Sean Justice/Image Library via Getty Images

Elevator promotion

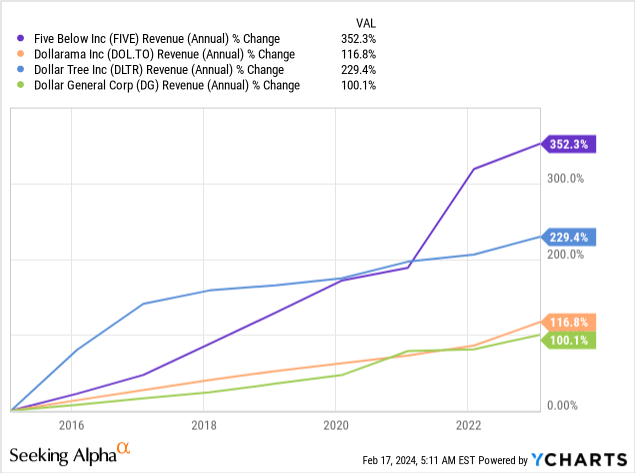

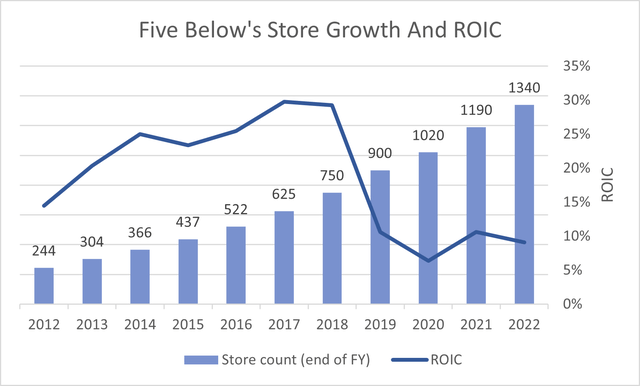

The following five-person company (Nasdaq: Five) is a retailer that, as the company name suggests, sells products mostly priced at $5 and under.This may indicate that the company has no advantage, but if we Digging a little deeper we find an interesting story. In the past 10 years, FIVE has grown from only 244 stores in 2012 to 1,340 stores in fiscal year 2022, and to 1,544 stores in fiscal year 2023. Revenue was equally impressive, growing from $418.8M to $3.08B in ten years. This represents a compound annual growth rate of 18.6% for store growth and 22.1% for revenue. This also means that FIVE’s revenue is growing faster than other retailers such as Dollarama (Department of Labor: California), Dale General Company (Director General) and Dollar Tree (DLTR):

Even more impressive is that all this vigorous expansion has Funded primarily by FIVE’s operating cash flow. The company borrowed from the credit line only in 2014 ($7 million) and 2020 ($50 million), and in both cases, the borrowings were repaid by the end of the fiscal year. It’s no surprise, then, that the company has an available line of credit with its lender – Wells Fargo Bank (World Financial Center) is one of them – growing from $34.5 million in 2012 to $192 million in fiscal 2022.

Where are the edges?

The key differentiator between FIVE and other retailers is giving teens what they want most: fun experiences. In the store, young customers can interact with a wide variety of fashion products. FIVE ensures that new products are constantly being added, turning their stores into new treasure hunts in the eyes of their customers every day. The idea is irresistible to young people and parents who, in times of economic crisis, cut off their children’s fun as a last resort resource:

Five or less investor relations

Most items cost between $1 and $5, but FIVE is also transforming the store into a “Five Beyond” model, adding a new world of items worth more than $5 and less than $25. It also gives the company more room to raise prices to offset higher costs, which they often do without seeing any damage to sales.

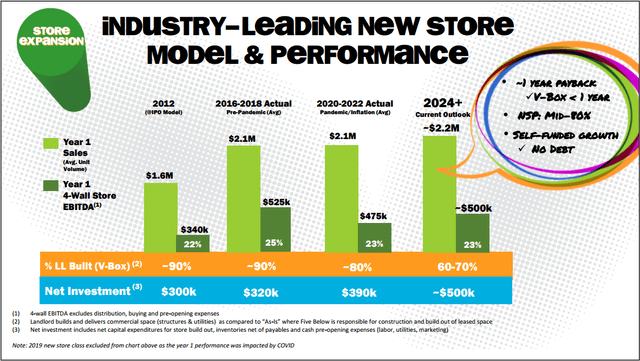

FIVE is implementing its “triple” plan: tripling the number of stores in 2021 to at least 3,500 stores by 2030, doubling total sales and earnings per share in 2021, and reaching sales in 2026 ~$5.7B, ~$10 per share. The company’s business model hinges on its store economics: Each new store requires an investment of about $400,000 and generates sales of about $2 million in its first full year of operation. Thus, the average payback period for the initial investment is less than one year:

