loyalty

This is a brief F&G Annuity and Life (NYSE:FG) will be updated based on the results of Season 4. The stock fell 10% after the news was announced. What scares investors? Is this decline deserved?

My previous article “F&G Annuities vs. Life: Stocks Have Rapidly Doubled, and The upside is not very attractive” Still works, just needs a few updates. However, I must reproduce a very brief description of the company for readers unfamiliar with the company.

A brief summary of previous episodes

You can find a description and investment thesis of the company in my previous post. Here I will briefly summarize the key points:

- F&G is almost exclusively a fixed (including fixed index) annuity provider. Only one life insurance product in F&G’s portfolio contributed only single digits (percentage) to assets under management (AUM).Its investments are managed by Blackstone (BX), which makes F&G similar to Apollo (apolipoprotein) Athena.

- Fidelity National Financial (FNF) acquired F&G on June 1, 2020. In December 2022, it will spin off 15% of its F&G shares to FNF shareholders. Beginning on June 1, 2025 (after 5 years of ownership), FNF can spin off the remainder of F&G to shareholders tax-free.

- Following Brookfield Company’s (BN) acquisition of American Equity Life (AEL), which is expected to close in the near future, F&G remains the only independent fixed annuity provider in the United States.

- Over the past decade or so, independent annuity providers have been targeted by alternative asset managers and/or large life insurance companies. In two recent transactions (Brookfield’s AEL and KKR’s (KKR) Global Atlantic balance), the acquirer paid the insurer’s book value excluding AOCI.

F&G positioning

I read somewhere once that every stock has its own duration, just like bonds. That might be a bit of an exaggeration, but it seems to describe F&G pretty well. It is likely that shortly after June 1, 2025, FNF will completely spin off F&G, which will not remain independent for long thereafter.

Standalone F&G is dwarfed by other players in the industry: Apollo’s Athene, BN’s Brookfield Reinsurance (BNRE), KKR’s Global Atlantic, MetLife (MET), Prudential (PRU) and others. Big players have several material advantages:

- Excellent financial strength rating.

- The balance sheet is stronger and the cost of debt is lower.

- Greater marketing clout.

- Reduce overhead.

While these projects make stand-alone F&G operations more challenging, they also incentivize potential acquirers who can reap synergies almost immediately.

The most logical acquirer is a life insurance company backed by Blackstone as a minority shareholder. F&G is one of only four precious insurance customers of Blackstone. Blackstone is interested in retaining its management fees and knows F&G well; CEO Chris Blunt once worked at Blackstone.

No matter who becomes the acquirer, I think the acquisition price is likely to be the book value of F&G minus AOCI at the time of acquisition. On December 30, 2023, the book value was $40.42, while the stock price is currently around $40. So, give or take, shareholders can rely on an IRR that’s not that different from the company’s ROE. Recently, adjusted ROE has stabilized at around 10%.

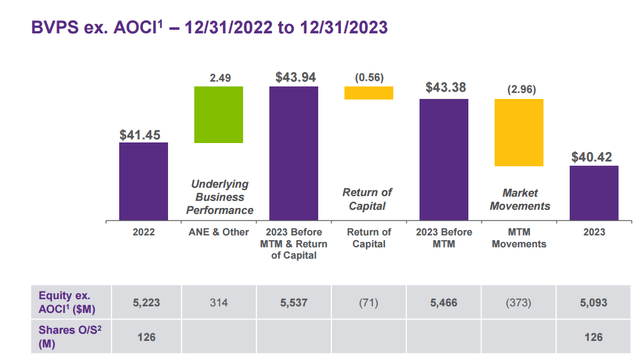

The slideshow below highlights that the small decline in BVPS in 2023 is primarily due to vagaries and ad hoc mark-to-market (MTM) accounting. Ignoring it, BVPS ex-AOCI is $43.38. :

F&G

If we accept this version, shareholders could potentially receive annual returns in excess of ROE prior to potential acquisitions.

Fourth quarter results

The quarter was slightly below average, but that’s not surprising. F&G’s rapid expansion has had two negative consequences: increased corporate development costs and accounting noise.

