bill oxford

This series of articles is designed to evaluate ETFs (exchange-traded funds) based on past performance and portfolio metrics. Comments containing updated information will be published when necessary.

defense force strategy

Charles Schwab Basic International Large Company Index ETF (NYSE: FNDF)be listed in August 15, 2013 and tracks the Russell RAFI™ Developed ex US Large Company Index. FNDF manages $12.8B of assets, holds 928 stocks, has a net expense ratio of 0.25%, and a 30-day SEC yield of 2.93%. Distributions are paid semiannually.

as described FTSE Russell, the underlying index uses the RAFI method, which takes a different fundamental view of company size than market capitalization. It selects and weights securities in the FTSE Global Cap Index (the parent index) using a base score based on three metrics:

- adjusted sales,

- Preserve operating cash flow,

- Dividends plus buybacks.

Cumulatively ranked top 87.5% of companies Basic scores are included in the index. The index is calculated annually and partially reconstructed quarterly into four equal parts to achieve an annual full reconstruction. In the most recent fiscal year, the portfolio turnover rate was 10.8%. This article will use the iShares Core MSCI Total International Stock ETF (Ix), which tracks a broad index of non-U.S. equities.

FNDF product portfolio

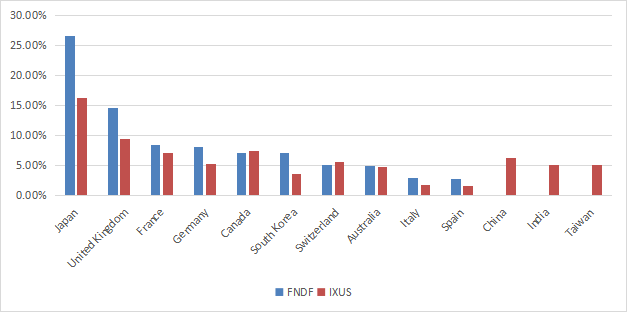

Europe is the heaviest region, accounting for approximately 49% of asset value. The top two countries are Japan (26.6%) and the United Kingdom (14.6%). Other countries are below 9%. Compared to the benchmark, FNDF overweights Japan, European countries as a whole, and South Korea. It ignores countries classified as developing markets such as China, India and Taiwan.

Country Allocation (Chart: Author; Data: Schwab, iShares)

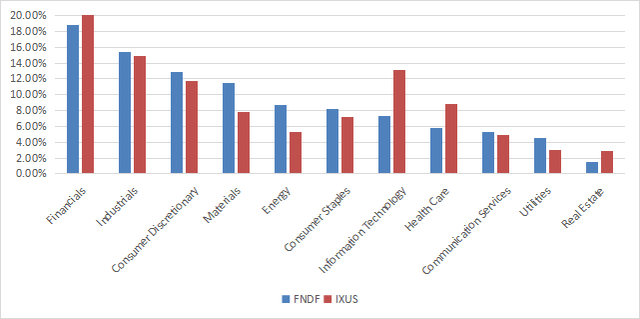

The top two sectors are financial (18.8% of assets) and industrial (15.4% of assets). Compared to IXUS, FNDF focuses primarily on materials, energy and utilities. It undervalued technology, healthcare and real estate.

Industry segmentation (chart: author; data: Schwab, iShares)

The top 10 holdings listed below account for 12.6% of total assets, with the heaviest holding accounting for 2.34% of total assets. As a result, the portfolio is highly diversified with low risk associated with individual companies.

|

Name |

weight% |

nation |

stock ticker |

department |

|

shell company |

2.34 |

National standard |

Sher |

vitality |

|

Samsung Electronics Co., Ltd. |

2.10 |

South Korea |

5930 |

science and technology |

|

Toyota Motor Corporation |

1.89 |

JP |

7203 |

Cs carte blanche |

|

overall energy |

1.30 |

FR |

Thermocouple |

vitality |

|

BP |

1.05 |

National standard |

blood pressure. |

vitality |

|

Honda Motor Co., Ltd. |

0.82 |

JP |

7267 |

Cs carte blanche |

|

Glencore Limited |

0.81 |

CH |

glen |

Material |

|

Nestlé |

0.80 |

CH |

NESN |

cesium staples |

|

Santander |

0.78 |

ES |

storage network |

finance |

|

BHP Group Ltd. |

0.75 |

African Union |

BHP Billiton |

Material |

basic knowledge

FNDF’s total valuation ratio is significantly lower than the benchmark (shown below).

|

FND |

Ix |

|

|

real time price to earnings ratio |

11.2 |

13.23 |

|

Price/Booking |

1.15 |

1.59 |

|

price/sales |

0.7 |

1.23 |

|

price/cash flow |

5.94 |

8.69 |

Source: Fidelity

Earnings growth was slightly better, but sales growth and cash flow growth were below the benchmark.