Five Below Store Model (Five Below Presentation at ICR Conference 2024)

Typically, FIVE owns (either through purchase or construction) a distribution center (DC) and leases all stores and corporate headquarters. But the model has changed slightly in recent years, and Chief Financial Officer Kristy Chipman explained it well at the 2024 ICR Annual Meeting:

As you know, rising interest rates over the past few years have left many landlords strapped for cash, which has limited the availability of regular box sites, with the landlord bearing the cost of delivering the site and enclosure to us. Our debt-free balance sheet (excluding leases) provides us with significant financial flexibility, allowing us to choose to attack and continue our aggressive growth plans, and we are able to leverage our balance sheet to lease locations on an “as-is” basis And take responsibility for our own construction.

There are a few things here. The upfront cost is higher, and the return on investment is also higher. It also provides tenant allowances in the form of rent relief. Over the next year or two, about 30% to 40% of our stores will be in this format. As rates normalize, so will our store mix over time, and we’re very pleased with the performance of our new stores and our new store format. (The five meeting minutes of the 2024 ICR conference are from TIKR.com)

FIVE’s return on invested capital (ROIC) has been above 10% for most of the past decade. As shown below, the ROIC value decreased significantly from 2019 due to the significant increase in the total value of property, plant and equipment from 2019 onwards. In 2019 alone, FIVE purchased a distribution center in Forsyth, Georgia, and land in Conroe, Texas for another distribution center that was up and running less than a year later. FIVE has been building, expanding and replacing older facilities to create a network of five distribution centers serving more than 2,000 stores. If the company hopes to open more than 3,500 stores by 2030, it may need more distribution centers in the coming years.

Even during the difficult period of the global economy since 2019, which has experienced the Sino-US trade war, tariffs as high as 30%, the epidemic, global supply chain disruptions, and historically high inflation, FIVE has continued to self-fund its expansion. Businesses that are so resilient are likely to return their ROI to previously higher levels. In my opinion, current values still suggest management is doing a good job of allocating capital and staying competitive:

SEC Filings. ROIC is calculated the same way as Investopedia.com

The specter of trade war

It is not my intention to discuss or predict macroeconomic trends, but I recently read an interesting report on SA that will likely continue to pop up in news feeds. This is about how the company’s operations in China may impact its business based on the outcome of the 2024 U.S. presidential election. I haven’t found the exact percentage of goods FIVE imports from China in the SEC filing, but you can read the following in the FY 2022 10-K (Item 1, “Sales, Purchasing and Distribution” section):

We work with approximately 1,000 suppliers, and no single supplier accounted for more than 5% of our fiscal 2022 purchasing volume. In fiscal 2022, approximately 60% of our purchasing volume came from domestic suppliers.

In 2018 and 2019, the United States imposed additional tariffs on certain imported goods from China, with tariffs as high as 25%. In those years, FIVE’s revenue grew by 22% and 18.4%, while gross profit margins remained at the highest levels: 36.2% and 36.5% respectively.

Joel Goldberg said this when asked about increased tariffs:

I mean, tariffs are everywhere. It’s constantly changing. I think what you should understand is that we may not be able to mitigate it immediately, but we will mitigate it, including where we have to make price adjustments in areas that we can’t mitigate. But in addition to China, we also source products from Honduras, India, South America and many other countries. Therefore, our overall dependence on China is not exclusive. Over time, if it stays at 25% or reaches 25%, we will definitely consider moving more products to other countries.

There is no doubt that increased tariffs will impact FIVE’s normal operating procedures, but the company has proven time and time again that they know how to adapt to changing circumstances and succeed. If a new wave of tariff increases materializes and FIVE’s stock price declines, a buying opportunity may arise based on FIVE’s resiliency and new fundamental analysis.

