onur dongle

GIC seeks stability

I have been discussing global industrial companies (NYSE:GIC) In the past, you can read the latest article published on January 9 here.The company continues to strengthen its e-commerce sales pipeline and traditional marketing effort. Its competitive pricing initiatives, including lower freight costs and promotional activities, should gradually improve its operating margins in 2024. On top of that, improved cash flow in 2023 should also improve investor sentiment.

However, industrial activity in the United States slowed in 2024. Given the current volatility of international routes, managing freight cost structures will be challenging in the short term. GIC recently increased its quarterly dividend, supported by a debt-free balance sheet and improving cash flow. The stock is relatively overvalued compared to its peers. However, I think industry drivers and cost management measures will expand its operating margins in the medium term.So, investors It would be nice to “hold” the stock.

Why did my rating remain the same?

In GIC’s last iteration, published on January 9, I discussed its investments in e-commerce channels and traditional one-to-one sales pipelines. Additionally, the acquisition of Indoff (May 2023) strengthens its B2B e-commerce platform and expands its product portfolio. However, it faces profit headwinds. In a previous article, I wrote:

GIC invests in digital transformation to improve returns, which helps expand its national and public sector accounts. The recent contract for floor cleaning equipment from Vizient is the latest addition in this direction. Another growth factor is the impact of the acquisition of Indoff, which distributes many products and has a large network of sales partners. In addition, the utilization of its B2B e-commerce platform has also been enhanced after the acquisition.

After the third quarter, the company focused on digital marketing, pricing intelligence and analytics to improve its sales and marketing efforts. The acquisition of Indoff continues to help strengthen its solutions-based approach. However, manufacturing appears to be shrinking in 2024. Margins are also likely to face some near-term pressure, although they should improve over time. Given the relative valuation multiples, I reiterate my “Hold” rating on the stock.

Current strategy: Stabilize profit margins

GIC 2023 Fourth Quarter Financial Report

GIC invests in sales, marketing and profit performance. It emphasizes digital marketing optimization, enhanced pricing intelligence and analytics. Its focus is on fine-tuning customer satisfaction, including helping customers choose the right core products and refill consumables. It improves category marketing.

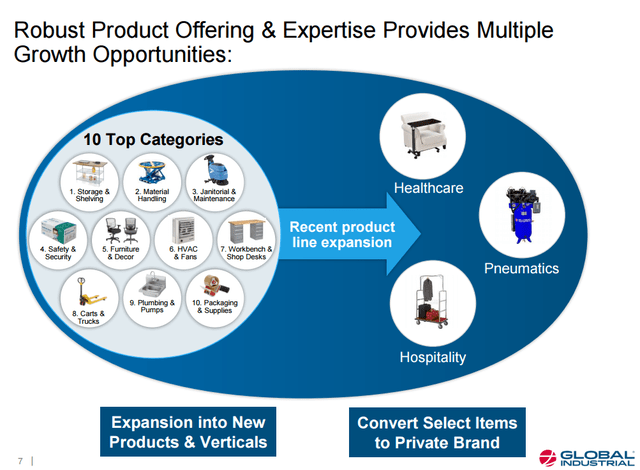

As discussed in my previous article, GIC acquired Indoff, a marketer of material handling products, commercial interiors, and commercial products, in May 2023. Indoff’s e-commerce platform enhances GIC’s network performance and its enterprise products. This strategy aligns perfectly with the company’s approach of providing a comprehensive solutions-based approach. It has enhanced product training and leveraged project management and installation capabilities to expand its product range.

Some challenges and industry outlook

After organic sales grew 5.1% in the fourth quarter, GIC may see lower growth due to seasonal factors. However, investors should also note that since GIC sells winter products, the negative impact is usually offset in the winter. From the end of the fourth quarter to the beginning of the first quarter, the company appeared to have recovered. However, I think investors should view the market with caution. The company aims to maintain stable pricing but may face sales headwinds.

From an industry perspective, the MRO market is likely to see “low single-digit growth,” as GIC management expects. Still, I see growth opportunities for the company as the market is fragmented and only small businesses with the right strategies can achieve growth.

