Anthony Bradshaw

Many investors appear to be ignoring gold and the gold mining industry in favor of “hot money” investments such as Bitcoin and artificial intelligence stocks like Nvidia (NVDA). However, gold prices have hit new highs recently. Gold prices are likely to rise further in the coming years. Gold mining stocks are generally not hitting new highs, which creates a value disparity and potentially strong buying opportunities. Some major looming concerns around the world could cause gold and gold mining stocks to rise strongly in the coming years, which could trigger a secular bull market for precious metals and miners.

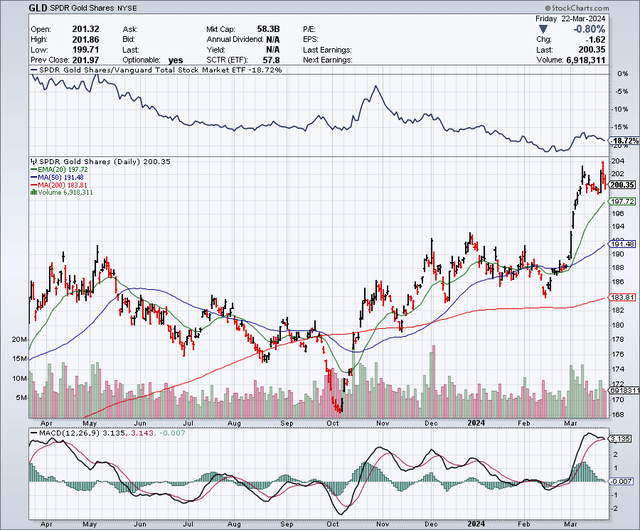

Gold five-year trend chart

As the 5-year chart of the SPDR Gold Stock ETF (GLD) shows, gold prices have just recently surpassed previous levels. A record high. This type of breakout usually leads to greater gains, although there may be retracements along the way. Notably, the 50-day moving average recently broke above the 200-day moving average, which created a bullish “golden cross” pattern on the chart.

StockCharts.com

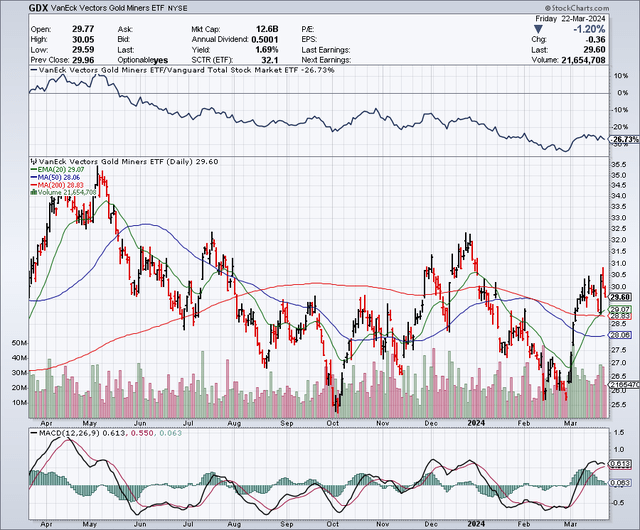

5-year chart of gold mining stocks

As the 5-year chart of the VanEck Vectors Gold Miners ETF (NYSE:GDX) shows that the all-time high price rebounded to around $42 in 2020. Despite its gains in recent days, it is only trading in the $29 range, which would represent a potential gain of around 40% if it returns to its previous highs. It is worth noting that compared to gold ETFs, there is no “golden cross” pattern on the chart. However, the ETF’s share price is currently trading above its 50-day and 200-day moving averages, and if this continues, it’s only a matter of time before gold mining stocks signal a potential breakout via the gold line. Cross formation. If that happens, I believe this ETF will play off the previous $42 high and probably generate gains of about 40% over the next year or so, with potentially even bigger gains in the coming years.

StockCharts.com

There are several reasons why investors could benefit from investing in gold and especially gold mining stocks, which appear to be undervalued at current levels and have the potential to breakout. Now let’s look at some of the reasons:

#1 US Treasury Bond

America’s debt is at record levels and accelerating at an alarming rate. I’m not a big fan of Bitcoin, but I can understand why people around the world are desperately seeking a “store of value.” Many third world countries have experienced massive currency devaluation and inflation, and they are right to want some kind of asset that central banks cannot print. As U.S. debt levels reach record levels, the United States is looking more and more like a Third World country when it comes to fiscal responsibility. The U.S. debt currently exceeds $34 trillion, equivalent to more than $102,000 per citizen. Since many citizens do not pay taxes, this debt burden amounts to approximately $267,000 per taxpayer. This means that if you are a taxpayer, your debt portion is at such a high level and growing.If you’ve never seen the U.S. Debt Clock, take a look hereyou can see how alarmingly and how rapidly our debt burden is growing every minute.

