Kutredrig/iStock Editorial via Getty Images

introduce

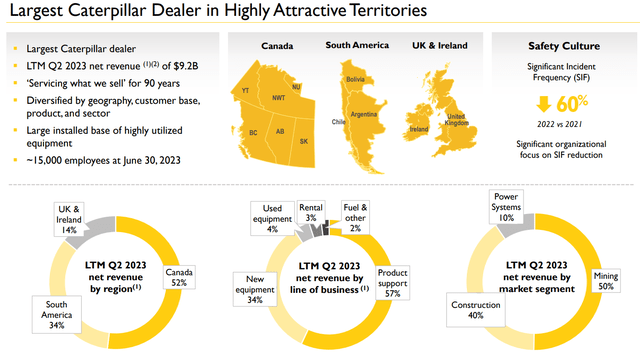

Finning International (TSX:FTT:CA) (OTCPK:FINGF) is a Canadian partner of Caterpillar (CAT) as it is an authorized dealer of the U.S. brand nearly 100 years In some areas of Canada. Currently, Finning Canada is an authorized dealer for the western provinces of Canada (Saskatchewan, Alberta, British Columbia, Yukon, Northwest Territories and parts of Nunavut), but it also operates abroad :

financial investor relations

Due to its close relationship with Caterpillar, the company is also an authorized dealer in Chile, Argentina and Bolivia. In Europe, Finning is an authorized Caterpillar dealer in the UK and Ireland. More than 50% of the after-sales market’s annual revenue comes from “product support” and is an important revenue driver for Caterpillar.

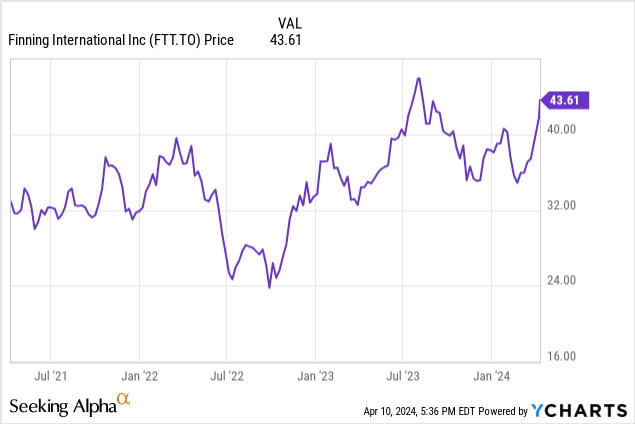

I have discussed Finning before in 2015 and 2016, this Total stock return is nearly 200%. It’s time to take another look at whether Fenning is attractive enough to re-enter a position.

2023 is a year of staggering EBIT growth

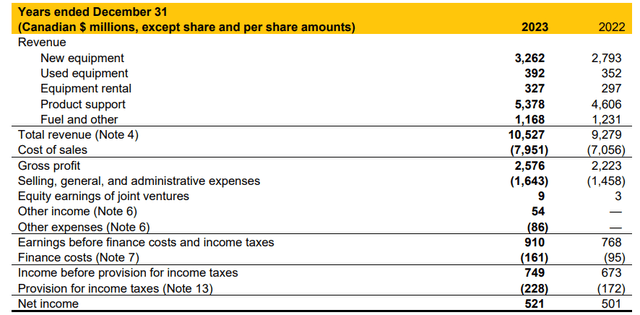

In 2023, Finning reported total revenue growth of nearly 14%, with total revenue jumping to Canadian dollars 10.5B, up from $9.28B in fiscal 2022. At the same time, COGS also increased significantly, but at a slightly lower rate, which meant that gross profit increased by more than 15%, reaching C$2.58B.

financial investor relations

While that’s good news, the company’s other operating expenses haven’t escaped the effects of inflation: SG&A expenses increased by nearly $200 million, but that wasn’t enough to stop Finning from reporting a record profit. As shown in the income statement above, even with net “other expenses” of CA$32 million, the impact on net profit was minimal, and although finance expenses increased by approximately 70%, pre-tax income increased by approximately 10% to C 749 million US dollars, net profit was 521 million Canadian dollars, of which 523 million Canadian dollars was attributed to Finning common shareholders (non-controlling interests recorded an attributable loss of 2 million Canadian dollars).

Earnings per share were calculated at C$3.55, an increase from the C$3.25 per share reported in fiscal 2022.

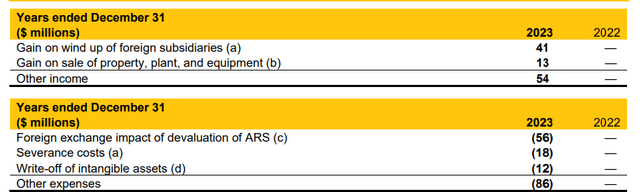

There are two elements of the income statement that require some additional detail. First, net “other charges” of C$32 million were primarily related to the depreciation of the Argentine peso. As shown below, most projects are non-repetitive in nature.

financial investor relations

Looking at financial costs, the company is simply stuck in a higher interest expense environment; the average interest rate on credit facilities doubled from 3.5% at the end of 2022 to 7% at the end of 2023. I think the worst is over in terms of financial market rates, so I don’t think we expect things to get significantly worse. From the perspective of the bond market, the average yield to maturity of Canadian dollar bonds maturing in the next ten years is approximately 4.5-4.75%. The 2042 bond has a yield to maturity of approximately 5.3%. The recently issued 5-year note yielded just under 4.78%.

