Anthony Bradshaw

Galliano Gold Analysis

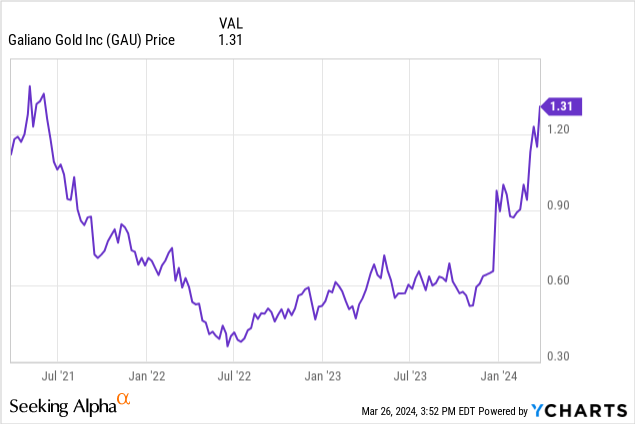

Y chart

this is about galliano gold corp. (NYSE:GAU), recently became a 90% shareholder of Asanko Gold Mine in Ghana Obtain Gold Fields (GFI) owns 45%). The key question for investors is whether Galliano remains an attractive investment opportunity based on current valuations after the stock surged 100%.

While some analysts may be balking at the current stock price, I think Galliano’s stock is undervalued. As a single-mining company that is rapidly becoming a mid-sized producer, Galiano is well-positioned to perform well as it lowers the Asanko mine’s all-in sustaining costs (“AISC”).

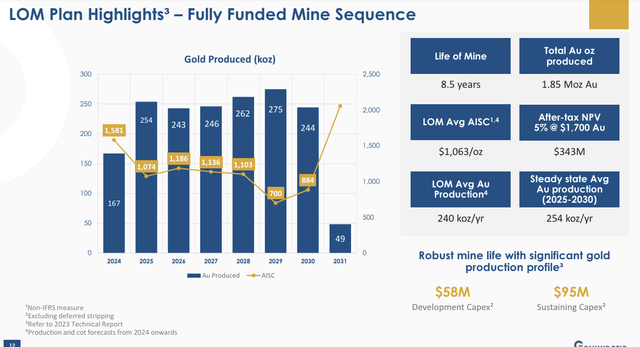

With capital expenditures completed and annual production ramped up to produce 240,000 ounces of gold annually at just over $1,000/oz, Asanko demonstrates Galiano’s continued growth value.

Additionally, Asanko is financially sound, with more than $100 million net cash Zero debt gives the company significant room to invest in its operations and explore meaningful mergers and acquisitions.

Despite some risks, Galliano presents a solid value proposition and upside potential in 2024, which I will explore further.

Galliano’s first mine: breakdown

Gaglianokin

Galiano owns Asanko, one of West Africa’s premier gold mines. In 2023, the mine produced 134,077 ounces of gold with an AISC of $1,522/oz. At an average gold price of $1,908, Asanko generated operating cash flow of $100 million and free cash flow of $48.4 million.

Galliano is committed to returning Asanko to its full operating capacity and improving efficiency. With increased mining activity, the 2025 target is to nearly double gold production from 2023 to 240,000 ounces.

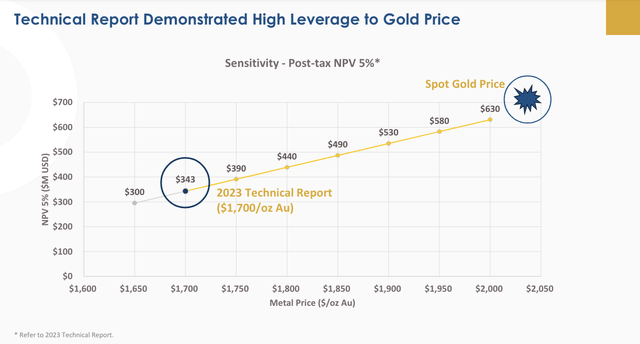

The 2023 technical report provides a promising outlook for Asanko, predicting annual gold production of approximately 240,000 ounces and an average AISC of $1,063. Assuming a conservative long-term gold price of $1,700/oz, the assessment puts the mine’s after-tax value at $343 million.

However, using current gold spot prices leads to a more optimistic valuation, which puts the mine’s value at over $600 million.

Galliano’s strategic agreement with gold mines

As a major strategic move, Galiano Gold announced at the end of 2023 that it had finalized an agreement to purchase Gold Fields’ 45% interest in Ghana’s Asanko gold mine for US$170 million.

The acquisition changed the ownership dynamics, making Galliano the majority shareholder with a 90% interest in the mine, valuing the asset at $377 million on a 100% basis.

