakers capable of producing an internal combustion engine car. However, this comes with the risk that we cannot predict a sales growth story just for car collectors.

Ferrari sales drop in Asia Pacific

source: Ferrari Q4 results announced – figure 2

Ferrari 2024 Guide

image 3

Valuation

In the lab, it’s time to question Ferrari’s valuation. The company has a more complex business than Hermès, which should mean a discount on the stock market. The current price-to-earnings ratios of both companies exceed 50 times, which is close to historical highs and much higher than the price-to-earnings ratios of other luxury goods companies. However, if we imply slower EPS growth (15% vs. 20%), Ferrari’s P/E target should be around 35/40x. Today, with Ferrari trading at the same price as Hermès, we’ll stop saying the cliché: “Ferraris have always been expensive and always will be“In 2025, our EBITDA margin will be 39.5%, while Hermès will reach Record annual EBITDA margin 47%. Therefore, we think a 10% discount is reasonable. The French luxury goods giant trades at a P/E ratio of 50x and continuing to apply a 10% discount brings us to a target price of €380 per share (ADR $405). Ferrari’s fundamentals are similar to those of car companies, such as declining sales in China and problems with auto parts (the North American class action lawsuit is just one example). Therefore, we adjust the ratings to equal weighting after two years.

risk

At Labs, we consider different risks, such as lower Ferrari sales growth, rapid changes in consumer tastes and technology, the failure of Formula 1, and what we believe to be lower valuation approaches from sell-side analysts. Ferrari is a car company that is subject to common business risks such as currency evolution, pricing pressure on raw materials, defective car parts and rising wages. The company is also subject to high corporate taxes.Ferrari is continuing with new lifestyle campaigns such as fashion industry. From now on, the company will launch men’s and women’s fashion collections every year. This is a new business and may not be able to meet expectations and necessary product development.

in conclusion

Ferrari has a stable order book, with the company’s production covering until 2025. Investors and sell-side analysts are positive about Ferrari’s order backlog; however, the company’s earnings per share could be slower than consensus estimates. Likewise, Ferrari’s exclusivity was also perceived due to the limited production of the car.Last time we were the first to believe there was Luxury brands still have room for growthBut today, given the higher valuation, we decided to downgrade Ferrari to Neutral.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.