to date and beyond

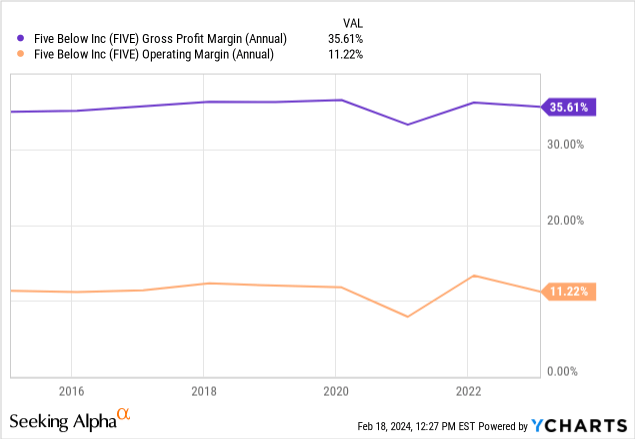

Overall, both gross margin and operating margin have remained stable over the past decade. Among other measures, FIVE has raised prices, negotiated better lease terms for stores and concentrated new stores in new areas to reduce marketing expenses and offset increased costs. Average net sales per store increased from $1.8 million in 2012 to $2.4 million in 2022. During the same period, except for 2020 and 2022, comparable sales (also known as “same-store sales”) have been positive and are expected to be around 3% for fiscal 2023.

As Joel Goldberg said at the 2024 ICR Annual Meeting, the outlook for management is positive:

You can also start to expect us to leverage as we overcome the headwinds and begin to subside, as we leverage comparative sales from new store sales growth to achieve average annual margin growth of approximately 20% to 40%. Drivers of this leverage include a strong new store growth pipeline; increasing supply chain efficiencies, such as when we opened an office in India last year; a complete focus on inventory optimization, led by Ken Bull; and the ability to now leverage our fixed costs. As with sales, you should consider this at the lower end of the range through 2024 as we head into a more difficult holiday period. Over time, you should expect our profit margins to improve to at least 12%. (The five meeting minutes of the 2024 ICR conference are from TIKR.com)

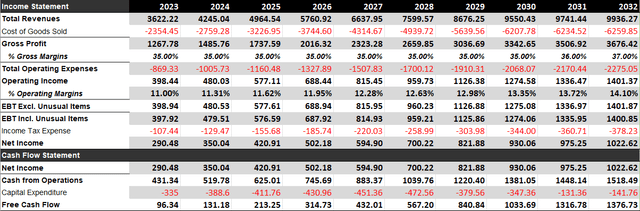

Considering FIVE’s history and prospects, we can build a profit model as shown below. Since the purpose is to obtain FCF data for discounted cash flow (DCF) analysis, rows such as number of shares outstanding and EPS are omitted from the model. Also, for simplicity, only the most important lines from the income statement and cash flow statement are shown (figures are in millions of dollars):

Author’s estimate

Valuation

For a company that’s expanding so rapidly, estimating a fair price for its stock is certainly challenging. But here are my two cents on the discounted cash flow analysis.

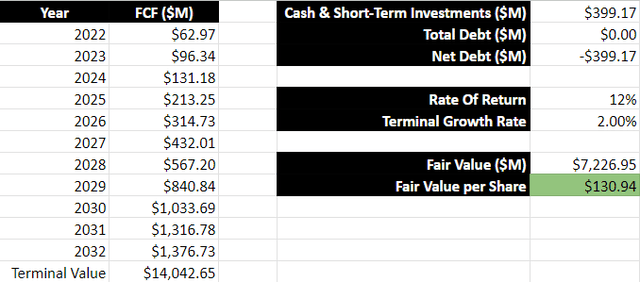

As discussed earlier, FIVE has not used a single dollar of its bank credit line. Therefore, I assume total debt for the DCF analysis is $0. Given this company’s successful business and store model, I think it’s fair to assume that 5 will continue to grow at least 2% beyond 2032. This value corresponds to the lowest positive comparable sales growth since 2012 and is used as the growth rate for the terminal DCF analysis. If we expect an annual return of 12%, we can conclude that:

Author’s calculations

Based on this analysis, FIVE stock currently has a fair value of approximately $131, while the company is trading at $190 per share at the time of writing. But that may change as 2030 approaches, and FIVE will have fewer capital-spending-intensive years ahead.

in conclusion

Five Below’s niche market and operations put the company in a unique position, away from other well-known retailers. Over the years, FIVE has executed aggressive growth plans during multiple recessions. Based on the model and DCF analysis developed here, FIVE stock is overvalued if we expect growth of 12% per year. In other words, the current share price suggests potential growth of 9% per year based on estimated free cash flow over the next ten years. For reference, FIVE’s share price has grown at a CAGR of 7.8% over the past five years, but has grown at a CAGR of 28.1% since the pandemic bottomed out in March 2020.

I’ll call five catch at present. In my opinion, the company has the potential to grow in the mid-teens over the long term. It’s done this over the past decade (with a compound annual growth rate of 16.9%) and is now doubling down on its expansion efforts without taking on any debt. This should at least earn it a spot in the “Five Under” list of stocks to watch.