taniel chain

Franklin FTSE Brazil ETF (NYSE: FLBR) is designed to track the performance of the FTSE Brazil RIC Capped Index, providing exposure to Brazilian large and mid-cap stocks. As of this writing, its assets are $161 million.It provides value, as well as amazing yields contour. It also looks attractive compared to its main rivals. However, big question marks remain over the government’s hostility to the fund’s main constituents and its willingness to intervene in private sector corporate governance and Brazil’s central bank. I currently rate FLBR a Hold.

Unbalanced growth story tempts interventionist policies

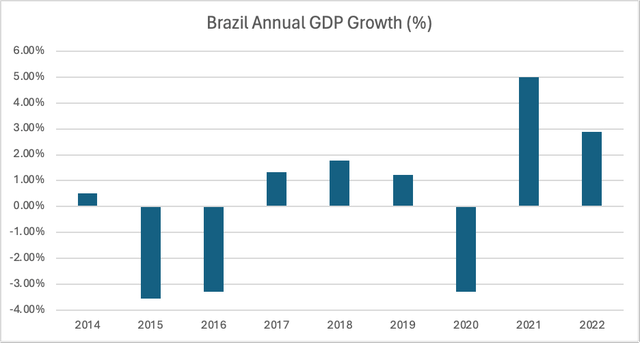

Brazil, Latin America’s largest economy, has had an uneven growth trajectory over the past decade. Brazil emerged from a deep recession in 2017 but suffered another setback with the COVID-19 outbreak. The economy will rebound in 2021 and 2021 2022. International Monetary Fund (IMF) Forecast GDP growth It will reach 3.1% in 2023 and fall back to 1.5% in 2024.

macro trends

Interest rates remain high, currently at 11.25%, down from 13.75% since August. central bank begins Its easing cycle. The overall inflation rate is currently 4.50%, higher than the expected 4.44%.Here is receive direct criticism Brazilian President Luiz Inácio Lula da Silva, or “Lula,” has in turn drawn attention to the president’s commitment to upholding central bank independence norms.

Commodity allocation

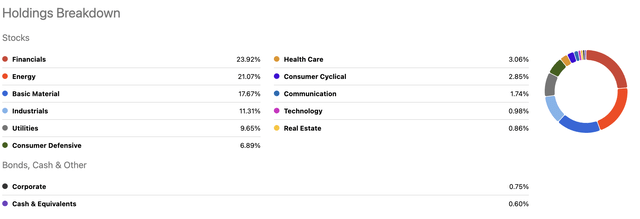

As of March 2024, FLBR’s industry allocation is heavily skewed toward financials (24%), energy (21%), and basic materials (18%).

Seeking Alpha

Brazil’s materials industry, dominated by mining and metals companies, has been the main driver of Brazil’s export-oriented economy. Brazil’s long-standing relationship with its main trading partner, China, will influence the industry’s prospects.President Lula made a public effort It conveyed a commitment to the relationship between the two countries despite rising tensions between China and the United States.

From an individual holdings perspective, FLBR is fairly well diversified. It has 85 stocks, and the top 10 holdings account for 53% of the assets. The largest allocation was to materials company Vale SA (VALE). The second largest holding is energy group Petrobras SA – Petrobras (PBR).

Seeking Alpha

Valuation

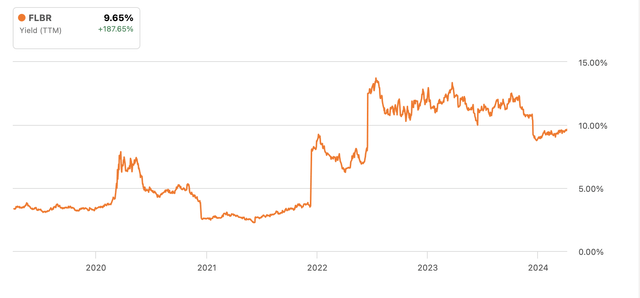

FLBR is a strong value, currently trading at 1.5x book value and currently trading at 8x P/E. FLBR also has an excellent dividend profile. The average yield in 2023 is 9.33%. Looking at its 5-year history, we find that the fund, while not always delivering consistent growth, has delivered an average TTM return of around 10% since 2022.

Seeking Alpha

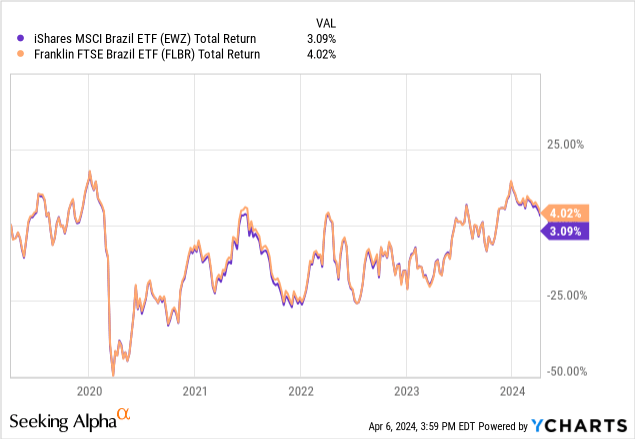

Significant differences from EWZ

I don’t often find it necessary to make a 1:1 comparison of single-country ETFs because the breadth of single-country stock markets is limited and there’s usually not much differentiation between the products. Brazil is an exception. FLBR’s main competitor is the iShares MSCI Brazil ETF (EWZ). It is more concentrated (57 holdings compared to FLBR’s 85 holdings). While its valuation profile is similar, its TTM yield is much lower, currently at 6.22%, compared to FLBR’s 9.33%. When looking at performance over the past 5 years (FLBR has only been around since 2017), we see that FLBR has outperformed the rest of the market, which brings me to my final point of comparison: cost. Expense ratios are not my favorite data point when evaluating ETFs. However, FLBR’s significantly cheaper price tag (0.19%) relative to EWZ (0.59%), combined with the difference in fund income generation, could result in a significant difference in total returns. Of course, FLBR also has its advantages over EWZ, with its wider bid-ask spread, but for buy-and-hold play, FLBR seems more attractive than EWZ.

There are still plenty of risks

As mentioned above, there are key risks that can affect FLBR or EWZ. Slow economic growth in Brazil appears to be the reality in the short to medium term. President Lula’s increased interventionism is a real concern and could spell trouble for key sectors of the Brazilian economy. A rate cut may benefit the export sector, but may also have a corresponding negative impact on FLBR’s financial sector. In addition, the Brazilian economy relies heavily on cooperation with China as a major trading partner, but this is not a sure thing.

Conclusion

Brazil’s growth story is currently unremarkable, and the head of state may become increasingly hostile to free-market principles; Brazil’s stock market isn’t exactly fertile ground. However, I acknowledge that the domestic macro situation may be less relevant to this assessment given the country’s export-oriented economy. Even so, the boom and bust realities of commodities present a level of risk to FLBR that is beyond my current appetite. Despite its relative attractiveness compared to EWZ and its overall value profile, the instability of FLBR’s juices doesn’t warrant a squeeze, and I currently rate the fund a Hold.