LSOphoto/iStock via Getty Images

introduce

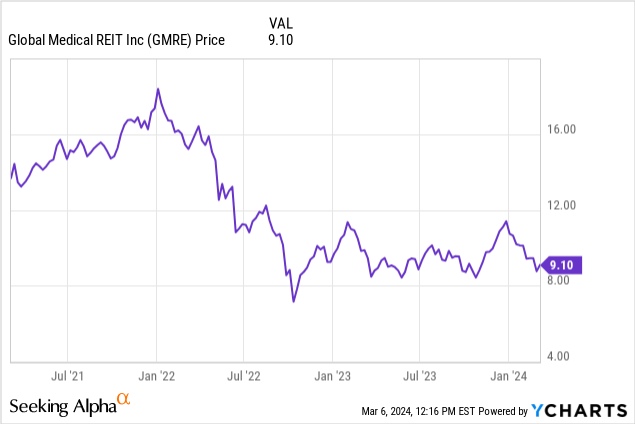

Global Healthcare REIT (NYSE:GMRE) is an internally managed real estate investment trust focused on leasing healthcare facilities to physicians and other healthcare-related groups.

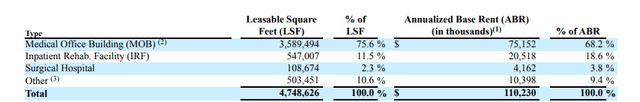

GMRE Investor Relations

This REIT owns 185 buildings in 34 locations States with 5.8 years of WALT.Unlike other healthcare REITs, Global Medical’s tenants appear to be well managed, as Combined rental coverage exceeds 4. The rate is high, but this does not include tenants for whom data was not immediately available (17% of rental income). About 20% of its annualized base rent is due for renewal in 2024 and 2025, so it will be interesting to see the lease spread at renewal time. In addition, there is an important feature: approximately 41.5% of its annualized base rent is only renewable from 2030, so the visibility of future rental income and cash flow should be quite strong.

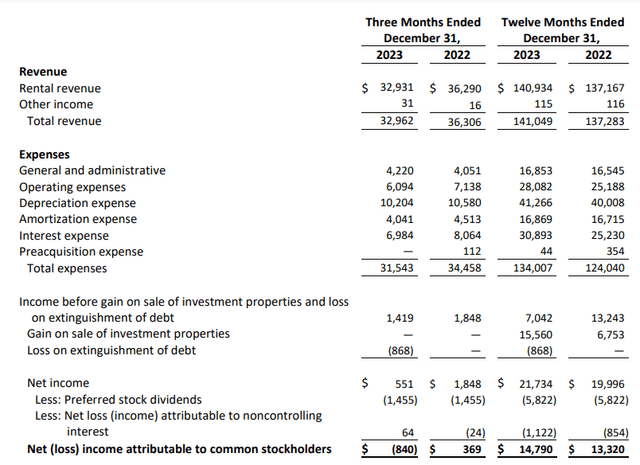

Global Healthcare’s underlying cash flow remains satisfactory

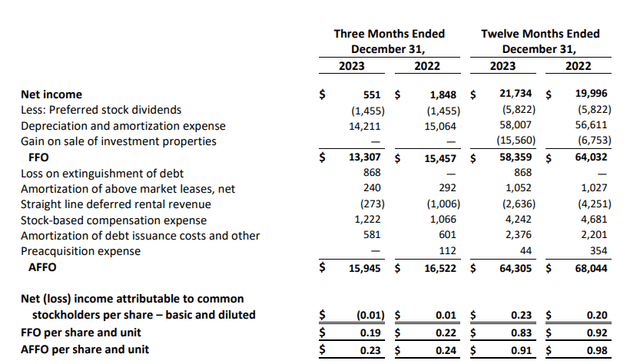

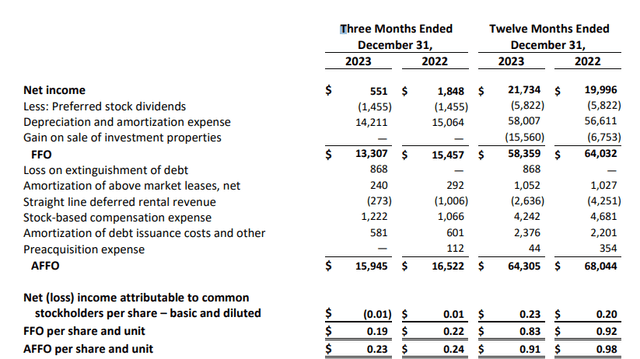

Since reported net income is relatively irrelevant to REITs, I wanted to dive directly into FFO and AFFO performance.As shown below, Global Medical REIT announced total FFO of $13.3 million in the fourth quarter of this year, while Total AFFO is approximately $15.9 million After adding back the value of stock-based compensation and some other non-cash and/or non-recurring items.

