bernie_photo/iStock via Getty Images

GAMCO Global Gold, Natural Resources and Income Trust (NYSE: GGN) invests in energy and natural resources through a short-term call option strategy to generate dividend cash. Over the past few years.Our articles e.g. GGN: Prevailing tailwinds await CEF, The importance of such funds to take advantage of growth and earn generous dividends is highlighted. Our optimistic belief is about to be realized. Fund prices break out from a long period of consolidation. Prices tracking fundamentals appear poised to move higher. Grab your magnifying glass, hold it in front of you, and let’s start looking around.

fund

the fund Define it as:

“A non-diversified, closed-end management investment company seeking to provide a high level of current income…Under normal market conditions, the Fund will attempt to It achieves its objectives by investing at least 80% of its assets in equity securities of companies primarily engaged in the gold industry and natural resources industry. “

It also sells call options to generate income, hoping the price is high enough to avoid the shares being called.

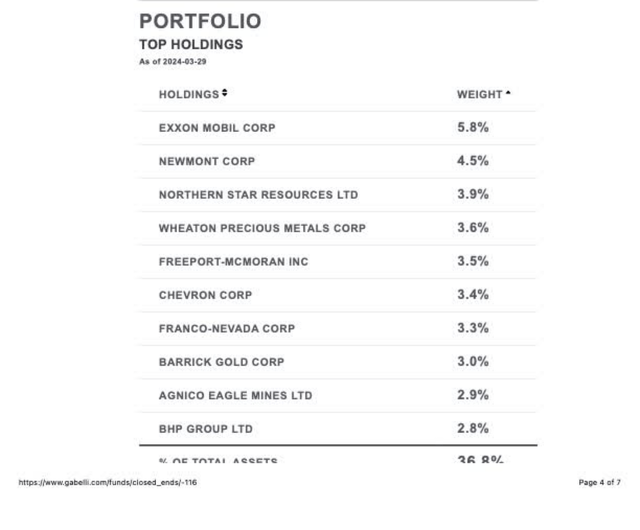

The top ten holdings shown in the next slide include major oil and metals companies.

GAMCO

The company also provides daily updates

GAMCO

On the last day before the release, the NAV was equal to $4.07, while the stock price closed at $4.10, which was still lower than the NAV and there was a material difference.

Fundamental

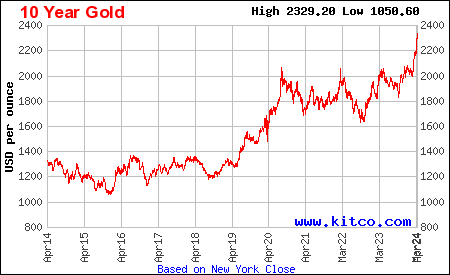

Most holdings include gold assets or crude oil producers. It is crucial to follow the pricing of both commodities. Let’s look at gold first.From the diagram we include GGN: Prevailing tailwinds await CEFillustrating the inverse relationship between gold and interest rates.

macro trends

While rate cuts remain on hold, analysts expect at least a modest cut this year. This will strengthen the bullish stance.

Gold broke above the $2,000 resistance level, as shown in the chart below.

Kit Corporation

A breakout of $2,000 from the $1,000 base would mean another $700 to $3,000 is possible.

Additional powers are outlined in 3 Catalysts That Could Boost Gold Prices Including central banks buying large amounts of gold to hedge against inflation. From the article,

“Following surprisingly strong performance in 2023, we expect further price increases in 2024, Driven by the triple power——Chasing hedge funds, central banks continue to steadfastly buy physical gold, especially new demand from ETF investors. “

Next, let’s discuss oil fundamentals.we write in Crude oil prices turn north following long-term fundamentals,

“Crude oil prices are in the low $80s, which is a resistance/support level. A retracement represents resistance, a breakout represents support. The next resistance point is the $110 to $120 range. If the market breaks through $85, expect a rise of more than $100 or $15 above”.

At the time of publication, crude oil prices were near $90. For the reasons mentioned in the article, especially strong demand, we expect prices to reach over $100 early in the summer before falling back throughout the remainder of the season.

Both commodities are in a bullish position for quite some time to come.

Options

In this strategy, management sells covered calls. In the past, we looked at the top 10 holdings, prices, and call strike prices. The purpose illustrates how management can effectively set a strike high enough so that no stock subscriptions are required, while still generating the cash needed to pay dividends. In this analysis, we use a different approach. We have been looking at the NAV published on the website each day and comparing it to the value published in the annual or six-month reports. Management has sold enough call options in the past to cover most, if not all, of the stock. Once the strike price is hit, asset growth slows or stagnates. Next included is a table for reviewing the current asset value and the past values of the other two.

| Net asset value (millions) | June 2023 | December 2023 | current value |

| net asset value | $600 | $613 | $706 |

| Cost basis vs. actual value | $770 vs. $705 |

Obviously, total net asset value has grown 15% so far, following fundamentals, which is reasonable.Since this year, crude oil Up $15 from $73 or 20%, while gold is $300 up from $2,000 Early January or 15%. Within reason, management is maintaining a profitable strategy.

Looking to the future

We have added daily charts for funds generated using TradeStation.

trading post securities

The GAMCO Global Gold, Natural Resources and Income Trust broke out and we expect it to continue higher and possibly even move into mid-range, with major holdings continuing to maintain their bullish stance.

risk

We first raise the risk that this isn’t a long-term hold similar to The Coca-Cola Associates (COKE). We believe this is a medium-term, several-year trading entity. Recession is a negative risk for oil assets. Gold is continuing to rise and is unlikely to stop anytime soon. Major countries in the world, including China, are buying gold like crazy, while gold production appears to be at a standstill. With this in mind, we’re pleased to maintain our Buy rating. At some point, this will become a sell because we don’t expect the dividend to increase with the price, so the yield may be lower than we expect. Until then, it’s a buy.