59 yuan

Earlier this year, we sat down with Michael Goosay, Chief Investment Officer of Global Fixed Income, to discuss his outlook for the fixed income market in 2024, and he saw opportunities and potential performance drivers.

Qin In many ways, the fixed income market in 2023 is a mixed bag. Do you expect fixed income investors to continue to face challenges in 2024?

2023 is a challenging year, with some drivers of volatility in fixed income markets, some of them non-traditional. Central banks around the world have just endured a prolonged period of tightening, with no clear end in sight for a long time.

Economic data showed signs of weakness, but inflation remained well above target.As 2024 approaches, the picture appears clearer – inflation remains above most central bank comfort levels, but is trending lower, and There are signs that economic growth may be slowing, but has not yet reached recessionary levels.

Given the slowdown in growth, the economy is at a stage where central banks can start to consider shifting from restrictive monetary policy to a more accommodative stance.

As 2024 begins to get into full swing, we expect fixed income to become an attractive asset class as the economic tightening cycle turns to policy pause and easing. Historically, this has been a good time to start buying fixed income.

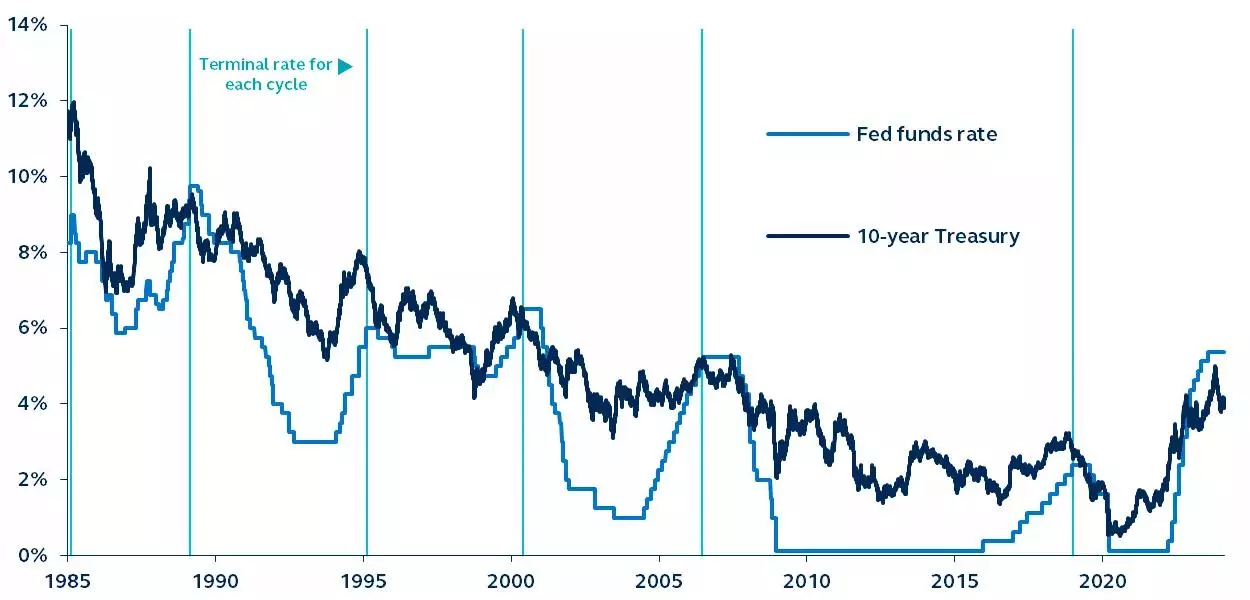

Historically interest rates have peaked around the time the Fed last raised interest rates.

10-Year U.S. Treasury Bond and Fed Funds Rate, 1985 to Present

source: Bloomberg, Federal Reserve, Principal Asset Management. Data as of February 7, 2024.