Trade Economic Network

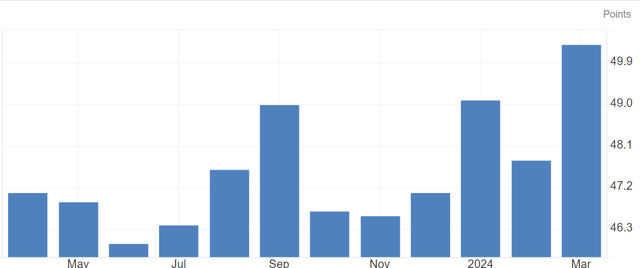

The ISM manufacturing PMI rose to 50.3 in February from 47.8 in February. This showed expansion in manufacturing activity and new orders. On the other hand, employment continued to decline, while prices slowed in March.

In the past three years, the average PPI in the manufacturing industry has grown by 1.4%, and the company’s adjusted EBITDA has grown by 24%. I expect the U.S. manufacturing index to remain stable, but not to see much upside in 2024. Given the company’s responsiveness to industry activity, its adjusted EBITDA should grow 15% to 20% in fiscal 2024.

Profit outlook

Seeking Alpha

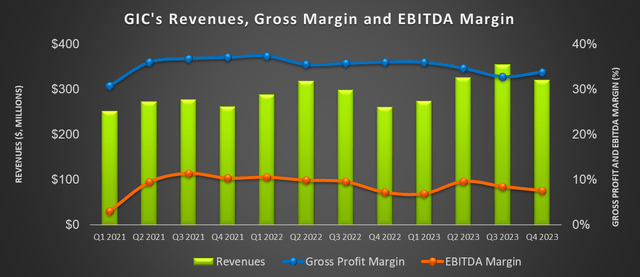

GIC’s adjusted gross profit margin fell 220 basis points annually in the fourth quarter. While Indoff’s gross margin remained stable during the period, its margins were lower than organic GIC’s (35.9% in Q4 2023). Investors may note that the management of margin positions is a key area of focus for GIC.

It employs competitive pricing initiatives, including reduced freight costs and promotions. As Indoff’s contribution to margins is expected to increase, I believe the company’s consolidated gross margin will contract in the first quarter. Additionally, disruptions to Red Sea shipping due to geopolitical tensions could lead to double-digit increases in freight costs in the short term. Therefore, it remains focused on maintaining its gross margin position despite margin headwinds.

Looking back at Q4 drivers

In the fourth quarter of 2023, GIC’s revenue increased by 23% year-on-year. declare in its fourth-quarter earnings press release on February 29. Organic revenue in the U.S. grew 5% and organic revenue in Canada grew 7%. E-commerce and digital sales accounted for the majority of its order volume in fiscal 2023. Private label demand accounted for 50% of its sales in fiscal 2023 and remained stable compared with the same period last year.

Cash flow and debt levels

In fiscal 2023, GIC’s cash flow from operations (or CFO) more than doubled from a year ago, primarily due to higher revenue. Free cash flow (or FCF) excluding acquisitions grew 1.5x in fiscal 2023.

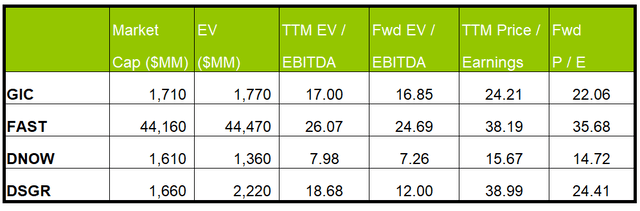

As of December 31, 2023, GIC’s liquidity totaled $131 million. It has no debt, giving its balance sheet an advantage over some peers (DNOW, DSGR and FAST). Due to the strength of its balance sheet, the company recently increased its quarterly dividend by 25% to $0.25 per share. This is equivalent to a dividend yield of 2.3%, which is higher than peer FAST (dividend yield of 2%).

