Chris Gordon/iStock via Getty Images

introduce

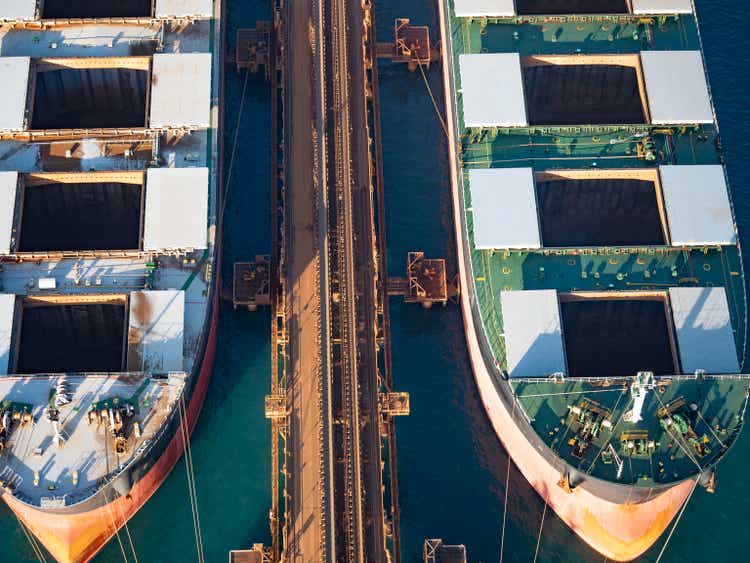

About seven months ago, I thought Fortescue (OTCQX:FSUMF) (OTCQX:FSUGY) was a decent call option on iron ore prices, and I haven’t been disappointed with its performance.this Currently, the stock is still up about 25% from its September 2023 share price, and the A$1.08 dividend received represents additional income for a total return of about 30%. The company’s shares reached highs of around A$30 per share in late January, but lost some momentum as iron ore prices softened.

Yahoo Finance

Fortescue’s primary listing location is Australia Listed under FMG as its stock symbol. Average daily trading volume is just under 6 million shares. Fortescue reports its financial results in US dollars, so I will use US dollars as the base currency in this article.as As a reminder, 1 share of FSUMF represents 1 share of the underlying stock. One share of FSUGY represents two shares. While I will be using the company’s financial results and performance in US dollars in this article, it goes without saying that I would recommend using the most liquid exchange for trading the company’s shares, which in this case would certainly be the ASX .

The cash flow continues (and continues)

The company’s fiscal year begins on July 1 Yingshi Until June 30 thmeaning the latest detailed financial results provided by Fortescue will focus on the first quarter of this financial year.

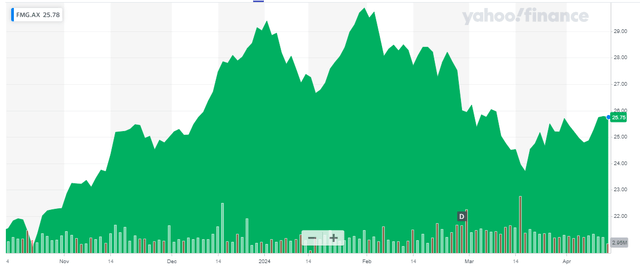

Because Fortescue’s iron ore consists of lower-grade material, its concentrate prices are significantly lower than the benchmark price (based on a concentrate with an average iron grade of 62%).As you can see below, the discount is very stable and actually narrowed in the second quarter of the current fiscal year.

Fortescue Investor Relations

During the first half of the fiscal year, the company produced and sold a total of more than 95 million wet tons of product at an average realized price of $108.19 per dry ton. Taking into account the moisture content in the iron ore concentrate, this results in total revenue of just over $9.5B ($8.5B of which comes from iron ore sales in the first half of the fiscal year).

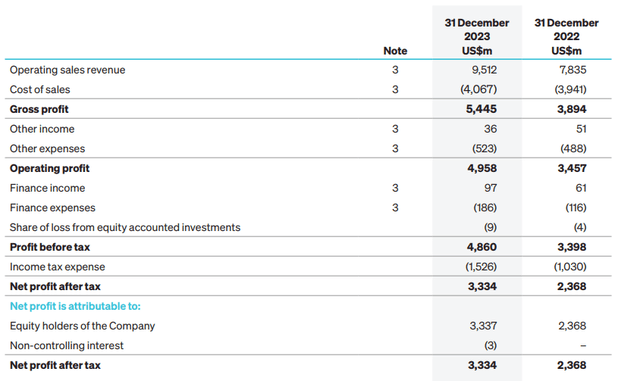

Since the company’s production costs remain industry-leading at less than $18 per wet ton, its margins and financial results are clearly very strong. As shown below, Gross profit is $5.4B The gross profit margin is slightly less than 60%. The cost of sales is not only the normal production cost, but also includes railway and port costs, transportation costs (reimbursable), US dollars 640 million in royalties. and nearly $900 million in depreciation and amortization charges.

Fortescue Investor Relations

With a fairly strong balance sheet and fairly low net finance charges (just over 1% of total iron ore sales revenue), pre-tax profit was $4.86B and net profit was $3.33B, which translates to earnings of $1.09 per share. Fortescue is clearly a major contributor to the local economy and the Australian economy, as the company owes nearly $2.2B in taxes and royalties based on results for the first half of FY24.