Under the terms of the deal, Galliano agreed to issue $20 million in stock to Gold Fields, granting it 19.9% ownership. There will be additional future cash payments of up to $85 million, of which $25 million will be paid by December 31, 2025.

The deal is structured with several flexible terms:

-

A $30 million contingent payment is associated with the production of 100,000 ounces of gold (on a 100% basis) from the Nkran deposit.

-

It is planned to pay installments of US$25 million and US$30 million on December 31, 2025 and December 31, 2026 respectively. This timeline is consistent with Asanko’s operational expansion and ensures Galiano can manage these payments through its projected cash flow.

Following the completion of the transaction, Galiano’s financial position has been strengthened, with its cash reserves increasing to $129 million from $55.3 million under the previous joint venture arrangement.

Gold Fields continues to be involved 19.9% shareholders The recognition of Galliano upon completion of the transaction represents a vote of confidence in the future prospects of the mine and in Galliano’s management. I believe that this stake ensures the success of Goldfields’ continued investment in the Asanco mine and provides Galliano with a “stakeholder” supporting partner.

All in all, this strategic acquisition by Galliano consolidates control of one of the important gold mines in West Africa. It improves the balance sheet and lays the foundation for Asanke Mine’s future growth and operating efficiency.

Assessing Galliano’s Valuation

Even though Galiano Gold’s share price has soared 137% in the past year, I think it still represents an attractive value. Here are three key considerations:

-

Acquisition of Goldfields’ stake in Asanke Gold Mine The total value of the mine is $377 millionsurpassing Asanko’s enterprise value of approximately $245 million, suggesting the stock is trading at a discount.

-

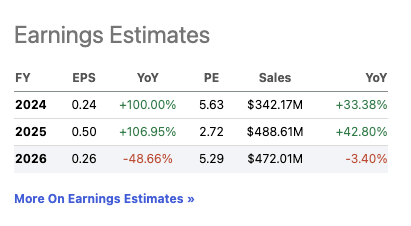

Financial indicators further underscore Galliano’s appeal.Its trailing price-to-earnings ratio (P/E) is 5, and its forward price-to-earnings ratio is 5.04, data provided by Yahoo Finance. Additionally, Seeking Alpha notes that analysts forecast earnings per share (EPS) of $0.24 this year, which equates to a price-to-earnings ratio of 5.63.Analysts forecast median 2025 EPS of $0.50, with the P/E ratio falling to 2.72.

-

According to its 2023 technical report, taking into account a conservative long-term gold price of $2,100 per ounce, the calculated fair net present value of the Asanko mine is $600 million (100% ownership). Given that Galliano owns 90% of the shares, this equates to a valuation of $540 million. Based on this valuation, the net asset value (NAV) per share is $2.13. Galiano stock is currently trading at $1.30, which represents a big deal. Its net asset value is discounted by 61%.

Seeking Alpha

Gaglianokin

Galliano Gold: Risks

Galiano Gold faces operational and legal risks, which are issues investors must consider.

The most recent incident at the Asanko gold mine on March 2, 2024, highlighted these challenges, when a dispute broke out between illegal miners and contracted security personnel near the town of Tontokrom, resulting in the death of three people.

While this tragic incident has not impacted operations at the mine, with the processing plant and southern mining lease continuing as normal, it clearly demonstrates the potential risks associated with the mine’s location.

Furthermore, in February 2023, Galliano reported unfortunate events Two contractors die This is the first major incident since the death of a contractor at the Ghana operation 2015. These incidents have drawn attention to the operational risks present in the region.

From a jurisdictional perspective, the situation in Ghana is mixed.While it is rated the fifth most attractive mining jurisdiction in Africa Fraser Institute latest mining surveyinvestors must weigh the impact of operating in Ghana versus operating in traditionally favorable mining jurisdictions such as Canada, the United States and Australia.

Gagliano King: The bottom line

Despite a more than 100% share price increase, Galiano Gold remains a compelling value investment.

As the controlling shareholder of Ghana’s Asanko gold mine, Galliano expects to produce 240,000 ounces of gold annually at a price of just over $1,000 an ounce as capital expenditures are completed and production ramps up.

Beyond the surface, Galliano’s valuation metrics reveal a deeper appeal. The acquisition of Gold Fields’ stake in Asanko consolidates Galliano’s operational control and signals a valuation relative to its intrinsic value. With a low price-to-earnings ratio and analysts predicting higher earnings per share, Galliano’s forward-looking financials suggest the company is on the verge of a valuation re-rating.

Galiano Gold Inc.’s financial position is strong, including a large amount of cash and no debt, and its stock is well-positioned for future growth. That makes the stock attractive to investors, even given the challenges it faces.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.