Another way to analyze the U.S. debt load is to compare our country’s gross domestic product, or “GDP,” to the debt load.U.S. government debt currently equals approximately 124% The country’s nominal GDP. By comparison, in 1974, U.S. debt was only 35% of GDP. As recently as 2019, debt was 105% of GDP, which shows how bad things have gotten in just four years.

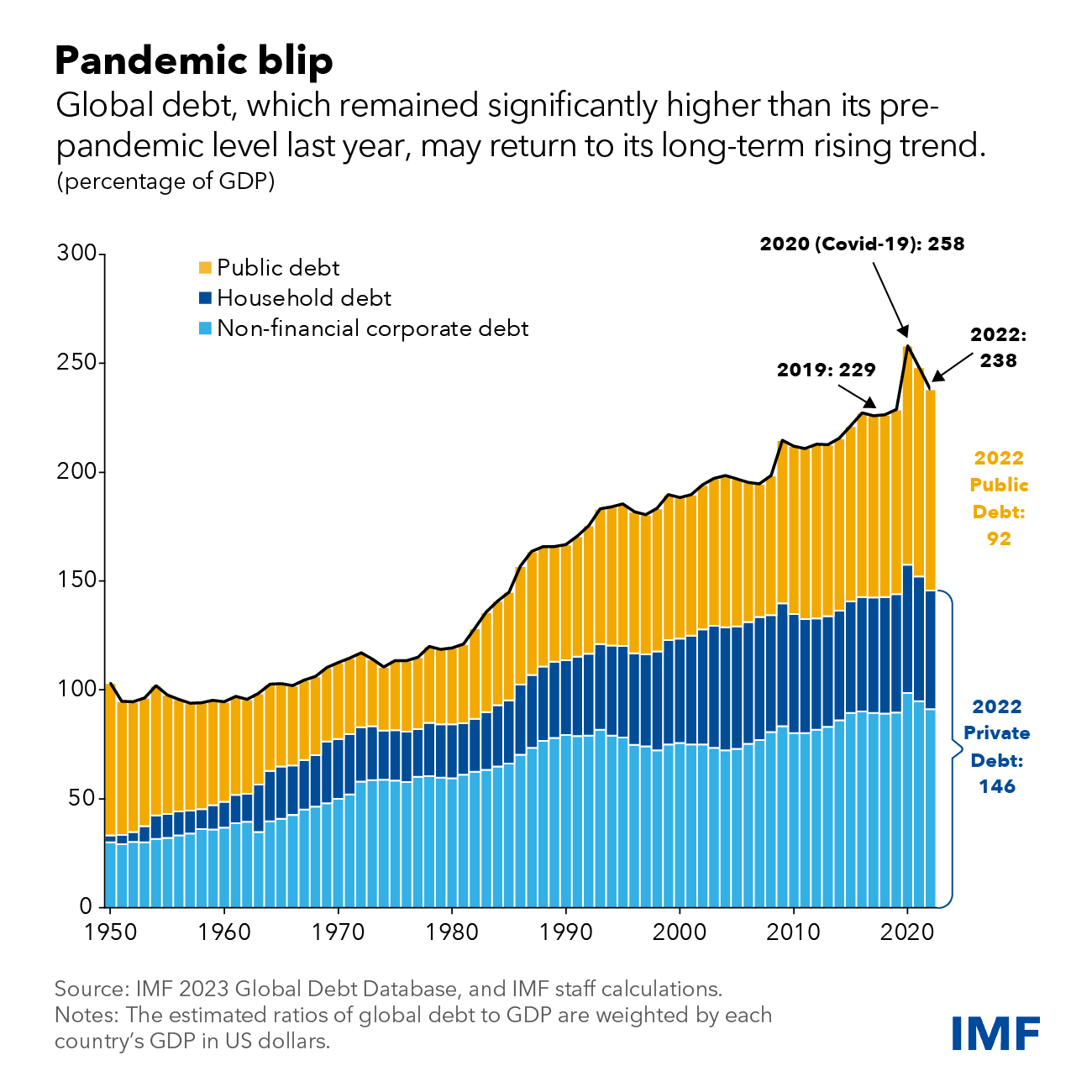

many Countries are heavily in debt. If you remember the huge concerns about Greece’s debt levels a few years ago, it’s worth noting that their debt-to-GDP ratio is currently about 172%. Venezuela is currently around 133%. Most investors know that Venezuela is not an economy we want to emulate, but within a year or two we could easily be at the same debt-to-GDP ratio. As investors, we need to keep an eye on U.S. debt levels, but we also need to consider global debt levels getting out of control, which is a very bullish factor for gold and gold mining stocks. As can be seen from the chart below, global debt levels continue to rise. The International Monetary Fund, or “IMF,” is concerned about the sustainability of this growing debt burden. In February 2024, the International Monetary Fund announced that global debt hit a record high $313 trillion. This shows that the world is deeply in debt and continues to grow. Debt can lead to slower economic growth and can also lead to debt and currency crises. Investors can hedge this risk by holding gold and gold mining stocks.

IMF Global Debt Database 2023 and IMF staff calculations

#2 Banking System

Even though the U.S. economy has been strong, we’ve seen some regional banks suddenly fail. Banks are inherently highly leveraged business models, and therefore, I no longer invest in banks. As most of us use “seeking alpha” to improve returns and expand our knowledge about opportunities, I enjoy (and take seriously) reading what Avi Gilbert has to say, and for a long time he has in warning us of potential risks to the U.S. banking system. He made many prescient calls, and it makes sense to take these warnings seriously. I think my biggest concern is, if we see some very large regional banks fail when the economy is strong, what’s going to happen if our banking system actually goes into recession? When the economy gets tough, banks tend to fall like dominoes.

Some of the bank failures that occurred in 2023 were at least partly the result of huge losses on bonds caused by the Federal Reserve’s sharp interest rate hikes.This is still an issue for some banks, but another issue is commercial real estate loans Many banks began to suffer losses. If we experience a recession, this could create another huge risk for the banking industry.

#3 Central banks are buying gold

