ligora/iStock via Getty Images

introduce

As explained in a previous article, Graston Land’s business model (NASDAQ: LAND) is very simple: REITs own farmland and lease it to farmers.It will not experience successful or disappointing harvests In addition to the impact on tenants. As of the end of 2023, Gladstone Land owned 168 farms in 15 states with nearly 112,000 acres of land. I remain very interested in the REIT’s preferred shares, and am particularly interested in LANDM’s value proposition as these securities either become redeemable before the end of January 2026 or the preferred yield jumps to over 8%.

REITs remain optimistic about FFO

Obviously, I’m primarily interested in a REIT’s ability to generate positive FFO and AFFO.Not because I’m keen on going long Common stock, but mostly because I want to make sure preferred stock dividends are still fully paid.

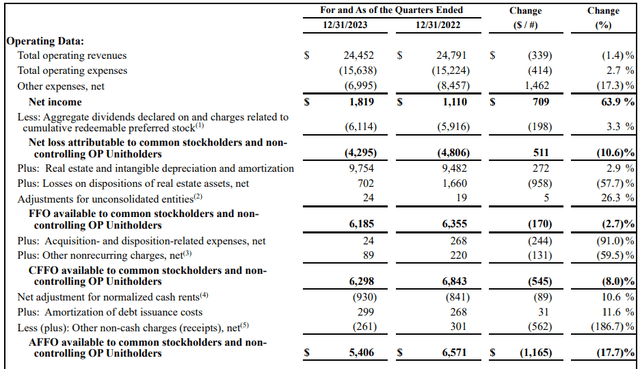

Looking at the fourth quarter results below, you can see that after adding depreciation expense and loss on asset sales, net loss was $4.3 million, resulting in FFO of $6.2 million. AFFO for the final quarter of the year was $5.4 million, or $0.15 per share based on 35.8 million shares in the quarter. That’s enough to cover the distribution of $0.139 per share.

Gladstone Land Investor Relations

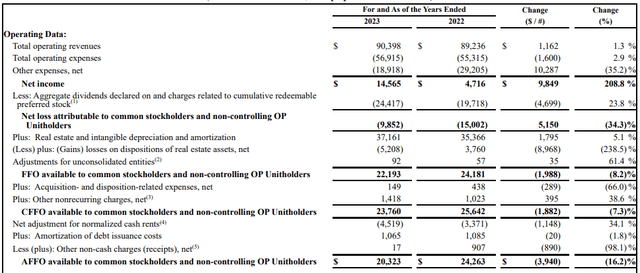

Taking a look at the full-year results below, you’ll see that AFFO came in at $20.3 million, with earnings per share just under $0.57. While this means the distribution of $0.554 per share is still paid, the dividend yield rises to a relatively unsettling 97%.

Gladstone Land Investor Relations

This was actually a pretty weak performance considering how much interest expenses Gladstone Land paid compared to the previous year. While this is certainly difficult for common unitholders, I view the results primarily from a preferred shareholder perspective. Despite the decline in preferred stock dividend coverage, the REIT still generated approximately $45 million in AFFO before preferred stock dividends, while the nearly $25 million in preferred stock dividends represented a payout ratio of approximately 55%. That’s a bit on the high side compared to what I like (I usually prefer to see a payout ratio below 20%), but I like Gladstone Land’s large land bank and it does provide good asset coverage.

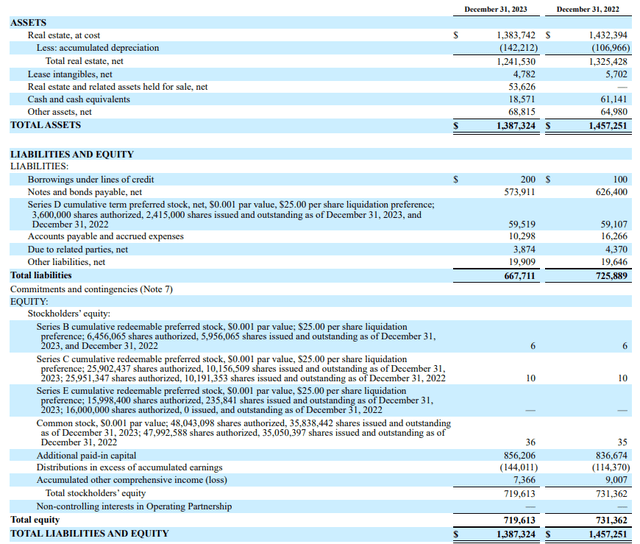

As shown below, the balance sheet contains $1.39B in assets, backed by $720M in equity. Of this $720 million, approximately $410 million is preferred stock, as approximately 16.35 million preferred shares are outstanding. It’s important to see that the Series D preferred stock (which I’ll discuss in more detail later) is listed as a liability on the balance sheet due to the mandatory redemption date.

Gladstone Land Investor Relations

In the worst-case scenario, if Gladstone Land chooses not to redeem these preferred shares, they will return to the equity stack, resulting in a total equity capital of approximately $780 million, of which approximately $470 million is preferred stock.

