Emil Hoymann/iStock via Getty Images

basic knowledge

Persistent inflationary pressures persisted in March, posing a problem for the Federal Reserve’s plans to begin cutting interest rates in June and raising doubts about whether rates can be cut this year with no sign of them happening. Economic slowdown. The Consumer Price Index (CPI), which measures the cost of goods and services nationwide, rose 3.5% annually in March, according to a report from the Labor Department on Wednesday. That beat economists’ expectations and was higher than February’s 3.2% gain. Core prices, which exclude volatile food and energy costs and are closely monitored by the Fed, also rose more than expected on a monthly and annual basis.

“Inflationary pressures remain strong everywhere,” said Blerina Uruçi, chief U.S. economist for fixed income at T. Rowe Price. Inflation “is stronger than expectations that the Fed will begin cutting interest rates at any time.” President Joe Biden, who has previously suggested the Fed would cut interest rates later this year, reiterated that belief but acknowledged the latest inflation data could delay a rate cut by about a month.

The report is highly anticipated because Fed leaders have downplayed higher-than-expected inflation in the past, attributing it to temporary factors. However, with inflation higher than expected for the third month in a row, that explanation is no longer viable. Therefore, Fed officials may postpone the rate cut plan to July or later. Some officials wanted to cut interest rates sooner rather than later to prevent a sharp economic downturn, but they may now wait longer, especially given stronger-than-expected inflation.

Analysts found the details in the report equally concerning. While some prices have fallen, such as car prices, others, especially services, have increased. The cost of services, including things like car insurance and health care, is closely tied to the strength of the job market. Contrary to predictions, housing costs also increased.

Ahead of the report, many economists believed inflation would begin to decline in March. However, some are revising their forecasts. For example, economists at Goldman Sachs and UBS originally expected three rate cuts starting in June, but now they predict two cuts starting in July and September.

The report is not the final word on last month’s prices. The Fed’s preferred indicator, due out later this month, has historically been lower than the consumer price index. Overall, inflation has fallen significantly since peaking in mid-2022, but concerns remain that it could return to 2%. One Fed official said it was too early to consider cutting interest rates given the risks.

Surveys show Americans remain frustrated by the cost of living. Although consumer confidence has improved slightly, it remains below pre-pandemic levels. A recent poll found that 74% of voters in states key to the 2024 election believe inflation has worsened over the past year.

Gold, inflation and the high interest rate environment

Store of value: Gold has historically been considered a store of value, especially during periods of inflation. When inflation erodes the purchasing power of fiat currencies, investors often turn to gold as a safe haven to preserve wealth. Unlike paper money, which can be printed in unlimited quantities, gold has a limited supply, making it naturally resistant to inflationary pressures.

Increased demand: As inflation rises, investors seek assets that provide a hedge against falling currency values. Gold is an attractive investment option due to its intrinsic value and universal acceptance. During times of inflation, increased demand for gold can push its price higher.

Central bank policy: The central bank may respond to inflationary pressures by implementing loose monetary policies such as quantitative easing to stimulate economic growth. These policies could lead to currency devaluation and heighten concerns about inflation, further boosting demand for gold as a safe-haven asset.

high interest rate

Opportunity cost: Unlike interest-earning assets such as bonds or savings accounts, gold does not pay interest or dividends. Therefore, when interest rates are high, the opportunity cost of holding gold increases. Investors may choose to allocate funds to interest-bearing assets with guaranteed returns rather than holding gold, which does not generate income.

Investor Sentiment: Higher interest rates could signal central banks tightening monetary policy to control inflation. That could lead investors to believe that inflationary pressures are resolving, reducing demand for safe-haven assets like gold. As a result, demand for gold may decrease, causing prices to fall.

Currency Strengthening: High interest rates can also make the domestic currency stronger relative to other currencies. Since gold in the international market is priced in U.S. dollars, a stronger U.S. dollar could make gold more expensive for foreign buyers, which could dampen demand and put downward pressure on prices.

Overall, while gold is often viewed as a hedge against inflation, its relationship with interest rates is more complex. While high interest rates may initially depress gold prices due to opportunity costs and changes in investor sentiment, other factors such as geopolitical tensions and macroeconomic uncertainty may affect gold demand and price dynamics.