Ultimately, F&G’s success depends on two factors: AUM and the net interest margin the company can squeeze out of AUM. The “net interest spread” here refers to the investment spread minus operating expenses.

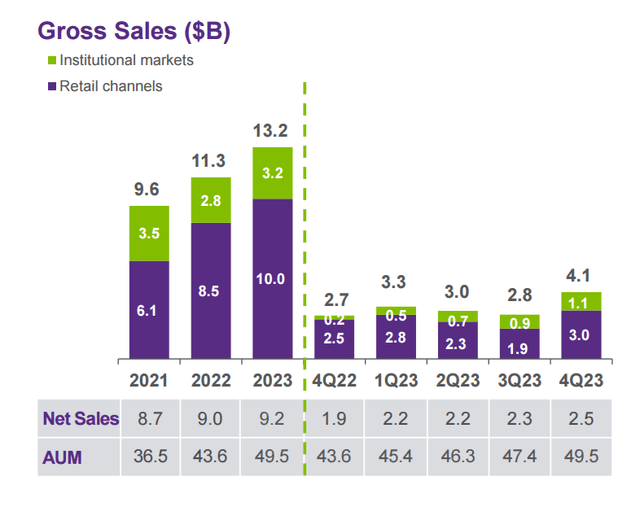

F&G’s AUM growth was pretty good in the fourth quarter, but the net interest margin could have been higher. The progress of AUM is shown in the slideshow below:

F&G

The decline in net sales and AUM does not include assets transferred to reinsurers, thus underestimating F&G’s sales and marketing strength.

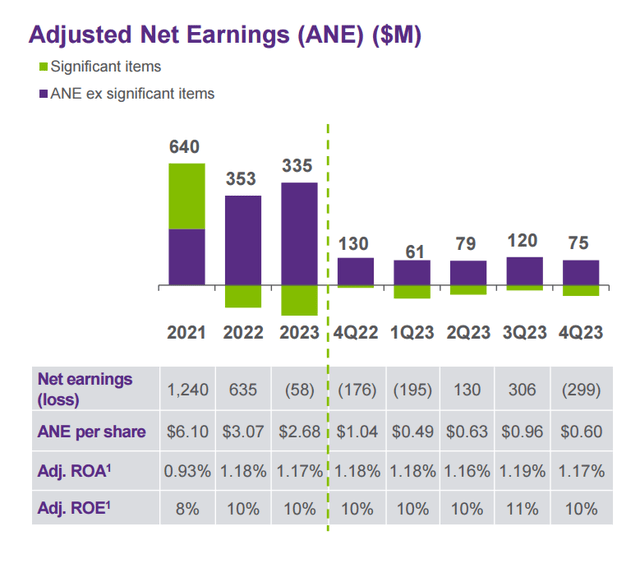

Another slide in the F&G briefing is devoted to net spreads:

F&G

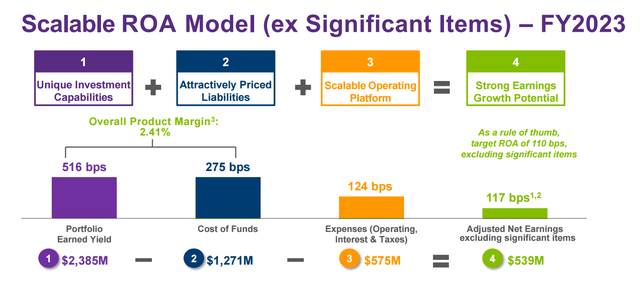

Adjustment. ROA on the slide is equal to normalized net interest margin. Another slide illustrates this point further:

F&G

Adjusted net earnings (ANE) exclude the significant items in the lower right corner of the slide above and are adjusted twice. First, GAAP net income is adjusted for MTM, such as realized and unrealized gains and losses, changes in various derivatives types, and market-related liabilities. The result of these adjustments is called ANE.

The next step is to further adjust the ANE for important items consisting of two main categories:

- The normalization of alternative assets such as private equity and real estate funds. Alts represent approximately 6% of F&G’s assets, and the company expects them to deliver a normalized annual return of 10% (the historical average return is approximately 13%). In each particular year, the returns on the alternatives are either 10% higher or lower, and the adjustment accounts for this difference.

