Miscellaneous Photography

Gilead Sciences (Nasdaq: Gilder) is probably one of the most discussed biotech investments.Before competition hurt its market position, the company leveraged an extremely strong HIV business and was actually the first to cure hepatitis C. basically.

Since then, the company has become known for making large acquisitions that have struggled to succeed. Still, times seem to have finally changed. The company is building an exciting new oncology business, which we expect will be able to generate strong returns for shareholders in the future.

Gilead Sciences 2023 Results

The company’s 2023 results are quite strong, with a market capitalization of just under $94 billion.

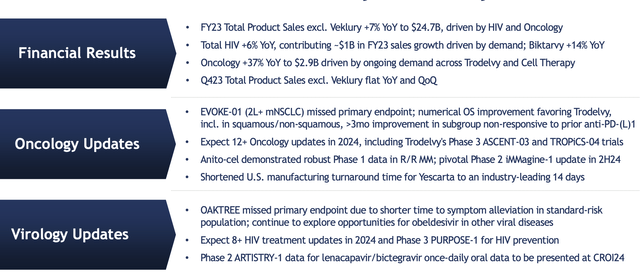

Gilead Sciences Investor Introduction

The company’s total product sales (excluding Veklury) in fiscal 23 grew 7% from the same period last year to nearly $25 billion.The company has successfully maintained its HIV portfolio strong and The company’s oncology portfolio also performed well. The annual growth rate of oncology is 37%, an astonishing increase, reaching nearly 3 billion US dollars. This means the company’s business finally reached double-digit positions.

Now it’s a strong business in its own right. The company expects to have significant trial data in 2024, which is exciting for oncology, and it’s also working to expand its manufacturing turnaround, which is impressive. In oncology, quick turnaround is more important than anything else.

The company did miss the finish line for OAKTREE, but with COVID-19 on the decline, that matters less.

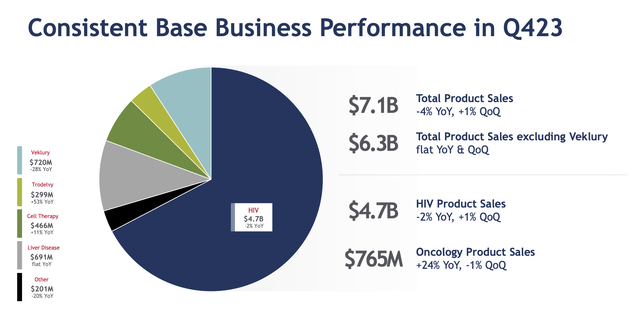

Gilead Sciences performance

This shows the company’s business performance by segment in the most recent quarter, which we discussed in the section above.

Gilead Sciences Investor Introduction

The company ended the year with quarterly earnings of $7.1 billion. That represented roughly 30% of the company’s quarterly earnings for the final quarter of the year, and was a great way to end the year. The company’s product portfolio continues to be HIV-focused, accounting for 66% of sales last quarter, but the company is expanding into other businesses.

Excluding Veklury (COVID-19), the company’s revenue was $6.3 billion, with about 90% of that coming from security. Worryingly, the company’s oncology product sales fell 1% from the previous quarter. But that’s still a big quarterly difference, and we expect the company to pick up in the coming quarters.

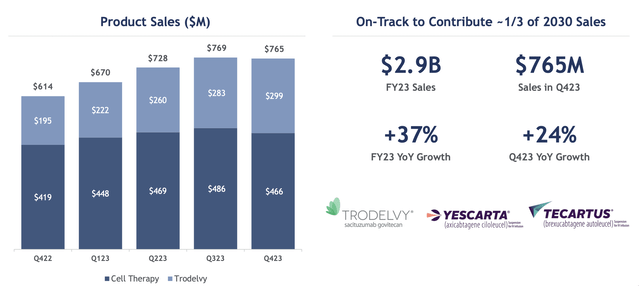

Gilead Sciences new business

This showcases the company’s new business. The company still targets 1/3 of its 2030 sales to come from the oncology business.

