Richard Darko/iStock via Getty Images

First Trust Capital Strength ETF (NASDAQ: FTCS) is an excellent example of complex, well-tailored strategies in the ETF league, but unfortunately, these strategies have repeatedly underperformed.Since my last note was published in September In 2023, this ETF underperformed the S&P 500 again, which may suggest that the concerns I expressed in the article were justified.

Seeking Alpha

Still, I should admit that my suspicions were only partially correct. Most likely, FTCS’s performance was affected by relatively minor growth factors rather than a relatively expensive price during a period of strong long-term stock rallies.

Today’s update is necessary for several reasons. First, FTCS is a high-turnover ETF, so it will be interesting to see how FTCS performs with the two reorganizations of the index it tracks since September 2023. The portfolio has grown. Second, I want to assess the contributors and critics of its performance. Finally, it should be discussed whether there is reason for a more optimistic rating on FTCS.

What are the core principles of the FTCS strategy?

According to the ETF’s website, the basis of its strategy is a capital intensity index. In my view, the index has a well-calibrated and effective methodology that filters out low-quality companies with red flags regarding their financial health.In short, as described in Investor Guidewhich is supposed to represent 50 less volatile stocks and REITs selected from the Nasdaq U.S. benchmark index that have passed a number of screens, including the following:

- No less than “US$1 billion in cash or short-term investments.” For context, by my calculations, the median total cash and ST investments held by FTCS was $4.13 billion as of February 28, compared with $4.1 billion as of the previous note. Ecolab (ECL) performed the least, at $919.5 million. Number one is Microsoft (MSFT), with revenue of $80.98 billion.

- The long-term debt/market capitalization ratio must be less than 30%.

- The return on equity must be higher than 15%. According to my analysis, the current median portfolio position is 28.7%.

Constituents are equally weighted, and ICB industry caps apply.I recommend reading prospectus To better understand the nuances.

What affected FTCS’s performance this time?

FTCS has replaced a significant portion of its portfolio as the capital intensity index has been restructured twice since September 2023. More specifically, as of September 8, 2023, 15 stocks with a weight of just under 30% have been removed from the portfolio, and 15 stocks are currently added with a weight of over 30%. In this regard, I will only discuss the contributors and detractors that are present in both versions of the portfolio (35 stocks).

Looking at the data, we find that out of 35 companies, only 4 (with a September weighting of about 10%) saw their share prices decline during this period, as shown below:

| in stock | % recession |

| Gilead Sciences (GILD) | -4.9% |

| PepsiCo (PEP) | -5.8% |

| Cisco Systems, Inc. (CSCO) | -14.5% |

| Archer Daniels Midland Corporation (ADM) | -32.7% |

Data calculation using Seeking Alpha and FTCS.Based on stock prices as of September 8 and February 29

Several notable stocks actually outperformed the S&P 500 during this period, including the following three stocks with the highest price returns:

| in stock | price return percentage |

| Costco Wholesale (COST) | 35.6% |

| WR Berkeley(WRB) | 34.9% |

| Garmin (GRMN) | 34.1% |

Data calculation using Seeking Alpha and FTCS

Regardless, that’s partly because the index’s equal weighting prevents these stocks from contributing more to ETF performance. As always, weighting is a double-edged sword: During a bear market, smart beta can cut losses (FTCS is down 10.2% in 2022, while IVV is down 18.2%). But it could also prevent a portfolio from easily capturing more upside during a recovery.

Apparently, FTCS’s recent poor performance is nothing new. More specifically, since the new index was adopted in June 2013, its annualized total returns have failed to beat those of the iShares Core S&P 500 ETF (IVV), as shown in the chart below.

| Folder | Federal Trade Commission | intravenous injection |

| Initial balance | $10,000 | $10,000 |

| final balance | $32,122 USD | $36,762 |

| CAGR | 11.66% | 13.09% |

| standard deviation | 13.71% | 14.94% |

| best year | 26.74% | 31.25% |

| worst year | -10.22% | -18.16% |

| maximum.retracement | -20.75% | -23.93% |

| Sharpe ratio | 0.78 | 0.82 |

| Sortino Ratio | 1.27 | 1.29 |

| market relevance | 0.94 | 1 |

Data from portfolio visualization tools.The period is July 2013-January 2024

Its lower volatility cannot make up for weaker returns, so the Sharpe and Sortino ratios are also weaker.