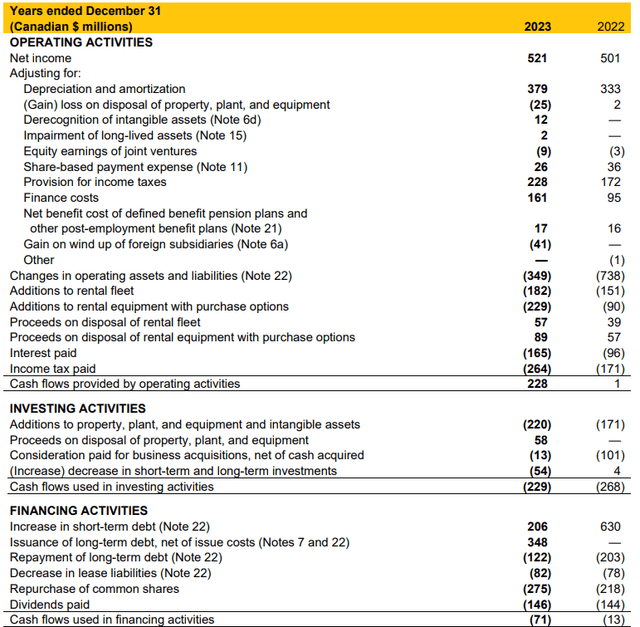

Fenning’s cash flow also remains very strong. In 2023, reported operating cash flow was just C$228 million, but that was mainly because the company continued to invest heavily in working capital projects, reaching C$349 million, while also spending C$182 million to grow its leased fleet, as You can see it below. This was partially offset by the sale of assets in the lease fleet and lease equipment. If I adjust operating cash flow only for the change in working capital position and then subtract the $82 million in lease payments, the adjusted operating cash flow is approximately $495 million, which is approximately $530 million after deducting: Taxes owed are considered, not taxes paid.

financial investor relations

As you can see above, total capex was only CA$220 million, resulting in an underlying free cash flow result of CA$310 million. As of the end of 2023, there were 144 million shares outstanding and free cash flow per share was C$2.15.

This was lower than reported net profit. Why? Because operating cash flow includes a net investment of C$125 million in leasing the fleet and an additional C$140 million in net investment in leasing equipment. Adding these two elements back into the equation (thus excluding net investment from these balance sheet items), underlying free cash flow is actually C$575 million, or almost exactly C$4 per share.

financial investor relations

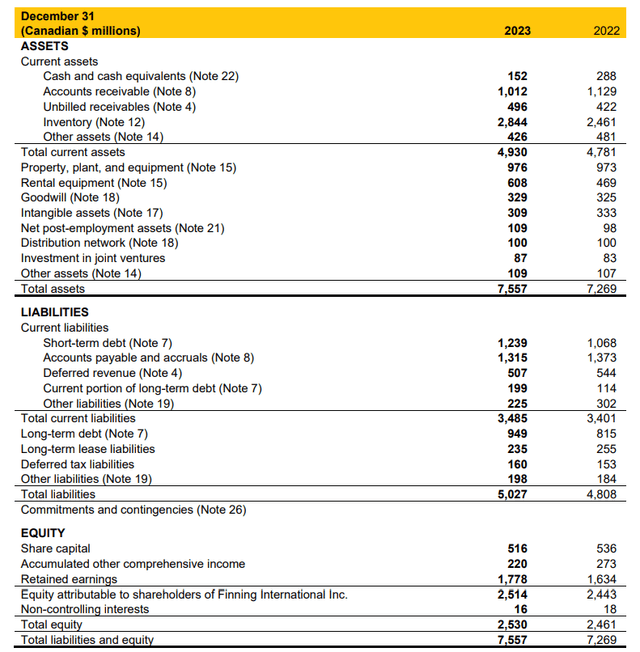

Fenning had about C$152 million in cash at the end of 2023, but had a working capital position on its balance sheet of about C$145 million due to higher inventory levels. This includes C$1.44B in short-term debt, while long-term debt totals C$949M. This means total net debt levels are approximately C$2.24B (excluding lease liabilities). EBITDA is just over C$1.2B (adjusted for lease amortization), and a debt ratio of less than 2x EBITDA is definitely comfortable.this Adjusted EBITDA exceeds C$1.3B After removing some non-recurring items from the equation.

investment thesis

The main risk is obviously seeing Caterpillar end its relationship with Fenning, but since the two partners have been working together for nearly a hundred years, I think the risk is minimal. If Finning begins to provide substandard performance to Caterpillar customers, CAT may give Finning some time to correct the situation rather than terminate the relationship with 90 days’ notice.

Finning’s current EV/EBITDA ratio is around 7, which is definitely not expensive. Additionally, with a free cash flow yield of approximately 9%, the company’s underlying cash generation remains strong, although this is somewhat overshadowed by increases in working capital needs and rental fleet and equipment. I don’t expect much growth in 2024, but it will be interesting to see what Finn will do with its incoming free cash flow. The dividend could potentially increase to C$1 per share, which would mean hundreds of millions of dollars in discretionary cash flow each year. Additionally, during the fourth-quarter conference call, Fenning’s management mentioned that it expected to release working capital and use the proceeds to pay down debt.

It’s been a while since I’ve owned Finning, but I’m still impressed with the way this company is managed. I will be keeping a close eye on the company as I would be interested in buying it again at its current valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.