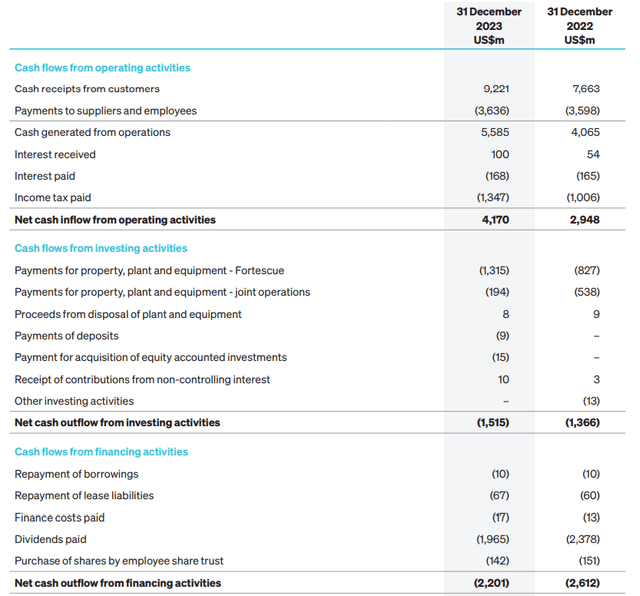

The cash flow statement below shows total operating cash flow of $4.17B, which is approximately $4B, after accounting for normalized taxes owed. After deducting certain finance costs (excluding interest payments) and $67 million in lease payments, adjusted operating cash flow was approximately $3.9B.

Fortescue Investor Relations

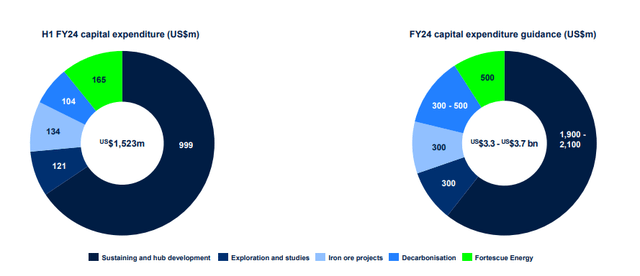

Capital expenditures were only $1.5B, and free cash flow results were approximately $2.4B. Keep in mind that this also includes some changes in working capital position, but unfortunately the company didn’t provide a detailed cash flow statement outlining changes in working capital. But consider that depreciation expense was only $922M, while Fortescue spent $1.57B on capital expenditures and lease payments. The chart below, released in the first half briefing, also clearly shows that ongoing capital expenditures in the first half were only $999 million, and are expected to be about $2 billion for the full fiscal year.

Fortescue Investor Relations

In the near future, average prices received should increase while capital expenditures should decrease as the Ironbridge project will produce 22 million tonnes per annum of high-grade concentrate at a C1 cash cost of US$45/wmt. As I explained in my last article, using a base price of $100/t and a 67%Fe price of $120/t, this would contribute just over US$1.1B in annual operating profit.

This is a fairly conservative estimate of the premium given that the current spot price for 62% iron ore concentrate is US$110/ton The spot price of 65% iron is approximately US$122/ton, indicating that the current premium for 67% iron concentrate is even higher than the benchmark price.

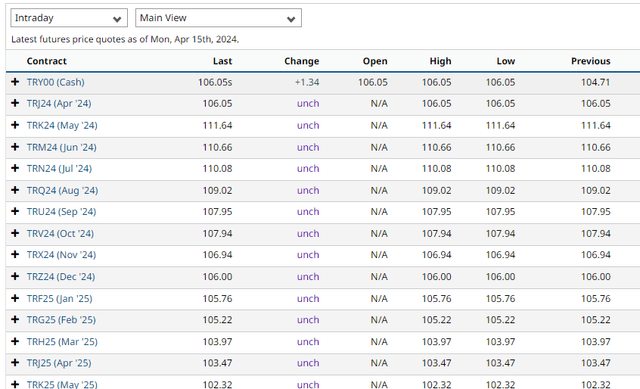

From the futures market, iron ore prices fell slightly, but prices are expected to continue to rise. 62% of iron ore concentrate prices remain above US$100/ton Five quarters ahead (of course, futures markets can change quickly).

Bar chart website

This means that, based on current conditions, Fortescue will likely continue to print money and will most likely keep its annualized earnings above $2/share, which would imply a price-to-earnings ratio of around 8x for the stock.

investment thesis

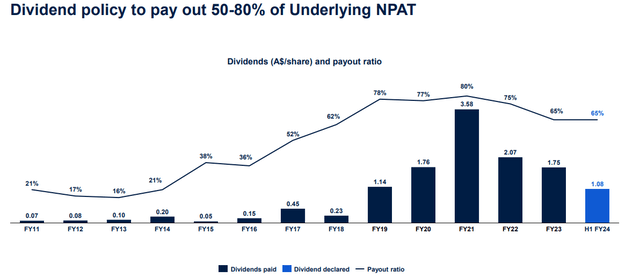

Although Fortescue Metals has been trying to diversify into copper, it remains an iron ore company. I own some Fortescue, not for the Fortescue energy division, which is expected to spend $500 million this year, but just for the iron ore price. I know this is a very volatile industry, so I wouldn’t put all my eggs in one basket, but Fortescue has extensive experience running large-scale operations where economies of scale are extremely important.The company has a long history of letting shareholders share in the wealth it creates and still does Plans to use 50-80% of net profits to pay dividends.

Fortescue Investor Relations

The same goes for after the first semester. Fortescue reported earnings of $1.085 per share and declared a dividend of A$1.08 per share, or approximately $0.701 per share, giving a payout ratio of approximately 65%. I’m reluctant to call Fortescue a “dividend stock” due to the volatility in iron ore prices, but over the past five years (since January 2019) it has paid out a cumulative $8 per share in dividends. Since my article in March 2016, when the stock was trading at just $1.87, the company has distributed about $8.65 in dividends. This represents a total return of approximately 1,250% over the past eight years.

I am a happy shareholder.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.