What I like is that it does provide some margin of safety during short parties on Wall Street, as indicated by its downside capture ratio, but that’s not enough for consistent alpha, and I think it may not be enough.

| ratio | Federal Trade Commission | intravenous injection |

| Upward capture | 86.97% | 100.47% |

| Downward capture | 84.99% | 97.08% |

Data from portfolio visualization tools

How has the mix of factors in FTCS evolved?

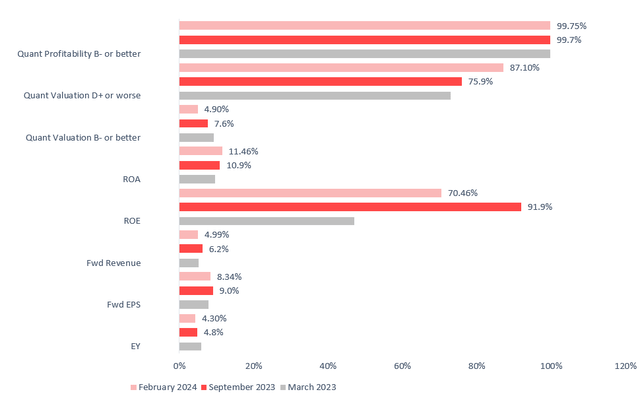

One of the core characteristics of this ETF that I think investors should keep in mind is that despite profound changes in the portfolio composition, its factor mix has fluctuated only slightly. So, while the changes in portfolio composition described above are considerable, I wouldn’t say there have been any material changes in the style factor exposures of ETFs. It remains a relatively high-priced, low-volatility portfolio of high-quality stocks. To better understand the context, I created the chart below. I’ve also added factor data for the March 2023 version of the portfolio I analyzed last year in the corresponding article.

Holdings as of February 28. Financial information as of February 29 (created by the author using information from Seeking Alpha and FTCS)

Nonetheless, my most attentive readers may point out here that weighted average ROE has declined significantly. However, this is not a cause for concern. The main culprit is Home Depot ( HD ), whose ROE fell from 2,066% to around 1,162%. This metric is skewed by the company’s heavy debt load, making it almost meaningless. The ETF’s median ROE hasn’t changed much, currently around 28.7%, compared with 29.4% previously.

There are other parameters worth sharing:

| Metric | Holdings as of March 22, 2023 | Holdings as of September 8, 2023 | Holdings as of February 28, 2024 |

| Market value, billions | 128.58 | 214.11 | 259.37 |

| Pressure/Pressure | 3.55 | 4.78 | 4.82 |

Data calculation using Seeking Alpha and FTCS

As can be seen, the portfolio remains dominated by large-cap stocks, as shown by the weighted average market capitalization. The P/S pointed to its long-standing valuation issues.

Should FTCS’s ratings be upgraded today?

FTCS uses a smart-beta, focused approach to quality investing. At first glance, this is an attractive strategy, but the returns don’t appear to be as strong as some investors might have expected from a portfolio of companies exhibiting “capital strength.” This is common among highly complex smart beta investments, so the ETF case is not unique.

I think the main problem with FTCS’s highest quality strategies is upside capture, which is limited due to the low volatility component. For example, in the current version, the weighted average beta coefficients for both 24 and 60 months are well below 1.

| 24M beta version | 60M beta version |

| 0.83 | 0.86 |

The author calculated this using data from Seeking Alpha and ETFs

So, in the base case, I think it’s highly unlikely that FTCS will deliver alpha in this bull market. This certainly doesn’t mean ETFs should be ignored. Conversely, investors who shy away from volatility and prioritize balance sheet resilience should put it on their shortlist. However, maintain the hold rating.