Relative Valuation and My Estimate

The author creates and seeks Alpha

GIC’s forward EV/EBITDA multiple shrinks less than its peers compared to current EV/EBITDA, which typically results in a significant reduction in EV/EBITDA multiples. However, its EV/EBITDA multiple (17x) is slightly lower than the average of its peers (FAST, DNOW and DSGR). Therefore, the stock is reasonably valued, but with a negative bias. It trades above its average over the past five years.

GIC’s average EV/EBITDA multiple over the past five years is 13.2x. If the stock were trading at its past average, it could be down 20% from current levels. The average EV/EBITDA multiple of GIC’s peers (FAST, DNOW, DSGR) is 17.6x. If the stock trades at this average level, the stock price could rise 7% from current levels. The stock is up about 21% since my last article in January with a “Hold” recommendation.

I think the company’s cost management efforts will slowly improve its operating margins. But until then, it will face revenue and margin headwinds. As I discussed earlier in this article, I expect adjusted EBITDA growth in 2024 to be 15%-20%. Incorporating these values into the EV calculation and assuming a sell-side forward EV/EBITDA multiple of 16.9x, I think the stock should trade between $52.50 and $55, implying an upside of 18%-23%.

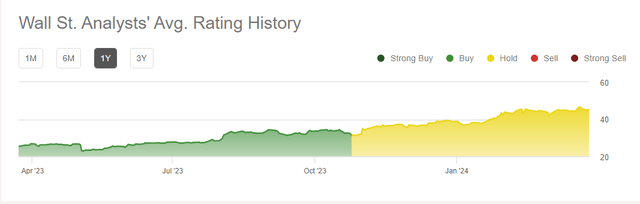

wall street ratings

Seeking Alpha

One analyst has rated GIC a “hold” within the past 90 days. No one rates it a Sell or Buy. The consensus price target is $48, indicating room for 7% upside from current prices. I think Wall Street analysts are being slightly conservative in estimating its returns given the current value drivers.

risk factors

Ongoing geopolitical uncertainty has heightened GIC’s risk profile. After the conflict in the Red Sea, transportation costs increased. The situation remains fluid and unpredictable. The imposition of sanctions also affected energy and economic markets. I think global supply chains and energy prices may increase risk factors for the company in 2024.

Another factor to consider about GIC is the impact of its pricing strategy on its market share and customer velocity. Promotional freight programs and pricing actions significantly impact its gross margins. For example, in the fourth quarter, the company’s gross profit fell 7% from the previous quarter due to rising freight costs. Given the current environment, I think its margins will remain under pressure in the first quarter.

What does GIC think?

Seeking Alpha

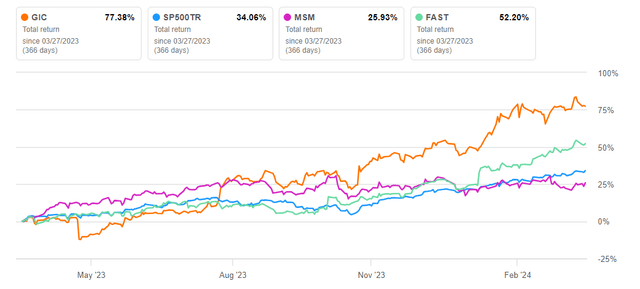

GIC continues to invest in digital transformation, resulting in the right selection of core products and complementary consumables. Its acquisition of Indoff in 2023 complements this strategy. In a fragmented market, the right strategic choices can help GIC win market share in 2024. Management of the profit position is a key area of focus. Demand for private brands will remain stable in 2023, contributing to the company’s stable revenue. As a result, the stock has outperformed the SPDR S&P 500 ETF (SPY) over the past year.

In the short term, geopolitical tensions in international waters could lead to higher freight rates. Its cash flow improved significantly in fiscal 2023. With the company’s balance sheet being debt-free, improving cash flow gives management the confidence to increase the dividend by 25% in the near term. Given the high relative valuation, I think the stock’s returns are likely to deteriorate slightly in the short term but recover by the end of the year. Therefore, I maintain a “Hold” rating.