|

FND |

Ix |

|

|

Profit growth % |

17.21% |

16.52% |

|

sales growth % |

5.45% |

8.59% |

|

Cash flow growth % |

1.42% |

7.88% |

Source: Fidelity

Performance

Since inception, FNDF’s annualized returns have been 1% higher than IXUS’s. Slightly higher risk, measured as maximum drawdown and standard deviation of monthly returns (“Volatility” in the table below).

|

total return |

annual profit |

retracement |

Sharpe ratio |

volatility |

|

|

FND |

87.91% |

6.13% |

-40.14% |

0.37 |

16.09% |

|

Ix |

69.88% |

5.13% |

-36.22% |

0.32 |

15.04% |

Over the past 12 months, the gap has exceeded 5%:

FNDF and IXUS, last 12 months (Seeking Alpha)

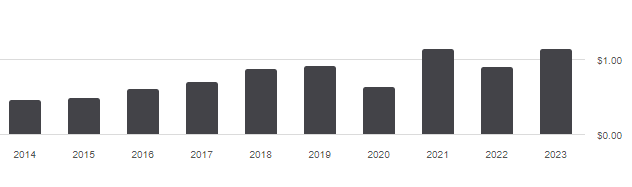

Between 2014 and 2023, the annual distribution amount increases from $0.47 to $1.15 per share. The growth rate of 144.7% in 9 years is much higher than the cumulative inflation (about 31% in the same period, based on CPI). Nonetheless, as the chart below shows, dividend growth has been quite irregular over the past 4 years.

FNDF distribution history (Seeking Alpha)

competitors

The fund is classified by Fidelity in the “foreign large value” category. Overall ratios confirm the tilt toward value styles, with over 80% of assets in stocks of large- and mega-cap companies. The table below compares the characteristics of FNDF and four non-U.S. large company weighted value ETFs:

- Dimension International Value ETF (DFIV)

- iShares MSCI EAFE Value ETF (EFV)

- Avantis International Large Cap Value ETF (AVIV)

- Alpha Architect International Quantitative Value ETF (IVAL)

|

FND |

DFIV |

EFV |

Ivey |

Ivar |

|

|

Inception |

August 15, 2013 |

April 16, 1999 |

August 1, 2005 |

September 29, 2021 |

December 16, 2014 |

|

expense ratio |

0.25% |

0.27% |

0.34% |

0.25% |

0.39% |

|

AUM |

$12.77B |

$7.05B |

$17.25B |

$346.72 million |

$156.38 million |

|

average daily volume |

$36.56 million |

$22.34 million |

$143.26 million |

$1.27 million |

$503.25K |

|

holding |

928 |

Chapter 547 |

Chapter 494 |

528 |

56 |

|

top 10 |

12.6% |

16.60% |

17.43% |

17.74% |

21.50% |

|

turnover |

11% |

12% |

twenty two% |

twenty one% |

74% |

|

Cut-off Time (TTM) Yield |

3.25% |

3.56% |

4.21% |

3.49% |

5.35% |

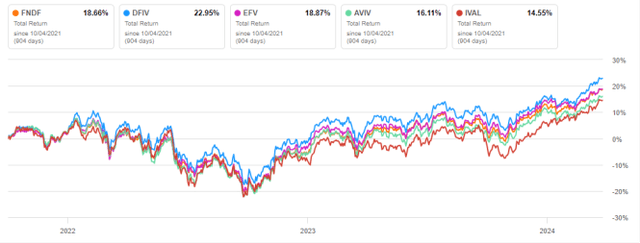

FNDF has the lowest fees (tied with AVIV), the lowest turnover, and ranks second in the group in terms of size and liquidity. The next chart plots total returns starting on October 4, 2021, to match historical data availability. FNDF trails DFIV and is the same as EFV.

How FNDF compares to competitors as of October 4, 2021 (Seeking Alpha)

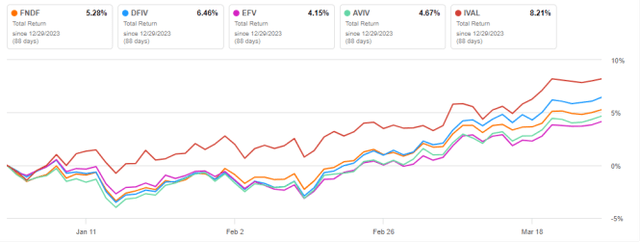

So far, it’s in the middle of 2024:

FNDF compared to competitors year-to-date (Seeking Alpha)

take away

The Charles Schwab Fundamentals International Large Company Index ETF uses the RAFI methodology, which takes a different fundamental view of company size than market capitalization. The portfolio is well diversified across sectors and holdings, but is overweight Japan. Valuations outperform international benchmarks, while growth metrics are slightly worse. FNDF has consistently outperformed its benchmark since inception, but its performance relative to peers since 2021 has been average.