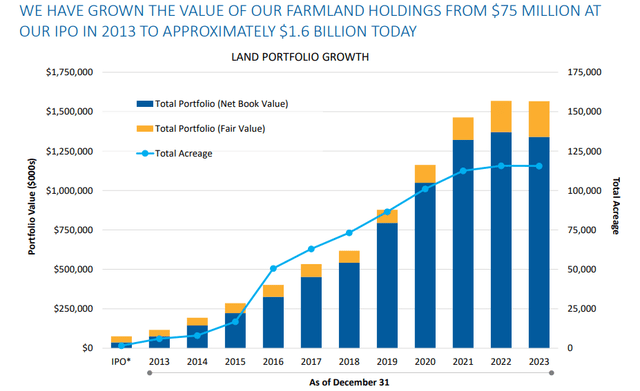

This does mean that the cushion of $310 million (total equity minus preferred shares) is relatively small, but there’s more than meets the eye. While most REITs must deal with the difference between the book value and fair value of their assets, few actually bother to publish the fair value of their assets. According to Gladstone, the fair value of its farmland is approximately $1.6B, which is hundreds of millions more than book value. That sounds realistic, and by the end of 2023, the REIT sold a farm for $66 million. The company originally purchased the farm seven years ago for $54 million, but it had an appraised value of just $64 million.

Gladstone Land Investor Relations

This means that the safety net of asset coverage could be much higher than $310 million, perhaps even double that, making the asset coverage of the preferred stock acceptable.

I like the term short-term fixed income preferred stocks

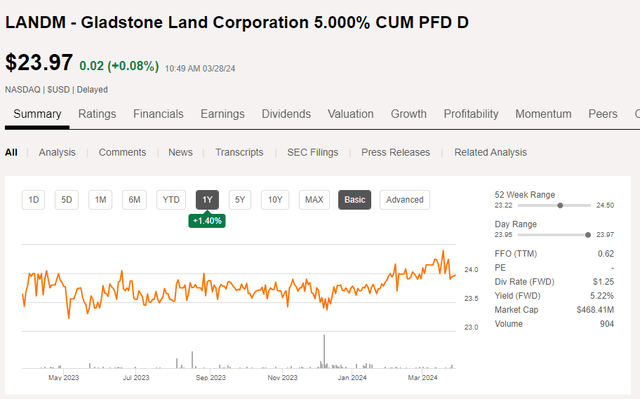

In my article last year, I focused primarily on the Series D preferred stock issued by Gladstone Land. These securities are being traded with (NASDAQ: LANDM) as the stock symbol and provides an annual preferred stock dividend of $1.25, paid in twelve equal monthly installments. Although Gladstone Land must redeem these preferred shares by the end of January 2026, if Gladstone Land fails to redeem these preferred shares, the preferred stock dividend will increase to $2 per year.

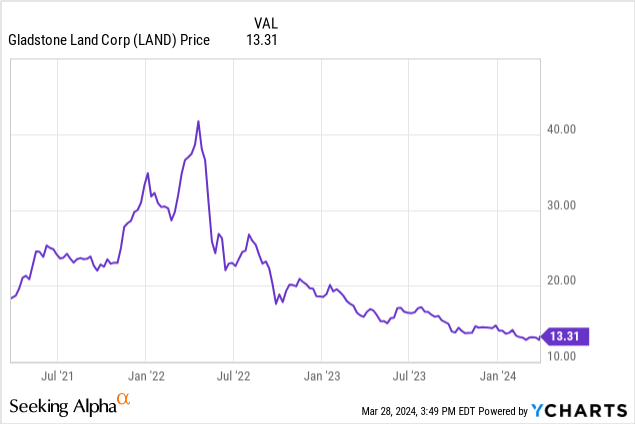

Seeking Alpha

This means there are two possible ways to view LANDM. The first is to assume that the securities will indeed be redeemed in January 2026, in which case the capital gain would be approximately 4.3% based on the current share price of $23.97. The yield on mandatory redemption is about 7.4%, which I think is quite attractive for a short-term security.

However, it does need to be noted that Gladstone would rather pay the 8% coupon than risk the security redemption. In this case, an annual preferred stock dividend of $2 would represent a yield of just over 8.3%, which is also perfectly acceptable compensation.

investment thesis

Although I love farmland, I have no position in Gladstone Land and have no intention of entering a long position. I do write some puts with a $12.50 strike price expiring in April and May, but I expect not to allocate any shares and may close those positions before expiration.

I currently hold a small long position in Series D preferred stock (LANDM) and may increase that position. While Graston Land’s disappointing performance primarily hurt common shareholders, preferred stock dividends were well covered, along with a substantial junior stake ranking below the preferred stock. I like the trade-off between getting a 7.4% annualized return over 22 months or increasing the preferred dividend yield to about 8.3-8.4%. I’m fine with both results.