according to Bloomberg, global gold demand hit a record high in 2023, and continued central bank gold purchases are expected to continue until 2024. Some of these purchases appear to be based on the idea that the Federal Reserve will begin cutting interest rates in 2024, making gold a more attractive asset. There are also countries that are trying to end the dollar’s dominance as a reserve currency, and gold is one of them.

#4 Falling interest rates could boost gold and mining stocks

There are approx. $6 trillion money market fund Currently, but the Fed is expected to lower interest rates in 2024 or even longer. As interest rates fall, holding assets like gold becomes more attractive. Currently, money market funds yield over 5%, but that could be cut by half in the next few years, which could lead many investors to look for more attractive investment options. If there is a recession in the next few years, consumers are worried about the banking system, which may boost demand for gold, and gold mining stocks will benefit from this.

What I don’t like about gold and mining stocks

The value of gold is likely to fall, especially if interest rates remain high for an extended period of time. Gold mining stocks tend to be volatile, which could represent a greater downside risk than expected for some investors. Gold mining companies are often located in unstable countries, and mining is inherently dangerous. For this reason, I never invest too much in a single gold mining stock. GDX is diversified by investing in many gold stocks, which reduces geopolitical risk as well as the risk of a major security incident.

In short

Gold is currently trading at an all-time high, and this breakout could ultimately fuel a similarly breakout rally in gold mining stocks to new highs. Investors may become increasingly concerned about having so much of their net worth invested in the U.S. dollar and in U.S. banks. The dollar and the U.S. banking system and national debt levels may pose greater risks than many of us currently realize.The U.S. national debt is said to increase by approx. $1 trillion, once every 100 days. The only way to resolve this debt seems to be either to have a debt crisis or to eliminate it by reducing the purchasing power of the dollar over time. Both solutions are highly beneficial to the gold and mining industry. I think it’s only a matter of time before gold makes higher highs, which should help fuel a rally in GDX that could take it back to its all-time highs (which would be a 40% gain) or even higher.

No warranties or representations are made. Hawkinvest is not a registered investment adviser and does not provide specific investment advice. This information is for reference only. You should always consult a financial advisor.