GMRE Investor Relations

So while the bottom line of the income statement showed a net loss of $0.01 per share, Global Medical’s FFO and AFFO were $0.19 and $0.23 per share, respectively.

Looking at the REIT’s full-year results, total AFFO was approximately $64.3 million, with AFFO per share of $0.91. You’ll notice right away that the price per share is about $3.7 million and $0.07 lower than in 2022, but that’s not necessarily a big deal. First, although interest expense was lower in the fourth quarter, interest expense for the full year 2023 was significantly higher as full-year interest expense was nearly $31 million, compared to just over $25 million in 2022. Interest expense declined to an annualized operating rate of approximately $28 million in the fourth quarter, but the lower interest expense was directly related to asset sales in the second and third quarters. Selling assets will obviously impact rental income.

GMRE Investor Relations

So while FFO and AFFO decrease in 2023, the REIT actually becomes safer. In March, the company sold a $4.4 million medical office building that included a $500,000 gain, while two sales in June and August totaled $76.1 million, including a $15.1 million gain.

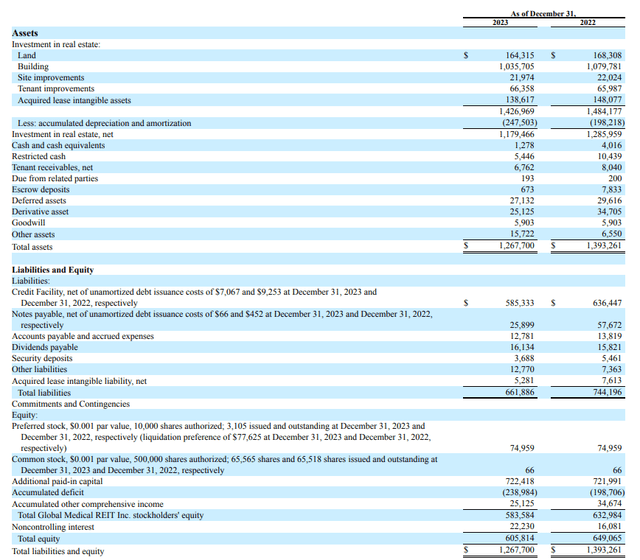

Needless to say, these sales have been a nice boost to the balance sheet. As shown below, the total book value of the remaining real estate assets is $1.18B, but more importantly, the total financial debt is reduced from nearly $695M to $610M. If we also remove nearly $7 million in cash and restricted cash from the equation, net debt is only $598 million, or 50.7% of the book value of assets. The book value includes nearly $250 million in accumulated depreciation.

GMRE Investor Relations

If we use the book value of assets, the existing equity is worth just under $584 million, providing an excellent safety net for the preferred stock. As you can see above, there are only 3.1 million preferred shares outstanding and the principal value per preferred share is $25, indicating total preferred capital capital of $77.5 million. This means there is nearly $510 million in common equity that ranks behind the preferred stock. Or in other words, even if Global Medial REIT had to sell all of its assets at a 40% discount to book value, preferred stockholders would still be left intact.

Preferred stock dividends remain fully paid

The preferred shares trade under the ticker symbol ((GMRE.PR.A)) and provide an annual cumulative dividend of $1.875, payable in four quarterly installments of $0.46875. The preferred shares are redeemable at any time, and I had expected the REIT to be redeemable in 2022. Global Healthcare REIT chose not to redeem its preferred shares, which in hindsight may have been a good idea as it helped avoid the market starting to hype Global Healthcare.

I’ve already discussed asset coverage levels, but ensuring that preferred stock dividends can be paid is obviously also important. Bringing up the FFO and AFFO calculations helps explain this.

GMRE Investor Relations

As you can see above, AFFO for the fourth quarter was $15.95 million, but that already includes $1.46 million in preferred stock dividends. This translates to net AFFO before preferred stock dividends of approximately $17.4 million, meaning the REIT only needs approximately 8.6% of AFFO to pay preferred stock dividends.

Looking at full-year results, Global Healthcare REITs only needed Approximately $9.6 million in capital expenditures its asset portfolio. This means that even if you subtract from the full-year AFFO of $64.3 million, the Global Healthcare REIT will still generate pre-dividend adjusted AFFO of $60.5 million ($64.3 million less capital expenditures of $9.6 million plus $5.8 million of Preferred stock dividends) This means the payout ratio remains below 10%. Capital expenditures will increase to $1.2-14 million in 2024, but this will have little impact on preferred stock dividend coverage.

investment thesis

I currently have a small long position in Global Healthcare REITs and wouldn’t mind adding to that position (provided cash is available). The preferred dividend coverage ratio is quite high, while the asset coverage ratio shows that there is a large amount of common equity on the balance sheet to provide a safety net.

The 9.3% yield on the common stock is also interesting, but the extra layer of safety provided by the preferred stock is more attractive to me.