da-kuk/E+ via Getty Images

paper

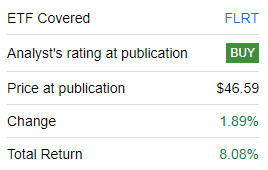

About eight months ago, we began reporting on a very interesting fund from Pacer, the Pacer Pacific Asset Floating Rate High Income ETF (NYSE: FLRT).We were still in the middle then The fund’s collateral is very attractive to macro cycles, i.e. the instrument consists of floating rate loans and CLOs, which are low duration assets.

In our original article, we highlighted why we believe the portfolio of assets in FLRT is one that is appropriate for the macroeconomic cycle and why we believe FLRT will deliver strong total returns.

The company has delivered excellent results since our initial “Buy” rating:

Author Rating (Seeking Alpha)

Please note that FLRT is an exchange-traded fund, not a CEF, so the fund will trade Compared with net asset value, the deviation is very small.

In this article, we will revisit the fund’s name and its composition in light of today’s “Goldilocks” scenario and outline why we believe the fund is no longer an attractive entry point and downgrade the fund to hold.

Collateral Construction – Classic High Yield Fund

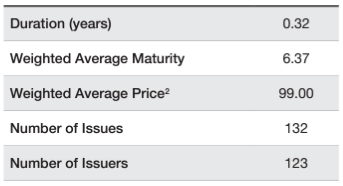

Through its allocation, the fund remains a low-duration instrument:

Term (Fund Fact Sheet)

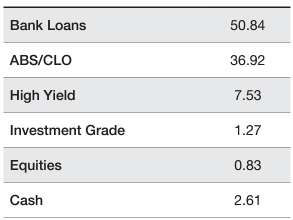

The instrument has a duration of only 0.32 years and there are 132 periods in its collateral pool. The ETF’s main sleeves consist of leveraged loans and CLOs, which account for more than 86% of the fund:

Asset Type (Fund Fact Sheet)

As a reminder, leveraged loans and CLOs are floating rate assets, so the fund operates on a very short term.

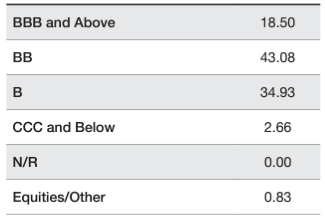

This fund does not have excessive credit risk (take more than 10% of the CCC bucket as an example), but it is a classic high-yield fund:

Rating (Fund Fact Sheet)

The majority of stocks in this ETF fall into the Double BB category at 43%, followed closely by the Single B category at 34.9%.

There are embedded levers in the structure

Even though FLRT is an exchange-traded fund, its collateral has leverage embedded into it. Leverage means that returns increase on both the upside and the downside. The fund contains Class BB CLOs, which is part of the subordinated CLO segment. CLO represents a pool of leveraged loans, parsed in terms of risk ratings. The most secure rating, AAA, has a large amount of dependency, while Class BB has very little dependency (usually 8 to 10 percent).

Let us understand this concept better through an example. Let’s say we have 100 leveraged loans, each with a percentage of 1%. An ETF based on these loans with an 8% dividend yield would only start to incur losses if the total default rate exceeds 8% for the year (for theoretical purposes only, we assume a zero recovery rate). Additionally, we assume a default rate of 10% this year. Therefore, the investor’s total return for the year was -2% (-10% principal loss, mitigated by 8% dividends).

The same paradigm for the BB CLO section will produce different results. Because the equity and subordinated tranches are the first to suffer losses among the collateral, for our 10% default rate this year (with zero recovery rate), tranche BB would likely sustain a full principal loss at 8% subprime and 2% tranche thickness. Therefore, investors here may only receive current year dividends, while future principal and interest will be zero. This is how embedded leverage in CLOs works.

While our example is a bit extreme, for retail investors, the BB CLO tranche contains a lot of embedded leverage and is significantly riskier than a simple BB leveraged loan.

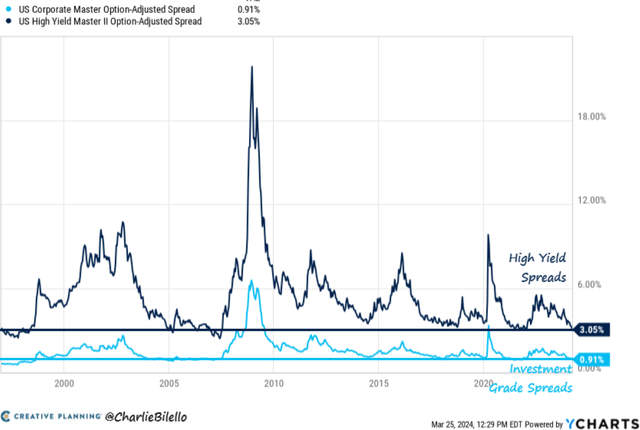

High-yield bonds have very tight credit spreads

A “soft landing” and current Goldilocks scenario has resulted in extremely tight spreads on high-yield and investment-grade bonds:

HY Communication (Creative Planning)

While we may get a “perfect landing,” mean reversion theory does suggest that spreads should be sold when spreads are very low and bought when spreads are high. The point to make here is that retail investors shouldn’t buy high-yield bonds when spreads are so low. Hold or divest is the action to take here.

In a perfect world, spreads remain low as the economy softens to a soft landing and delinquencies and defaults moderate. In any other scenario, we would see spreads widen again and FLRT net decline.

While no one can predict the timing of the market, the historical chart above provided by Creative Planning makes it clear that we should be careful now that there is no more tightening to come. From here the risk shifts towards the wider spread.

High-Yield Bonds ‘Hold’ Until Fed Cuts Rates

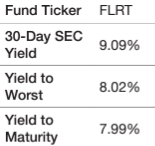

Before the Fed starts cutting interest rates, ETFs offer very attractive high yields:

Yield (Fund Fact Sheet)

The fund’s 30-day SEC yield is 9.09%, which is fully supported. Keep in mind that this is an ETF structure, so it cannot be over-allocated like a CEF structure.

This fund benefits from high federal funds and implied SOFR rates and will continue to provide a high dividend yield until the Fed begins cutting rates and SOFR decreases. The market expects the Federal Reserve to cut interest rates for the first time in June 2024, so yields are expected to remain unchanged until that point.

The current structure and yields are the reason we are changing this name to “Hold” instead of “Sell” and our schedule is to revisit this name a few months after the Fed’s first rate cut.

in conclusion

FLRT is a fixed-income exchange-traded fund. This instrument holds leveraged loans and CLOs with a shorter maturity of 0.3 years and a 30-day SEC yield of 9.09%. The collateral composition helps the fund in a rising interest rate environment, but could be detrimental to the fund once the Fed cuts rates. Although the fund is an ETF and therefore does not have direct leverage, the fund’s name contains a 36% BB/B CLO component, which has leverage embedded in the structure. With high yield spreads at historically low levels, the market is currently pricing in a perfect landing. From a macro perspective, we believe today’s high-yield space is no longer attractive and view FLRT as no longer an attractive entry point, thus downgrading it to Hold until the Fed starts cutting interest rates.