Gilead Sciences Investor Introduction

The company has four active clinical trials here and has sales approaching $3 billion. The company is looking for four product line extensions that it believes can help round out its product portfolio. Trodelvy has officially become a blockbuster, albeit an extremely expensive acquisition. analysts expect Annual sales >$2-3 billion.

The company’s cell therapy business makes billions of dollars a year, but the company needs to work to build capacity due to the complexity of manufacturing.We discussed some of that above, but companies expect By 2026, production capacity will roughly double. This could allow the company to double its revenue in the segment over the next few years.

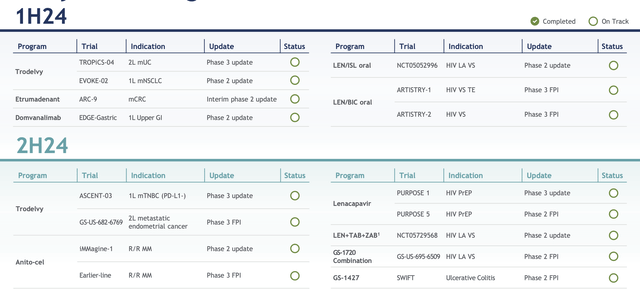

Gilead Sciences 2024 Milestones

The company has a number of milestones set to hit in 2024, and we’re watching closely.

Gilead Sciences Investor Introduction

These include the company’s core growth drug Trodelvy, with multiple Phase 3 updates that could allow the drug to expand its indications and increase revenue. The company’s latest HIV drug, Lenacapavi, also has some potential Phase 3 approvals. That will be some exciting data to see in the second half of the year.

There are also readouts here for some drug combinations, as well as some of the company’s new drugs.Some like Anito-cel can potentially Sales are in the billions, but they are still very young drugs. We avoid being too optimistic about this given the company’s previous disappointments with new drugs.

Gilead Sciences Financial Corporation

Ultimately, in the face of all the noise above, the problem comes down to Gilead Sciences’ financial health.

Gilead Sciences Investor Introduction

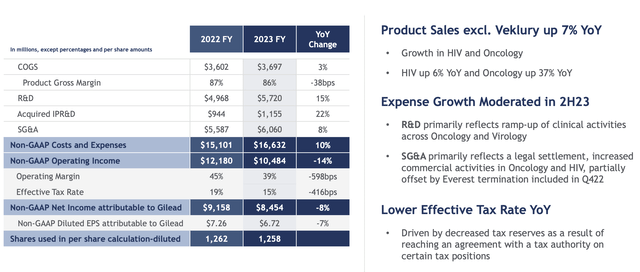

The company’s cost of goods sold remained strong, supporting higher product gross margins. The company’s R&D expenses did rise significantly, resulting in large non-GAP costs and expenses (up 10% year over year). This resulted in the company’s operating income falling 14% compared with the same period last year. The company’s net operating margin fell to less than 40%, which is always disappointing.

But the company’s valuation remains low. Its outstanding shares fell from 1.262 million shares to 1.258 million shares compared with the same period last year, which is exciting in the continuously dilutive technology world. Meanwhile, the company’s stock price of $74 per share means its price-to-earnings ratio remains just 11 times despite declining revenue. Investors remain unconvinced by the company’s story.

That’s not surprising given the recent setbacks. The company will continue to invest in future growth, with R&D expenses expected to grow by double digits to nearly $6 billion. We need to see R&D succeed.

Dissertation Risks

The biggest risk to our thesis is the company’s ability to develop new market segments. The company spent billions of dollars on acquisitions that ultimately failed. Even its new oncology portfolio is complex, requiring the company to tediously build out its manufacturing capabilities and new customer relationships.

The company sets aggressive goals, but these goals may not lead to success for the company and its shareholders.

in conclusion

Gilead Sciences has an exceptionally strong 2023. The company is finally starting to show results from its acquisitions, with oncology sales up significantly from the same period last year. Meanwhile, the company’s HIV portfolio remains unparalleled and it continues to launch new drugs despite the noise from other companies.

Still, the company has a long way to go to prove itself. The company increased research and development spending by double digits to nearly $6 billion. The company needs R&D spending to be successful to justify its investment and enable it to deliver strong long-term returns to shareholders. We expect the company to succeed based on its oncology strengths, but overall we think the company is a strong investment.