- Everything else includes actuarial adjustments, discrete taxes, and several other smaller items.

One might view multiple adjustments with a certain amount of skepticism, but without them it’s difficult to understand what’s going on within life insurance companies. Incredible accounting is one of the fundamental disadvantages of investing in life insurance companies. F&G’s ANE excluding significant items is more or less similar to Athene’s SRE, but with two negative differences:

- Athene produces less accounting noise and the various tweaks are less noticeable. Athena’s size and maturity may explain this difference.

- Athene’s net interest margin is 1.44% normalized (that is, excluding significant items in F&G lingo), or 1.49% pre-normalized in 2023. Once you recall that the asset-to-equity ratio is above 10, that’s much better than F&G’s 1.17%. :1.

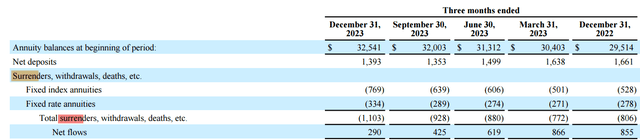

Taking into account all the adjustments, one might ask why the stock fell 10% post-quarter, which isn’t particularly bad. In my opinion, the answer is twofold. The stock trades above its fair value due to enthusiasm generated by F&G’s rapid growth in previous quarters. Even mild disappointment can trigger a sell-off. But there’s also a specific disturbing trigger shown on the slide below:

F&G

Surrender is a big taboo for life insurance companies. In the fourth quarter, for some reason, they went up. And the company doesn’t do a good job of explaining that growth. Let me quote Mr. Chris Blunt on the earnings call:

There was a lot of publicity and the number of surrenders increased, but the inflow of money increased dramatically. So I know this sounds weird, but unlike a bank, someone turns over a very old contract, charges a small surrender charge, and then brings in a brand new contract, charges a brand new surrender charge. Ironically, we are actually improving the risk profile of our liabilities. Generally speaking, we make a profit when someone pays surrender charges.

So this is an unusual situation. Yes, surrender rates are up, but I don’t think it’s going to materially change our net sales model.

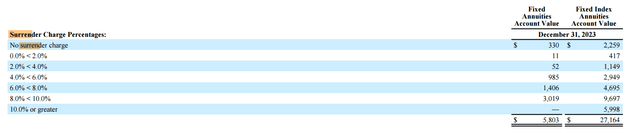

This explanation is not detailed enough. For example, Athena devotes a page of its supplemental report to surrender, breaking it down into categories. This brings clarity to the situation and clears up misunderstandings. Perhaps, F&G will also start doing this in the future. Still, I don’t think a slight increase in single-quarter surrender rates should be a warning sign. Often, in a tough economic context, capitulation is dangerous, and entire industries have experienced this. That doesn’t appear to be the case here. F&G’s data shows its retail annuity liabilities remain reliably protected by surrender charges.

F&G

in conclusion

There were several other announcements in the Season 4 material, but these were previously known from other sources. For example, FNF invested an additional $250 million in F&G in early 2024 in the form of mandatory convertible preferred stock. This, coupled with the additional debt issued by F&G in the fourth quarter, significantly increased the company’s capital base.

In 2024, F&G also began marketing a new product called RILA (Registered Index-Linked Annuity), which is very similar to a fixed index annuity but is marketed particularly well through broker-dealers. It is expected to further increase and diversify sales.

Finally, in early 2024, AMBest updated F&G’s financial strength rating to A from A-. This is an important step.

What if FNF does not spin off F&G in 2025 or F&G is not acquired after the spin-off? The most likely explanation for these inactions is that F&G has achieved blockbuster success beyond current expectations. In this scenario, F&G either becomes too valuable to be worth delaying the spin-off, or it becomes too expensive to acquire. Although this seems unlikely, I would welcome this scenario.

Overall, my evaluation of F&G has not changed much from the previous article. I still rate the stock a “Hold.” I significantly reduced my position at the end of 2023 but still hold some shares.