Q: You mentioned that central banks, especially the Federal Reserve, may consider cutting interest rates in 2024. Do central banks around the world have the same view?

Unlike the Federal Reserve, many global central banks have less opportunity to ease policy in 2024 and beyond. In many cases, they have tightened policy far less than the Fed.

We are already seeing the impact of rising interest rates on the UK and many European economies. The pass-through of higher rates is felt in these economies because European mortgages tend to have floating rates and are much more responsive to changes in central bank policy.

Conversely, U.S. mortgage rates and consumer borrowing costs have been much slower to respond to changes in Fed policy rates because of the longer fixed-rate terms in our home and credit card markets.

While we have seen European and UK economies facing risks from rising interest rates, some Asian economies are yet to feel these risks.

Japan, for example, has had zero interest rates and massive quantitative easing for decades, so we are just beginning to see the evolution of inflation from such aggressive policies.

Looking ahead, we expect the Bank of Japan to lag behind the Bank of England and the Federal Reserve in monetary policy adjustments.

Q: Pay attention to the Federal Reserve. What pace do you expect to cut interest rates in 2024? Will it be an immediate steep decline or a more conservative pace?

The bond market has two conflicting views on the path and pace of the Fed’s interest rate cuts. On the one hand, we see a group of investors insisting that the Fed needs to adjust monetary policy quickly.

They believe that we are already seeing signs of a rupture on the consumer side and that the impact of rising interest rates on consumers and residential real estate will become apparent in the first half of 2024.

Because of this, these investors believe the Fed should significantly lower policy rates in the first half of the year.

Instead, some investors believe the Fed may be more patient and lower policy rates slowly and methodically in the second half of the year. They believe consumers, while stressed, are in relatively good shape and companies are still showing reasonable profit numbers.

When viewed alongside the still-strong employment data, the Fed’s most important number, we find ourselves even more convinced of this view.

While we are seeing signs of deterioration in consumer quality and deterioration in income data, albeit slowly, we believe the Fed wants to see inflation fully subdued before starting to lower policy rates.

We expect rate cuts to begin in the third quarter of 2024, but we expect the rate cuts to be larger and more aggressive, aiming to have a more significant impact on the economy in a short period of time.

Q: Given your economic outlook, who should investors be looking for in 2024 for their fixed income investments? Are there any specific asset classes that will benefit from the expected macro environment?

Traditionally, when the Fed begins to pause and eventually lower policy rates, it is the best time to take on more interest rate risk in the duration and move overnight money market funds into longer-dated assets.

We are looking for higher-quality instruments with longer maturities—such as agency mortgages and higher-quality investment-grade corporates—that are attractive as long as they maintain interest rate and credit sensitivity.

Additionally, municipal bonds are also an option for investors because they are an attractive place to move money during cyclical turns and are a viable way to earn tax-advantaged returns in the fixed income market.

For fixed income areas that are more sensitive to slowing economic growth, such as emerging market debt or high yield, investors should be more cautious, and active management and differentiated strategies are crucial.

Companies and countries in these sectors are more highly leveraged relative to some higher-quality investment grade or U.S. government-insured issuers.

While timing remains a challenge, it has become clear over time that extending maturities is a beneficial first step when central banks pause or shift to an easing cycle, with greater risks associated with buying once a slowdown or recession strikes. asset.

Q: What factors should investors pay attention to when investing in fixed income currently?

Three main characteristics make fixed income an attractive asset class. The first and most obvious is that the income and yields investors are receiving today are more attractive than they have been in more than a decade.

Second is the total return opportunity. Given the sharp rise in interest rates over the past year and a half, we expect total returns to be in line with what investors would receive in their equity portfolios.

The third is the diversification benefits that fixed income brings to investors’ portfolios relative to other allocations. When fixed income performs well, it usually means alternative assets and/or equities are performing poorly.

These three factors – income, total return and diversification – are why fixed income plays an important role in any investor’s portfolio today.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.