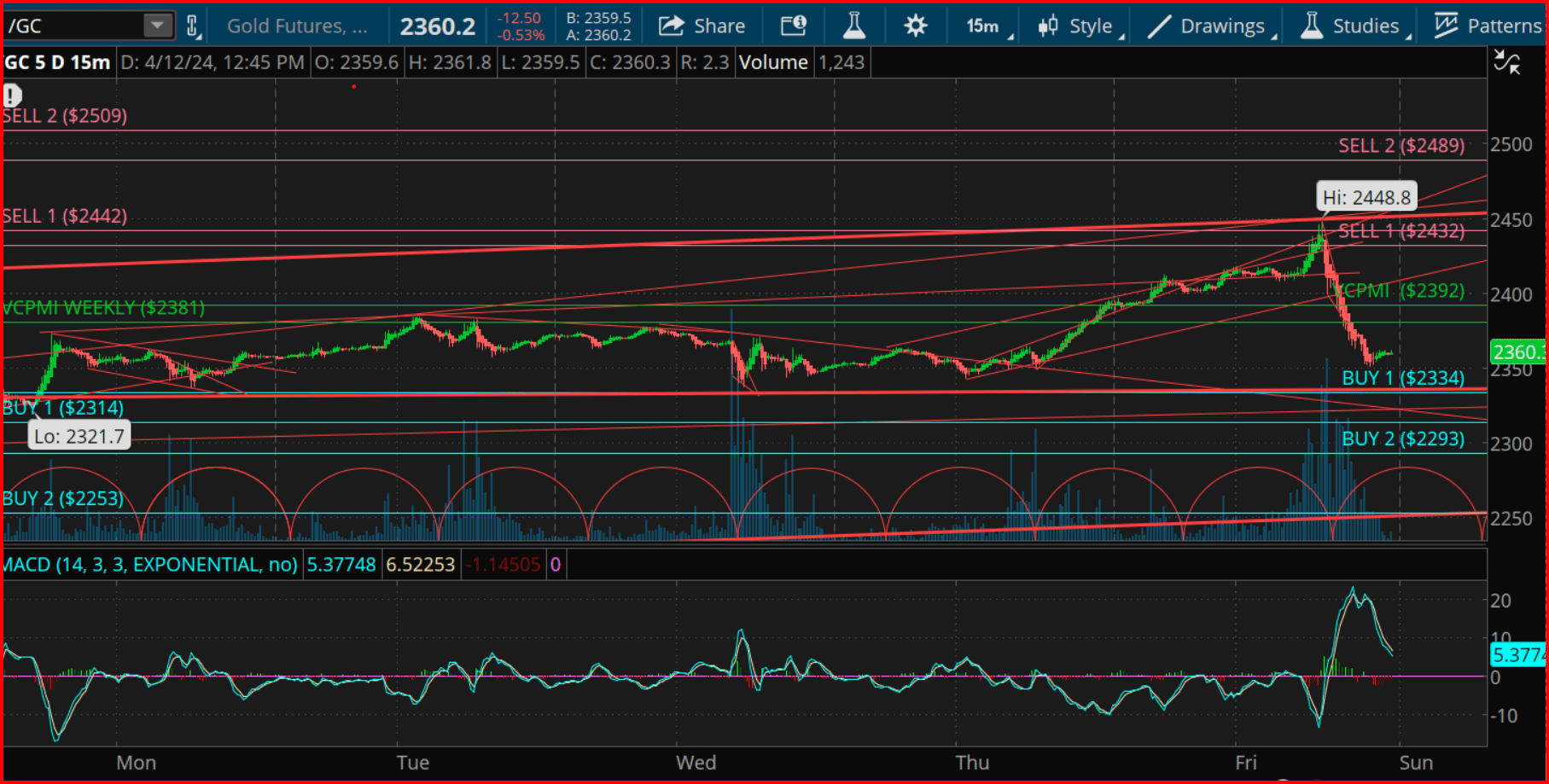

Let’s take a look at the weekly standard deviation report to see what short-term trading opportunities we can identify in this high-volatility environment

Gold: Weekly Standard Deviation Report

April 13, 2024 12:50 EST

generalize

- The gold futures contract closed below its 9-day moving average, indicating bearish short-term trend momentum.

- The market closed below Venture Capital’s weekly price momentum indicator further confirming bearish price momentum.

- Traders recommend that short sellers take profits at 2314-2253 prices, while bull sellers wait for reversal signals.

Weekly Gold (TOS)

weekly trend momentum: Analysis shows that the gold futures contract closed at 2374, below the 9-day simple moving average (SMA) of 2395. Traders often use moving averages to gauge the direction of a trend, with a close below the SMA indicating a potential downtrend.

Weekly Price Momentum: Additionally, the market closed below 2,381 points on the Venture Capital Weekly Price Momentum indicator, further confirming the bearish price momentum. This indicator uses volume data to confirm price movements. Therefore, the SMA and VC indicators are unanimously showing bearish sentiment in the short term. However, it was mentioned that a close above the 9 SMA would shift the trend to neutral, indicating a possible reversal of the short-term bearish trend.

Profit taking and reversal points: For traders holding short positions, it is recommended to consider taking profits during the price level adjustment period of 2314-2253. This means that if the market pulls back within this price range, this could be a good opportunity to secure profits on short positions. On the other hand, for those looking to enter a long position, the advice is to wait for weekly reversal signals before initiating trades. This prudent approach is designed to ensure that traders open positions at favorable points in the market and reduce the risk of loss.

Profit Target for Long Positions: If traders hold long positions, it is recommended to take profits when the market hits the 2442-2509 price level within the month. Profit taking is an important part of a trading strategy, allowing traders to lock in gains and mitigate potential losses. Based on the expected movement of the market, the specified price level will serve as the exit target for the long position.

cycle: It is mentioned that the expiration date of the next cycle is 4.15.24, indicating the specific date when a major market cycle is expected to occur. Traders often focus on cycle dates because they can influence market behavior. Understanding market cycles can help traders predict potential turning points or trends, allowing them to adjust their strategies accordingly.

overall strategy: The overall strategy outlined in the analysis involves a combination of technical indicators, profit-taking strategies, and market cycle awareness. Traders are advised to remain vigilant and react to changes in market conditions. Whether you are going short or long, it is important to have clear profit taking and stop loss levels to effectively manage risk. Additionally, staying abreast of market developments and adjusting your strategy accordingly is crucial to successful trading.