Michael M. Santiago

It’s time for the meme stock OG again GameStop Corporation (NYSE:GME); The company will report earnings a few days after the market close on Tuesday, March 26.The financial report is already full Results in recent quarters have been surprising, as the company has desperately tried to reinvent itself and diversify away from a core business that has been moribund for years, with varying degrees of success. We will have an update on these efforts early next week.

I last covered the stock ahead of its third-quarter report, about four months ago, and at that time, the stock price surged following the report. I said the rally was excessive and unjustified, and the stock has fallen about 16% since then. I see many of the same issues in the Q4 report, although we’ll cover some basic developments below.However, overall, I Don’t like GameStop here and believe the odds are in favor of the bears going forward. Let’s dig a little deeper.

Is a bigger collapse coming?

We’ll start with the technicals, where it seems to me that the bulls have a lot of work to do. I have drawn a descending triangle on the daily price chart below which is almost complete. This is a bearish pattern with lower highs, and if it completes, downside risk is expected to reach $7 or $8. I’ll keep the downside price target until we actually see the breakdown, but for now, I believe we’ll likely see GameStop stock in the single digits in 2024.

stock chart

The bottom line is just above $13, so the stock’s performance on the earnings report is pretty volatile. On the bright side, we see that both the PPO and the 14-day RSI are currently strong, which gives the bulls some comfort. However, over the past 10 months or so, the accumulation/distribution line has been very poor and earnings have deteriorated further. As I said, overall, this chart looks like it’s going to break out to the downside, with the potential for a sharp decline. Is the earnings report the catalyst? We’ll find out in a few days.

Complex fundamentals and even stranger decisions

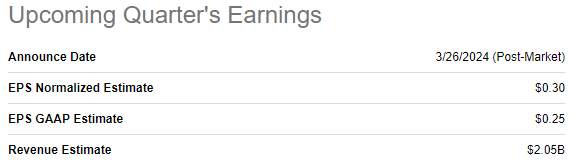

Looking ahead to the report, analysts expect fourth-quarter adjusted earnings per share to rise 30 cents on revenue of just over $2 billion. Keep in mind that the fourth quarter is absolutely crucial to GameStop’s year because it’s the most important for both revenue and earnings given the extreme seasonality of its sales.

Seeking Alpha

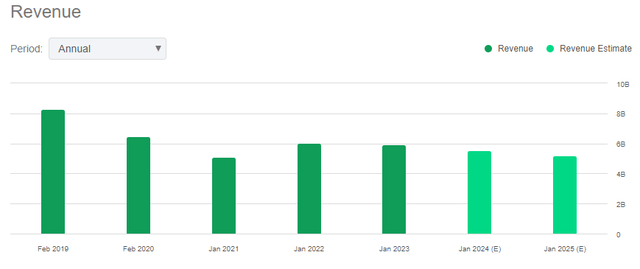

Revenue has been weak for years, peaking in 2019, rising only slightly in 2022, and then falling again in fiscal 2024. As the chart below shows, more weakness is expected next year.

Seeking Alpha

This is clearly a fundamental problem at the heart of GameStop; as I mentioned above, its core business is selling new and used video game systems, games, and accessories that became obsolete a few years ago. Recent data suggests some stabilization across the industry, but keep in mind that GameStop is subject to the release cycles of major games and gaming systems themselves. To its credit, GameStop has tried various methods to stem these declines, but with little sustained success, in my opinion.

The company had tried to enter popular areas such as NFTs, but gave up a few months ago. The fact that this didn’t work surprised no one, but it does illustrate what I think is the board’s desperation to try any method to generate revenue.

In December, investors learned that GameStop was trying to become a mutual fund of sorts, noting that it had changed its investment policy to include any stock it wanted to buy. This is definitely a company that doesn’t have confidence in itself, because companies that believe in their business tend to pay dividends, or buy back their own stock (or both). The fact that GameStop chose other companies instead of buying its own stock is enough evidence that I don’t want to own this company.

What to look for in a report

As far as the company’s existing business is concerned. What I look for in a report are a few things. First, revenue is obviously absolutely critical. You might roll your eyes and think this is obvious, but for GameStop, it absolutely needs a strong revenue performance to help its bottom line. It’s not just about higher income; It’s about operating leverage, and that’s what I’m looking at.

actually

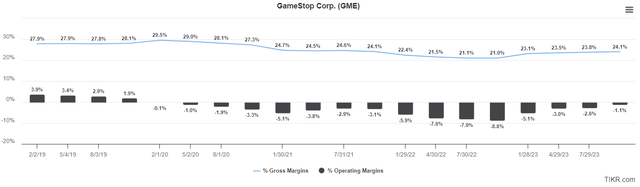

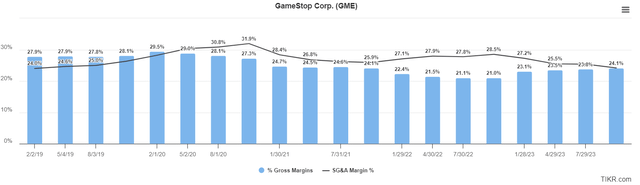

Above we have the gross margin and operating margin for the trailing twelve months, and we can see that there has actually been some material improvement.The gross profit margin is bad For GameStop, they’re still in the mid-1920s. However, there has been an improvement from the very negative levels of recent quarters, and if this continues, GameStop has a chance of turning a full year profitable in the near future.

actually

The key is selling and administrative expense (SG&A) costs, which we can see above in relation to gross margin.Note that since 2020, SG&A costs are actually higher Higher than gross margin, this is completely unsustainable for any business. To its credit, that gap has narrowed as of last quarter, so we’ll need to see further progress in the upcoming earnings report. SG&A costs are heavily dependent on revenue performance, so I’ll go back and say revenue numbers are critical here because they heavily impact margins. If we see good revenue performance, margins should improve significantly. If not, well, you know.

Valuations have improved, but are they enough?

GameStop doesn’t have sustainable profitability, so we can’t say that about it. However, we can value it using a price-to-sales ratio, which we’ll do below to understand what we’re dealing with.

Seeking Alpha

As we can see above, its P/E ratio currently stands at 0.73, which is well below last year’s average. Is this cheaper? If we consider that operating margins have improved significantly over the past few quarters, then that helps the idea that perhaps its valuation is much better today than it was before. The logic is that as profit margins rise, each dollar of sales becomes more valuable, which will result in a higher price-to-sales ratio (all else being equal).

However, I believe that given the company’s huge fundamental issues and its previous extremely inflated P/E ratio, the valuation decline is simply reversion to the mean rather than the stock becoming “cheap” on a fundamental basis. As always, valuation is in the eye of the beholder, so it’s subjective, but I don’t think it’s a reason to buy the stock ahead of earnings.

In response, I saw a pattern on the price chart that looked extremely bearish. I’ve also seen a company be so unsure of its future that it tries to turn it around by holding shares in other companies instead of its own. On the bright side, margins have improved significantly, but with revenue set to decline further in the coming quarters, I wonder how durable this is. Without new, substantial cost savings, operating margins could deteriorate further due to lower revenue.

Ahead of the upcoming report, I maintain a sell rating on GameStop Corp. stock as I see no reason to hold the stock. If the stock goes up after the report without me being there, so be it; in my opinion, the risk of a further collapse in the stock is greater than the risk of a new rally.