Palto/iStock via Getty Images

investment thesis

fubo tv co. (NYSE:FUBO) was once a fast-growing stock with a large shareholder following. Today it is a shadow of its former self.Although the stock has fallen significantly from its all-time highs, I think Not only is the stock not undervalued, but it may actually sell off further, as fuboTV could dilute investors in early 2025 as it seeks to raise valuable capital to keep its balance sheet float.

Here, I expect investors to look back at fuboTV at around $2 a share over the next 12 months as a high worth pursuing.

That’s why I give FUBO a sell rating.

quick review

In February, I titled my fuboTV analysis “Cheap has nothing to do with it.” I said there,

Bulls can point FuboTV’s revenue is expected to reach $2 billion in 2024.

Bears, meanwhile, were quick to counter that the business would run out of cash in less than 18 months and would need to raise more capital on extremely onerous terms.

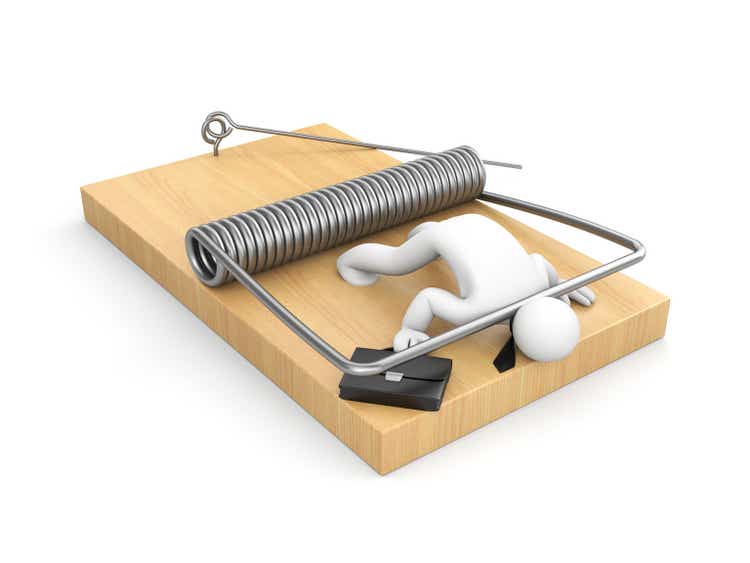

The author’s works on FUBO

FUBO has sold off 28% since I wrote this article. However, I state that despite the stock’s sharp decline, it is far from cheap. In fact, I’m now convinced that fuboTV will run out of cash in less than 18 months, and have downgraded my rating to Sell.

fuboTV’s near-term prospects

FuboTV is a streaming service that provides live sports. Subscribers can access various sports-related content, including live sports events, through various devices such as smart TVs. FuboTV aims to provide a comprehensive streaming experience with a focus on sports-centric programming.

The bullish case is that fuboTV’s paying subscriber base continues to climb, and fuboTV has demonstrated its ability to retain paying customers in a highly competitive streaming market. This is a bull market situation in a nutshell.

The problem is that fuboTV has yet to successfully monetize its paying subscribers. But I’m getting ahead of myself. First, let’s turn our attention to its growth rate.

Revenue growth will slow

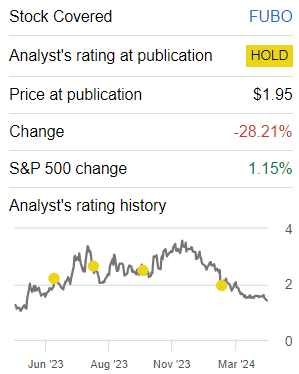

FUBO revenue growth rate

fuboTV looks set for strong 2023 given acquisition of Molotov. But fuboTV’s ability to continue growing in 2024 will slow significantly. In fact, I doubt fuboTV will be able to successfully implement the guidance it previously provided.

Regardless, however, the conclusion is clear: fuboTV is no longer a fast-growing business.

As a result, investors won’t be inclined to pay a premium for a stock whose earnings will decline significantly in the coming year. However, that’s not the whole story. There is a more poignant aspect, which we discuss next.

FUBO Stock Valuation – Shareholder Dilution Could Occur in Less than 18 Months

Whenever I visit any stock, I spend 5 minutes looking at the company’s balance sheet. This exercise has immediate results, but these short 3-5 minutes can provide a huge return on investment. I find that few investors pay attention to the balance sheet.

What we see is that in the fourth quarter of 2022, fuboTV had a net debt position of about $60 million. It’s not great, but it’s not particularly challenging either. This time, fuboTV’s net debt position as of the fourth quarter of 2023 was $155 million. Without looking any further, you can already see that the company’s balance sheet is deteriorating. Looking at a company’s prospects this way is easy to do. You don’t need to be an accountant.

Moving forward, I believe fuboTV will consume $140 million in free cash flow by 2024. Given that fuboTV holds roughly the same amount of cash as net cash, this would mean a reaffirmation of my previous argument that fuboTV will run out of cash within 18 months.

To further complicate matters, given that its market capitalization valuation has begun to shrink, this will mean that fuboTV will have to raise $100 million in cash, and its shareholders will be forced to endure a 20% dilution.

All in all, this is a narrative-heavy, short-profit company. avoid.

bottom line

All in all, while fuboTV Inc. stock is down significantly from its previous highs, it’s far from undervalued. Central to my concerns is the company’s deteriorating balance sheet, highlighted by its escalating net debt position, which has surged from approximately $60 million in Q4 2022 to $1.55 in Q4 2023 One hundred million U.S. dollars.

Looking ahead, the coming cash crunch poses a serious challenge to fuboTV, and my forecast is that free cash flow may burn $140 million in 2024. Raising much needed capital could result in investors being diluted by 20%.